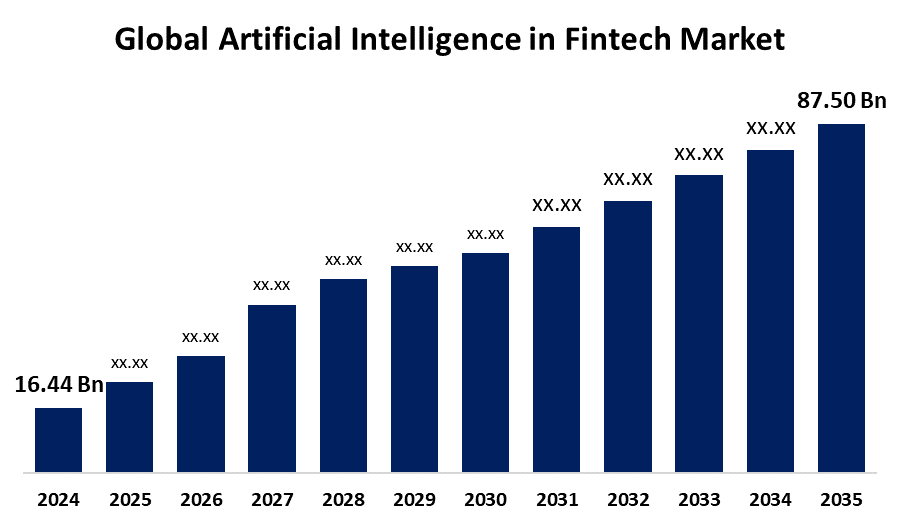

Global Artificial Intelligence in Fintech Market Size to Exceed USD 87.50 Billion by 2035 | CAGR of 16.42%

Category: Information & TechnologyGlobal Artificial Intelligence in Fintech Market Size to Exceed USD 87.50 Billion by 2035

According to a Research Report Published by Spherical Insights & Consulting, The Global Artificial Intelligence in Fintech Market Size is expected to Grow from USD 16.44 Billion in 2024 to USD 87.50 Billion by 2035, at a CAGR of 16.42% during the forecast period 2025-2035.

Get more details on this report -

Browse 210 Market Data Tables And 45 Figures Spread Through 190 Pages and In-Depth TOC On the "Global Artificial Intelligence in Fintech Market Size, Share, and COVID-19 Impact Analysis, By Components (Solutions, and Services), By Application (Virtual Assistant, Business Analytics and Reporting, Customer Behavioural Analytics, Fraud Detection, Quantitative and Asset Management, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/artificial-intelligence-in-fintech-market

The term artificial intelligence (AI) in the fintech market refers to the use of cutting-edge computing tools, such as data analytics, machine learning, and natural language processing, to improve, automate, and optimize financial services and processes. Through real-time analysis of vast amounts of structured and unstructured data, artificial intelligence (AI) helps fintech companies provide more effective, safe, and customized financial solutions. Among the most important uses are risk management, algorithmic trading, fraud detection, credit scoring, and automated customer support. The main forces enabling quicker, more precise, and more economical operations are rapid digitalization and the growing need for automation in the financial services industry. Artificial intelligence (AI) technologies effectively meet the growing demand for real-time decision-making and advanced analytics brought about by the proliferation of financial data. Additionally, the use of AI-powered security and risk management technologies has increased due to an increase in fraud and cyber threats. AI integration is also driven by consumer desire for individualized banking and investing services. However, high implementation costs, legal complexity, data privacy issues, and a shortage of qualified AI specialists are some of the factors that restrict the artificial intelligence in fintech market.

The solutions segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the components, the artificial intelligence in fintech market is divided into solutions, and services. Among these, the solutions segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The high percentage can be ascribed to software tools, which help the banking sector use AI-enabled solutions to extract accurate and comprehensive data quickly and from a sizable volume of data.

The business analytics and reporting segment accounted for the largest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the application, the artificial intelligence in fintech market is divided into virtual assistant, business analytics and reporting, customer behavioural analytics, fraud detection, quantitative and asset management, and others. Among these, the business analytics and reporting segment accounted for the largest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Developments in AI technologies that facilitate precise forecasting, risk assessment, and strategic planning throughout the fintech sector support the expansion of the business analytics and reporting market.

North America is expected to hold the majority share of the global artificial intelligence in fintech market during the forecast period.

Get more details on this report -

North America is expected to hold the majority share of the global artificial intelligence in fintech market during the forecast period. North America's significant investments in AI research, sophisticated technological infrastructure, and established financial services industry all contribute to the region's propensity for adopting and innovating AI-powered fintech solutions. Furthermore, the integration of AI in financial services is being expedited by strategic alliances among government, academia, and industry.

Asia Pacific is anticipated to grow at the fastest pace in the global artificial intelligence in fintech market during the forecast period. The Asia Pacific region is recognized as a major contributor to the global fintech innovation landscape due to its rapid digital transformation, rising internet penetration, pro-business governmental policies, and large investments in AI technologies across emerging economies.

Major vendors in the global artificial intelligence in fintech market are Oracle, Microsoft, Affirm, Inc., Google LLC, Salesforce, Inc., Instructure, Inc., Amelia U.S. LLC, Narrative Science, Upstart Network, Inc., Inbenta Technologies, Amazon Web Services, ComplyAdvantage.com, Nuance Communications, Inc., International Business Machines Corp., and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, The Financial Technology Report, which highlights AI's revolutionary influence in financial services, released The Top 25 FinTech AI Companies of 2025. This year, the focus is shifting from innovation to quantifiable outcomes, enhancing operational effectiveness, combating cyberthreats, and advancing fair credit availability.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the artificial intelligence in fintech market based on the below-mentioned segments:

Global Artificial Intelligence in Fintech Market, By Components

- Solutions

- Services

Global Artificial Intelligence in Fintech Market, By Application

- Virtual Assistant

- Business Analytics and Reporting

- Customer Behavioural Analytics

- Fraud Detection

- Quantitative and Asset Management

- Others

Global Artificial Intelligence in Fintech Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?