Global Cybersecurity Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Type (Standalone and Tailored), By Coverage Type (First-party and Liability Coverage), By Enterprise Size (SMEs and Large Enterprise), By End-user (Healthcare, Retail, BFSI, IT & Telecom, Manufacturing, and Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Information & TechnologyGlobal Cybersecurity Insurance Market Insights Forecasts to 2032

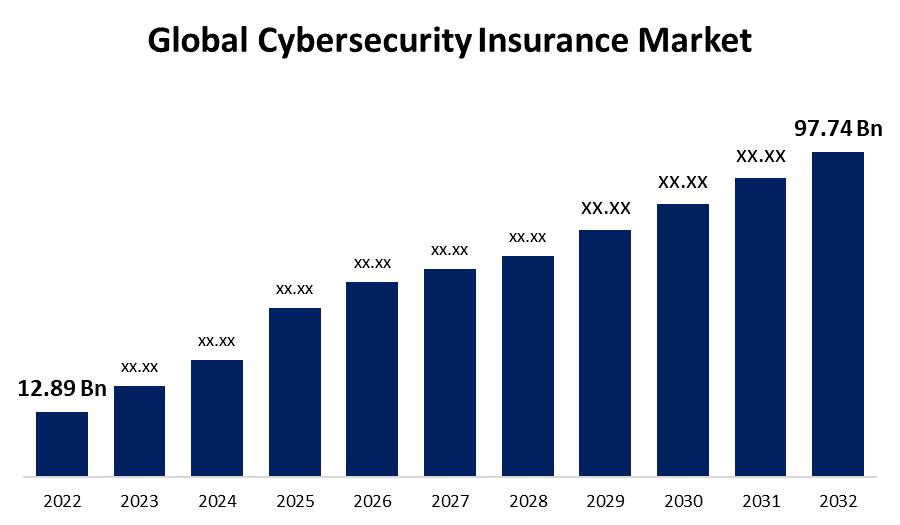

- The Global Cybersecurity Insurance Market Size was valued at USD 12.89 Billion in 2022.

- The Market is Growing at a CAGR of 22.46% from 2022 to 2032

- The Worldwide Cybersecurity Insurance Market Size is expected to reach USD 97.74 Billion by 2032

- Asia-Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Cybersecurity Insurance Market Size is expected to reach USD 97.74 Billion by 2032, at a CAGR of 22.46% during the forecast period 2022 to 2032.

The Cyber Security Insurance Market was created to support businesses in the event of a cyber-related security breach or comparable occurrence. To lessen risk exposure, it provides coverage for both first-party and third-party claims, compensating the costs related to the recovery of internet-based cyber losses. It frequently includes, among other things, indemnity from lawsuits connected to data breaches, damages from network security breaches, and loss of privacy.

Because of the increased risk that these attacks pose to people, businesses, and governments, solutions for cyber security insurance have been developed. Enterprises are negatively impacted by cyberattacks in the form of a declining customer base, economic disruption, regulatory fines, legal penalties and attorney fees, intellectual property loss, and reputational injury. The market for cybersecurity insurance is anticipated to help businesses prevent losses brought on by potential cybercrime risks including ransomware, malware, distributed denial-of-service attacks, and other dangers that might gravely damage a network. The Cyber Security Insurance Market covers a business's liability for a data breach including private customer data such as credit card, social security, account, driver's license, and health record numbers. It helps with access control management, system defense against malware, viruses, unauthorized access, data protection, and other system-level threats.

Global Cybersecurity Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 12.89 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 22.46% |

| 2032 Value Projection: | USD 97.74 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Insurance Type, By Coverage Type, By Enterprise Size, By End-user, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Travelers Indemnity Company, AXA XL, Chubb, American International Group, Inc., Beazley Group, AXIS Capital Holdings Limited, CNA Financial Corporation, BCS Financial Corporation, The Hanover Insurance, Inc., Zurich Insurance, Sayata Labs, Zeguro, Ivanti, SafeBreach, Cronus Cyber Technologies, Liberty Mutual, Lloyd’s of London, Lockton, Munich Re Group and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In businesses of all sizes, cyberattacks and data breaches are becoming more commonplace. According to Forbes, the percentage of ransomware attacks that affected organizations increased by 29% from the previous year to 66% in 2021. These increasing cyberattacks affected how well the organizations could function, which is anticipated to spur market expansion.

Due to the massive amount of stored consumer data, industries such as BFSI, healthcare, education, and retail are frequently targeted by hackers and threat actors. Additionally, these industries are in danger of data breaches due to increased digitization, Internet banking, mobile banking, online shopping, digital payments, and electronic medical records.

cyber insurance provides comprehensive coverage for the business and lessens the effects of cyberattacks. Thus, the need for varied policies is growing as cybercrime increases. cyber insurance provides comprehensive coverage for the business and lessens the effects of cyberattacks. Thus, the need for varied policies is growing as cybercrime increases.

Restraining Factors

Cyber insurance protects various industries from cybercrime and dangers, resulting in increased demand for insurance products. However, due to the high premium insurance policy costs, the industry faces difficulties. The rising cost of insurance plans is preventing both renewal and continuance. As prices rise, corporations like American International Group Inc. are increasing premium rates by 30% and lowering coverage limitations.

With limited resources, small and medium-sized firms (SMEs) are unwilling to invest more in security insurance. It follows that high prices will likely impede market expansion.

By Insurance Insights

The Standalone segment dominates the market with the largest revenue share over the forecast period.

Based on Insurance, the global cybersecurity insurance market is segmented into standalone and tailored. Among these, the Standalone segment is dominating the market with the largest revenue share of 38.6% over the forecast period. An organization is shielded against legal action brought for security or privacy violations that claim a failure to protect sensitive information by standalone insurance. Additionally, standalone policies protect against a variety of asset risks, such as business interruption, data loss/destruction, and money transfer loss. Due to its covering of potential industry hazards in industries including BFSI, healthcare, IT, and telecom, tailored insurance is becoming more and more popular.

By Coverage insights

The First-party segment is witnessing significant CAGR growth over the forecast period.

Based on Coverage, the global cybersecurity insurance market is segmented into first-party and liability coverage. Among these, the first-party segment is witnessing significant CAGR growth over the forecast period. It gives companies financial support to lessen the impact of data breaches and cyberattacks. The rise in cyber theft, hacking, extortion, and data destruction is expected to propel the first-party industry.

During the projected period, the liability/third-party coverage category is expected to grow. Liability insurance is in high demand since it has evolved into an essential component of risk management programs. Liability coverage is tailored to the specific needs of enterprises, with benefits such as business interruption loss coverage, data breach coverage, forensic aid in defending against cyber extortion, and coverage that goes beyond standard liability policies. As a result, organizations dealing with confidential customer data are increasingly relying on third-party coverage.

By Enterprise Size Insights

The Large Enterprise segment is expected to hold the largest share of the global cybersecurity insurance Market during the forecast period.

Based on the enterprise size, the global cybersecurity insurance market is classified into SMEs and large enterprises. Among these, the large enterprise segment is expected to hold the largest share of the cybersecurity insurance market during the forecast period. As a result of the extensive data gathering, major organizations are anticipated to dominate the segment. cybercrime and severe data breach occurrences are on the rise as a result. To safeguard the security of customer and company data, large corporations make significant investments in risk management solutions.

However, during the estimated period, SMEs are anticipated to have significant expansion. The latest target of hackers is SMEs. Small firms are eager to invest in cybersecurity insurance solutions as a result.

By End-user Insights

The BFSI segment accounted for the largest revenue share of more than 57.2% over the forecast period.

Based on end-users, the global cybersecurity insurance market is segmented into healthcare, retail, BFSI, IT & telecom, manufacturing, and others. Among these, the BFSI segment dominates the market with the largest revenue share of 57.2% over the forecast period. Cyber threats are predicted to rise as a result of consumer preferences for digitalization, mobile apps, and internet banking. Because of the large amount of data generated in the financial sector, it is an easy target for hackers. This is projected to increase demand for cybersecurity insurance in the BFSI sector, driving segmental expansion.

The healthcare industry, on the other hand, is expected to develop at the fastest CAGR during the forecast period. Because of the increase in data breaches in the healthcare industry, the adoption of insurance policies is increasing. Between 2009 and 2021, the healthcare industry reported around 4,419 data breaches involving more than 500 records.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 38.7% market share over the forecast. rising cyberattacks and the significant danger of data loss are driving regional expansion. Because of the country's robust government regulation and tight cybersecurity policies, the United States market has the largest share in the region. Furthermore, the presence of leading solution suppliers contributes to the expansion.

Asia-Pacific, on the contrary, is expected to grow the fastest during the forecast period. According to Cyber Risk Management research, insurance demand for cybersecurity surged by 87% in Asia Pacific. Due to constantly increasing connectivity, cyber insurance solutions are gaining popularity in the Asia Pacific area. The organization is becoming more vulnerable to cyber abuse as it accelerates its digital transition.

Europe market is expected to register a substantial CAGR growth rate during the forecast period. The regional expansion can be attributable to changing insurance regulatory restrictions, which enhance demand for certain insurance services. According to Wavestone, Marsh, and law firm CMS research, insurance claims are increasing faster than the number of policies across Europe, as organizations' digitization remains exposed to harmful assaults.

List of Key Market Players

- Travelers Indemnity Company

- AXA XL

- Chubb

- American International Group, Inc.

- Beazley Group

- AXIS Capital Holdings Limited

- CNA Financial Corporation

- BCS Financial Corporation

- The Hanover Insurance, Inc.

- Zurich Insurance

- Sayata Labs

- Zeguro

- Ivanti

- SafeBreach

- Cronus Cyber Technologies

- Liberty Mutual

- Lloyd’s of London

- Lockton

- Munich Re Group

Key Market Developments

- On March 2023, Saiber Innovation Technologies formed a relationship with CYMAR Management Ltd., a cyber-insurance specialist, to meet the cyber insurance needs of the UAE marine and logistics sectors and to assist in defending the maritime and logistics sectors from cyber-attacks.

- On February 2023, Cowbell, a cyber-insurance provider, partnered with Millennial Shift Technologies to deliver Cowbell's cyber insurance programs, Cowbell Prime 100 and 250, to access Millennial Shift's e-trading broker platform, mFactor, for improved operations.

- On July 2022, SBI General developed the SBI General Cyber Vault Edge insurance plan, which protects against financial losses caused by cyber risks and assaults.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global cybersecurity insurance Market based on the below-mentioned segments:

Cybersecurity Insurance Market, Insurance Analysis

- Standalone

- Tailored

Cybersecurity Insurance, Coverage Analysis

- First-party

- Liability Coverage

Cybersecurity Insurance Market, Enterprise Analysis

- SMEs

- Large Enterprise

Cybersecurity Insurance Market, End-User Analysis

- Healthcare

- Retail

- BFSI

- IT & Telecom

- Manufacturing

Cybersecurity Insurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?