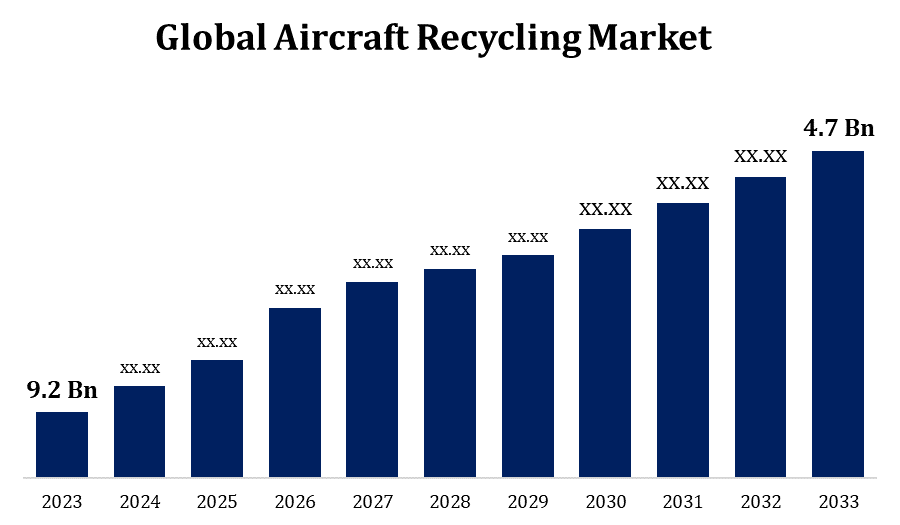

Global Aircraft Recycling Market Size To Worth USD 9.2 Billion By 2033 | CAGR of 6.95%

Category: Aerospace & DefenseGlobal Aircraft Recycling Market Size To Worth USD 9.2 Billion By 2033

According to a research report published by Spherical Insights & Consulting, The Global Aircraft Recycling Market Size to Grow from USD 4.7 Billion in 2023 to USD 9.2 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 6.95% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 Market data tables and figures & charts from the report on the "Global Aircraft Recycling Market Size By Aircraft (Narrow-Body, Wide-Body, Regional), By Component (Engines, Landing Gear, Avionics), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/aircraft-recycling-market

The market for aircraft recycling has grown significantly as a result of an increase in the number of retired aircraft worldwide in recent years. With the continued growth of aircraft fleets, especially with the expansion of the commercial aviation industry, it is expected that the need for aircraft recycling services would increase. The main driving elements behind aircraft recycling are laws and environmental concerns. End-of-life aeroplanes include valuable resources like titanium, aluminium, and other recyclable metals. Hazardous materials including chemicals, hydraulic fluids, and lubricants also need to be disposed of correctly to prevent environmental contamination. Among the participants in the aircraft recycling industry are aerospace manufacturers, parts brokers, and specialised recycling companies.

Aircraft Recycling Market Value Chain Analysis

The aircraft recycling market value chain encompasses a sequence of interconnected stages, beginning with the retirement and decommissioning of aircraft by owners and operators, with support from maintenance, repair, and overhaul (MRO) providers. Subsequently, aircraft recycling companies and salvage operators engage in dismantling and component removal, recovering reusable parts like engines, avionics, and interiors. Metal recyclers and composite material processors then handle the recycling of recovered materials, such as aluminum, titanium, and carbon fiber reinforced polymers (CFRP). Hazardous waste management firms ensure the safe disposal of fluids and chemicals extracted from retired aircraft. Parts brokers, distributors, and aftermarket service providers manage the resale and refurbishment of salvaged components, ensuring compliance with safety standards for reuse in active aircraft. Environmental regulatory agencies and certification bodies monitor adherence to environmental and safety regulations throughout the process. Aerospace manufacturers and research institutions contribute to the value chain through R&D efforts focused on sustainable aircraft design and recycling technologies.

Aircraft Recycling Market Opportunity Analysis

The world's aircraft fleet is expanding due to the rising demand for air travel. As more aircraft near the end of their operational lifespan, the need for aircraft recycling services is increasing, which offers opportunity for companies who specialise in this industry. Electronics, metals, and composites important components utilised in aircraft can all be recycled and used again in a number of different industries. Forward-thinking recycling companies have an opportunity to gather and resell materials from retired aircraft, creating value as we transition to a circular economy that places a premium on recycling and resource reuse. By recycling their aircraft, owners and operators can make money and reduce costs.

If operators are aware of the financial benefits of aircraft recycling, they might be persuaded to investigate recycling as a financially feasible alternative to traditional disposal methods. Owners of aeroplanes can earn extra money by gathering and reselling valuable materials and components, which helps to partially offset decommissioning costs. Growing awareness can help the market grow by fostering collaboration between stakeholders, including airlines, recycling companies, governmental organisations, and educational institutions. Through this collaboration, the aircraft recycling industry may see a rise in productivity and competitiveness as best practices, standardised processes, and technological breakthroughs are developed. Businesses that demonstrate their commitment to ethical business practices and sustainable development can enhance their reputation and public image.

