Woodworking Machinery Market Summary

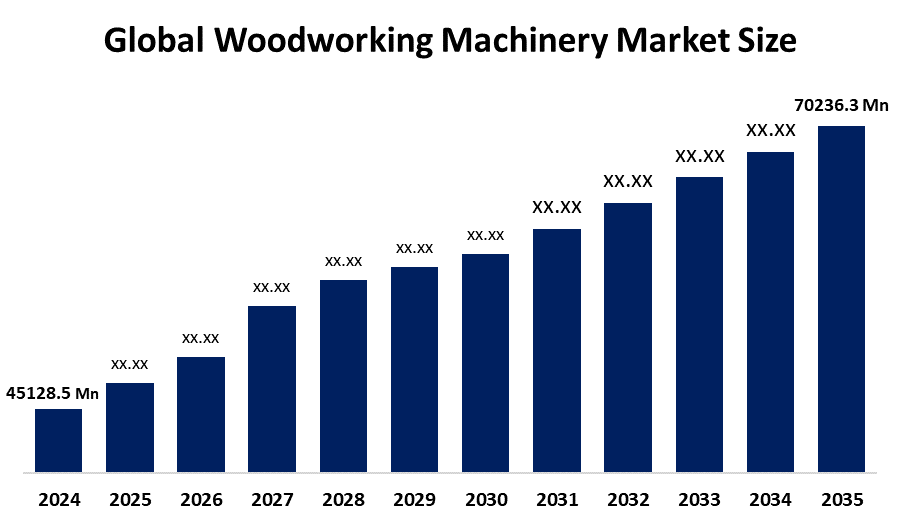

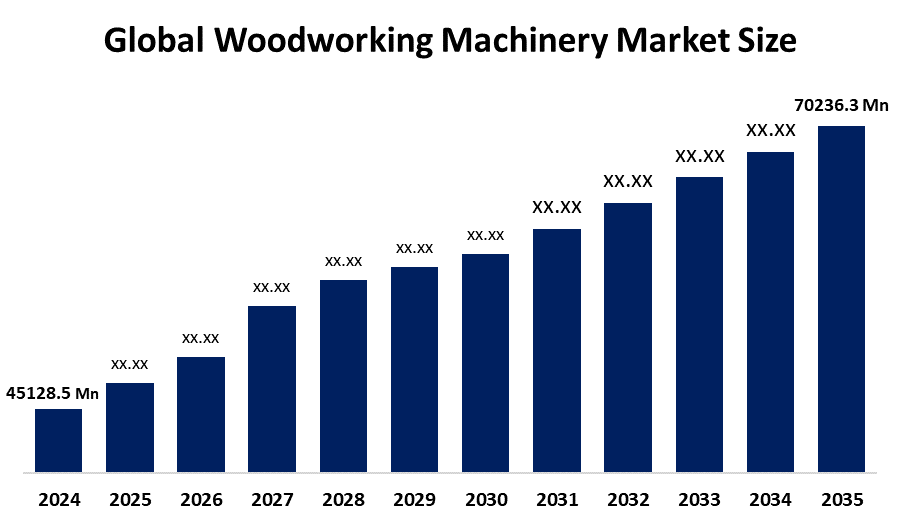

The Global Woodworking Machinery Market Size Was Estimated at USD 45128.5 Million in 2024 and is Projected to Reach USD 70236.3 Million by 2035, Growing at a CAGR of 4.1% from 2025 to 2035. The market for woodworking machinery is expanding because of factors like growing demand for furniture and construction, automation and smart manufacturing adoption, urbanisation, the development of CNC and precision tools, the expansion of the woodworking industries in emerging economies, and the demand for high-quality, efficient production processes.

Key Regional and Segment-Wise Insights

- In 2024, the European woodworking machinery market held the largest revenue share of 38.1% and dominated the global market.

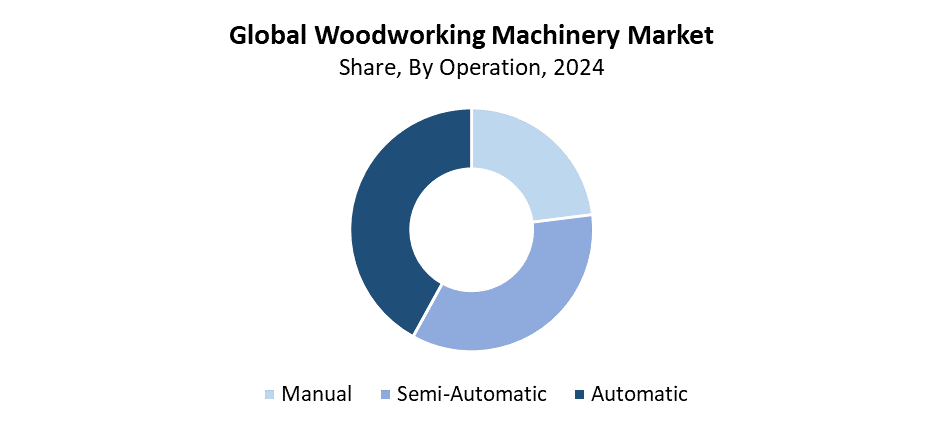

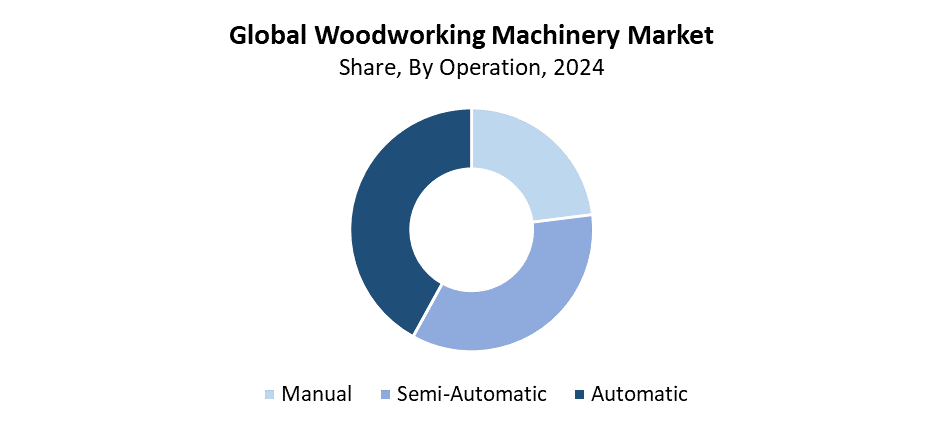

- In 2024, the automatic segment held the highest revenue share of 42.8% and dominated the global market by operation.

- With the biggest revenue share of 23.4% in 2024, the saws segment led the worldwide woodworking machinery market by product type.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 45128.5 Million

- 2035 Projected Market Size: USD 70236.3 Million

- CAGR (2025-2035): 4.1%

- Europe: Largest market in 2024

The Market Size for woodworking machinery includes the production and usage of equipment that performs cutting, shaping, joining, and finishing operations on wood and wood-based materials. The building, flooring, cabinetry, and furniture manufacturing industries all make extensive use of these devices, which include saws, planers, sanders, CNC routers, and moulding machines. The market finds its main driving force through worldwide rising construction activities and rapid urban growth, together with increasing consumption of furniture and interior products. The market expansion receives support from automated production systems and efficient manufacturing processes, which meet consumer demand for personalised wooden products. The woodworking industry in developing countries experiences growth. This leads to increased investment in modern equipment because of the need for high-quality, sustainable wood products.

The woodworking machinery market experiences changes because of technological progress, which includes CNC machines, robotic automation, AI-based precision systems, and energy-efficient equipment that enhance operational efficiency, accuracy, and safety standards. The worldwide government sector supports smart manufacturing development through funding programs. These promote industrial modernisation and automated, environmentally friendly equipment. The manufacturers need to follow strict safety rules and environmental standards, which require them to implement state-of-the-art dust collection systems, noise reduction technology, and waste management solutions. The new technologies, together with growing training programs and industry collaborations, lead to increased use of modern woodworking equipment, which drives steady worldwide market growth.

Operation Insights

The automatic segment dominated the global woodworking machinery market by holding the largest revenue share of 42.8% in 2024. The woodworking industry maintains its market position because it delivers precise and efficient woodworking processes to meet the needs of cabinetry, building, and furniture manufacturing. The production of large-scale and customised wood products becomes more efficient through automatic machines because they boost manufacturing speed while minimising mistakes and cutting down on human work. The market experiences growth because automated control systems, robotics, and CNC technology become more prevalent in industrial applications. The woodworking machinery market proves the automatic segment's leading position because manufacturers deploy automated solutions to achieve safe operations and energy efficiency while overcoming rising labour expenses.

The semi-automatic segment will experience substantial growth during the forecast period. The market expansion originates from the rising demand for adaptable woodworking solutions, which provide cost-effective systems that combine automated functions with manual control elements. The semi-automatic machines offer better accuracy and productivity than manual equipment, but they provide more operational flexibility and lower costs than fully automatic systems. The tools prove to be an excellent choice for small and medium-sized woodworking operations that want to enhance their production capabilities while keeping their expenses low. The trend of semi-automatic gear usage has grown because people now focus more on interior design and furniture customisation. The woodworking machines market continues to grow worldwide because digital controls and advanced safety features make these machines more appealing to customers.

Product Type Insights

The saws segment held the largest revenue share of 23.4% and led the global woodworking machinery market in 2024. Saws maintain their leading position because they serve as essential tools for cutting and shaping wood materials. These find application in flooring and cabinet making, construction, and furniture manufacturing. The manufacturing industry depends on CNC and band saws, and circular saws because these tools deliver precise cutting operations and efficient production methods. The market demand grows because urban areas expand while construction projects and interior design activities continue to increase. The saws segment maintains its leading position in the woodworking equipment market because technological advancements have brought automated controls and enhanced safety systems, and energy-efficient designs.

The planers segment of the woodworking machinery market is expected to grow at the fastest CAGR throughout the projection period. The market growth results from the increasing demand for uniform and smooth wood surfaces that meet precise standards in flooring, cabinet, furniture, and construction applications. Planers function as vital woodworking tools which help produce superior wood surfaces for both professional woodworking shops and large-scale manufacturing operations. The market grows because automated and CNC-enabled planers operate faster and produce better results. They reduce waste and maintain consistent quality standards. The segment will achieve global acceptance through the rising interest in furniture personalisation and woodworking business growth in developing nations, and the creation of fast energy-saving planners.

Regional Insights

North America experiences steady growth in the woodworking machinery market because the cabinetry, construction, and furniture industries need more equipment. The United States and Canada lead the market because they possess sophisticated industrial facilities together with automated and CNC woodworking equipment, and operate with a focus on precision and high production rates. The market expansion continues because residential construction, urban growth, and home improvement activities create an increasing need for premium wood products. Manufacturers spend money on machinery that meets safety standards, operates in environmentally friendly ways and uses energy efficiently to comply with strict regulatory requirements. North America maintains its position as the leading worldwide woodworking machinery market through technological advancements, which include robotic systems and digital controls. Smart monitoring systems enhance operational performance and decrease labour expenses.

Europe Woodworking Machinery Market Trends

The European region dominated the woodworking machinery market worldwide by holding the largest revenue share of 38.1% in 2024. The region achieves its market dominance through strong furniture manufacturing and woodworking operations, which thrive in Germany, Italy, and France because these countries produce high-quality, precision wood products. The demand for custom furniture and cabinets, and interior design solutions, leads to increased popularity of modern woodworking equipment. The production quality and operational efficiency of European manufacturing facilities have improved through their adoption of automated systems and digital technology, and energy-saving equipment. This includes robotic systems, CNC machines, and intelligent monitoring systems. The European woodworking machine industry maintains its leading position in the global market because manufacturers must follow strict safety and environmental regulations, which require them to adopt modern, sustainable equipment.

Asia Pacific Woodworking Machinery Market Trends

The Asia Pacific woodworking machinery market will experience substantial growth during the forecast period because of the region's industrial expansion, urban growth, and increasing requirements for construction materials and furniture products. China, India, and Japan lead the market through their expanding industrial infrastructure development and woodworking industry. The area has experienced a major rise in automated saws and planers, and CNC equipment, which produces better results at lower costs. It also has higher efficiency. The market growth receives additional support from increasing construction operations and interior design work, as well as expanding consumer interest in customised wood products. The government supports advanced woodworking machinery adoption through its industrial modernisation programs, skill development initiatives, and sustainable manufacturing practices. The Asia Pacific region has become a strong high-growth market for the global woodworking machinery industry through this development.

Key Woodworking Machinery Companies:

The following are the leading companies in the woodworking machinery market. These companies collectively hold the largest market share and dictate industry trends.

- HOLYTEK INDUSTRIAL CORP.

- Michael Weinig AG

- Gongyou Group Co., Ltd.

- SCM Group

- A L Dalton Ltd.

- Biesse Group

- CKM

- Solidea Srl

- SOCOMEC S.R.L.

- Nihar Industries

- IMA Schelling Group GmbH

- Dürr Group

- Others

Recent Developments

- In July 2025, the Morbidelli X50, a new CNC drilling centre from SCM Group, is designed to increase productivity and flexibility in woodworking processes. While satisfying the changing demands of the industry, the system is made to optimise manufacturing procedures. Its cutting-edge characteristics allow manufacturers to increase accuracy and output. SCM Group's continuous dedication to innovation and offering cutting-edge solutions for contemporary woodworking is demonstrated by this launch.

- In March 2025, Comeva has introduced the FRAME BR-605E CNC line, which is intended to improve accuracy when machining aluminium and wood rebates and door frames. Automatic loading and unloading is a characteristics of the system that streamlines production and increases productivity. Comeva's clever COMEVA DOORS software is integrated with it, enabling simple modifications and improved performance. The FRAME BR-605E is designed for high-volume production and guarantees constant quality and output. Comeva is positioned as a major pioneer in contemporary frame production technology thanks to this cutting-edge solution.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the woodworking machinery market based on the below-mentioned segments:

Global Woodworking Machinery Market, By Operation

- Manual

- Semi-Automatic

- Automatic

Global Woodworking Machinery Market, By Product Type

- Saws

- Planers

- Routers

- Drills

- Grinding Machines

- Others

Global Woodworking Machinery Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa