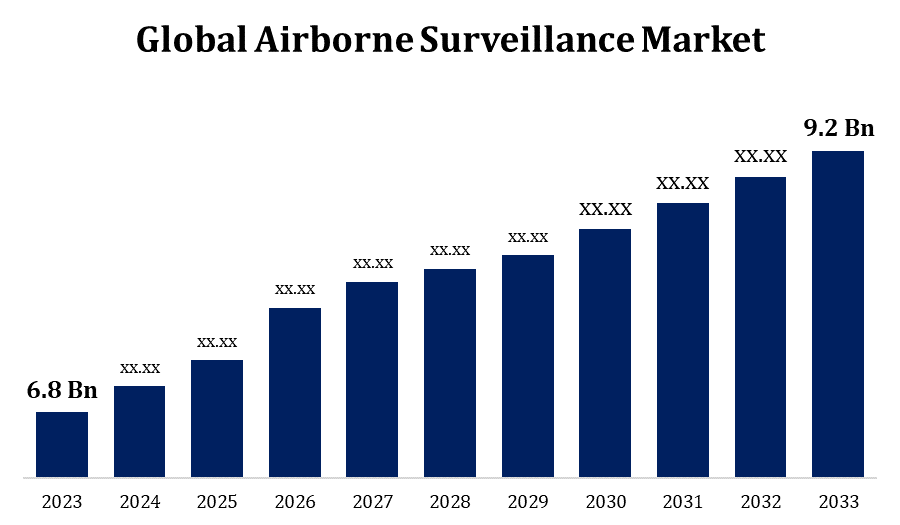

Global Airborne Surveillance Market Size To Worth USD 9.2 Billion By 2033 | CAGR Of 3.07%

Category: Aerospace & DefenseGlobal Airborne Surveillance Market Size To Worth USD 9.2 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Airborne Surveillance Market Size to grow from USD 6.8 billion in 2023 to USD 9.2 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 3.07% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 120 Market data tables and figures & charts from the report on the "Global Airborne Surveillance Market Size By Component (Radars, Sensors, Imaging System, Others), By Technology (Unmanned System, Manned System), By Application (Commercial, Military & Government), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/airborne-surveillance-market

The market for airborne surveillance has grown significantly in recent years as a result of rising security concerns, border threats, territorial conflicts, and the requirement for real-time situational awareness. AI and data analytics are gradually being integrated into airborne surveillance systems to expedite data processing, enhance target recognition, and provide actionable intelligence in real-time. This integration enables quicker decision-making and more efficient use of surveillance resources. Some emerging trends in the airborne surveillance market include the development of swarming drones for collective surveillance, the use of satellite-based surveillance systems for wide-area coverage, and the integration of unmanned aerial vehicles into manned surveillance platforms already in place for enhanced capabilities.

Airborne Surveillance Market Value Chain Analysis

Component manufacture is the process of creating various hardware subsystems and parts for airborne surveillance systems. This includes other mechanical and electronic components, sensors (radar, electro-optical/infrared cameras), communication systems, and data processing units. The aerial platforms need to have subsystems such as sensors, communication devices, and surveillance systems installed and interconnected. In this process, software installation, testing, and certification are also performed to ensure that the surveillance systems meet legal requirements and performance standards. Distribution and sales channels are used to market and sell airborne surveillance systems to customers, including defence agencies, governmental organisations, law enforcement agencies, and commercial enterprises.

Airborne Surveillance Market Opportunity Analysis

Opportunities exist for companies that specialise in software development, sensor integration, and UAV manufacture as a result of the increasing usage of UAVs for surveillance. Unmanned aerial vehicles, or UAVs, provide flexible and affordable platforms for a range of surveillance applications, including infrastructure monitoring, border security, and disaster assistance. As concerns over border security, illegal immigration, smuggling, and marine hazards increase, there is a growing demand for sophisticated airborne surveillance solutions. Businesses that offer comprehensive surveillance systems with real-time monitoring capabilities for vast border areas and maritime domains can achieve these opportunities. Commercial uses of airborne surveillance systems extend beyond defence and security to include environmental monitoring, agricultural, infrastructure inspection, and disaster management.

Armed forces can now conduct instantaneous airborne surveillance operations, follow enemy movements, conduct reconnaissance missions, and gather intelligence without putting crew members in danger thanks to Unmanned Aerial Systems (UAS). Using UAS improves situational awareness on the battlefield, which helps in decision-making and increases operational efficacy. UAS come in a range of sizes and forms, ranging from large, long-range drones to small, tactical drones. Defence forces can utilise unmanned aerial systems (UAS) for a wide range of surveillance activities, including information gathering, target acquisition, battle damage assessment, and convoy protection, due to their versatility. Because unmanned aerial systems (UAS) are often integrated into larger command and control (C2) systems, they can be easily coordinated with other aerial and terrestrial assets.

In order to build and incorporate state-of-the-art sensors, communication systems, and data analytics capabilities into airborne surveillance aircraft, a significant amount of experience and funding for research and development are required. Technology complexity can lead to more expensive and time-consuming development cycles as well as challenges in ensuring compatibility and interoperability across a wide range of platforms and systems. Aircraft surveillance systems are vulnerable to cybersecurity threats such as data leaks, hacking, and signal jamming. To prevent unwanted access and misuse of private data, it is imperative to ensure the security and integrity of data transferred between aerial platforms and ground-based command and control centres. The market for airborne surveillance is becoming more and more competitive, with several companies fighting for contracts and market share.

Insights by Component

The radar segment accounted for the largest market share over the forecast period 2023 to 2033. Radars are essential for the long-range identification of targets, including vehicles, ships, aircraft, and other fascinating items. As security and defence agencies strive to improve their situational awareness and early warning capabilities, there is an increasing need for radar systems with longer detection ranges and higher sensitivity. Radar systems are sometimes paired with additional sensors, such as electro-optical/infrared (EO/IR) cameras, to give supplementary surveillance capabilities. Operators can enhance situational awareness and mission effectiveness by tracking targets with combined sensor suites by utilising EO/IR sensors for visual identification and radar for first detection. Armed forces, homeland security agencies, and border protection authorities use radar equipment for a range of surveillance and reconnaissance applications.

Insights by Technology

The unmanned systems segment accounted for the largest market share over the forecast period 2023 to 2033. UAVs are becoming more and more common for surveillance work due to their low cost, versatility, and ability to operate in places that manned aircraft might find too risky or impractical. Unmanned aerial vehicles, or UAVs, offer a flexible platform for performing a range of surveillance activities, including aerial reconnaissance, border patrol, infrastructure monitoring, and disaster assistance. Unmanned aerial vehicles (UAVs) enable operators to quickly launch surveillance flights in response to events or emerging threats because of their quick deployment capabilities. In addition to providing scalable surveillance solutions for border security, disaster response, and the protection of critical infrastructure, UAVs can be employed in swarms to cover large areas at once.

Insights by Platform

The military and government segment accounted for the largest market share over the forecast period 2023 to 2033. Many countries are funding defence modernization initiatives to increase their monitoring capabilities. Governments set aside enormous sums of money for the procurement of advanced airborne surveillance technology, such as drones, unmanned aerial vehicles (UAVs), sensors, and communication systems, in order to safeguard national security and enhance situational awareness. Cybersecurity and data protection are high priorities for military and government entities in order to safeguard sensitive data collected by airborne surveillance equipment. To prevent enemies from accessing, intercepting, and using surveillance data without authority, governments invest money in cybersecurity procedures, encryption technologies, and secure communication networks.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Airborne Surveillance Market from 2023 to 2033. Two of the largest defence spenders in the world, the United States and Canada, provide considerable resources for the development and purchase of airborne surveillance systems. These investments strengthen defences against evolving threats, enhance situational awareness, and help modernise the armed forces. In addition to defence and security, the demand for airborne surveillance systems is increasing due to commercial applications such environmental assessment, aerial photography, agricultural, and infrastructure monitoring. Businesses in North America are using drones and other aerial platforms equipped with advanced sensors to provide data-driven solutions to various industries.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region is defined by geopolitical tensions and a range of territorial conflicts, particularly in the South China Sea and the Korean Peninsula. Airborne surveillance systems are crucial for keeping an eye on marine activity, conducting reconnaissance, and preserving maritime security in contested areas. Many nations in the Asia-Pacific region face problems from terrorism, insurgency, and transnational crime. Aerial surveillance technology is used in law enforcement, border surveillance, and counterterrorism operations to detect and stop threats, secure borders, and protect critical infrastructure. Airborne surveillance systems are becoming more and more necessary for disaster management, environmental protection, and infrastructure monitoring in the Asia-Pacific region because to the region's fast urbanisation and economic growth.

Recent Market Developments

- In March 2021, a USD 977,439 contract was given to TerraSense Analytics to develop the Multimodal Input Surveillance & Tracking (MIST) advanced airborne surveillance system through the Department of National Defense's Innovation for Defence Excellence and Security (IDEaS) programme.

Major players in the market

- Raytheon

- Lockheed Martin

- Saab

- BAE Systems

- Safran

- Thales

- Leica Geosystems

- Teledyne Technologies

- Leonardo

- FLIR Systems

- Northrop Grumman

- L-3 Wescam

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Airborne Surveillance Market, Component Analysis

- Radars

- Sensors

- Imaging System

- Others

Airborne Surveillance Market, Technology Analysis

- Unmanned System

- Manned System

Airborne Surveillance Market, Application Analysis

- Commercial

- Military & Government

Airborne Surveillance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?