Shunt Reactor Market Summary

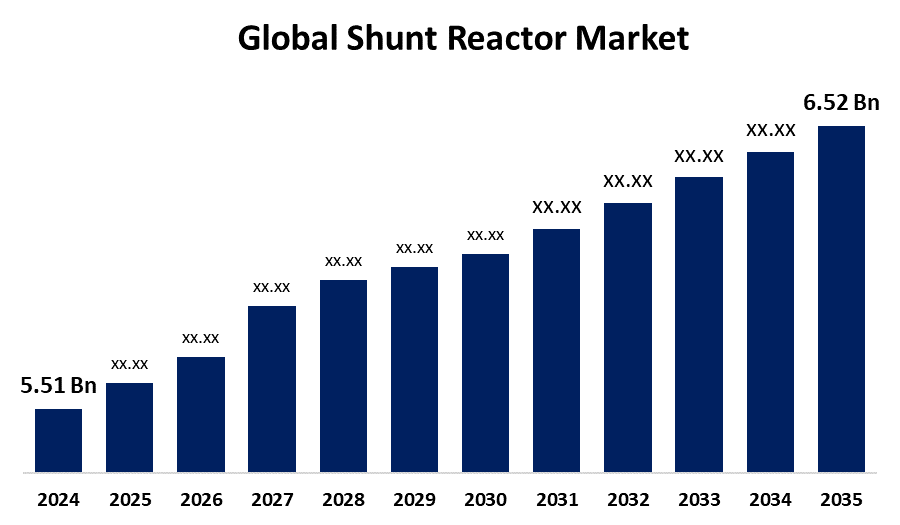

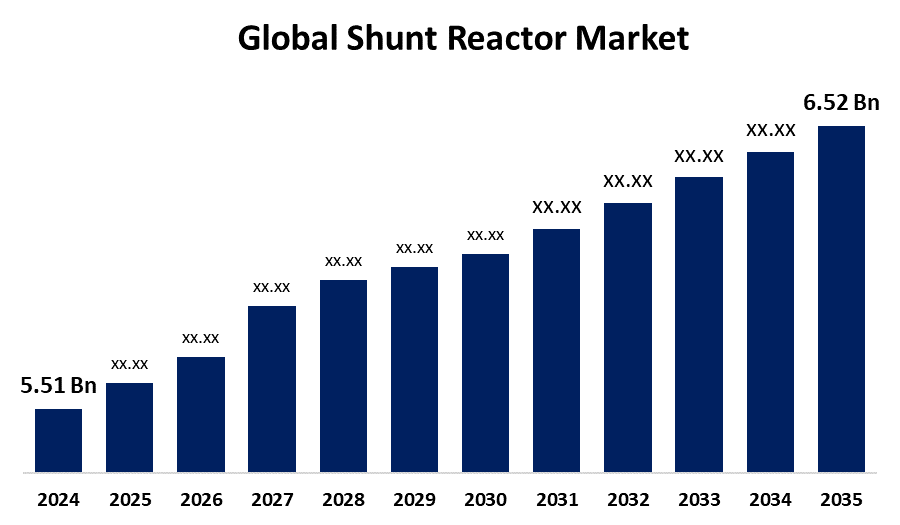

The Global Shunt Reactor Market Size was Estimated at USD 2.75 Billion in 2024, and is projected to reach USD 5.51 Billion by 2035, Growing at a CAGR of 6.52% from 2025 to 2035. The growing need for power, grid upgrades, and the incorporation of renewable energy sources are the main drivers of the shunt reactor market's expansion.

Key Regional and Segment-Wise Insights

- With the biggest revenue share of 29.6% in 2024, the shunt reactor market in North America dominated the global market.

- In 2024, the largest share of the shunt reactor market was held by the United States.

