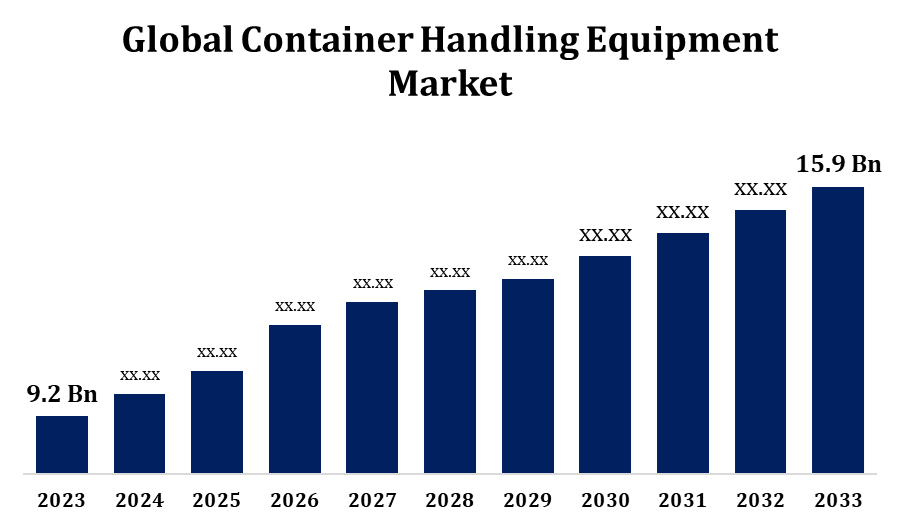

Global Container Handling Equipment Market Size To Worth USD 15.9 Billion By 2033 | CAGR 5.62%

Category: Automotive & TransportationGlobal Container Handling Equipment Market Size To Worth USD 15.9 Billion By 2033 | CAGR 5.62%

According to a Research Report Published By Spherical Insights & Consulting, The Global Container Handling Equipment Market Size to Grow from USD 9.2 Billion in 2023 to USD 15.9 Billion By 2033, at a Compound Annual Growth Rate (CAGR) of 5.62% during the Forecast Period.

Get more details on this report -

Browse key industry insights spread across 245 pages with 120 Market data tables and figures & charts from the report on the the "Global Container Handling Equipment Market Size, Share, and COVID-19 Impact Analysis, By Propulsion (Diesel, Electric, Hybrid), By Capacity (Up to 10 tons, 10-50 tons, 50 tons and above), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/container-handling-equipment-market

The Container Handling Equipment Market Size is steadily Expanding, driven by rising global trade volumes and the growing scale of port and terminal operations. Technological advancements, particularly in automation and smart systems, are significantly improving the safety and efficiency of cargo handling. Increasing environmental awareness and stricter emissions regulations are prompting a shift toward electric and hybrid equipment. Industry leaders are prioritizing innovation, fleet upgrades, and enhanced fuel efficiency to address evolving customer demands. Emerging economies are witnessing particularly strong demand due to rapid infrastructure development and heightened trade activity. As a result, the market is becoming increasingly competitive, with a strong focus on improving operational performance, reducing costs, and promoting sustainable practices throughout the logistics and transportation industries.

Container Handling Equipment Market Value Chain Analysis

The value chain of the container handling equipment market consists of several integrated stages. It begins with raw material suppliers who provide essential inputs like steel, electronics, and hydraulic systems. Manufacturers then use these materials to design and build various equipment types, including cranes, forklifts, and reach stackers. Technology providers contribute by integrating automation and telematics to enhance functionality and efficiency. Distributors and dealers are responsible for marketing and delivering these machines to end users such as ports, terminals, shipping firms, and logistics companies. After-sales support covering maintenance, spare parts, and operator training ensures sustained performance and customer satisfaction. Regulatory agencies shape the value chain by enforcing safety and environmental standards, driving innovation and eco-friendly practices. Close collaboration across all stakeholders is key to meeting industry needs and maintaining smooth, compliant operations.

Container Handling Equipment Market Opportunity Analysis

The container handling equipment market is set to grow, fueled by expanding global trade, technological innovation, and a heightened focus on sustainability. The adoption of automation, IoT, and robotics is transforming port operations, boosting efficiency and reducing reliance on manual labor key advantages in addressing labor shortages and supporting 24/7 operations. The transition toward electric and hybrid equipment is also accelerating, as ports work to meet increasingly stringent environmental standards. Rapid infrastructure development in emerging economies, especially across Asia-Pacific, is further driving demand for advanced, efficient handling systems. Meanwhile, the rise of e-commerce is intensifying the need for faster, automated cargo handling solutions. These trends present significant opportunities for equipment manufacturers and technology firms to innovate and grow in a dynamic, modernizing logistics environment.

The adoption of automated systems and digital technologies is playing a pivotal role in driving the growth of the container handling equipment market. Innovations such as autonomous guided vehicles (AGVs), remote-controlled cranes, and AI-powered logistics software are enhancing efficiency, minimizing human error, and optimizing container movement and storage. These technologies support real-time data monitoring, predictive maintenance, and streamlined operations, resulting in reduced downtime and greater throughput. Digital tools like IoT integration and cloud-based platforms further improve fleet management, safety, and decision-making. The growing push toward smart ports and sustainable logistics is also accelerating investment in advanced, eco-friendly equipment. With global trade volumes on the rise, ports and terminals are increasingly turning to these technologies to boost competitiveness, scalability, and regulatory compliance contributing to continued market growth.

The high upfront costs associated with advanced automated systems and digital technologies pose a significant challenge, particularly for small and mid-sized ports. Integrating these innovations with existing infrastructure often demands complex retrofitting and specialized labor, which may be scarce. Maintenance requirements and potential equipment downtime can also affect operational efficiency and profitability. Moreover, demand for container handling equipment is susceptible to global trade fluctuations, which may be influenced by geopolitical tensions, economic instability, or supply chain disruptions. Increasingly stringent environmental regulations are pushing manufacturers toward greener solutions, raising R&D expenditures. Additionally, the lack of standardization across ports and equipment types complicates interoperability and coordination. Addressing these challenges requires strategic investment and long-term planning to support sustainable growth in the market.

Insights by Propulsion

The diesel segment accounted for the largest market share over the forecast period 2023 to 2033. Diesel engines remain well-suited for demanding, heavy-duty operations, particularly in areas where electric infrastructure is lacking. This makes them a reliable choice for equipment such as reach stackers, rubber-tired gantry cranes, and mobile harbor cranes. While the industry is gradually shifting toward electrification due to environmental concerns and regulatory mandates, diesel-powered machinery continues to play a critical role in high-capacity applications, especially in regions with limited access to alternative energy sources. Ongoing advancements in cleaner diesel technologies and improved fuel efficiency are also helping extend the viability of diesel equipment in a more sustainability-focused market. With their proven durability and versatility, diesel engines are expected to retain a strong presence in the container handling equipment sector for the foreseeable future.

Insights by Capacity

The 10 tons capacity segment accounted for the largest market share over the forecast period 2023 to 2033. This type of equipment is widely favored in warehouses, mid-sized manufacturing facilities, and ports handling moderate cargo volumes. Its lower cost compared to higher-capacity machinery makes it a practical option for budget-conscious operators. Known for their versatility, these systems can handle various tasks including lifting, moving, and stacking within confined or space-constrained areas. Their flexibility and user-friendly design make them well-suited for businesses aiming to enhance material handling efficiency without compromising adaptability. As industries increasingly focus on optimizing space and streamlining operations, demand for equipment in this capacity range is projected to stay strong, underscoring its continued importance in the market.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Container Handling Equipment Market from 2023 to 2033. The container handling equipment market in North America is driven by the need for infrastructure modernization, automation, and sustainability. Ports are increasingly adopting cutting-edge technologies, including electric and hybrid equipment, to meet stricter environmental regulations and improve operational efficiency. Automation is a central focus, with systems like automated stacking cranes and electric rubber-tired gantry cranes being implemented to boost throughput and reduce labor costs. However, challenges persist, such as the significant capital investment needed for these technologies, integration difficulties with existing infrastructure, and concerns about job displacement due to automation. Despite these obstacles, continued investments in port modernization, a shift toward sustainable practices, and the growth of smart port initiatives are expected to sustain the expansion of the region's container handling equipment market.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific container handling equipment market is experiencing robust growth, driven by rapid industrialization, increasing global trade, and substantial investments in port infrastructure. Key nations such as China, India, Japan, and South Korea are embracing automation technologies, including automated guided vehicles (AGVs), automated stacking cranes, and hybrid cranes, to boost efficiency and reduce turnaround times. For instance, China’s Qingdao Qianwan Container Terminal stands as the first fully automated terminal in the region, utilizing IoT, big data, and cloud technologies. India’s Outer Harbor Project at Chidambaranar Port is also expanding capacity through significant investments, fueling demand for advanced equipment. While challenges like high upfront costs, integration complexities, and skilled labor shortages persist, the region's commitment to modernization and sustainability continues to drive market growth.

Recent Market Developments

- In November 2024, ZPMC has delivered three ship-to-shore (STS) cranes to the Hateco Hai Phong International Container Terminal (HHIT) in Vietnam, marking the company's inaugural collaboration with HHIT.

Major players in the market

- Ambergate Invest Sverige AB

- PALFINGER AG

- Hyster-Yale Materials Handling, Inc.

- Liebherr Group

- Sany Group Co., Ltd.

- Toyota Industries Corporation

- CVS ferrari S.P.A.

- China Communications Construction Company, Ltd.

- Tadano Ltd.

- Cargotec Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Container Handling Equipment Market, Propulsion Analysis

- Diesel

- Electric

- Hybrid

Container Handling Equipment Market, Capacity Analysis

- Up to 10 tons

- 10-50 tons

- 50 tons and above

Container Handling Equipment Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?