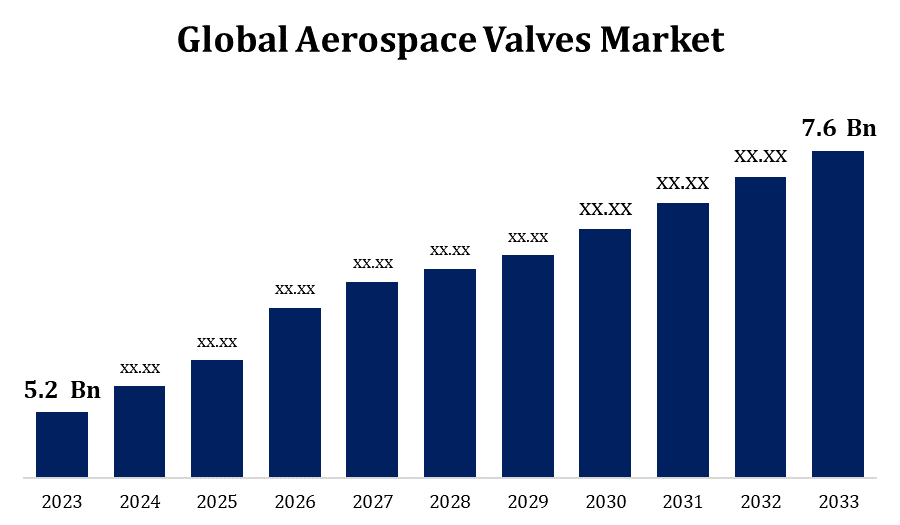

Global Aerospace Valves Market Size To Worth USD 7.6 Billion By 2033 | CAGR of 3.87%

Category: Aerospace & DefenseGlobal Aerospace Valves Market Size to Worth USD 7.6 Billion by 2033

According to a Research Report published by Spherical Insights & Consulting, the Global Aerospace Valves Market Size to Grow From USD 5.2 Billion in 2023 to USD 7.6 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 3.87% during the Forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 120 market data tables and figures & charts from the Report on the "Global Aerospace Valves Market Size By Type (Fuel System Valves, Hydraulic System Valves), By Mechanism (Solenoid, Manual, Automatic), By Material (Steel, Aluminium, Titanium), By End-User (OEMs, Aftermarket), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/aerospace-valves-market

The growing worldwide need for both military and commercial aircraft is driving the aerospace valves market. Aircraft manufacturers such as Boeing, Airbus, and others rely on valves to ensure the safe and efficient operation of their aircraft platforms. Aerospace valve producers are continuously innovating to make their valves stronger, lighter, and more resilient to extreme conditions. Advances in materials science, additive manufacturing (three-dimensional printing), and smart valve technologies are driving the market's expansion. Modern aerospace valves are in high demand for military aircraft, as a result of global defence modernisation initiatives.

Aerospace Valves Market Value Chain Analysis

At the top of the value chain are suppliers of the parts and raw materials required to manufacture aeronautical valves. These materials include, but are not limited to, metals (such as titanium, aluminium, and stainless steel), alloys, polymers, ceramics, and specialty coatings. Companies specialising in producing various parts for aviation valves, including bodies, stems, actuators, springs, and seals. These parts have to meet strict quality, reliability, and performance standards set by the aerospace industry. Precision machining, brazing, welding, and assembly are among the techniques used by valve manufacturers to assemble various components into completed aircraft valves. Aerospace valves are subjected to rigorous testing and quality assurance procedures to ensure compliance with industry and legal requirements.

Aerospace Valves Market Opportunity Analysis

The ongoing growth in demand for air travel worldwide is leading to a boom in aircraft deliveries for major OEMs such as Boeing and Airbus. Because of this, more aerospace valves will be required to equip new aircraft with cutting-edge systems and technology. Due to increased worldwide defence investment and modernization initiatives, military aircraft have a significant demand for advanced aerospace valves. Manufacturers can capitalise on opportunities in the defence sector by producing valves for military aviation applications, including fighter jets, transport aircraft, helicopters, and unmanned aerial vehicles (UAVs). In the aerospace valves market, sourcing strategies, logistics management, and supply chain optimisation can all result in cost savings, lead time improvements, and increased competitiveness.

The aviation sector is growing steadily because of the increasing demand for air travel, especially in emerging and developing nations with growing economies. Consequently, the demand for aerospace valves to equip commercial aircraft with essential systems like fuel, hydraulic, and pneumatic systems rises as more orders are placed with manufacturers such as Boeing and Airbus. Airlines everywhere are expanding their fleets to meet the growing demand for air travel. Older aircraft are also being decommissioned and replaced with newer, more fuel-efficient models as part of fleet modernization projects.

To make aircraft valves that meet the exacting requirements of the aviation industry, a great deal of research, development, and testing are required. In order to enter a market or introduce a new product, startups or smaller businesses may encounter difficulties due to high development costs. In the extremely competitive aircraft valves sector, numerous domestic and foreign companies are vying for market supremacy. Established manufacturers may have a competitive advantage over newer entrants or smaller companies due to their vast product offerings, strong customer ties, and well-known brands. Trade conflicts, political turmoil, economic downturns, and unforeseen natural disasters like pandemics can all impact the aviation industry's need for aircraft and aerospace valves.

Insights by Type

The hydraulic system valve segment accounted for the largest market share over the forecast period 2023 to 2033. The growing demand for air travel worldwide is driving up the development and delivery of commercial aircraft. Hydraulic system valves are critical components of many aircraft systems, such as the landing gear, flight control surfaces, thrust reversers, and cargo doors. The need for hydraulic system valves increases in tandem with the expansion of airline fleets to handle increasing passenger volumes. Emerging markets in regions like the Middle East, South America, and Asia-Pacific are seeing fast growth in their aircraft fleets and aviation infrastructure. The growing capability of these locations for both commercial and military aviation is corresponding with an increasing need for hydraulic system valves to support aircraft operations.

Insights by Mechanism

The automatic segment accounted for the largest market share over the forecast period 2023 to 2033. In the aircraft industry, automation is being employed more and more to improve safety, reduce human error, and increase production. Because automatic valves provide precise control over fluid flow, pressure, and direction, they are a crucial component of automated aviation systems. They are also known as electronically controlled valves or solenoid valves. Aerospace manufacturers and airlines are prioritising fuel efficiency improvements and emissions reductions in order to meet environmental regulations and reduce operating costs.

Insights by Material

The titanium segment accounted for the largest market share over the forecast period 2023 to 2033. Titanium's exceptional strength-to-weight ratio, resistance to corrosion, and high-temperature performance make it an ideal material for aerospace applications. Because titanium aerospace valves are lightweight and robust, they can operate better and burn less fuel. Titanium valves perform better mechanically than traditional materials like steel or aluminium. They can withstand high temperatures and pressures commonly encountered in aircraft systems, including engine parts and fuel and hydraulic systems. Global modernization programmes and increased defence spending are driving the titanium aerospace valve market.

Insights by End Use

The aftermarket segment accounted for the largest market share over the forecast period 2023 to 2033. The military and commercial aircraft fleet of today is either approaching the end of its useful life or entering a phase that requires more regular maintenance. The need for aftermarket aerospace valves rises as aircraft age due to the need for replacement parts and repairs to maintain operating reliability. The global aircraft fleet expansion has an impact on the need for aerospace valves, particularly in developing countries and regions experiencing rapid economic growth. In response to the increasing demand for air travel, airlines are expanding their fleets, which is driving up the requirement for aftermarket valve replacement and repair services.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aerospace Valves Market from 2023 to 2033. United Airlines, American Airlines, and Delta Air Lines are major airlines that operate sizable fleets of aircraft in the area. There is also a thriving commercial aviation industry in the region. Aerospace valves are essential components of commercial aircraft fuel, hydraulic, and pneumatic systems. The aerospace valves market in North America is supported by a vast network of maintenance, repair, and overhaul (MRO) facilities and includes a sizeable aftermarket segment. Aftermarket service providers offer valve repair, overhaul, and spare parts supply services to meet the maintenance needs of operators of both military and commercial aircraft.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The aviation sector in Asia-Pacific is expanding quickly as a result of rising urbanisation, rising middle-class populations, and rising demand for air travel. This region boasts some of the fastest-growing economies globally, prompting significant investments in airline fleets, aviation infrastructure, and aerospace production capacity. Aircraft manufacturers like Boeing and Airbus are expanding their footprint in the Asia-Pacific region in response to the growing demand for commercial aircraft. The assembly and fabrication of new aircraft require a larger supply of aerospace valves due to the increase in aircraft production and deliveries.

Recent Market Developments

- In June 2021, Eaton Corporation will supply a new 4-port fuel valve for military aircraft that provides increased fuel flow and improved performance in challenging circumstances.

Major players in the market

- Honeywell International Inc.

- United Technologies Corporation

- Triumph Group Inc.

- Crane Aerospace & Electronics

- Parker Hannifin Corporation

- Woodward Inc.

- Eaton Corporation

- Zodiac Aerospace SA

- Meggitt PLC

- Circor International Inc.

- ITT Inc

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Valves Market, Type Analysis

- Fuel System Valves

- Hydraulic System Valves

Aerospace Valves Market, Mechanism Analysis

- Solenoid

- Manual

- Automatic

Aerospace Valves Market, Material Analysis

- Steel

- Aluminium

- Titanium

Aerospace Valves Market, End Use Analysis

- OEMs

- Aftermarket

Aerospace Valves Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?