Tea Subscription Market Summary, Size & Emerging Trends

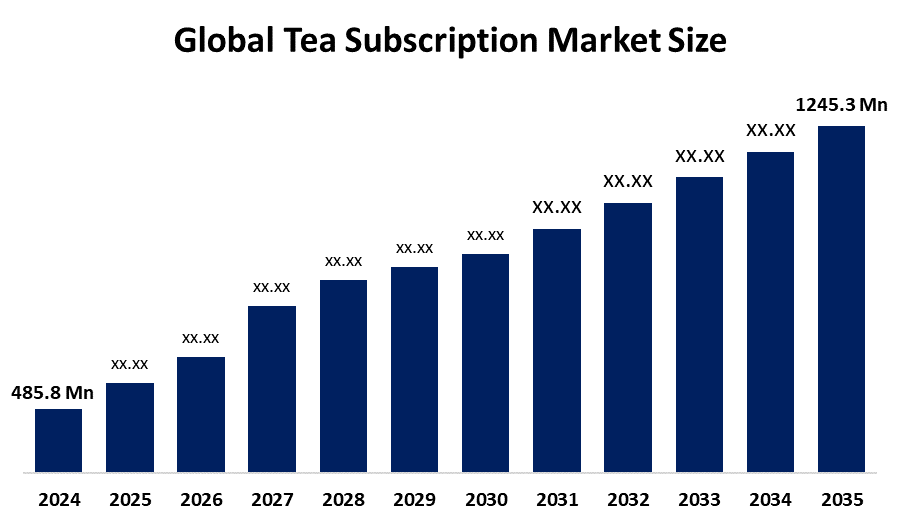

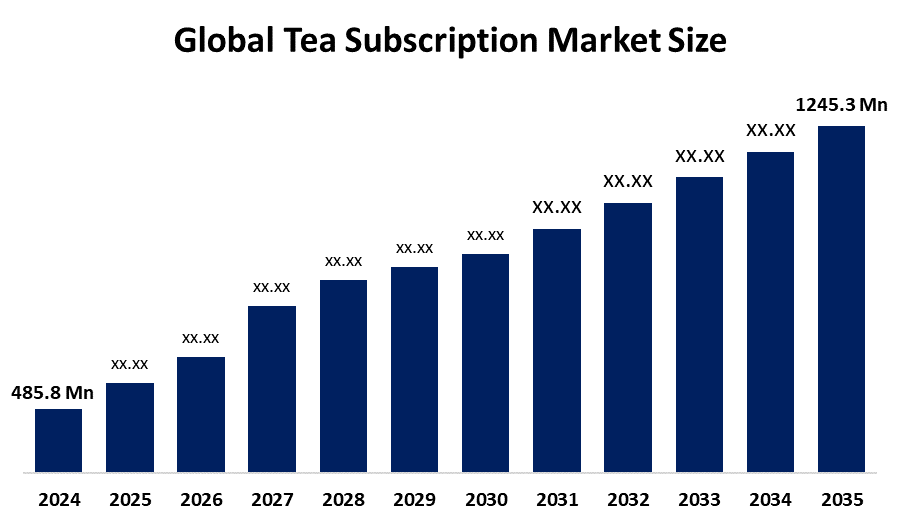

According to Decision Advisor, The Global Tea Subscription Market Size is expected to Grow from USD 485.8 Million in 2024 to USD 1245.3 Million by 2035, at a CAGR of 8.93% during the forecast period 2025-2035. The rising demand for premium, specialty, and personalized tea experiences through online and subscription-based models is a key driving factor for the tea subscription market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the tea subscription market during the forecast period.

- In terms of type, the loose-leaf segment dominated in terms of revenue during the forecast period.

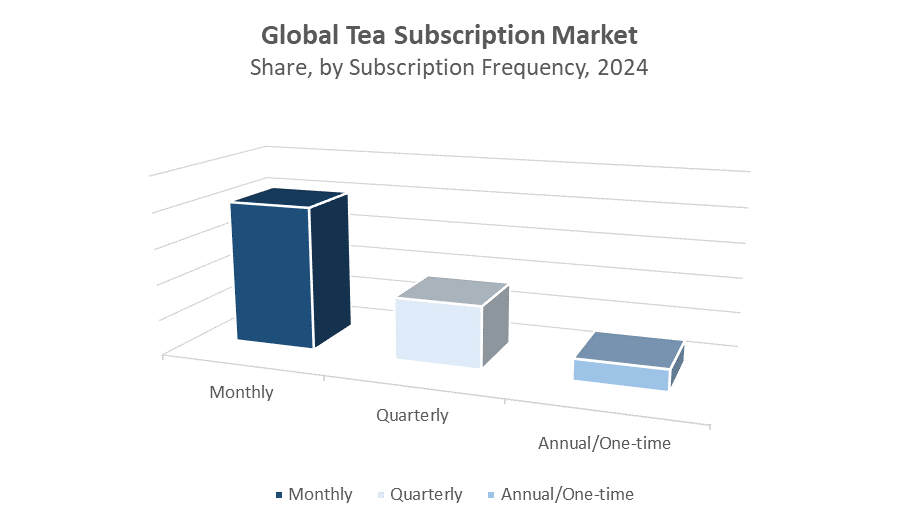

- In terms of subscription frequency, the monthly segment accounted for the largest revenue share in the global tea subscription market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 485.8 Million

- 2035 Projected Market Size: USD 1245.3 Million

- CAGR (2025-2035): 8.93%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Tea Subscription Market

The tea Subscription Market Size revolves around curated, recurring deliveries of diverse tea selections directly to consumers. It allows subscribers to choose between loose-leaf, tea-bag/blend, or specialty teas, with flexible delivery plans such as monthly, quarterly, or annual options. This model appeals to consumers seeking convenience, variety, and premium-quality experiences. Growth is driven by rising e-commerce adoption, increasing health and wellness awareness, and demand for personalized products. Tea subscriptions also make attractive gifting options, enhancing brand engagement and customer retention. As consumers increasingly prioritize sustainability, authentic flavors, and premium beverages, the market is poised for strong global expansion.

Tea Subscription Market Trends

- Growing consumer preference for premium, specialty, and artisanal teas.

- Increasing emphasis on eco-friendly and sustainable packaging in subscription boxes.

- Expansion of personalized subscription models offering customized tea selections.

- Rising collaborations between tea subscription services and wellness or lifestyle brands.

Tea Subscription Market Dynamics

Driving Factors: Rising Demand for Convenience and Premium Tea Experiences

The tea subscription market is primarily driven by consumers’ increasing preference for convenience and high-quality beverage experiences. With busy lifestyles and growing digital adoption, home delivery services have become a preferred way to enjoy curated tea selections. The rising popularity of specialty and artisanal teas—offering unique flavors, organic ingredients, and wellness benefits—has further accelerated demand. Digital platforms and social media have amplified tea culture by connecting enthusiasts with global tea communities and educational content. Subscription models not only offer flexibility and variety for consumers but also provide companies with stable, recurring revenue streams. The growing influence of e-commerce and direct-to-consumer strategies continues to enhance accessibility and brand loyalty across global markets.

Restrain Factors: Intense Competition and High Customer Churn

Despite steady growth, the tea subscription market faces challenges from strong competition and fluctuating consumer retention. Traditional tea retailers and other beverage subscription services compete for the same customer base, making differentiation crucial. Maintaining consistent product quality, freshness, and novelty is essential to reduce subscription fatigue and prevent cancellations. Moreover, the need to deliver delicate products such as tea across regions adds logistical complexity and costs. International shipping expenses, customs duties, and storage conditions can affect profit margins and operational efficiency, particularly for small and emerging brands.

Opportunity: Expansion into Emerging Markets and Sustainable Product Innovation

Emerging markets present vast potential for growth as digitalization and disposable incomes rise in regions with strong tea-drinking cultures. The growing preference for functional and wellness-based teas—such as herbal, detox, and adaptogenic blends—offers opportunities for product diversification and innovation. Sustainability has also become a key differentiator, with eco-friendly packaging and ethically sourced ingredients gaining consumer trust and loyalty. Strategic collaborations with specialty tea producers, wellness influencers, and gifting platforms further expand visibility and brand reach. Companies investing in technology-driven personalization and subscription flexibility are well-positioned to capture new consumer segments and strengthen market presence.

Challenges: Supply Chain Disruptions and Pricing Pressures

Supply chain disruptions remain a significant obstacle for the tea subscription market. Dependence on international tea suppliers exposes companies to price volatility, weather impacts, and geopolitical uncertainties affecting production and shipping. Maintaining a consistent supply of high-quality teas from diverse regions requires careful supplier partnerships and risk management. Additionally, increasing logistics costs, sustainability compliance requirements, and growing price sensitivity among consumers create pressure on profit margins. As competition intensifies, subscription brands must balance affordability with premium offerings while ensuring operational efficiency to sustain long-term profitability.

Global Tea Subscription Market Ecosystem Analysis

The global tea subscription market ecosystem includes key players such as tea growers, blenders, packaging suppliers, subscription service providers, e-commerce platforms, and end consumers. Suppliers, especially from tea-producing regions like China, India, and Sri Lanka, play a critical role in determining availability and pricing. Subscription providers focus on curation, marketing, and customer experience, while regulatory bodies influence labeling and food safety standards. The market’s growth depends on supply consistency, innovation, and evolving consumer preferences for premium and sustainable products.

Global Tea Subscription Market, By Type

What factors enabled the loose-leaf segment to lead the tea subscription market in revenue?

The loose-leaf segment dominated the tea subscription market during the forecast period due to a combination of quality, flavor, and consumer preferences. Loose-leaf tea is widely perceived as higher quality than bagged tea because it uses whole or larger leaves, retaining more natural oils and flavors, which results in a richer taste and aroma. This premium perception appeals to tea enthusiasts seeking a superior sensory experience. Additionally, loose-leaf tea offers customizable brewing options, allowing subscribers to control strength, quantity, and steeping time, which aligns well with the subscription model’s focus on personalized and exploratory experiences.

Why did the tea-bag/blend segment account for 40% of the global tea subscription market during the forecast period?

The tea-bag/blend segment accounted for approximately 35–40% of the tea subscription market during the forecast period due to its convenience, affordability, and consistent quality. Tea bags are easy to brew and require minimal preparation, making them ideal for consumers seeking a quick and hassle-free tea experience. This segment also appeals to a broad audience due to its cost-effectiveness compared to loose-leaf teas, allowing subscription services to target both casual drinkers and price-conscious customers. Additionally, the pre-measured blends ensure uniform flavor and strength, providing a reliable taste experience that builds consumer trust.

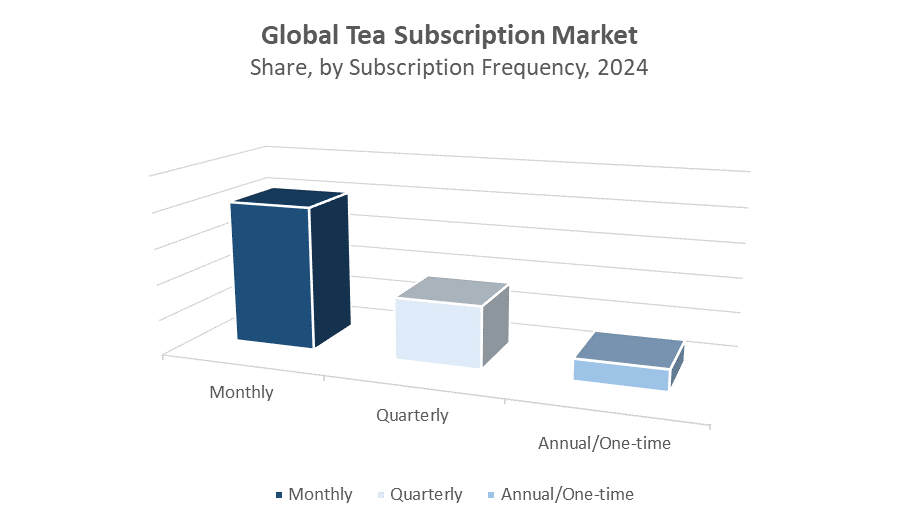

Global Tea Subscription Market, By Subscription Frequency

How did the monthly subscription model gain a competitive edge in the tea subscription market?

The monthly subscription segment dominated the tea subscription market, accounting for approximately 55% of global revenue during the forecast period, due to its convenience, affordability, and customer retention benefits. Monthly subscriptions offer a predictable and manageable delivery schedule, allowing consumers to receive fresh tea regularly without the need for repeated ordering. This model also provides a cost-effective option for subscribers, as many services offer discounted rates for recurring monthly plans compared to one-time purchases. Additionally, the monthly format helps subscription providers maintain steady revenue streams and build long-term relationships with customers, enhancing loyalty and reducing churn.

What made the quarterly subscription segment a popular choice among tea subscribers?

The quarterly subscription segment held a significant share of around 35% of the tea subscription market during the forecast period due to its balance between convenience, flexibility, and affordability. Quarterly subscriptions provide consumers with the opportunity to receive larger tea shipments at a time, reducing the frequency of orders while ensuring a steady supply of tea over an extended period. This model appeals to consumers who prefer to plan ahead and avoid monthly commitments, offering more flexibility for those with irregular consumption patterns. Additionally, quarterly plans often come with cost benefits compared to monthly subscriptions, making them attractive to value-conscious customers.

Asia Pacific is expected to dominate the tea subscription market, holding approximately 45% of global market revenue during the forecast period. The region’s strong tea-drinking culture, particularly in countries like China, India, and Japan, drives high consumer engagement. Rapid digitalization and growing online shopping adoption further accelerate the popularity of subscription-based tea services. Consumers in Asia Pacific increasingly seek specialty and premium teas, curated experiences, and home delivery convenience, which aligns perfectly with subscription models. The expansion of e-commerce platforms and mobile payment solutions also supports seamless ordering and delivery, reinforcing the region’s leadership in the global market.

North America is anticipated to register a significant CAGR during the forecast period, fueled by growing demand for specialty, wellness-focused, and organic teas. Rising consumer interest in premium beverages, sustainability, and health-conscious lifestyles drives market adoption in the United States and Canada. Subscription services offering curated selections, unique blends, and eco-friendly packaging appeal to a broad demographic of tea enthusiasts. The combination of lifestyle trends and increased online retail penetration positions North America as a key growth region.

Europe represents a mature tea market, with countries like the United Kingdom, Germany, and France leading subscription adoption. Established e-commerce channels, coupled with innovative packaging designs and curated tea experiences, support consistent consumer engagement. European consumers favor high-quality and specialty teas, and subscription services capitalize on convenience, gifting potential, and lifestyle-oriented marketing to maintain steady growth in the region.

WORLDWIDE TOP KEY PLAYERS IN THE TEA SUBSCRIPTION MARKET INCLUDE

- Sips by

- Tea Runners

- Simple Loose Leaf

- Plum Deluxe

- The Tea Spot

- Art of Tea

- Free Your Tea

- Teasparrow

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the tea subscription market based on the below-mentioned segments:

Global Tea Subscription Market, By Type

- Loose-leaf

- Tea-bag/Blend

- Specialty/Novel

Global Tea Subscription Market, By Subscription Frequency

- Monthly

- Quarterly

- Annual/One-time

Global Tea Subscription Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the market size of the Global Tea Subscription Market in 2024?

A: The Global Tea Subscription Market size was estimated at USD 485.8 million in 2024.

Q: What is the projected market size of the Global Tea Subscription Market by 2035?

A: The market is expected to reach USD 1245.3 million by 2035.

Q: What is the forecasted CAGR of the Global Tea Subscription Market from 2025 to 2035?

A: The market is expected to grow at a CAGR of 8.93% during 2025–2035.

Q: Which region is expected to hold the largest share of the Global Tea Subscription Market?

A: Asia Pacific is projected to account for the largest market share, driven by strong tea-drinking cultures and increasing adoption of subscription services.

Q: Which region is expected to grow the fastest in the Tea Subscription Market?

A: North America is anticipated to register the fastest growth due to rising demand for specialty, wellness-focused, and organic teas.

Q: Which type of tea dominates the subscription market in terms of revenue?

A: The loose-leaf segment dominated in terms of revenue due to its premium quality, rich flavor, and customizable brewing options.

Q: Why is the tea-bag/blend segment significant in the subscription market?

A: Tea-bag/blend accounted for around 35–40% of the market due to convenience, affordability, consistent quality, and ease of brewing.

Q: Which subscription frequency is most popular among consumers?

A: Monthly subscriptions dominate, accounting for approximately 55% of global revenue, offering convenience, affordability, and steady customer engagement.