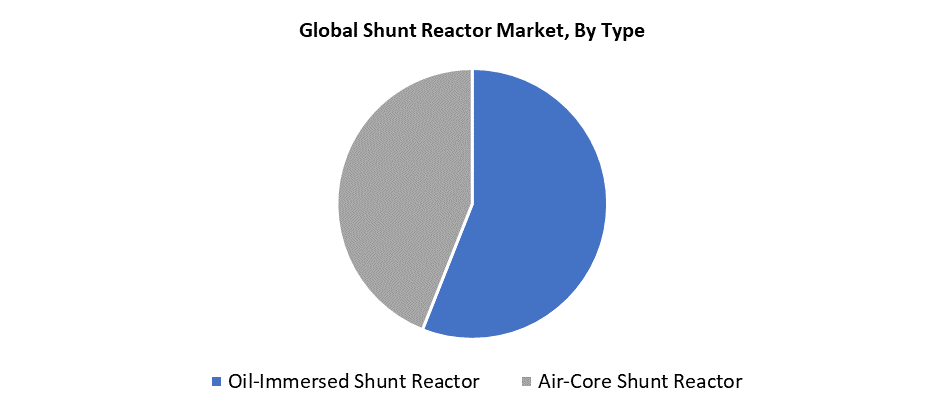

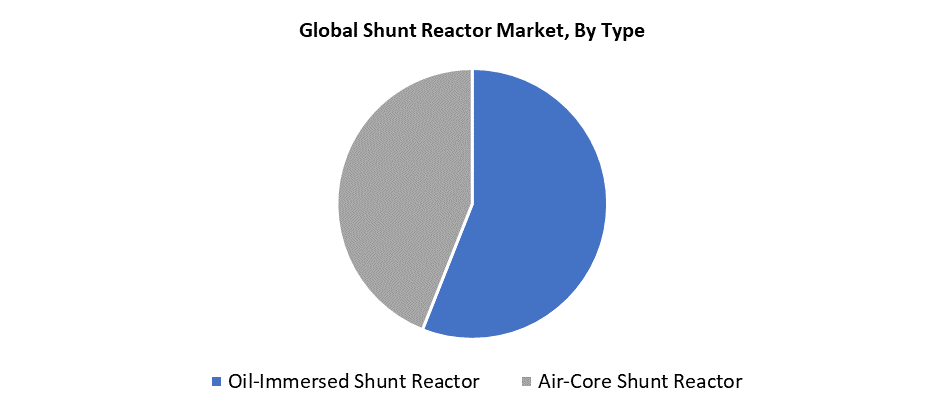

- With the largest revenue share of 56.5% in 2024, the oil-immersed shunt reactor segment led the market by type.

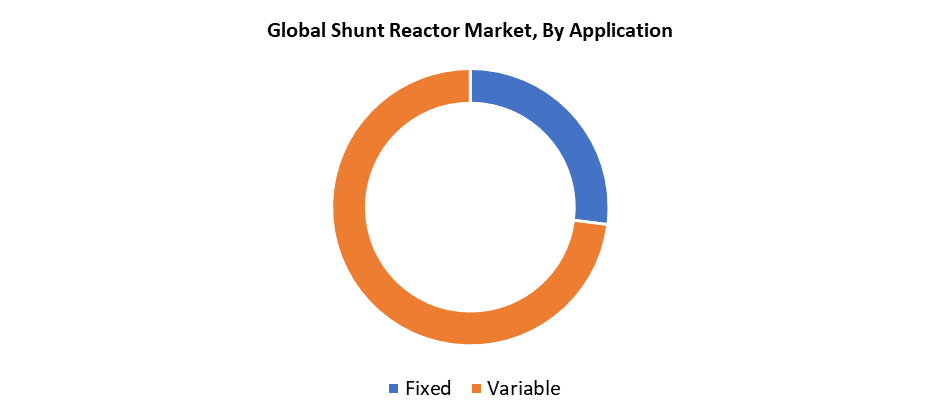

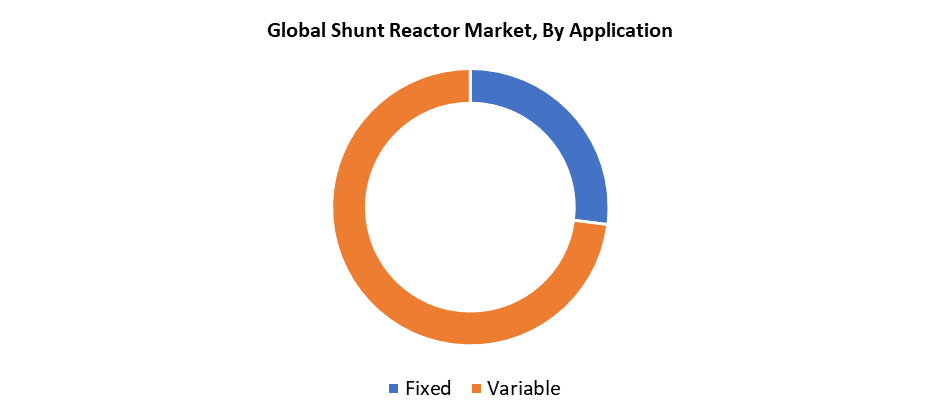

- In 2024, the variable category held the biggest market share for shunt reactors by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.75 Billion

- 2035 Projected Market Size: USD 5.51 Billion

- CAGR (2025-2035): 6.52%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The shunt reactor market consists of the worldwide industry that manufactures shunt reactors, which serve to absorb reactive power in high-voltage power transmission systems. The expansion of shunt reactors is derived from rising worldwide power demand, which stems from urban growth, industrial progress, and infrastructure projects. The grid demands voltage management because renewable power sources such as solar and wind create more variability in its operation. Shunt reactors play a vital role in high-voltage transmission systems to control reactive power and stabilize voltage fluctuations. The market acceptance of shunt reactors benefits from both strict energy efficiency standards and rising environmental concerns. The implementation of shunt reactors across the globe is speeding up because governments, including Australia, support renewable energy through the Environment Protection and Biodiversity Conservation Act. The established policies support the deployment of technologies that fulfill environmental standards and sustain grid reliability.

The shunt reactor market experiences growth because of rapid advancements in grid infrastructure combined with increasing wind and solar power integration. Voltage stability and system dependability need reactive power adjustment because these energy sources have inherent variability. The operation of power networks becomes more stable when shunt reactors perform voltage regulation and decrease the chance of overvoltage. The growing adoption of renewable energy resources led the U.S. Environmental Protection Agency (EPA) to highlight modern technology solutions that enhance grid resilience. The increasing adoption of electric vehicles (EVs) creates a power grid challenge because these vehicles raise energy requirements and require extensive charging networks, thus making voltage control essential. The worldwide power system complexity drives the growing demand for shunt reactors.

Type Insights

The oil-immersed shunt reactor category had the highest revenue share, accounting for 56.5% in 2024 because of its outstanding dependability, together with its longevity and performance. Mineral oil functions as the insulation and cooling medium in these reactors, which enables them to operate continuously in power systems of substantial size because it effectively disperses heat. These reactors deliver higher power rating capabilities than dry-type models, which makes them suitable for both expanding infrastructure and substation refurbishment projects. The combination of low maintenance needs and excellent performance under variable load conditions makes oil-immersed reactors perfect for complex and demanding power grid environments. The rising popularity of oil-immersed units across both developing and advanced power markets stems from their endurance with long-term efficiency as global energy needs increase and electrical networks grow more sophisticated.

The segment air-core shunt reactors demonstrate the rapid expansion at a significant CAGR throughout the forecast period because of increasing requirements from high-voltage direct current (HVDC) transmission systems, together with renewable energy projects. The reactors function with air instead of magnetic materials in their cores to provide benefits including lower core losses, minimal environmental impact, and reduced electromagnetic interference. Their lightweight and compact design enables them to function efficiently in locations where space is limited, including urban substations as well as offshore wind farms and modular energy systems. The transition to clean power infrastructure by utilities benefits from air-core reactors, which offer sustainable voltage control and stability solutions that enhance grid performance and enable renewable energy adoption.

Application Insights

Variable shunt reactors held the highest market share in 2024 since they deliver flexible reactive power support for changing electrical loads and grid conditions. The voltage regulation of variable reactors occurs through mechanisms that include adjustable tapping mechanisms and electronic controls. The flexibility of variable reactors proves essential for power grids that depend more on renewable energy sources such as solar and wind because these sources bring variable power output. The installation of variable reactors sustains voltage stability and minimizes power losses while improving the overall reliability of power grids. Their advanced control capabilities make them optimal for dynamic and complex energy networks, which require precise reactive power management to achieve operational efficiency and reduce disruptions.

The fixed segment will experience a significant CAGR throughout the forecasted period, because of its rising uses in power transmission systems and industrial areas where consistent, steady-state voltage control matters during the forecasted timeframe. Utilities select fixed reactors because their straightforward design leads to lower costs while allowing simple system integration, thus making them the preferred solution for dependable voltage control without adjustable features. Fixed reactors serve as a dependable solution for baseline reactive power management because power networks expand and face unpredictable usage patterns. Transmission lines and substations at large scales depend on fixed reactors to sustain both power quality standards and grid stability. Fixed shunt reactors serve essential roles in substation and transmission line applications when operators need to manage overvoltage conditions during light loads on long-distance high-voltage networks.

