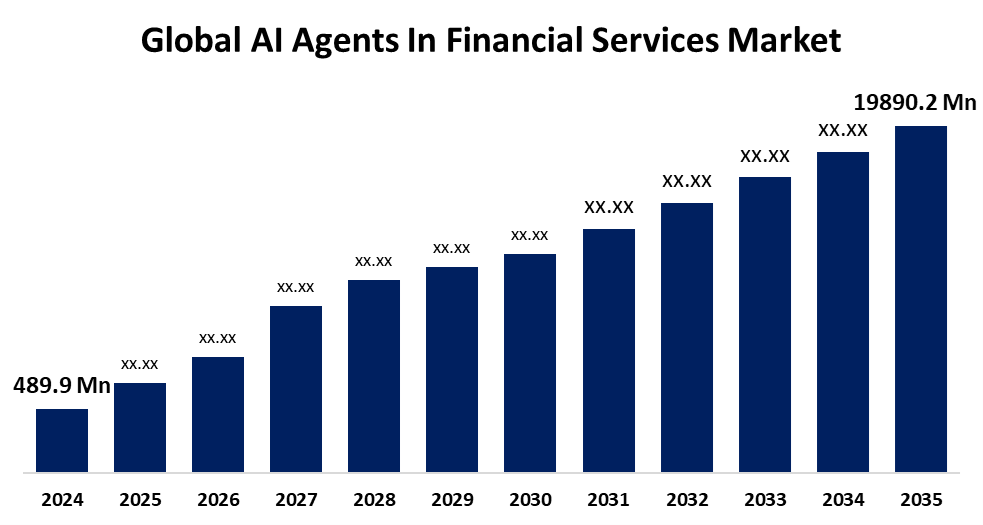

Global AI Agents In Financial Services Market To Exceed USD 19890.2 Million By 2035 | CAGR 40.03%

Category: Information & TechnologyGlobal AI Agents In Financial Services Market To Exceed USD 19890.2 Million By 2035 | CAGR 40.03%

According to a Research Report Published By Spherical Insights & Consulting, The Global AI Agents In Financial Services Market Size is Expected to Grow from USD 489.9 Million in 2024 to USD 19890.2 Million by 2035, at a CAGR of 40.03% during the Forecast Period 2025-2035.

Get more details on this report -

Browse key industry insights spread across 245 pages with 120 Market Size data tables and figures & charts from the report on the " Global AI Agents In Financial Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Risk Management Agents, Compliance and Regulatory Agents, Fraud Detection Agents, Customer Service Agents, Credit Scoring Agents, and Others), By Institutional Type (Traditional Banks, InsurTech Firms, FinTech Companies, and Others), By Technology (Machine Learning (ML) & Deep Learning, Large Language Models (LLMs), Robotic Process Automation (RPA), Cloud Computing & APIs, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 – 2035." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/ai-agents-in-financial-services-market

The AI Agents In The Financial Services Market Size Refer to the autonomous software systems driven by artificial intelligence, often in conjunction with large language models (LLMs), that are capable of managing a range of economic tasks, from data analysis and document generation to operational execution and strategic decision-making. The market growth is driven by the increasing accuracy of decisions and the automation of complex procedures. They save costs, streamline processes, and deliver faultless customer experiences through advanced data analysis. These solutions assist financial institutions in maintaining their adaptability and competitiveness in a rapidly evolving industry. As customer expectations and digital needs change, businesses are being compelled to offer more personalized, responsive services. The availability of cloud-based solutions has created an equitable playing field for smaller firms. However, the market growth is hindered by the strict data privacy laws and evolving regulations, and high costs and talent shortages further limit adoption, especially for smaller institutions.

The fraud detection agents segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the AI agents in financial services market is divided into risk management agents, compliance and regulatory agents, fraud detection agents, customer service agents, credit scoring agents, and others. Among these, the fraud detection agents segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the AI fraud detection agents are revolutionizing financial security by enabling faster and more accurate identification of fraudulent activity. Their real-time monitoring and adaptive learning improve risk assessment and reduce false positives. With the growing complexity of fraud schemes, these agents offer a proactive defense. Their continual investment demonstrates their vital role in protecting modern financial systems.

The traditional bank segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the institutional type, the AI agents in financial services market is divided into traditional banks, insurtech firms, fintech companies, and others. Among these, the traditional bank segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to the traditional banks are using AI agents to boost efficiency, reduce costs, and offer more customized services. AI integration is transforming core banking functions, such as customer service and risk management. Partnerships with AI providers foster creativity and address a lack of skilled workers. The competitiveness of banks in the digital era is ensured by this shift in strategy.

The large language models segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the AI agents in financial services market is divided into machine learning (ML) & deep learning, large language models (LLMs), robotic process automation (RPA), cloud computing & apis, and others. Among these, the large language models segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to all sectors, since optimization and machine learning are making it possible to make better informed, data-driven decisions and run operations more effectively. Uptiq's AI Workbench is one product that makes it simple for developers to construct secure, personalized AI agents. These platforms accelerate innovation in areas such as financing and underwriting. As their use grows, they alter the value that financial services offer.

North America is expected to hold the majority share of the global AI agents in financial services market during the forecast period.

Get more details on this report -

North America is expected to hold the majority share of the global AI agents in financial services market during the forecast period. The region's growth is expanding due to the early adoption, robust tech industry, and significant investment. By automating risk management, fraud detection, customer service, and customized financial advice, they increase productivity and enhance the client experience. For instance, as part of some major efforts to automate and expedite financial crime investigations, Oracle Financial Services introduced AI agents in its Investigation Hub Cloud Service in March 2025. This reduced manual labor and improved judgment consistency for financial institutions worldwide.

Asia Pacific is anticipated to grow at the fastest pace in the global AI agents in financial services market during the forecast period. The region's use of AI agents is rapidly transforming financial services across the Asia-Pacific region, with China, India, and Japan setting the pace. These agents are often used to boost customer engagement, automate back-office chores, and enhance fraud detection systems. Financial institutions increasingly view AI as a strategic tool to increase efficiency and meet the increasing demands of the digital world. Digital financial projects financed by regional governments and a strong push for innovation encourage this shift.

Major vendors in the global AI agents in financial services market are Accenture, Zest AI, Amazon Web Services (AWS), WorkFusion, FICO, Upstart, Microsoft, Temenos, NVIDIA, Oracle, Salesforce, SAP, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Development

- In March 2025, Auquan announced the launch of its industry-first risk agent, an AI agent designed specifically for financial risk monitoring and detection. Unlike traditional solutions, Auquan's risk agent automates the whole risk monitoring and reporting workflow, offering early detection of emerging problems across investment and credit portfolios. The risk agent draws on over two million data sources in 65 languages to provide global institutions with unrivaled risk visibility and situational awareness.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the AI agents in financial services market based on the below-mentioned segments:

Global AI Agents In Financial Services Market, By Type

- Risk Management Agents

- Compliance and Regulatory Agents

- Fraud Detection Agents

- Customer Service Agents

- Credit Scoring Agents

- Others

Global AI Agents In Financial Services Market, By Institutional Type

- Traditional Banks

- InsurTech Firms

- FinTech Companies

- Others

Global AI Agents In Financial Services Market, By Technology

- Machine Learning (ML) & Deep Learning

- Large Language Models (LLMs)

- Robotic Process Automation (RPA)

- Cloud Computing & APIs

- Others

Global AI Agents In Financial Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?