Soil Tillage Implements Market Summary, Size & Emerging Trends

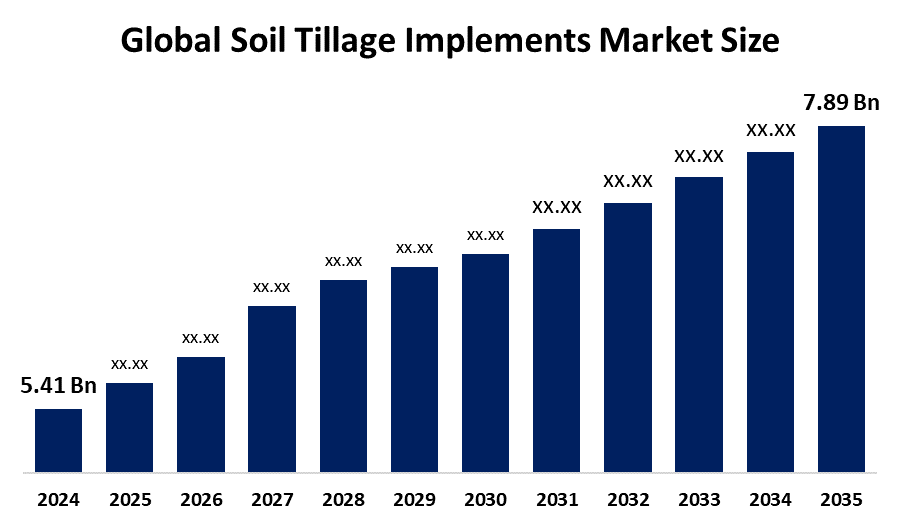

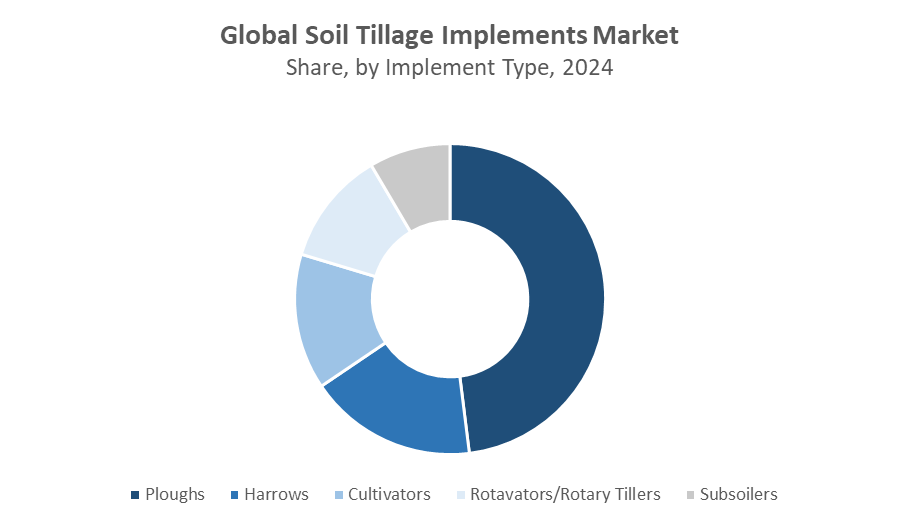

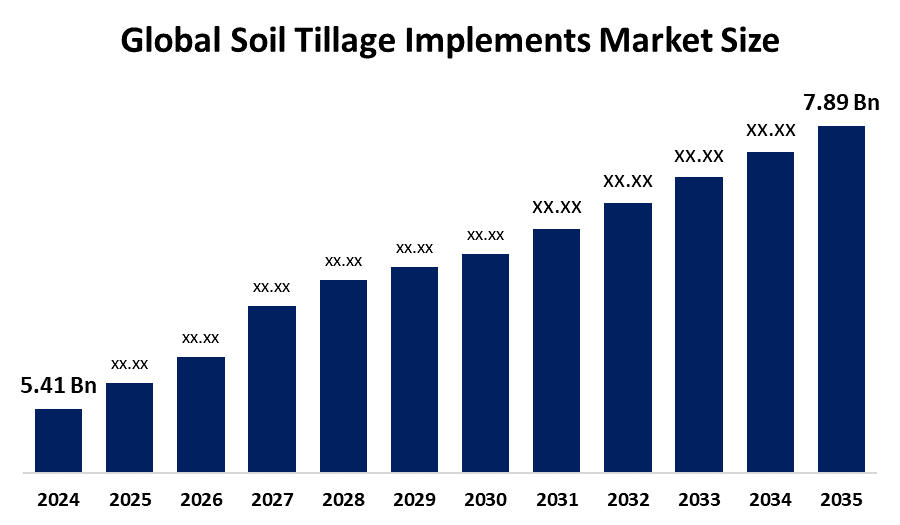

According to Decision Advisor, The Global Soil Tillage Implements Market Size is Expected To Grow from USD 5.41 Billion in 2024 to USD 7.89 Billion by 2035, at a CAGR of 3.49% during the forecast period 2025-2035. Rising mechanization in agriculture, government subsidies for modern farming equipment, and increasing demand for higher crop productivity are key factors driving the growth of the soil tillage implements market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in The soil Tillage Implements Market Size during the forecast period.

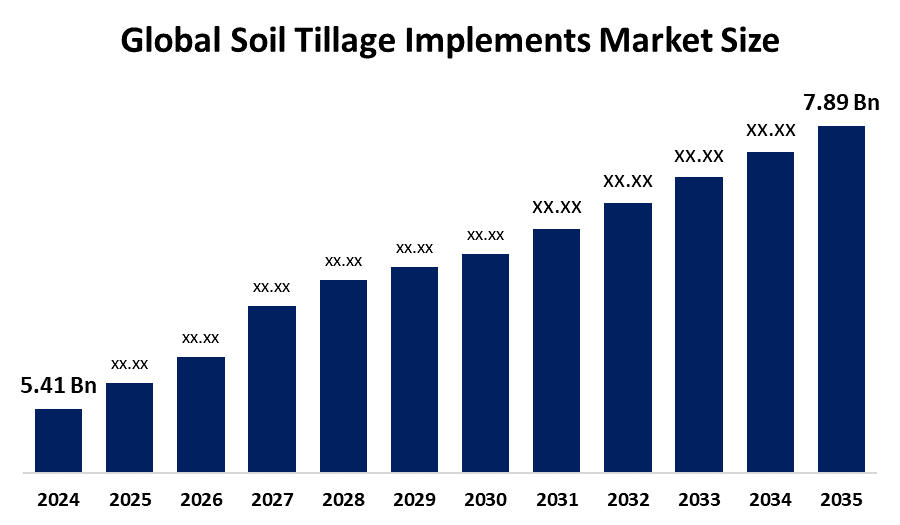

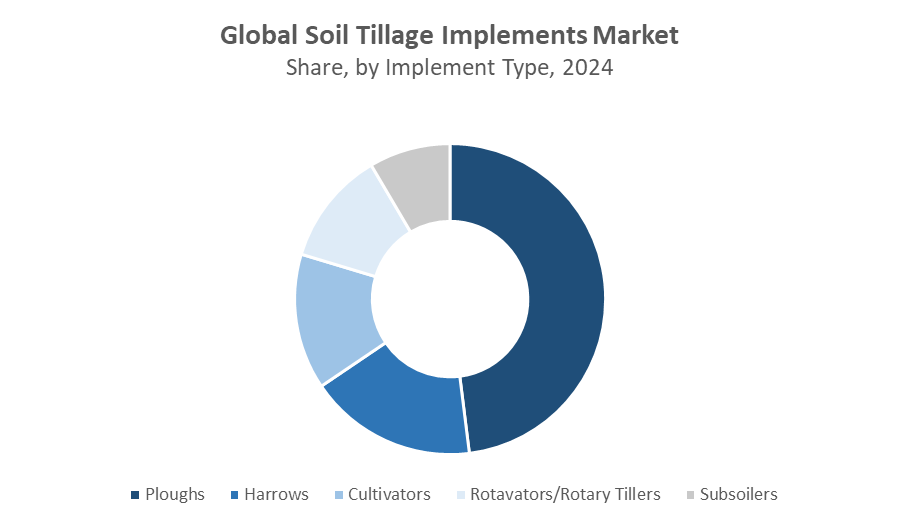

- In terms of implement type, ploughs dominate the market in revenue share.

- In terms of power source, tractor-mounted PTO implements hold the largest revenue share globally.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 5.41 Billion

- 2035 Projected Market Size: USD 7.89 Billion

- CAGR (2025-2035): 3.49%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Soil Tillage Implements Market

The soil tillage implements market focuses on equipment used to prepare soil for planting, including ploughs, harrows, cultivators, rotavators, and subsoilers. These tools improve soil aeration, nutrient distribution, and water retention, directly enhancing crop yields. Mechanization is rising, with implements powered by tractors, self-propelled engines, or animals in regions with limited mechanization. Government support through subsidies, tax incentives, and agricultural modernization programs encourages adoption. Market growth is fueled by the need for higher productivity, labor efficiency, and sustainable farming practices. Increasing awareness of precision agriculture and innovative equipment designs further drives demand. The market caters to both large commercial farms and smallholder farmers, reflecting a trend toward mechanized, efficient, and environmentally conscious soil preparation methods that optimize yield while reducing operational costs and manual labor requirements.

Soil Tillage Implements Market Trends

- Adoption of precision agriculture technologies is increasing the efficiency of soil tillage operations.

- Eco-friendly and low-energy tillage equipment is gaining popularity to reduce environmental impact.

- Manufacturers are investing in innovative implement designs to improve durability and performance.

Soil Tillage Implements Market Dynamics

Driving Factors: Rising mechanization and need for higher crop yields

The soil tillage implements market is propelled by the growing trend of mechanized farming, driven by the need to improve efficiency and maximize crop yields. Expansion of commercial agriculture globally, especially in regions with large arable land, is increasing demand for ploughs, harrows, cultivators, rotavators, and subsoilers. Government programs offering subsidies and incentives for modern farming equipment further accelerate adoption. Advanced implements, such as self-propelled rotavators, mini-tillers, and tractor-mounted tools, reduce labor dependency, improve soil aeration, minimize compaction, and enhance productivity, making mechanisation increasingly essential for sustainable and efficient farming.

Restrain Factors: High equipment costs and maintenance requirements

The high initial investment required for mechanised tillage implements such as self-propelled rotavators, mini-tillers, and advanced cultivators can limit adoption, particularly among smallholder and price-sensitive farmers. Beyond purchase costs, ongoing fuel expenses, spare parts, and regular maintenance add to the financial burden. In regions with limited access to skilled operators or technical service centers, improper use or breakdowns can reduce equipment lifespan and efficiency. Furthermore, lack of awareness about the long-term benefits of mechanised tillage, such as improved soil health, higher yields, and labour savings, slows adoption, especially in emerging and rural markets where traditional manual or animal-drawn methods are still prevalent.

Opportunity: Technological innovation and expansion in emerging economies

Emerging economies in Asia, Africa, and Latin America offer substantial growth potential due to expanding arable land, mechanization initiatives, and government subsidies for modern farming tools. Technological innovations, including GPS-enabled implements, automated self-propelled machines, and energy-efficient designs, improve precision, reduce labor dependency, and optimize fuel usage. Such innovations also allow farmers to adopt sustainable practices by minimizing soil degradation and enhancing crop productivity. Increased awareness and training programs in these regions further drive market expansion.

Challenges: Supply chain disruptions and fluctuating raw material costs

The market is sensitive to global steel and alloy price fluctuations, as these materials form the core of tillage implements. Supply chain disruptions, including delays in shipping and raw material shortages, can increase lead times and costs. Additionally, competition from low-cost, locally manufactured implements affects pricing and market share. Labor shortages, stringent environmental regulations, and rising operational costs further restrict market growth, necessitating strategic planning, localized production, and investment in durable, low-maintenance equipment.

Global Soil Tillage Implements Market Ecosystem Analysis

The global soil tillage implements market ecosystem includes raw material suppliers (steel and mechanical components), implement manufacturers, and end-users in agriculture, horticulture, and landscaping sectors. Suppliers, especially in Asia, influence cost and availability. Manufacturers focus on durability, fuel efficiency, and ease of operation. Regulatory bodies enforce safety standards and environmental compliance. The ecosystem’s growth depends on technological innovation, regional mechanization trends, and alignment with sustainability initiatives.

Global Soil Tillage Implements Market, By Implement Type

What key advantages helped ploughs outperform other soil tillage implements?

Ploughs dominate the global soil tillage implements market, accounting for approximately 45% of total revenue. Their widespread use is driven by their efficiency in primary tillage, ability to break and turn soil effectively, and suitability across various soil types and farming scales. Ploughs enhance soil aeration, improve water infiltration, and prepare fields for sowing more efficiently than many other tillage implements. These functional advantages, combined with farmer familiarity and cost-effectiveness, have cemented ploughs as the leading choice in the global market.

How did harrows achieve notable market presence in soil tillage implements?

Harrows account for approximately 20% of the soil tillage implements market revenue. Their popularity is due to their effectiveness in secondary tillage, leveling the soil, and breaking up clods after ploughing. Harrows improve soil aeration, prepare a finer seedbed, and enhance crop uniformity. These functional advantages, along with their adaptability to different soil conditions and cost-effectiveness, have established harrows as a significant segment within the global soil tillage implements market.

Global Soil Tillage Implements Market, By Power Source

Why were tractor-mounted PTO implements preferred over other soil tillage implements?

Tractor-mounted power take-off (PTO) implements dominate the global soil tillage implements market, accounting for approximately 50% of total revenue. Their dominance is driven by the efficiency and versatility they offer, allowing farmers to attach various implements such as ploughs, harrows, and seeders directly to tractors. PTO implements enhance operational productivity, reduce manual labor, and enable precise soil preparation. The growing mechanization of agriculture and increasing adoption of tractor-mounted equipment have further strengthened their position as the leading choice in the global market.

What made self-propelled tillage implements a preferred choice among large-scale farms?

Self-propelled tillage implements are gaining traction, particularly in large-scale commercial farms, accounting for approximately 20% of market revenue. Their popularity is driven by high operational efficiency, reduced labor requirements, and superior performance in extensive agricultural fields. These implements offer precise soil preparation and faster field coverage compared to tractor-mounted alternatives. The increasing adoption of mechanized farming and demand for high productivity in commercial agriculture have contributed to the growing market share of self-propelled tillage implements.

Asia Pacific is the largest market for soil tillage implements, accounting for approximately 45% of global revenue. The region’s dominance is driven by rapid mechanization in countries such as India, China, and across Southeast Asia. Expanding commercial agriculture, increasing farmland productivity needs, and government initiatives promoting modern farming equipment have fueled demand. Large-scale adoption of ploughs, harrows, and rotavators, along with the availability of tractor-mounted and self-propelled implements, further strengthens the market position.

India is projected to grow at a CAGR of around 10% during the forecast period. Growth is driven by rural mechanization programs, government subsidies on farm equipment, and increased awareness of modern tillage methods. Rising labor costs and demand for higher crop yields are accelerating the adoption of ploughs, cultivators, and mini-tillers. States with intensive agriculture, such as Punjab, Haryana, and Tamil Nadu, are witnessing rapid market penetration.

North America accounts for approximately 20% of global revenue, is experiencing strong growth due to the adoption of automated, self-propelled, and precision tillage implements. Large-scale commercial farms are investing in advanced mechanized solutions to improve efficiency, reduce labor dependency, and enhance soil management. Technological innovations like GPS-guided tillage systems and energy-efficient machines are boosting market growth.

Europe contributes around 15% of the global market revenue, with a strong focus on energy-efficient, eco-friendly, and sustainable tillage implements. Adoption is driven by stringent environmental regulations, the push for reduced fuel consumption, and demand for high-quality soil preparation techniques. Farmers in Germany, France, and the UK are increasingly opting for precision and conservation tillage tools to improve soil health while minimizing environmental impact.

WORLDWIDE TOP KEY PLAYERS IN THE SOIL TILLAGE IMPLEMENTS MARKET INCLUDE

- John Deere

- AGCO Corporation

- CNH Industrial

- Mahindra & Mahindra Ltd.

- Kubota Corporation

- Väderstad Group

- CLAAS Group

- SDF Group

- Escorts Limited

- Argo Tractors

- Others

Product Launches in Soil Tillage Implements Market

- In March 2024, John Deere launched a GPS-enabled automated cultivator in the U.S., targeting commercial and large-scale farms. This advanced implement enhances operational efficiency by enabling precision tillage, reducing manual labor, and ensuring uniform soil preparation. Its automation features allow farmers to optimize field coverage, minimize fuel consumption, and maintain consistent soil quality, supporting higher crop yields.

- In June 2023, Kubota Corporation introduced an eco-friendly mini-tiller designed for smallholder farms in India and Southeast Asia. This implement focuses on affordability, energy efficiency, and ease of use, enabling small-scale farmers to adopt mechanized tillage with minimal environmental impact. Its compact design and fuel-efficient operation make it suitable for fragmented farmlands, supporting sustainable agriculture and improving soil productivity.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the soil tillage implements market based on the below-mentioned segments:

Global Soil Tillage Implements Market, By Implement Type

- Ploughs

- Harrows

- Cultivators

- Rotavators/Rotary Tillers

- Subsoilers

Global Soil Tillage Implements Market, By Power Source

- Tractor-Mounted PTO

- Self-Propelled

- Animal-Drawn

- Mini-Tillers

Global Soil Tillage Implements Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the adoption trend for self-propelled tillage implements?

A: Self-propelled implements are gaining traction, particularly in large-scale commercial farms, accounting for around 20% of market revenue due to high efficiency and reduced labor dependency.

Q: What are the key market trends in soil tillage implements?

A: Increasing adoption of precision agriculture technologies, eco-friendly and low-energy equipment, and innovative implement designs to improve durability and performance are key trends.

Q: Which countries are driving growth in Asia Pacific?

A: India, China, and Southeast Asian nations are driving growth, with India projected to grow at a CAGR of around 10% due to government mechanization programs and rising labor costs.

Q: Who are the leading companies operating in the Global Soil Tillage Implements Market?

A: Key players include John Deere, AGCO Corporation, CNH Industrial, Mahindra & Mahindra Ltd., Kubota Corporation, Väderstad Group, CLAAS Group, SDF Group, Escorts Limited, and Argo Tractors.

Q: What are some recent product launches in this market?

A: John Deere launched a GPS-enabled automated cultivator in March 2024 for large-scale farms in the U.S., and Kubota introduced an eco-friendly mini-tiller in June 2023 for smallholder farms in India and Southeast Asia.

Q: Which market segments are covered in the report?

A: The report segments the market by implement type (Ploughs, Harrows, Cultivators, Rotavators/Rotary Tillers, Subsoilers), power source (Tractor-Mounted PTO, Self-Propelled, Animal-Drawn, Mini-Tillers), and region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa).

Q: What is the long-term market outlook for Soil Tillage Implements?

A: The market is expected to continue growing steadily, driven by mechanization, sustainable farming practices, precision agriculture adoption, and government support programs globally.