Steviol Glycoside Market Summary

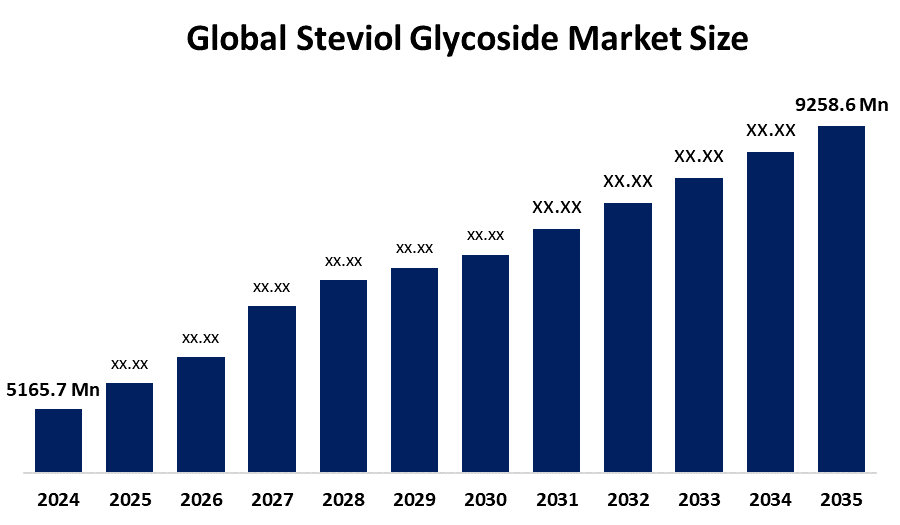

The Global Steviol Glycoside Market Size Was Estimated at USD 5165.7 Million in 2024 and is Projected to Reach USD 9258.6 Million by 2035, Growing at a CAGR of 5.45% from 2025 to 2035. The market for steviol glycosides is expanding due to growing consumer awareness of the negative health effects of sugar consumption and a growing desire for natural, low-calorie sweeteners.

Key Regional and Segment-Wise Insights

- In 2024, the North American steviol glycoside market held a 34.6% revenue share, dominating the global market.

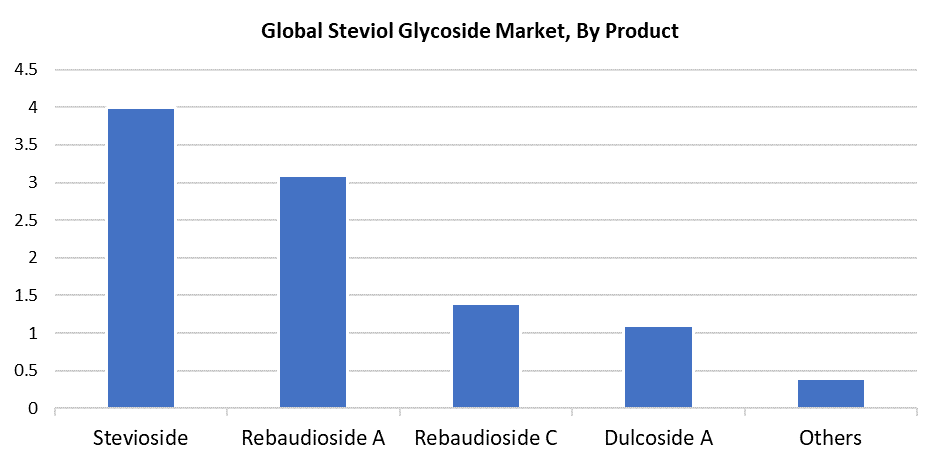

- In 2024, the stevioside segment had the biggest revenue share of 40.7% and dominated the market by product.

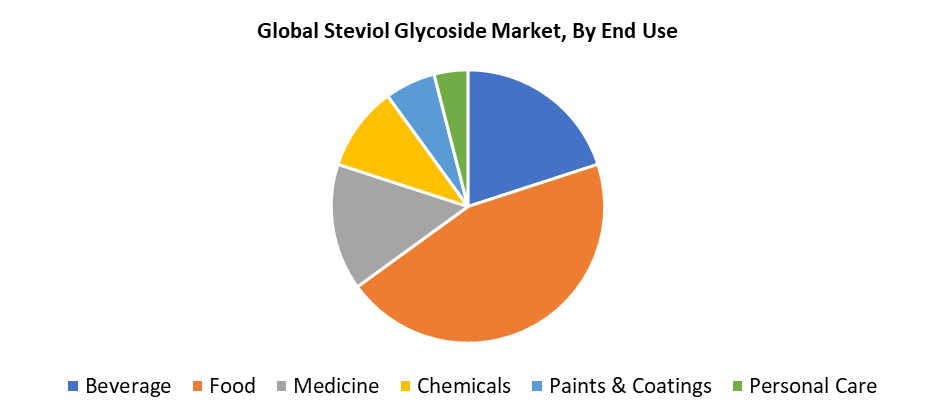

- In 2024, the food segment held a 45.7% revenue share, dominating the market by end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 5165.7 Million

- 2035 Projected Market Size: USD 9258.6 Million

- CAGR (2025-2035): 5.45%

- North America: Largest market in 2024

The worldwide industry that produces and sells steviol glycosides from the Stevia rebaudiana plant encompasses the steviol glycosides market. The demand for steviol glycosides continues to grow exponentially throughout the world because diabetes and obesity, along with high sugar consumption, receive increasing health focus. The natural zero-calorie compound from stevia plants, known as steviol glycosides, serves as a suitable replacement for traditional sweeteners because people want sweeteners that do not affect blood sugar levels. People have adopted steviol glycosides as a safe plant-based sweetener that provides extra health benefits because they understand the risks of artificial sweeteners and refined sugars. Consumers who seek functional food products choose these sweeteners because they help decrease calorie intake while improving blood sugar control. International regulatory approvals from agencies such as the FDA and EFSA drive customer trust and product acceptance in this market trend.

The market for steviol glycosides expands because producers and customers find better flavor characteristics and more efficient extraction methods attractive. The ingredient continues to spread across multiple food and beverage categories, which include dairy, baked goods, dietary supplements, and soft drinks. The worldwide increase in plant-based diets and vegan lifestyles has driven the growing interest in natural, clean-label components such as steviol glycosides. Emerging economies in South America and the Asia-Pacific region witness rising consumption because people have more disposable income and greater health awareness. Steviol glycosides have a strong potential to become a staple natural sweetener market component when researchers invest more in development and create new products.

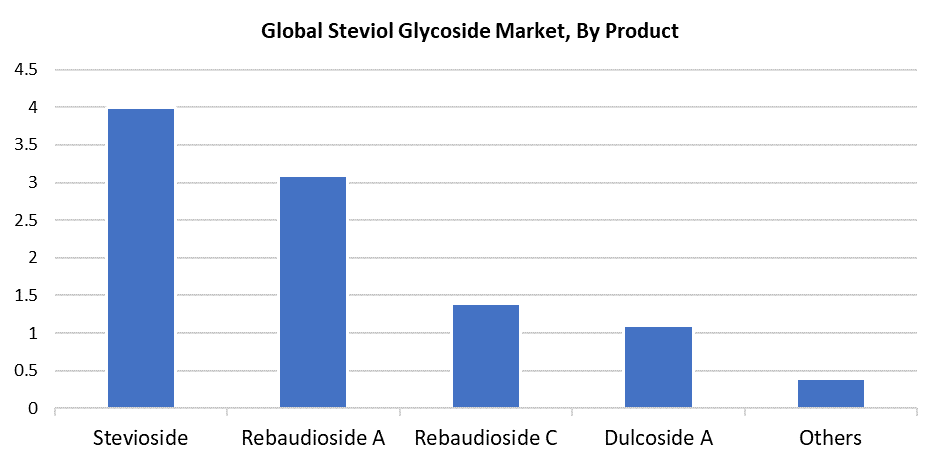

Product Insights

The stevioside category led the global steviol glycosides market in 2024 by generating 40.7% of total revenue because of increasing demand for natural zero-calorie sweeteners. The Stevia rebaudiana plant produces stevioside as its main component, which delivers intense sweetness while being suitable for diabetic patients and people who are conscious about their calorie intake. The global health trend toward sugar reduction and rising consumer health awareness drives its broad application in food and beverage products, including baked goods, along with soft drinks. The U.S. FDA, together with EFSA and Asian food agencies, has provided regulatory approvals to it, which boosted both its market reach and its market acceptance. The rising consumer demand for plant-based and clean-label products has accelerated the market growth of stevioside in health-oriented product formulations.

The Rebaudioside A segment experiences rapid expansion because its taste resembles sugar more closely and produces less bitterness than other steviol glycosides. Rebaudioside A maintains high purity and demonstrates outstanding processing stability, which drives its increasing use in beverages, dairy products, and tabletop sweeteners. This zero-calorie sweetener fits perfectly for product reformulation during sugar reduction initiatives because it delivers superior flavor while maintaining zero calories in markets such as North America and Europe that focus on health. The increasing consumer preference for clean-label plant-based products has driven up the popularity of this product. The rapid expansion of this industry depends on ongoing improvements in stevia extraction technologies, together with international regulatory approvals from important countries.

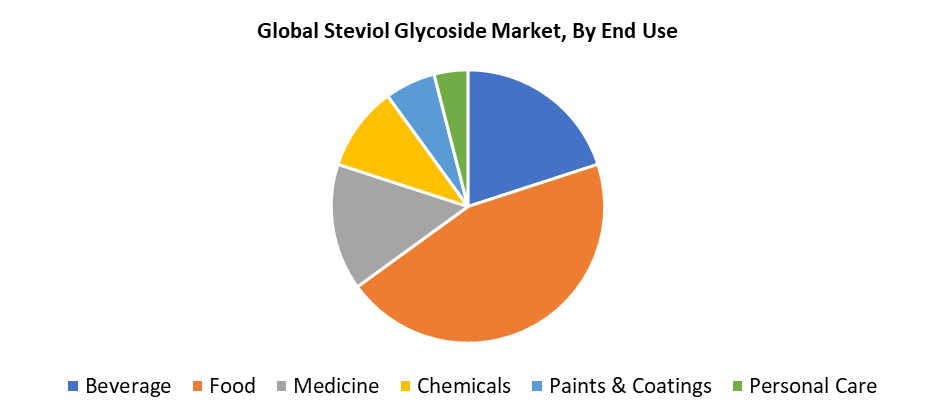

End Use Insights

The food category led the steviol glycosides market in 2024 by holding a 45.7% revenue share because consumers sought functional natural ingredients. The rise of health awareness, together with sugar health concerns, made people search for healthier alternatives to conventional food products. The plant-based, zero-calorie nature of steviol glycosides enables their increasing use in various food products such as cereals, baked products, sauces, and dairy substitutes. The growing demand for health-oriented food choices among consumers is strongest in developing nations because of their rising disposable incomes and increasing urban populations. Steviol glycosides are being transformed by food producers into new products for both clean-label and low-sugar diet trends because of the worldwide nutrition awareness.

The beverage segment accounted for 31.7% of the steviol glycosides market revenue in 2024 and is expected to expand rapidly because of growing consumer preferences for clean-label, low-calorie drinks. The growing preference among health-aware consumers to avoid artificially sweetened and sugary beverages has made steviol glycosides and other natural sweeteners increasingly popular. These plant-based sweeteners contain no calories or glycemic effect and therefore serve as ideal ingredients for energy drinks, teas, flavored waters, and soft drinks. Beverage manufacturers are rapidly transforming their existing products while launching stevia-sweetened alternatives because of shifting health patterns. The growing worldwide demand for sugar reduction enables the beverage industry to expand its usage of steviol glycosides.

Regional Insights

The steviol glycosides market in North America maintained its global dominance with a 34.6% revenue share in 2024 because of rising natural sweetener usage and health awareness among consumers. The increasing number of diabetic and obese patients, together with sugar-related illnesses, has driven customers to seek clean-label products, which has led to numerous food and beverage industry product reformulations. The demand for steviol glycosides has surged because of sugar tax implementation and rising consumer interest in keto, along with low-carb and diabetic-friendly diets. The FDA, together with regulatory agencies, enables these substances to be utilized across various sectors, including medical items and food and beverage products. Multiple regional companies are expanding their stevia-based product offerings, and beverage manufacturers continue to use steviol glycosides for product flavor enhancement and consumer appeal.

Asia Pacific Steviol Glycoside Market Trends

The Asia Pacific steviol glycoside market shows rapid expansion through multiple channels because of strong agricultural potential, increasing health awareness, and shifting consumer choices. China leads the world in stevia cultivation, yet India experiences a natural sweetener surge because of rising lifestyle-linked health issues. South Korea and Japan's developed markets show rising popularity of steviol glycosides in functional foods, drinks, and medications. The transition of the region towards plant-based components, clean-label products, and reduced sugar content drives strong market growth. The Asia Pacific market leads the world in growth because of government initiatives, local innovations, and expanding applications in the food and beverage and healthcare sectors.

Europe Steviol Glycoside Market Trends

The European steviol glycoside market is anticipated to experience significant growth throughout the forecasted period because consumers prefer natural sweetener alternatives and clean-label product applications. Food and beverage companies now use stevia-based substitutes for their products because of EU-wide sugar reduction programs, combined with rising obesity rates and diabetes cases, and growing health awareness among consumers. The legislative support for healthier ingredients has enabled Germany, together with the United Kingdom and the Netherlands, to lead this transformation. The European market for stevia leaf imports drives innovation through advanced extraction methods and growing demand for high-purity chemicals, including Rebaudioside M and D. Steviol glycoside application base and market potential in this region continue to expand because of these factors, together with changing consumer preferences.

Key Steviol Glycoside Companies:

The following are the leading companies in the steviol glycoside market. These companies collectively hold the largest market share and dictate industry trends.

- PureCircle (a part of Ingredion)

- HOWTIAN

- ADM (Archer Daniels Midland)

- Zydus Wellness.com

- GLG Life Tech Corp.

- Whole Earth Brands

- Kerry Group plc.

- MORITA KAGAKU KOGYO CO., LTD.

- Tate & Lyle

- FUJIFILM Wako Pure Chemical Corporation

- Daepyung Co., Ltd.

- GLSTEVIA

- Others

Recent Development

- In June 2024, Ingredion Incorporated declared that the use of PureCircle by Ingredion's bioconverted steviol glycosides has been approved by UK food safety regulators, increasing access to the most delicious stevia molecules for use in food and beverage applications.

- In May 2024, HOWTIAN unveiled SoPure Andromeda, a new product in its highly acclaimed SoPure stevia line, which includes unique stevia blends that have been enhanced and tailored for a range of beverage applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the steviol glycoside market based on the below-mentioned segments:

Global Steviol Glycoside Market, By Product

- Stevioside

- Rebaudioside A

- Rebaudioside C

- Dulcoside A

- Others

Global Steviol Glycoside Market, By End Use

- Beverage

- Food

- Medicine

- Chemicals

- Paints & Coatings

- Personal Care

Global Steviol Glycoside Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa