Global Sheet Metal Market Size To Exceed USD 484.85 Billion by 2033

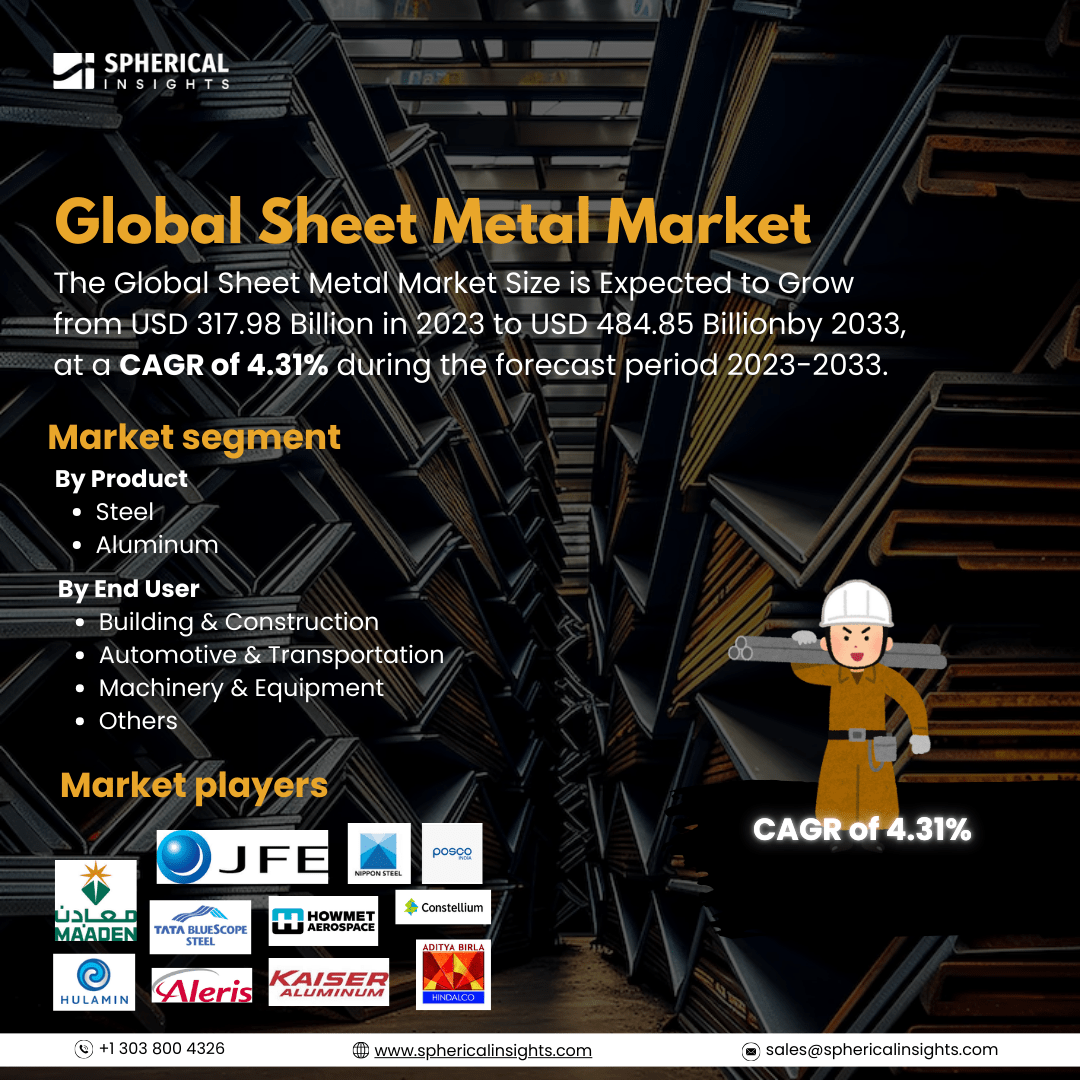

According to a research report published by Spherical Insights & Consulting, the Global Sheet Metal Market Size is Expected to Grow from USD 317.98 Billion in 2023 to USD 484.85 Billion by 2033, at a CAGR of 4.31% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Sheet Metal Market Size, Share, and COVID-19 Impact Analysis, By Product (Steel and Aluminum), By End User (Building & Construction, Automotive & Transportation, Machinery & Equipment, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The global sheet metal market refers to the industry involved in the manufacturing, processing, and distribution of sheet metal, which are thin, flat slabs of metal used in a variety of industries, including electronics, industrial, automotive, aerospace, and construction. This market includes an array of metals, including copper, brass, aluminum, and steel, which are produced using rolling, stamping, bending, and welding. Key driving factors for the growth of the sheet metal market include increasing urbanization and industrialization, which have increased the demand for sheet metal in the automotive, aerospace, and construction sectors. The market has grown substantially due to the increase in infrastructure development projects and improvements in production technologies, including automation and CNC machining. Additionally, aluminum and advanced sheet metals are being used increasingly because of the automotive and aerospace industries' increasing need for lightweight, high-strength materials to enhance performance and fuel efficiency. However, the growth of the market as a whole is affected by several variables such as changing raw material prices, high manufacturing costs, strict environmental laws, competition from alternative materials, supply chain interruptions, and trade restrictions.

The steel segment accounted for the largest revenue share in 2023 and is projected to grow at a significant CAGR during the forecast period.

On the basis of product, the global sheet metal market is divided into steel and aluminum. Among these, the steel segment accounted for the largest revenue share in 2023 and is projected to grow at a significant CAGR during the forecast period. The segment growth is attributed because of its exceptional strength, durability, affordability, sustainability, and numerous uses in the heavy, automotive, and construction sectors, all of which are driven by global industrialization and infrastructure expansion.

The automotive & transportation segment accounted for the highest revenue share in 2023 and is anticipated to grow at a substantial CAGR during the forecast period.