Regional Insights

The North American shunt reactor market holds the leading position in 2024 by accounting for 29.6% of global revenue. The primary market growth driver consists of substantial financial investments toward upgrading old grid infrastructure and integrating renewable power systems. The region leads the market because it needs reliable and efficient transmission and distribution systems, which pushes the deployment of shunt reactors. Utility companies and grid operators acquire shunt reactors to enhance power system performance in industrial sectors because grid stability, together with voltage regulation requirements, is rising. The United States leads the industry because of its strict regulatory frameworks and rising need for an uninterruptible electrical supply. The "Building a Better Grid" project from the U.S. Department of Energy, along with other government initiatives, promotes investments for upgrading the grid and building high-voltage transmission facilities.

U.S. Shunt Reactor Market Trends

The U.S. shunt reactor market dominated in 2024 because of modernized power infrastructure, together with rising energy efficiency requirements. The introduction of environmentally friendly solutions represents a key development since Hitachi Energy releases variable shunt reactors, which stabilize voltage levels and minimize environmental impact. Power companies operating in the US implement shunt reactors at their substations to achieve voltage stability and operational efficiency because of increasing energy demands. The deployment of state-of-the-art grid elements, such as shunt reactors, receives backing from financial investments in energy infrastructure improvement. The integration of renewable energy into the grid creates voltage fluctuations that shunt reactors work to minimize.

Europe Shunt Reactor Market Trends

The European shunt reactor market will experience substantial expansion throughout the forecast period because the area focuses on transmission loss reduction and grid reliability improvement. The renewable energy targets Europe creates substantial demand for shunt reactors because these devices help maintain a stable power supply during renewable power source integration. The transition to renewable energy sources makes voltage stability management an essential priority. Renewable energy grids need shunt reactors because these components regulate voltage levels during power fluctuations that occur from renewable sources. The utilities in Europe deploy shunt reactors for low-carbon grid support with particular attention to sustainability and energy efficiency goals. Local environmental goals align perfectly with the power delivery optimization strategies that help reduce carbon emissions.

Asia Pacific Shunt Reactor Market Trends

The Asia Pacific shunt reactor market will experience the fastest CAGR of 5.8% between 2025 and 2035 due to rapid development and urbanization in China and India. The market gains momentum through expanding power generation facilities, together with smart grid technology development and renewable power investments in the region. Shunt reactors provide necessary reactive power compensation to modern T&D networks that need voltage regulation technologies to ensure efficient energy supply. Shunt reactors help Asia Pacific utilities achieve lower voltage fluctuations and better transmission stability through their installation on expanding high-voltage lines. The development of automated and intelligent grid frameworks creates an increased demand for advanced shunt reactors. These reactors play an essential role in maintaining grid operations while optimizing power transmission efficiency.

Key Shunt Reactor Companies:

The following are the leading companies in the shunt reactor market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Fuji Electric Co., Ltd.

- NISSIN ELECTRIC Co., Ltd.

- General Electric Company

- Mitsubishi Electric Corporation

- Hilkar

- Siemens

- TOSHIBA CORPORATION

- Trench Group

- TBEA

- Crompton Greaves Consumer Electricals Limited

- Hitachi Energy Ltd

- Others

Recent Developments

- In May 2025, Power Grid Corporation placed a significant order with GE Vernova T&D India to supply more than 70 shunt reactors and high-voltage transformers for vital transmission projects. Under India's Tariff-Based Competitive Bidding system, the 765 kV shunt reactor units facilitated the evacuation of renewable energy.

- In September 2023, to support TenneT's transmission grid growth initiative in Germany, Hitachi Energy formed a strategic cooperation with the company to deliver transformers and shunt reactors. Hitachi Energy hopes to facilitate the transition to a more sustainable energy system by enhancing reactive power compensation and voltage regulation within TenneT's infrastructure through the provision of modern shunt reactors.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the shunt reactor market based on the below-mentioned segments:

Global Shunt Reactor Market, By Type

- Oil-Immersed Shunt Reactor

- Air-Core Shunt Reactor

Global Shunt Reactor Market, By Application

Global Shunt Reactor Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa