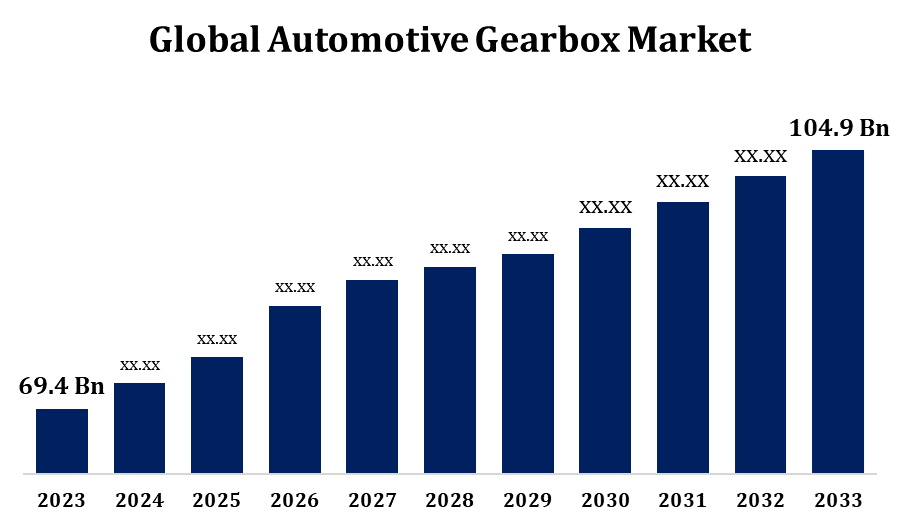

Global Automotive Gearbox Market Size To Worth USD 104.9 Billion By 2033 | CAGR of 4.22%

Category: Automotive & TransportationGlobal Automotive Gearbox Market Size To Worth USD 104.9 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Automotive Gearbox Market Size to Grow from USD 69.4 Billion in 2023 to USD 104.9 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 4.22% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 230 pages with 110 Market data tables and figures & charts from the report on the "Global Automotive Gearbox Market Size, Share, and COVID-19 Impact Analysis, By Gearbox Type (Manual Transmission (MT), Intelligent Manual Transmission (IMT), Automated Manual Transmission (AMT), Automatic Transmission (AT), Continuously Variable Transmission (CVT), and Dual Clutch Transmission (DCT)), By Fuel Type (IC, HEV, and BEV), By Vehicle Type (Hatchback/Sedan, SUVs, LCV, and HCV), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/automotive-gearbox-market

The automotive gearbox market is experiencing consistent growth, fueled by increased vehicle production and a growing demand for enhanced driving experiences. Gearboxes, which play a critical role in transferring power from the engine to the wheels, are evolving with technological advancements like automated manual transmissions (AMTs) and continuously variable transmissions (CVTs). As consumers increasingly prioritize fuel efficiency and high-performance vehicles, the demand for advanced gearbox systems is rising. Electric vehicles (EVs) are also shaping market trends, driving innovations in both single-speed and multi-speed transmissions. The Asia-Pacific region leads the market, driven by significant automotive production in countries such as China, Japan, and India, while Europe and North America continue to invest heavily in cutting-edge gearbox technologies. Key industry players are focusing on lightweight materials, enhanced durability, and smarter integration to comply with stricter emission standards and meet shifting consumer demands.

Automotive Gearbox Market Value Chain Analysis

The automotive gearbox market value chain consists of several key stages, beginning with raw material suppliers who provide metals, alloys, and electronic components. Manufacturers then design and produce critical gearbox parts, such as gears, shafts, and casings, incorporating advanced technologies to enhance performance. These components are assembled into complete gearboxes by OEMs (Original Equipment Manufacturers) or specialized suppliers. System integrators ensure the gearboxes meet vehicle design and performance standards. Distribution channels, including authorized dealers and aftermarket suppliers, deliver the gearboxes to automakers and end customers. Aftermarket services, including maintenance, repairs, and upgrades, also play a vital role in the value chain. Research and development by technology providers and manufacturers is essential for fostering innovation, with a focus on improving efficiency, utilizing lightweight materials, and meeting sustainability goals to keep up with changing automotive trends and regulatory requirements.

Automotive Gearbox Market Opportunity Analysis

The automotive gearbox market offers substantial opportunities driven by technological innovations and evolving industry trends. The increasing adoption of electric and hybrid vehicles is spurring demand for cutting-edge gearbox solutions, such as multi-speed transmissions designed specifically for electric drivetrains. Growing consumer demand for vehicles with smoother performance, improved fuel efficiency, and lower emissions is boosting the need for advanced systems like dual-clutch and automated manual transmissions. Rapid vehicle production growth in emerging markets, especially in the Asia-Pacific region, presents additional expansion opportunities. Moreover, the shift toward lightweight materials and smart, electronically controlled gearboxes aligns with global initiatives to enhance energy efficiency and comply with stricter emission standards. Companies focused on research and development, as well as strategic partnerships, are well-positioned to meet the evolving demands of the automotive industry.

The increasing adoption of electric vehicles (EVs) equipped with advanced transmission systems is playing a key role in the growth of the automotive gearbox market. As EV technology continues to advance, manufacturers are incorporating multi-speed transmissions and innovative drive systems to improve vehicle efficiency, performance, and range. Traditional single-speed transmissions are being complemented by advanced gear mechanisms to meet the diverse needs of high-performance and commercial electric vehicles. This shift is driving demand for specialized gearboxes that are lightweight, compact, and highly efficient. Furthermore, the push for better energy efficiency and enhanced driving dynamics is fueling ongoing research and development in transmission technologies. With governments around the world promoting electric mobility and imposing stricter emission regulations, the automotive gearbox industry is experiencing a surge of opportunities to develop next-generation solutions for the electric vehicle market.

The automotive gearbox market faces several challenges that could hinder its growth. The rise of electric vehicles (EVs), which typically use simpler transmission systems, is reducing the demand for traditional gearboxes. Additionally, the high production and maintenance costs of advanced gear systems can discourage adoption, particularly in cost-sensitive markets. Incorporating modern, high-performance gearboxes into vehicles requires complex engineering and advanced manufacturing techniques, leading to higher development costs. Volatility in raw material prices and ongoing supply chain disruptions further complicate production and profitability. Moreover, stringent environmental regulations are pushing manufacturers to develop lightweight, energy-efficient gearbox solutions, adding pressure for innovation. The emergence of alternative propulsion technologies, like direct drive systems, also challenges traditional gearbox designs. Overcoming these hurdles is essential for maintaining competitiveness in the rapidly evolving automotive industry.

Insights by Gearbox Type

The automatic transmission (AT) segment accounted for the largest market share over the forecast period 2023 to 2033. This preference is especially noticeable in urban areas, where stop-and-go traffic makes manual gear shifting less appealing. Technological innovations, such as the integration of electronic controls and the use of lightweight materials, have further improved the performance and attractiveness of automatic transmissions. Moreover, the growth of electric and hybrid vehicles has driven the development of specialized automatic transmission systems, including single-speed and dual-clutch transmissions, to address the specific needs of these powertrains. As a result, the automatic transmission (AT) segment is expected to retain its dominant position in the automotive gearbox market in the years ahead.

Insights by Fuel Type

The ICE segment accounted for the largest market share over the forecast period 2023 to 2033. The growth of the internal combustion engine (ICE) segment can be attributed to its well-established infrastructure, affordability, and widespread consumer familiarity. Manufacturers are working to enhance ICE efficiency through innovations like smaller, more fuel-efficient engines and hybrid systems. Companies such as Toyota are developing engines that can operate on multiple fuels, including carbon-neutral alternatives, while automakers like General Motors are increasing production of ICE transmission components. This underscores the ongoing demand for traditional gearbox systems, particularly in markets and vehicle categories where electric vehicle (EV) adoption is slower. As a result, the ICE segment remains a vital part of the automotive gearbox industry, even as electric mobility continues to grow.

Insights by Vehicle Type

The SUV segment accounted for the largest market share over the forecast period 2023 to 2033. SUVs are increasingly favored for their higher ground clearance, larger cabin space, and superior performance capabilities. As consumer preference shifts toward SUVs, the demand for advanced gearbox solutions has grown, particularly for automatic and dual-clutch transmissions that can manage the increased power and weight of these vehicles. The rising popularity of SUVs is driving manufacturers to innovate and incorporate specialized transmission systems that meet the specific needs of this segment. Furthermore, the focus on creating more fuel-efficient and performance-driven SUVs is further fueling the demand for sophisticated gearbox technologies designed to enhance the driving experience.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Automotive Gearbox Market from 2023 to 2033. The growing adoption of automatic, dual-clutch, and continuously variable transmissions highlights consumer demand for improved driving comfort and fuel efficiency. Technological advancements, such as the integration of electronic controls and the use of lightweight materials, are further driving market growth. However, the market faces challenges like supply chain disruptions and trade uncertainties, which can affect production and profitability. Despite these obstacles, the strong presence of leading automotive manufacturers and continued investments in research and development position North America as a key player in the global automotive gearbox industry.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The automotive gearbox market in the Asia-Pacific region is experiencing significant growth, driven by rising vehicle production, increased demand for fuel-efficient transmissions, and the rapid adoption of electric and hybrid vehicles. Countries such as China, India, Japan, and South Korea are at the forefront of this expansion, benefiting from robust manufacturing infrastructure and supportive government policies that promote cleaner mobility solutions. Consumers are increasingly opting for automatic, dual-clutch, and continuously variable transmissions (CVTs) due to their improved comfort and efficiency. Additionally, technological innovations, such as the use of lightweight materials and advanced electronic controls, are further fueling market growth.

Recent Market Developments

- In April 2024, Stellantis unveiled its new electrified dual-clutch transmission (eDCT) at the Mirafiori Automotive Park in Italy. The company also revealed plans to invest approximately USD 267 million in the site and the Italian automotive sector, with the goal of developing the Mirafiori Automotive Park 2030.

Major players in the market

- Getrag

- Hyundai Powertech

- BorgWarner

- Driveline Systems International

- Allison Transmission

- Jatco

- Dana

- Aisin Seiki

- Eaton

- Ricardo

- Oerlikon Graziano

- ZF

- Magna

- Schaeffler

- AVL List GmbH

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Gearbox Market, Gearbox Type Analysis

- Manual Transmission (MT)

- Intelligent Manual Transmission (IMT)

- Automated Manual Transmission (AMT)

- Automatic Transmission (AT)

- Continuously Variable Transmission (CVT)

- Dual Clutch Transmission (DCT)

Automotive Gearbox Market, Fuel Type Analysis

- IC

- HEV

- BEV

Automotive Gearbox Market, Vehicle Type Analysis

- Hatchback/Sedan

- SUVs

- LCV

- HCV

Automotive Gearbox Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?