On the basis of end user, the global sheet metal market is divided into building & construction, automotive & transportation, machinery & equipment, and others. Among these, the automotive & transportation segment accounted for the highest revenue share in 2023 and is anticipated to grow at a substantial CAGR during the forecast period. The segment growth is attributed to market expansion due to the widespread application of galvanized steel in frames, doors, hoods, and fuel tanks, increasing demand in the manufacturing of automobiles, the increasing demand for lightweight, fuel-efficient vehicles, and advancements in electric vehicles (EVs).

North America is anticipated to hold the largest share of the global sheet metal market over the predicted timeframe.

North America is anticipated to hold the largest share of the global sheet metal market over the predicted timeframe. The expanding construction and transportation industries. Demand in the automotive industry continues to rise as a consequence of rising vehicle manufacturing, particularly for electric vehicles that need lightweight materials. With the help of government funding for defense and expanding aircraft manufacturing, the aerospace sector is a substantial contributor. North America's position as the largest continent in the global sheet metal market has been reinforced by government policies that promote domestic manufacturing, developments in fabrication technology, and the presence of significant industry players.

Asia Pacific is expected to grow at the fastest CAGR in the global sheet metal market during the forecast period. The regional growth can be attributed to countries like China and India's good government practices, substantial manufacturing infrastructure, and affordable, skilled labor. With the help of significant steel and aluminum producers, regional demand is further driven by growing urbanization, the construction and automotive industries, and integrated supply chains.

Company Profiling

Major vendors in the global sheet metal market are Tata BlueScope Steel Private Limited, Nippon Steel Corporation, POSCO, United States Steel Corporation, JFE Steel, Baosteel Group, Howmet Aerospace, Inc., Ma’aden, Hindalco Industries Limited, Kaiser Aluminum Corporation, Constellium SE, Aleris Corporation, Hulamin Limited, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, China announced the termination of tax rebates on exports of semi-manufactured aluminum products, effective starting from December. This policy shift is expected to remove over 5 million metric tons of Chinese aluminum products from the international market, aiming to address overcapacity in China's aluminum processing sector and reduce international trade tensions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global sheet metal market based on the below-mentioned segments:

Global Sheet Metal Market, By Product

Global Sheet Metal Market, By End User

- Building & Construction

- Automotive & Transportation

- Machinery & Equipment

- Others

Global Sheet Metal Market, Regional

- North America

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa