Wallpaper Market Summary

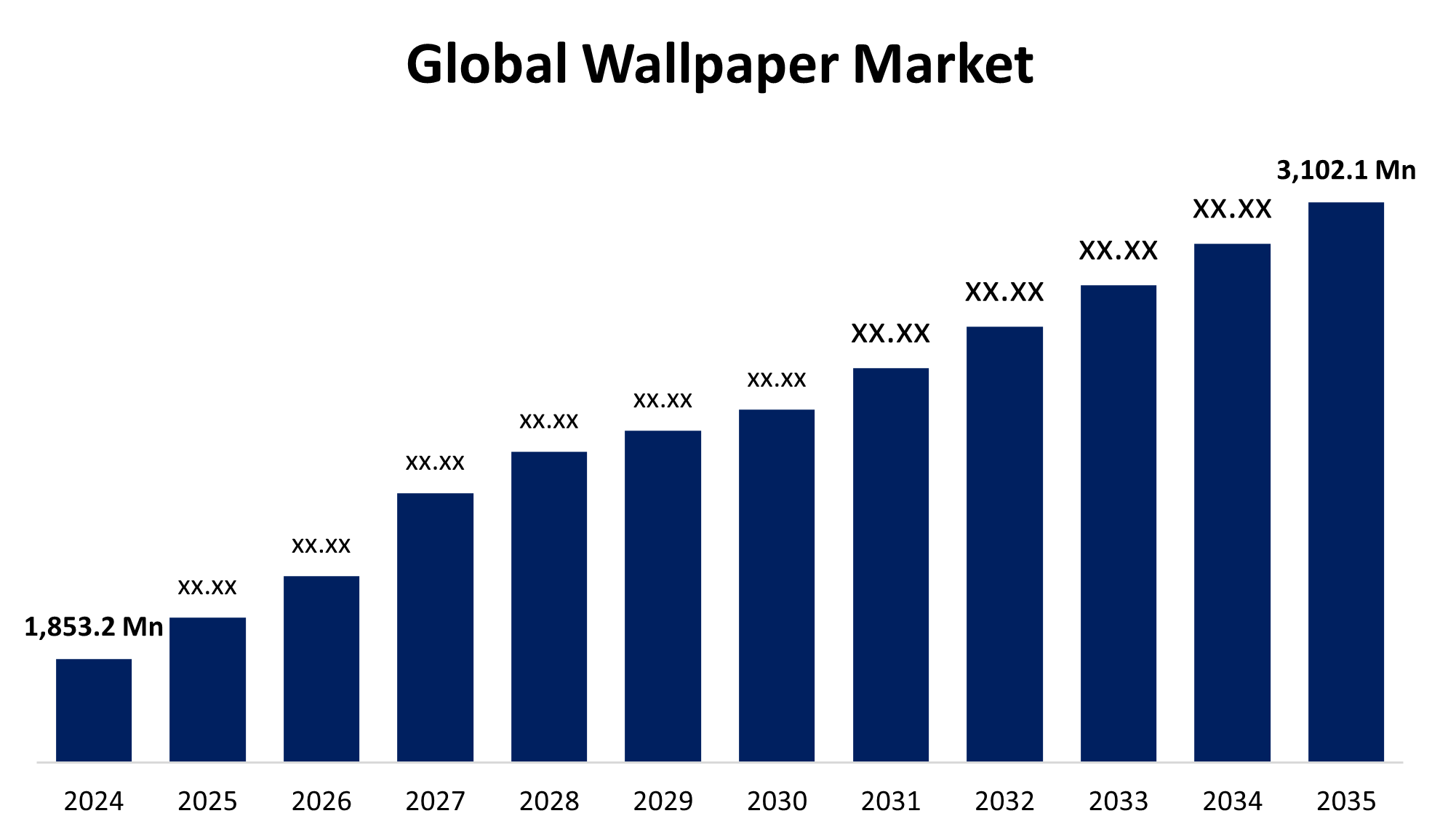

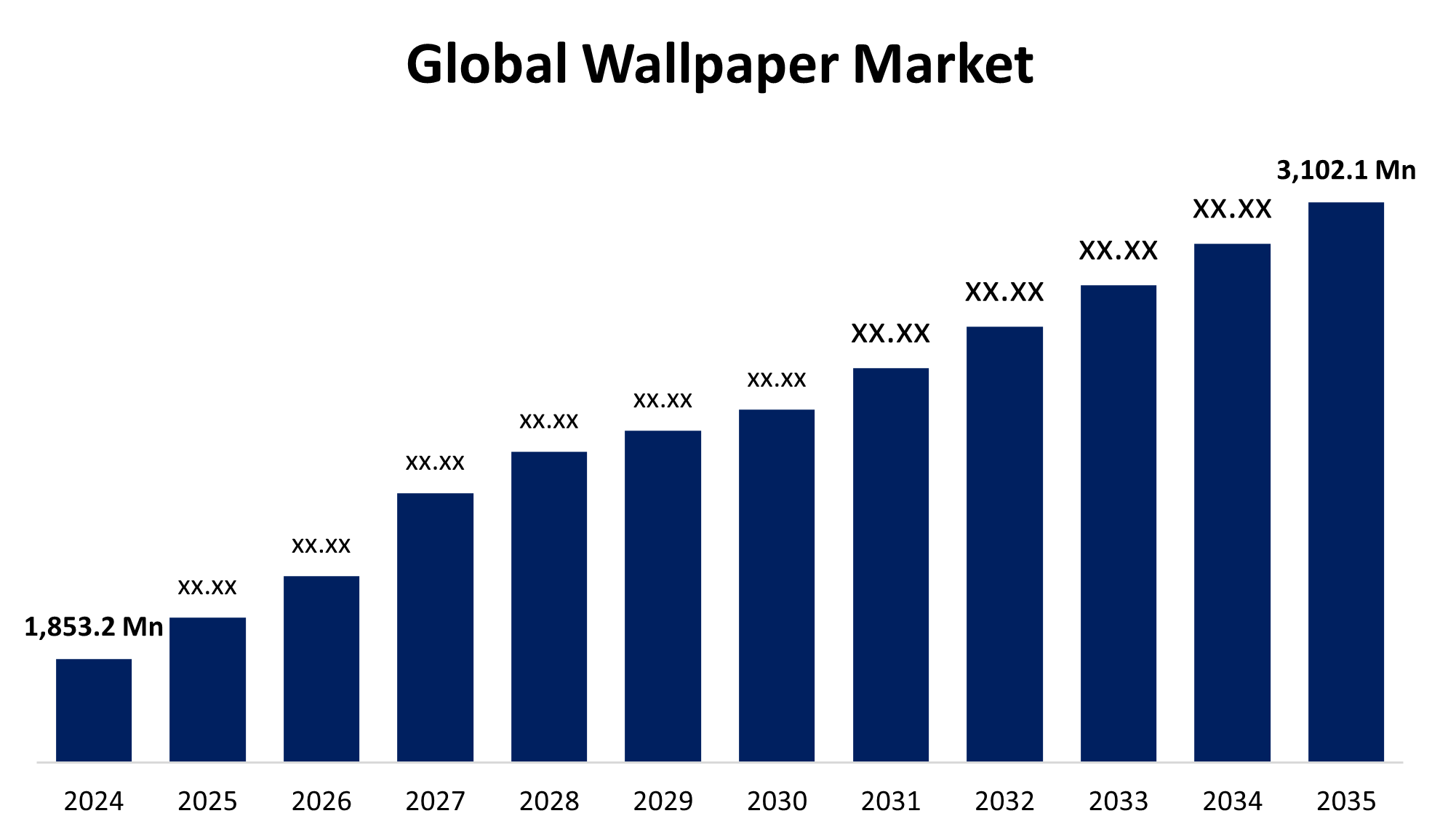

The Global Wallpaper Market size was estimated at USD 1,853.2 Million in 2024 and is projected to reach USD 3,102.1 Million by 2035, growing at a CAGR of 4.79% from 2025 to 2035. Several factors, such as increased urbanization, rising disposable incomes, and a growing demand for interior design and house renovations, are driving expansion in the worldwide wallpaper industry. The industry is growing as a result of changing customer preferences, technological developments in wallpaper materials, and the emergence of e-commerce platforms.

Key Regional and Segment-Wise Insights

- In 2024, the North American wallpaper market held a revenue share of more than 35.4%, dominating the global market.

- The U.S. wallpaper market is anticipated to expand at a CAGR of 2.3% between 2025 and 2035.

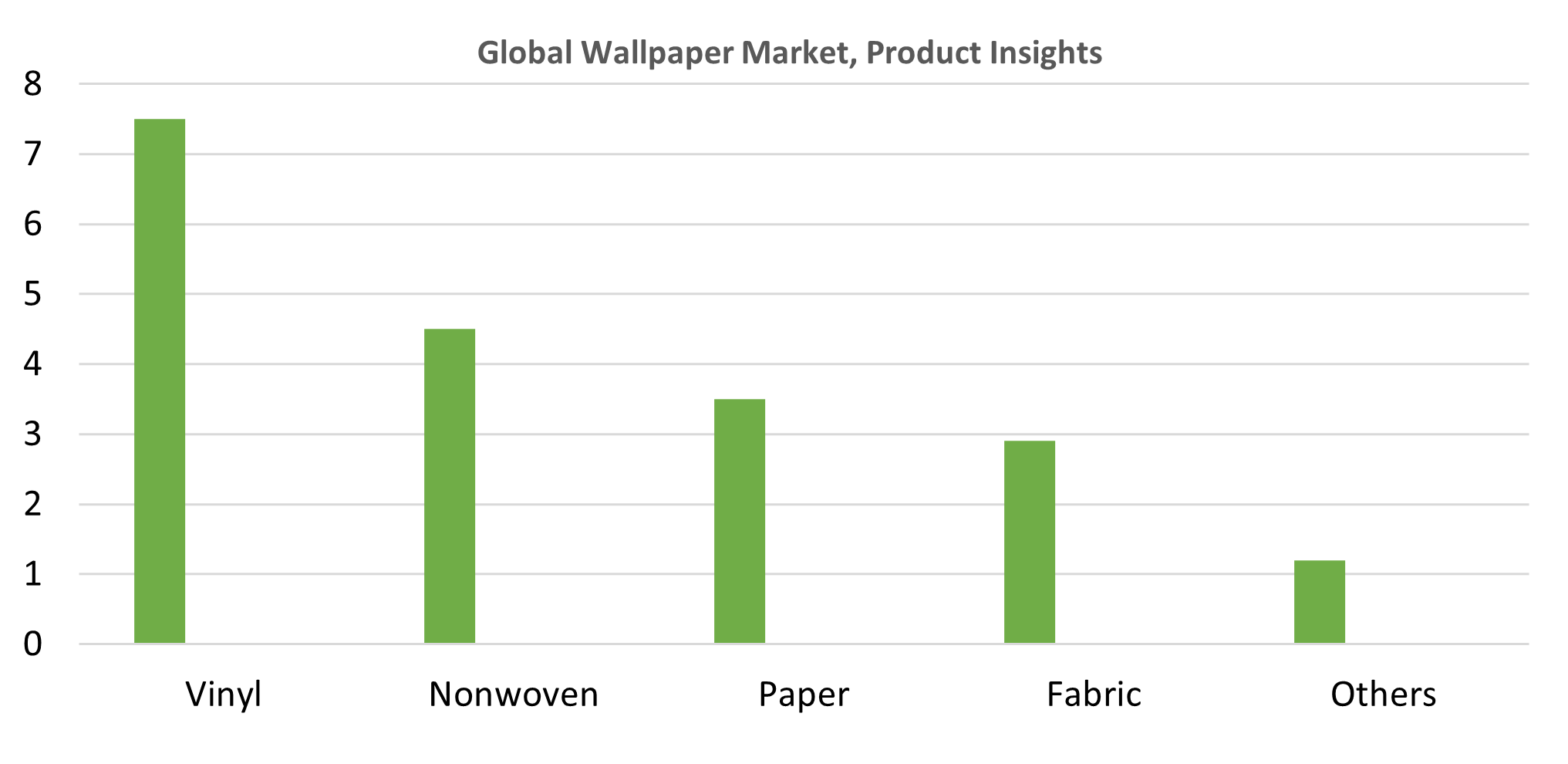

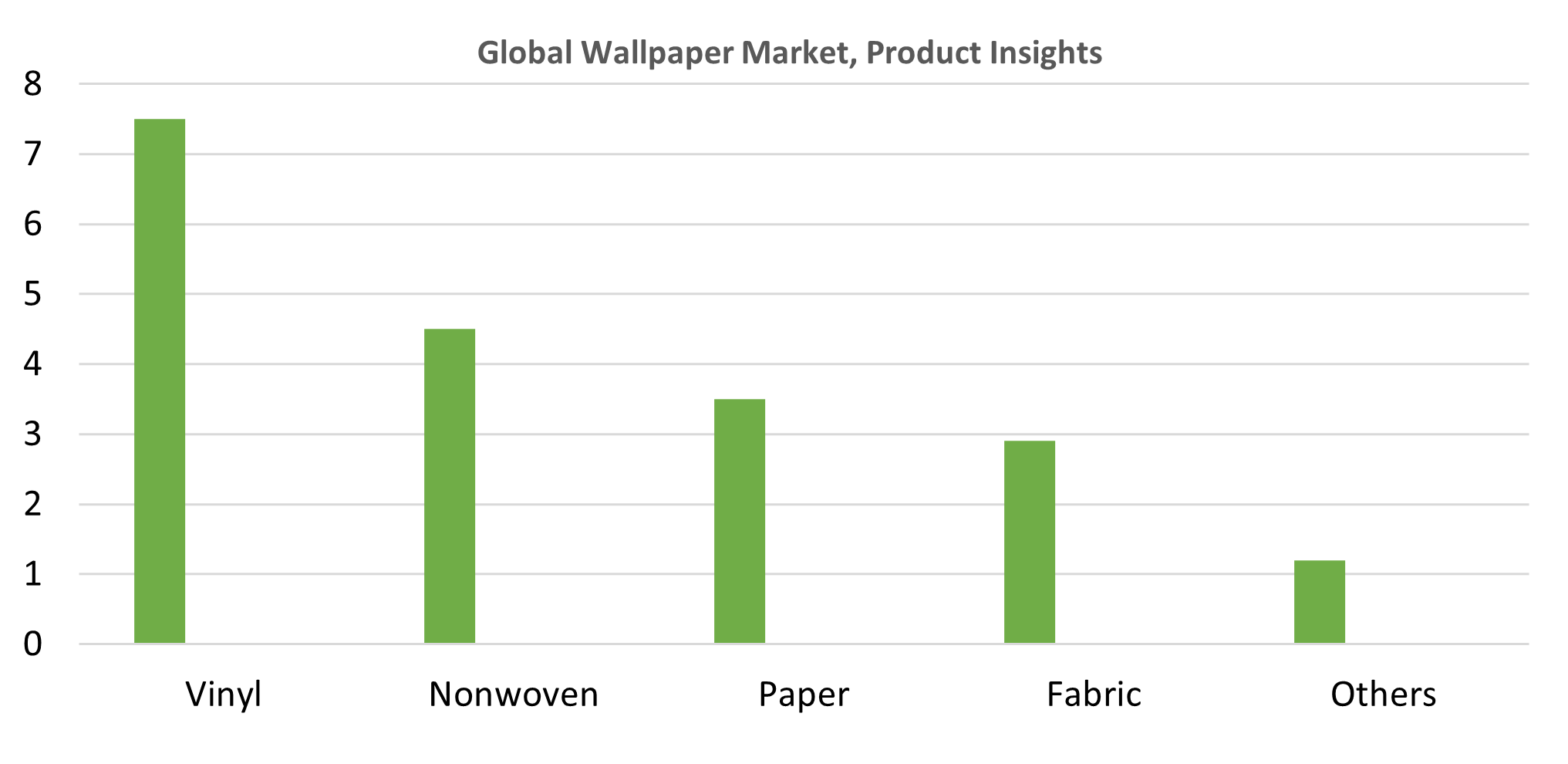

- With the highest revenue share of about 35.6% in 2024, vinyl-based wallpaper dominated the global market based on product.

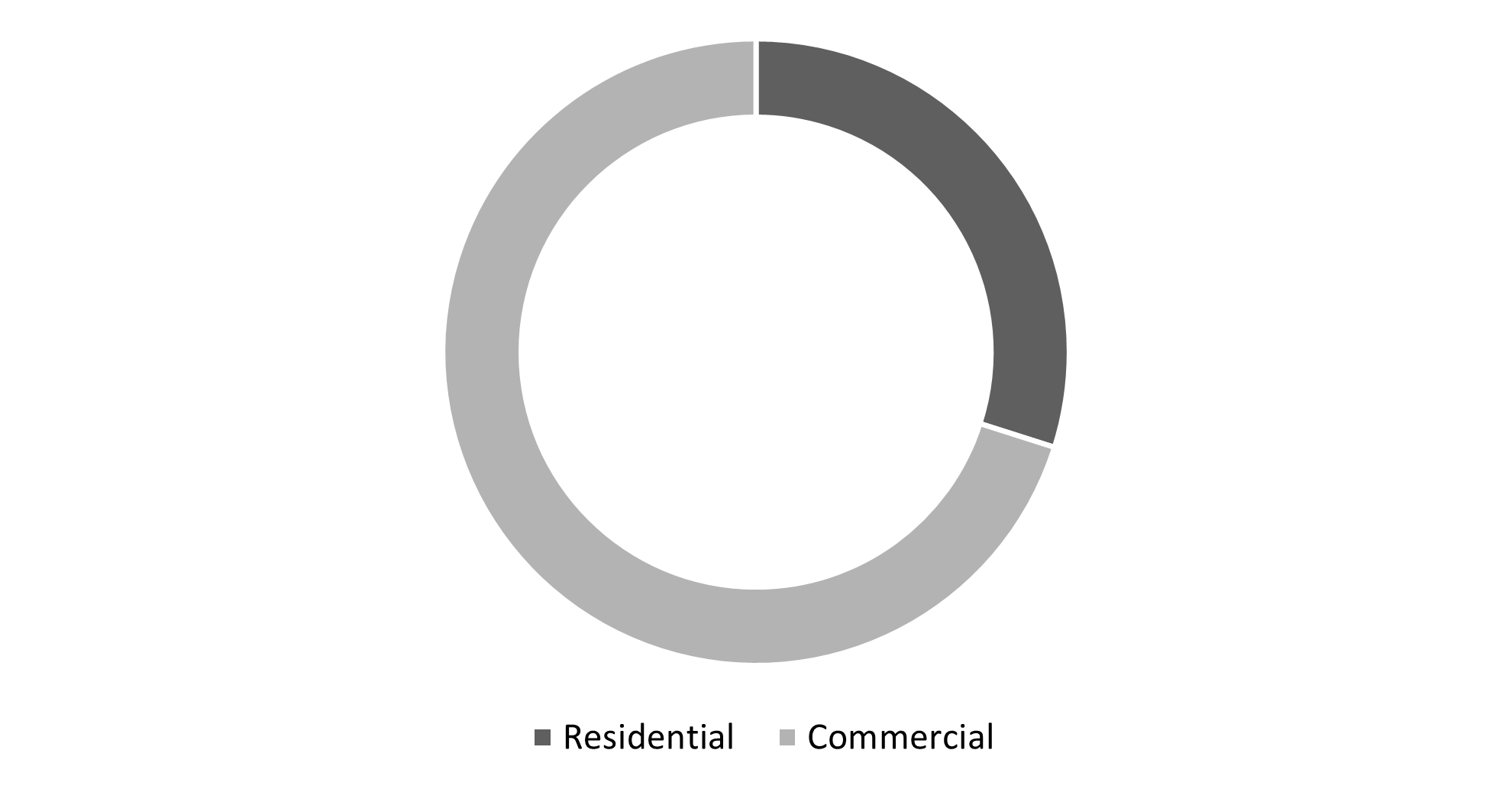

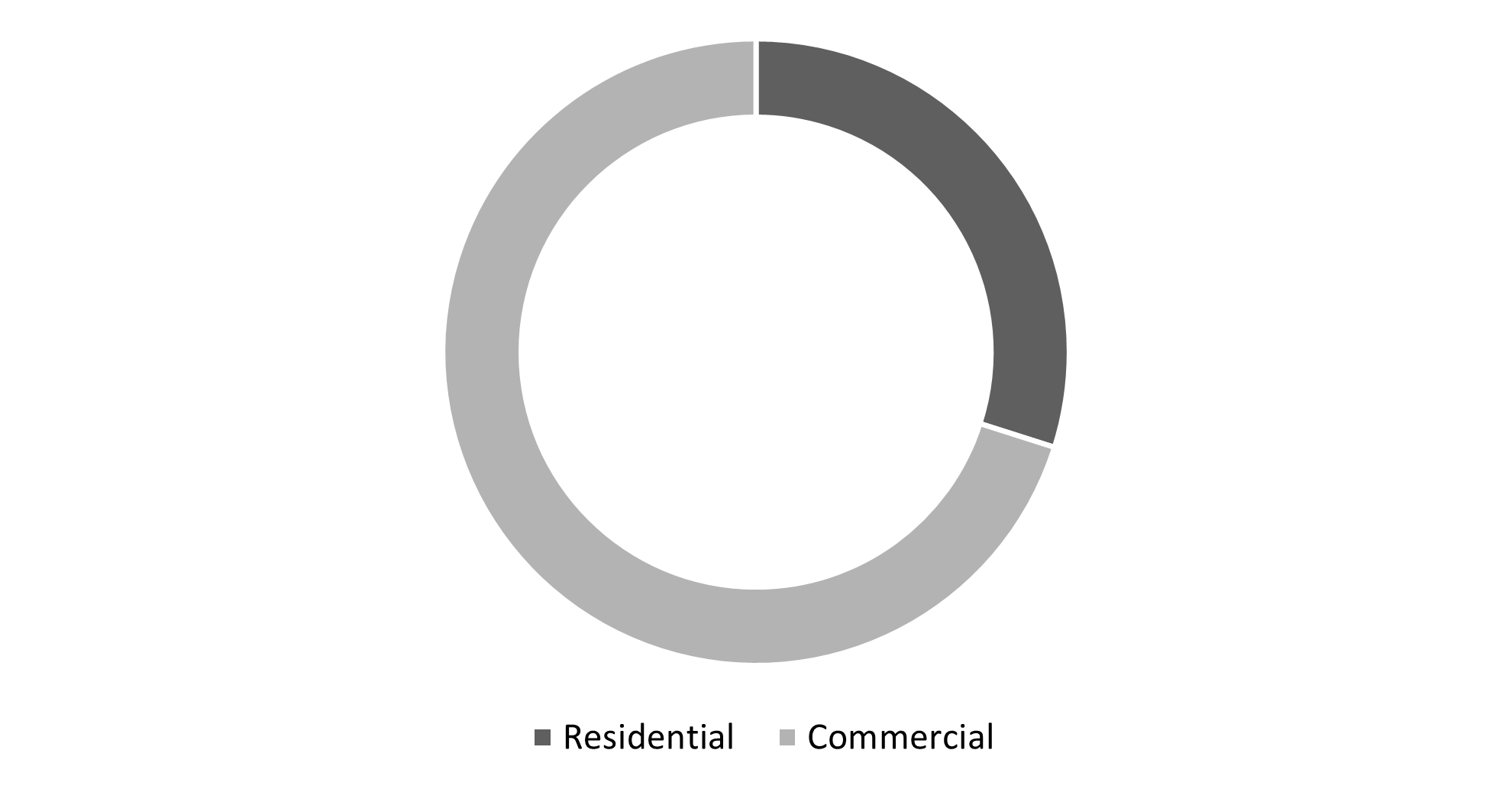

- In 2024, wallpaper sales for commercial applications dominated the global market with a share of about 50.9% based on end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1,853.2 Million

- 2035 Projected Market Size: USD 3,102.1 Million

- CAGR (2025-2035): 4.79%

- North America: Largest market in 2024

- Asia Pacific: Fastest Growing

The global wallpaper market encompasses the global industry engaged in producing, distributing, and selling wallpaper. The wallpaper industry focuses primarily on decorative and protective wall coverings for residential or commercial wall surfaces. The global wallpaper market is influenced by fluctuating trends in the interior design industry, as consumers search for versatile and attractive ways to personalize their spaces. The wallpaper market is being driven by the demand for customized and aesthetically pleasing spaces, along with the development of digital printing technologies that allow more detail and customization to be included in wallpaper formats. Urbanization and increasing disposable incomes have prompted more consumers to buy luxury home décor offerings. Wallpaper manufacturers classify their offerings by commercial and residential use, with some products requiring different types of paper and weight/thickness. Manufacturers are responding to consumer demand for eco-friendly and stain-resistant wall coverings. In order to commercialize products and solutions to prevent bacterial growth, some manufacturers are measuring humidity conditions. Some companies, such as York Wallcoverings and Sangetsu Corporation, have developed a variety of stain and damage-resistant products.

Manufacturers are spending more money on collaborations, marketing, and sponsorships as they work to elevate their client base. For brands that have previously invested heavily in promotions to create a powerful brand identity in the market and build a loyal customer base, the direct-to-customer growth element allows for high profit margins. The number of brand image-oriented companies, geographic, and distributed has made the industry extremely competitive. The industry will anticipate the continued growth of mergers and acquisitions in the future, which will support the expansion of the industry, as hey major players are looking for ways to increase their regional footprint.

Product Insights

In 2024, vinyl wallpaper accounted for the largest market share of about 35.6%, making it the leading segment globally. Their durability and durability makes them suitable for commercial applications and residential installations when children or pets are present. They are a smart choice for residential and commercial purposes because they are durable, resistant to stains, moisture, and wear and tear. Furthermore, vinyl wallpapers come in a wide variety of patterns, textures, and colors, allowing consumers to select from many options to suit their interior design tastes and preferences. As consumers desire low-maintenance and durable options for their interiors, this market continues to grow. Additionally, there is a growing market for sustainable wallpapers, and vinyl wallpapers are manufactured with less energy than traditional paper wallpapers. The growth of the vinyl wallpaper market is also due to consumers' willingness to prioritize sustainability without sacrificing quality or style.

The non-woven wallpaper market is expected to account for a CAGR of 4.2% in the forecast period because non-woven products are more durable, easier to install, and more breathable than traditional paper-based products. When installed directly on the wall, non-woven wallpapers effectively disguise wall fractures. With simple removal, any area's surface after the wall covering looks smooth and attractive. The weather-resistant features of wallpapers that resist warping, shrinking, and ripping show the progression in fiber bonding techniques and substrate manufacturing. Growing demand due to consumer interest in low-maintenance and eco-friendly interiors has increased the adoption of non-woven wallpaper in both new construction and renovation work. Contractors and interior designers prefer non-woven wallpaper because they are easy to install and remove, and can be reused, especially in high-traffic areas.

End Use Insights

In 2024, wallpaper sales in the commercial sector accounted for 50.9% of the global wallpaper market. Wallpaper enhances the feel and aesthetic character of commercial areas. In commercial settings, wallpaper is used as a branding tool; it can utilize company logos, colors, and visual identities, reinforcing the brand image and creating a distinct ambiance throughout the company. Wallpapers can provide antibacterial, thermal, or sound-insulating features depending on the specific needs of various commercial settings. It is projected that wallpaper use continues to increase in the commercial sector as companies strive to create appealing spaces for customers and memorable environments to attract customers. Manufacturers and designers are actively pursuing custom wallpaper solutions to meet the specific needs of this market sector.

The residential wallpaper segment is expected to experience the fastest growth of 3.2% CAGR from 2025 to 2035, due to the increased demand for home personalization and improvement projects. Wallpaper has become popular among consumers as a lower-cost aesthetic for traditional paints. The availability of sustainable products, such as lead and PVC-free wallpaper, as well as the wide variety of patterns and textures, is also fueling demand. Consumers all over the world are drawn to build unique themes and designs for home improvement projects, and modern wallpaper has a longer, more durable lifespan than older papers. One of the reasons consumers love wallpaper is the ease of removal and the availability of so many patterns and designs. Consumers are now much more likely to furnish their homes using wallpaper as a replacement for paint. One thing is certain: wallpaper is expanding quickly into new markets, much like home improvement is rapidly expanding in developing countries, along with aesthetic preferences.

Regional Insights

In 2024, North America accounted for the largest market share of over 35.4%. There is a large demand for wallpapers because of the North American culture's strong emphasis on interior design and home repair. The wallpaper consumption is higher, as homeowners and businesses put more importance on creating visually appealing and personalized spaces. North America features a strong retail ecosystem, consisting of stores such as home improvement retailers and specialty wallpaper shops, and online retailers. Porch.com also reports that over 75% of American households have completed at least one home improvement renovation project since the pandemic began. The area seems to be drawing a demand for many of the clientele using wallpapers with bold patterns and textures. The demand for wallpaper and other interior decorative products in North America is driven by new builds, remodels, and rehabilitation projects.

U.S. Wallpaper Market Trends

From 2025 to 2035, the U.S. wallpaper market will grow at a CAGR of 2.3%. The increased consumer focus on house renovation and personalized interior design is the primary contributor to that growth. The market is currently driven by vinyl wallpaper, but nonwoven wallpaper is growing the fastest due to its durability and ease of installation. The wallpaper market is also growing from the emergence of environmentally-friendly materials and technological advances in digital printing.

Europe Wallpaper Market Trends

In 2024, the European wallpaper market held a sales share of more than 27.4%. Growth in the wallpaper market is being fuelled by the increasing trend of customisation in both residential and commercial spaces and the underlying demand for premium interior decoration solutions. When consumers can make selections of more durable, washable, and sustainable materials, vinyl and nonwoven wallpaper are examples, as these materials do have directional plausibility. The resurgence of heritage-inspired designs and renovations in Western Europe is driving product innovation and design variety for wallpapers. Wallpaper is also being increasingly adopted in the retail and hotel sectors to create distinctive in-store interior identities. The competitive landscape across Europe is still being shaped by advances in technology in digital printing and renewable raw materials.

Asia Pacific Wallpaper Market Trends

The fastest growth of the wallpaper market is predicted to occur in the Asia Pacific, which is expected to grow at a CAGR of 4.7% between 2025 and 2035. This growth is attributable to the growing construction industry in the region, with countries like China and India driving demand for decorative wall coverings in both residential and commercial use. Urbanization, increased disposable income, and increasingly eco-friendly consumer preferences toward design led to increased demand for wall coverings, especially in developing countries.

- The wallpaper industry in India is expected to grow at a 6.3% CAGR through the forecast period. A considerable shift in customer preference toward environmentally friendly products has led wallpaper manufacturers throughout the nation to integrate particular sustainable materials into their products. UDC Homes provides its customers with its Nuance Collection of plant-based wallpapers, which represents a major product line in India.

Key Wallpaper Companies:

The following are the leading companies in the wallpaper market. These companies collectively hold the largest market share and dictate industry trends.

- Sangetsu Corporation

- 4walls

- Osborne & Little

- York Wall Coverings Inc.

- Brewster Wallpaper Corporation

- The Romo Group

- F. Schumacher & Co.

- AS Creation Tapeten AG

- Grandeco

- Asian Paints

- Others

Recent Developments

- In February 2024, Asian Paints partnered with Sabyasachi to offer exceptional wall coverings in a range of classic colorways on opulent textured paper.

- In April 2023, to introduce a new collection, The Romo Group collaborated with Alice Temperley, the creator and creative director of Temperley London. Wallpapers, cushions, textiles, and trims are all part of the collection. It has 12 different wallpaper patterns that showcase a variety of motifs, from rich flowers to exotic chinoiserie and animal prints.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the wallpaper market based on the below-mentioned segments:

Global Wallpaper Market, By Product

- Vinyl

- Nonwoven

- Paper

- Fabric

- Others

Global Wallpaper Market, By End Use

Global Wallpaper Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa