Silica Flour Market Summary

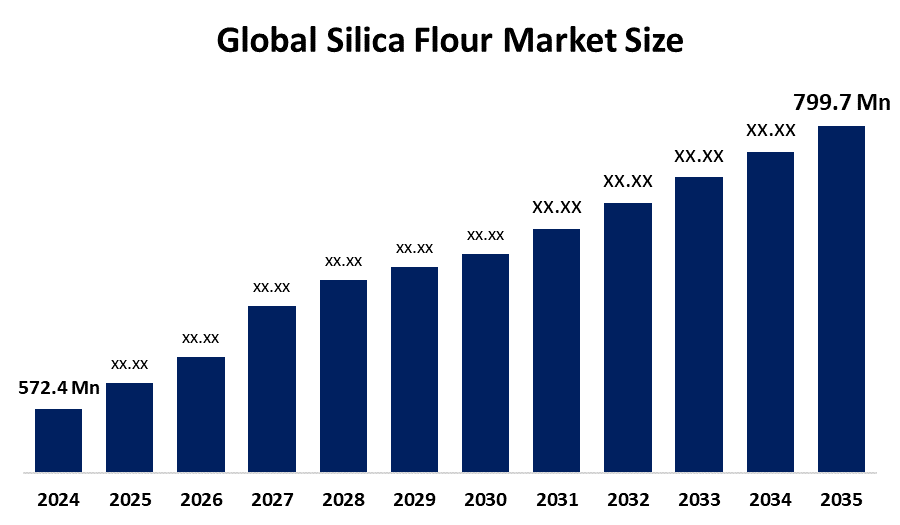

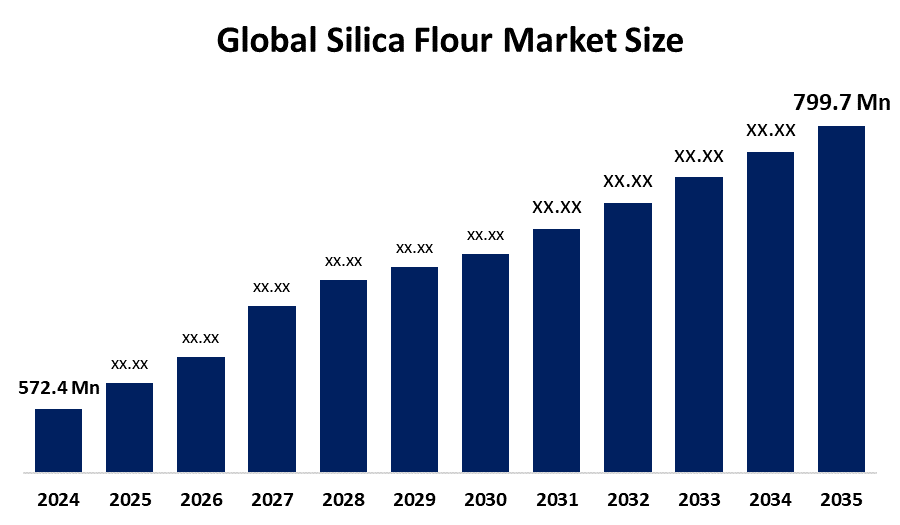

The Global Silica Flour Market Size Was Estimated at USD 572.4 Million in 2024 and is Anticipated to Reach USD 799.7 Million by 2035, Growing at a CAGR of 4.36% from 2025 to 2035. The growing oil and gas industry, growing building activity, and rising demand in the foundry and glass manufacturing sectors are some of the major reasons driving the silica flour market's expansion.

Key Regional and Segment-Wise Insights

- With a 21.5% sales share in 2024, North America led the global market for silica flour.

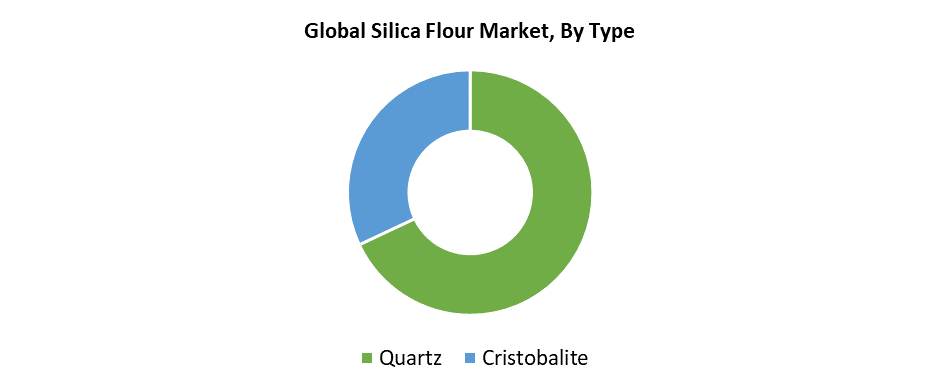

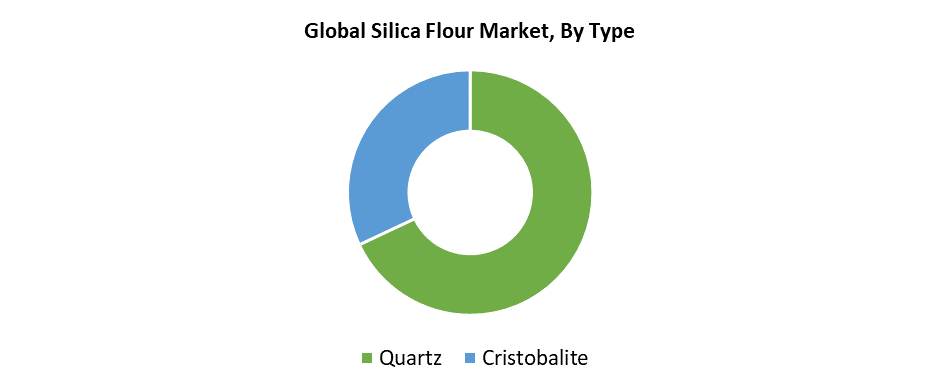

- In 2024, the quartz segment led the silica flour market by type, accounting for the greatest revenue share at 68.7%.

- In 2024, the fiberglass sector held the biggest revenue share of 23.5%, dominating the market by end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 572.4 Million

- 2035 Projected Market Size: USD 915.4 Million

- CAGR (2025-2035): 4.36%

- North America: Largest market in 2024

The worldwide market for silica flour consists of businesses that produce and sell finely ground powder from crystalline silica rocks and high-purity silica sand. The market growth continues because industries need advanced materials for their construction and industrial operations. The growing demand for oil and gas exploration, particularly in North America and the Middle East, drives market growth. The chemical purity, along with the thermal stability of silica flour, drives increasing popularity in the paint, coating, and plastic sectors. The market gains momentum from the rising use of electronics and semiconductors and the increasing need for automotive precision casting and worldwide infrastructure development.

Silica flour production has advanced through new processing technologies, which create better quality and diverse products available in the market. The industries of glassmaking, electronics, and pharmaceuticals require precise particle sizes along with high purity, which advanced grinding procedures combine with strict quality control systems to achieve. The industry is implementing sustainable production processes and recycling technology to minimize environmental impacts. Multiple government bodies support occupational health standards while setting exposure limits for silica dust to protect workers. The increasing use of custom-made silica products that meet strict compliance requirements has grown substantially. The market expansion in premium silica-based materials is driven indirectly by green building projects, together with infrastructure development policies.

Type Insights

The quartz segment led the silica flour market by generating 68.7% of total revenue in 2024. The chemical stability of quartz-based silica flour, together with its hardness and high purity, makes it a widely preferred choice across multiple industries. Its exceptional properties make it the ideal material for challenging applications that involve chemical production, paint manufacturing, ceramic production, glass manufacturing, and foundry operations. The oil and gas industry, along with the construction sector, primarily rely on quartz silica flour for their drilling and cementing operations, leading to its market dominance. The advancement of grinding technology, along with the consistent availability of top-grade quartz, has enhanced both the cost-effectiveness and performance of this material. The quartz segment will maintain its market supremacy in silica flour as long as industries require durable products with superior performance capabilities.

The cristobalite segment is expected to experience a substantial CAGR during the forecast period because of its rising utilization in high-performance applications. The special features of cristobalite silica flour, including its whiteness enhancement, thermal stability, and UV resistance, make it suitable for applications in paints and coatings, plastics, and dental materials. End-use products benefit from improved durability and enhanced finishes through their increased strength and brightness, which drives their demand across different industrial sectors. The growing appeal of advanced polymers and composites supports the market expansion of this sector. The cristobalite market will experience substantial growth throughout the next few years because manufacturers are adopting this material for both industrial and consumer applications.

End Use Insights

The fiberglass segment led the silica flour market by generating 23.5% revenue share in 2024. The manufacturing process of fiberglass relies on silica flour as its primary raw material, which enhances both product strength, heat resistance, and long-term durability. The usage of silica flour has expanded significantly because the automotive, aerospace, renewable energy, and construction sectors need more fiberglass for their insulation and composite and lightweight material applications. Fiberglass applications in wind turbine blade manufacturing and green construction materials experience rising demand because of global sustainability and energy efficiency initiatives. The silica flour market will maintain its leading position through the fiberglass segment because emerging markets continue to develop their industrial base and infrastructure projects.

The oil well cement segment is expected to experience substantial CAGR throughout the projected period because of rising global oil and gas exploration and production operations. Oil well cement incorporates silica flour as an additive to enhance both its strength and thermal resistance when used in high-temperature and high-pressure drilling environments. The material functions as a vital component during deep and ultra-deep well operations by preventing cement failure and maintaining well integrity. The demand remains exceptionally strong in regions that invest heavily in energy infrastructure development, including North America and the Middle East, together with Asia-Pacific. The oil well cement market is expected to grow steadily at a strong pace because of advancements in drilling technology and continuous increases in energy usage.

Regional Insights

North America led the global silica flour market by generating 21.5% of total sales during 2024 because of its strong industrial base, along with extensive end-use demand. The area benefits from strong infrastructure that supports large-scale production and sophisticated mining and processing technology, and abundant natural silica reserves. High-purity silica flour serves as a vital component for major American industries, which include glass production, oil and gas operations, as well as construction and automotive manufacturing. The region's leadership in the market was preserved through its increasing demand for fiberglass and active oil well cementing operations. The region maintains its position as the globe's leading producer and user of silica flour due to legal systems that support innovation, along with technological development initiatives.

Europe Silica Flour Market Trends

The European silica flour market experiences continuous growth through its application in construction, along with glass, ceramics, and automotive manufacturing. Industrial infrastructure strength, together with advanced technologies in Germany, France, and the UK, positions them as top consumers of this market. The European market places a strong emphasis on environmentally friendly materials, which drives up the consumption of refined silica flour for applications in fiberglass production alongside paint and varnish products and specific chemicals. European focus on renewable energy and green construction methods has led to increased demand for silica flour in solar panel components and insulation materials. The use of processed and engineered silica products, which comply with safety and regulatory standards, has expanded because of environmental regulations that control silica dust exposure.

Asia Pacific Silica Flour Market Trends

The Asia Pacific silica flour market experiences rapid growth because of the expanding glass and automotive industries, the electronics sector, and the construction industry. The industrialization, together with urbanization and infrastructure development, makes China, India, Japan, and South Korea the primary leaders in this market. China stands as both the largest producer and consumer of silica flour because of its abundant silica deposits and its significant industrial demand in ceramic, paint, and photovoltaic applications. The region needs more energy and thus requires additional cementing activities, which drives up silica flour demand for oil wells. The Asia Pacific market will expand strongly because of rising foreign investments, along with beneficial government policies and increased usage of advanced materials in consumer electronics manufacturing.

Key Silica Flour Companies:

The following are the leading companies in the silica flour market. These companies collectively hold the largest market share and dictate industry trends.

- U.S. Silica

- Sil Industrial Minerals

- Sibelco

- AGSCO Corpo

- Adwan Chemical Industries Co. Ltd.

- Capital Sand Company

- Fineton Industrial Minerals Limited

- Hoben International Ltd.

- 3M

- Others

Recent Developments

- In October 2023, Solvay intends to begin construction of a new electric furnace at its Silica Plant in Collonges, France, in 2025. This strategic move to sustainable energy sources is expected to reduce CO2 emissions associated with silica production by 20%.

- In June 2022, the Board of Directors of U.S. Silica Holdings, Inc., a diversified industrial minerals company and the top last-mile logistics supplier to the oil and gas sector, has completed the previously announced review of strategic alternatives for its Industrial & Specialty Products ("ISP") segment.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the silica flour market based on the below-mentioned segments:

Global Silica Flour Market, By Type

Global Silica Flour Market, By End Use

- Fiberglass

- Foundry

- Oil Well Cement

- Ceramic & Refractory

- Glass & Clay

- Pharmaceuticals

- Personal Care & Cosmetics

- Other End-uses

Global Silica Flour Market, By Regional Analysis