Global Aerospace Valves Market Size By Type (Fuel System Valves, Hydraulic System Valves), By Mechanism (Solenoid, Manual, Automatic), By Material (Steel, Aluminium, Titanium), By End-User (OEMs, Aftermarket), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Aerospace Valves Market Size Insights Forecasts to 2033

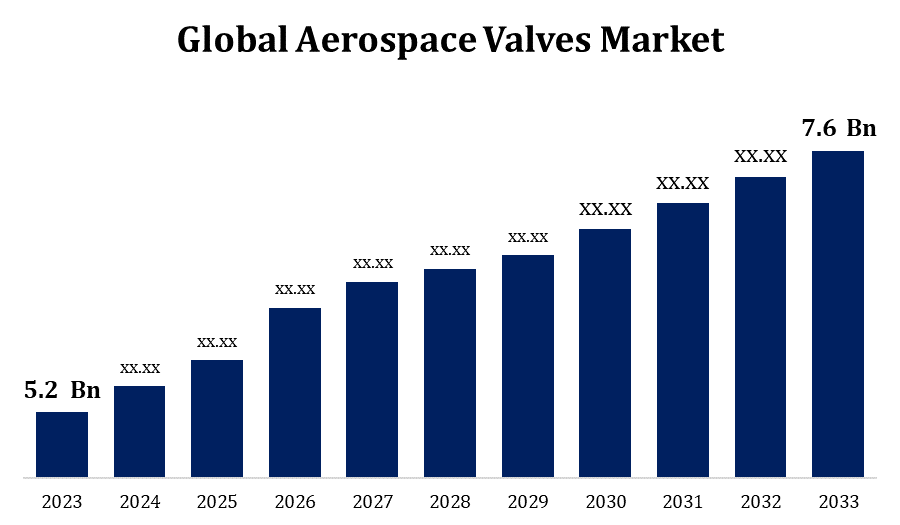

- The Global Aerospace Valves Market Size was valued at USD 5.2 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.87% From 2023 to 2033.

- The Worldwide Aerospace Valves Market Size is Expected to Reach USD 7.6 billion by 2033.

- Asia Pacific is Expected to Grow the Fastest during the Forecast period.

Get more details on this report -

The Global Aerospace Valves Market is Expected to Reach USD 7.6 Billion by 2033, at a CAGR of 3.87% during the Forecast period 2023 to 2033.

The aerospace valves Market is being driven by the increasing Global demand for both military and commercial aircraft. Manufacturers of aircraft, including Boeing, Airbus, and others, depend on valves to guarantee the secure and effective functioning of their aircraft platforms. Manufacturers of aerospace valves are constantly coming up with new ideas to create valves that are stronger, lighter, and able to function in harsh environments. The market is growing as a result of developments in materials science, additive manufacturing (3D printing), and smart valve technologies. Global efforts to modernise defences are driving demand for military planes fitted with cutting-edge aerospace valves. Government spending on modernizations, retrofit projects, and new aircraft platforms opens doors for defence industry producers of aerospace valves.

Aerospace Valves Market Value Chain Analysis

Suppliers of the components and raw materials needed to make aeronautical valves are at the start of the value chain. Metals (including titanium, aluminium, and stainless steel), alloys, polymers, ceramics, and specialty coatings are a few examples of these materials. Businesses specialise in manufacturing individual aircraft valve parts, such as actuators, springs, stems, seals, and valve bodies. Tight aerospace industry requirements for quality, dependability, and performance must be met by these parts. Manufacturers of valves use processes such as precise machining, brazing, welding, and assembly to combine different parts into finished aerospace valves. Aerospace valves go through stringent testing and quality assurance processes to guarantee that they meet legal and industry requirements. OEMs of engines, systems, and aeroplanes are supplied with valves by aerospace valve manufacturers.

Aerospace Valves Market Opportunity Analysis

Major OEMs like Boeing and Airbus are seeing a surge in aircraft deliveries as a result of the continual development in demand for air travel worldwide. As a result, there will be a greater need for aerospace valves to outfit new aircraft with cutting-edge technology and systems. Advanced aerospace valves are in high demand for military aircraft, as a result of global defence spending and modernization programmes. By creating valves for military aviation applications, such as fighter jets, transport aircraft, helicopters, and unmanned aerial vehicles (UAVs), manufacturers can take advantage of opportunities in the defence sector. In the market for aerospace valves, cost reduction, lead time improvements, and improved competitiveness can all be achieved through optimising supply chain operations, sourcing tactics, and logistics management.

Global Aerospace Valves Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | 5.2 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.87% |

| 2033 Value Projection: | 7.6 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Mechanism, By Material, By End-User (OEMs, Aftermarket), By Region, By Geographic Scope |

| Companies covered:: | Honeywell International Inc., United Technologies Corporation, Triumph Group Inc., Crane Aerospace & Electronics, Parker Hannifin Corporation, Woodward Inc., Eaton Corporation, Zodiac Aerospace SA, Meggitt PLC, Circor International Inc., ITT Inc, and others, |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aerospace Valves Market Dynamics

Expansion of the aviation industry

The demand for air travel is rising, which is driving the aviation industry's steady growth, particularly in emerging countries and those with expanding economies. As a result, manufacturers like Boeing and Airbus place more orders for commercial aircraft, which in turn increases demand for aerospace valves to outfit these aircraft with vital systems like fuel, hydraulic, and pneumatic systems. To accommodate the rising demand for air travel, airlines all around the world are extending their fleets. As part of fleet modernization initiatives, older aircraft are also being retired and replaced with newer, fuel-efficient types. Aerospace valves are crucial parts of fleet modernization and growth programmes, and they are used in both new aircraft deliveries and retrofitting operations.

Restraints & Challenges

Extensive research, development, and testing are needed to create aircraft valves that satisfy the strict specifications of the aviation sector. High development expenses can be a problem for startups or smaller firms trying to break into a market or launch a new product. There are many local and international competitors fighting for market dominance in the fiercely competitive aircraft valves industry. A competitive edge over more recent arrivals or smaller businesses may belong to established manufacturers with well-established client relationships, broad product portfolios, and high brand awareness. Trade disputes, political unrest, economic downturns, and unanticipated catastrophes like pandemics can all have an effect on the demand for aircraft and aerospace valves in the aviation sector. Uncertain economic times may cause airline profitability to decline, aircraft orders to be delayed, and aerospace component purchases to be made cautiously.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace Valves Market from 2023 to 2033. Major airlines operating large fleets of aircraft in the region include United Airlines, American Airlines, and Delta Air Lines. The region also features a robust commercial aviation sector. Aerospace valves are crucial parts of the fuel, hydraulic, and pneumatic systems in commercial aircraft. The aerospace valves market in North America comprises a substantial aftermarket segment that is bolstered by an extensive network of maintenance, repair, and overhaul (MRO) facilities. In order to serve the maintenance requirements of operators of both military and commercial aircraft, aftermarket service providers provide valve repair, overhaul, and spare parts delivery services. The aerospace supply chain ecosystem in North America is well-established, with suppliers and subcontractors offering parts and subsystems to aircraft manufacturers.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Due to growing middle-class populations, increased air travel demand, and increasing urbanisation, the aviation industry in Asia-Pacific is growing rapidly. Some of the fastest-growing economies in the world are found in this region, which has led to large expenditures in airline fleets, aviation infrastructure, and aerospace production capacity. As the demand for commercial aircraft rises, aircraft manufacturers like Boeing and Airbus are increasing their presence in the Asia-Pacific area. Due to the rise in aircraft production and deliveries, there is a greater need for aerospace valves in the assembly and manufacturing of new aircraft. The demand for air travel is rising quickly in the Asia-Pacific region's emerging economies, which include China, India, and Southeast Asian nations, as is the development of their infrastructure.

Segmentation Analysis

Insights by Type

The hydraulic system valve segment accounted for the largest market share over the forecast period 2023 to 2033. The manufacture and delivery of commercial aircraft are rising as a result of the increasing demand for air travel around the globe. A number of aircraft systems, including the landing gear, flight control surfaces, thrust reversers, and cargo doors, depend on hydraulic system valves as essential parts. Hydraulic system valve demand rises in tandem with airline fleet expansions made to accommodate growing passenger volumes. The aviation infrastructure and aircraft fleets of emerging markets in countries like the Middle East, Latin America, and Asia-Pacific are expanding at a rapid pace. The need for hydraulic system valves to support aircraft operations is rising in tandem with these regions' increased capacity for both commercial and military aviation.

Insights by Mechanism

The automatic segment accounted for the largest market share over the forecast period 2023 to 2033. Automation is being used more and more in the aerospace sector to boost productivity, lower the risk of human mistake, and increase safety. Automatic valves are essential to automated aviation systems because they allow exact control over fluid flow, pressure, and direction. They are also referred to as solenoid valves or electronically controlled valves. In order to comply with environmental requirements and minimise operational expenses, aerospace manufacturers and airlines are placing a greater emphasis on enhancing fuel efficiency and lowering emissions. Automatic valves with precise control capabilities optimise engine performance, fuel system management, and hydraulic system functioning, all of which lead to increases in fuel efficiency.

Insights by Material

The titanium segment accounted for the largest market share over the forecast period 2023 to 2033. Titanium is the perfect material for aerospace applications because of its remarkable strength-to-weight ratio, resistance to corrosion, and high-temperature performance. Titanium aerospace valves are strong and lightweight, which enables improved performance and less fuel use. When it comes to mechanical qualities, titanium valves outperform conventional materials like steel or aluminium. They are resistant to high temperatures and pressures that are frequently found in aircraft systems, such as fuel and hydraulic systems, and engine parts. The market for titanium aerospace valves is driven by rising defence spending and modernization initiatives across the globe.

Insights by End Use

The aftermarket segment accounted for the largest market share over the forecast period 2023 to 2033. Today's fleet of military and commercial aircraft is either nearing the end of its useful life or transitioning into a period that calls for more frequent maintenance. The requirement for replacement parts and repairs to preserve operating reliability causes an increase in demand for aftermarket aerospace valves as aircraft get older. Aerospace valve demand is influenced by the expansion of the world's aircraft fleet, especially in developing nations and areas with fast-paced economic growth. The need for aftermarket valve replacement and repair services rises in tandem with airlines' fleet expansions in response to the growing demand for air travel.

Recent Market Developments

- In June 2021, for military aircraft, Eaton Corporation will provide a new 4-port fuel valve that offers better performance in harsh conditions and greater fuel flow.

Competitive Landscape

Major players in the market

- Honeywell International Inc.

- United Technologies Corporation

- Triumph Group Inc.

- Crane Aerospace & Electronics

- Parker Hannifin Corporation

- Woodward Inc.

- Eaton Corporation

- Zodiac Aerospace SA

- Meggitt PLC

- Circor International Inc.

- ITT Inc

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Valves Market, Type Analysis

- Fuel System Valves

- Hydraulic System Valves

Aerospace Valves Market, Mechanism Analysis

- Solenoid

- Manual

- Automatic

Aerospace Valves Market, Material Analysis

- Steel

- Aluminium

- Titanium

Aerospace Valves Market, End Use Analysis

- OEMs

- Aftermarket

Aerospace Valves Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?