Adhering to many regulations concerning environmental preservation, hazardous material management, and safety presents challenges for aircraft recycling enterprises. Navigating these limitations requires expertise and resources, which vary according on the area or jurisdiction. Establishing an aircraft recycling industry requires a large initial investment in skilled workers, machinery, and facilities. The significant upfront cost may deter existing operators from expanding or upgrading their facilities as well as keep new competitors from joining the market. Those involved in the aircraft recycling process include owners, operators, maintenance providers, recyclers, and parts brokers, among many other supply chain partners. Organising these parties and handling logistics can be challenging, especially when multiple aircraft are participating in extensive recycling operations.

Insights by Aircraft

The narrow-minded segment accounted for the largest market share over the forecast period 2023 to 2033. One reason for narrow-minded sector expansion could be a concentrate on recycling specific aircraft types, such commercial airliners, while neglecting other segments, including military or general aviation planes. If recycling companies focus only on one market segment, they run the danger of underutilizing or missing out on growth opportunities in other ones. Narrow-minded sector growth can also result from differences in industry innovation and technology adoption. Companies that invest in state-of-the-art recycling equipment and processes may grow faster than those that continue with outdated methods; this could lead to market segmentation based on technological superiority. Narrow-minded segment growth in the aircraft recycling business could result from variations in consumer tastes and market demand.

Insights by Component

The engine segment is dominating the market with the largest market share over the forecast period 2023 to 2033. As aircraft engines get closer to the end of their useful lives, there is an increasing demand for overhauls, repairs, and refurbishments. Aircraft owners searching for cost-effective ways to extend the life of their engines are driving growth in the engine recycling sector. Used aircraft engines are becoming more and more in demand in the aftermarket, especially for older aircraft models and in developing nations. MRO firms and aeroplane operators are drawn to used engines because they are less expensive than their new counterparts. Customer demand is driving growth in the recycling industry's engine section. Due to new developments in engine design, engine recycling companies may now concentrate on disassembling and recycling more modern engine models.

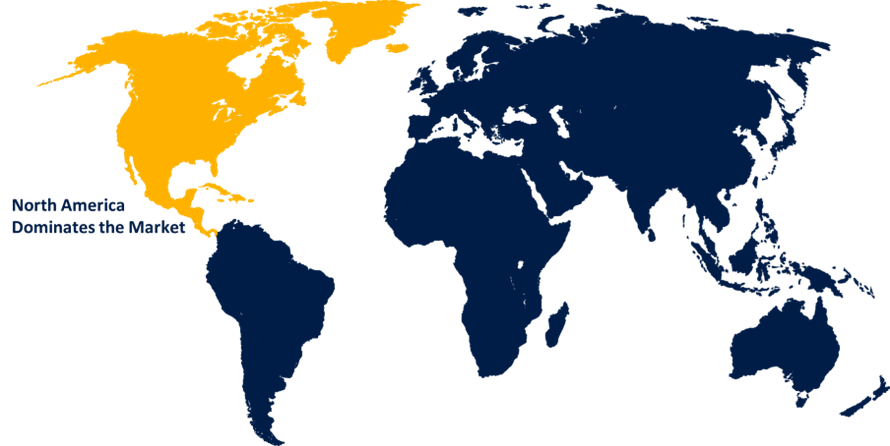

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aircraft Recycling Market from 2023 to 2033. North America is home to a sizeable portion of the global aircraft fleet, which includes commercial airliners, military aircraft, and private jets. As these aircraft get closer to the end of their useful lives, there is an increasing need for aircraft recycling services. North America is the hub for technological innovation in the recycling and aerospace sectors. Businesses in the region are investing in state-of-the-art recycling technologies, including as automated dismantling systems and composite material recycling techniques, to improve the efficacy and sustainability of aircraft recycling operations. The North American aviation industry has a significant need for recycled aeroplane parts due to the size of the fleet and the economical benefits of using reconditioned parts.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region is seeing a rapid increase in air travel demand, which is driving up the fleet size. The need for aircraft recycling services to handle the retirement and disposal of end-of-life aircraft is growing. China, India, and the countries of Southeast Asia are among the emerging economies in Asia-Pacific that are investing heavily in aviation infrastructure and expanding their fleets of commercial aircraft. This presents opportunities for aircraft recycling companies to enter these markets and offer their services in response to the growing demand for aircraft decommissioning and recycling.

Recent Market Developments

- In October 2023, Air France-KLM and Safran Landing Systems have established a partnership to develop and implement a closed-loop recycling plan for landing gear components. The plan aims to recycle every component of the landing gear to 100% by 2030.

Major players in the market

- TARMAC Aerosave

- Airbus

- Air Salvage International

- Total Technic

- Vallair

- CAVU Aerospace

- ComAv Technical Services

- Sycamore Aviation

- Falcon Aircraft Recycling

- VAS Aero Services

- Aviation Internation Recyling

- ADI-Aircraft Demolition & Recyling

- KLM UK Engineering

- AELS

- Aerocycle

- Aircraft Recycling International

- ROTH International

- Aircraft Solutions ME

- AJ Walter Aviation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Recycling Market, Aircraft Analysis

- Narrow-Body

- Wide-Body

- Regional

Aircraft Recycling Market, Component Analysis

- Engines

- Landing Gear

- Avionics

Aircraft Recycling Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?