Secondary Refrigerants Market Trends

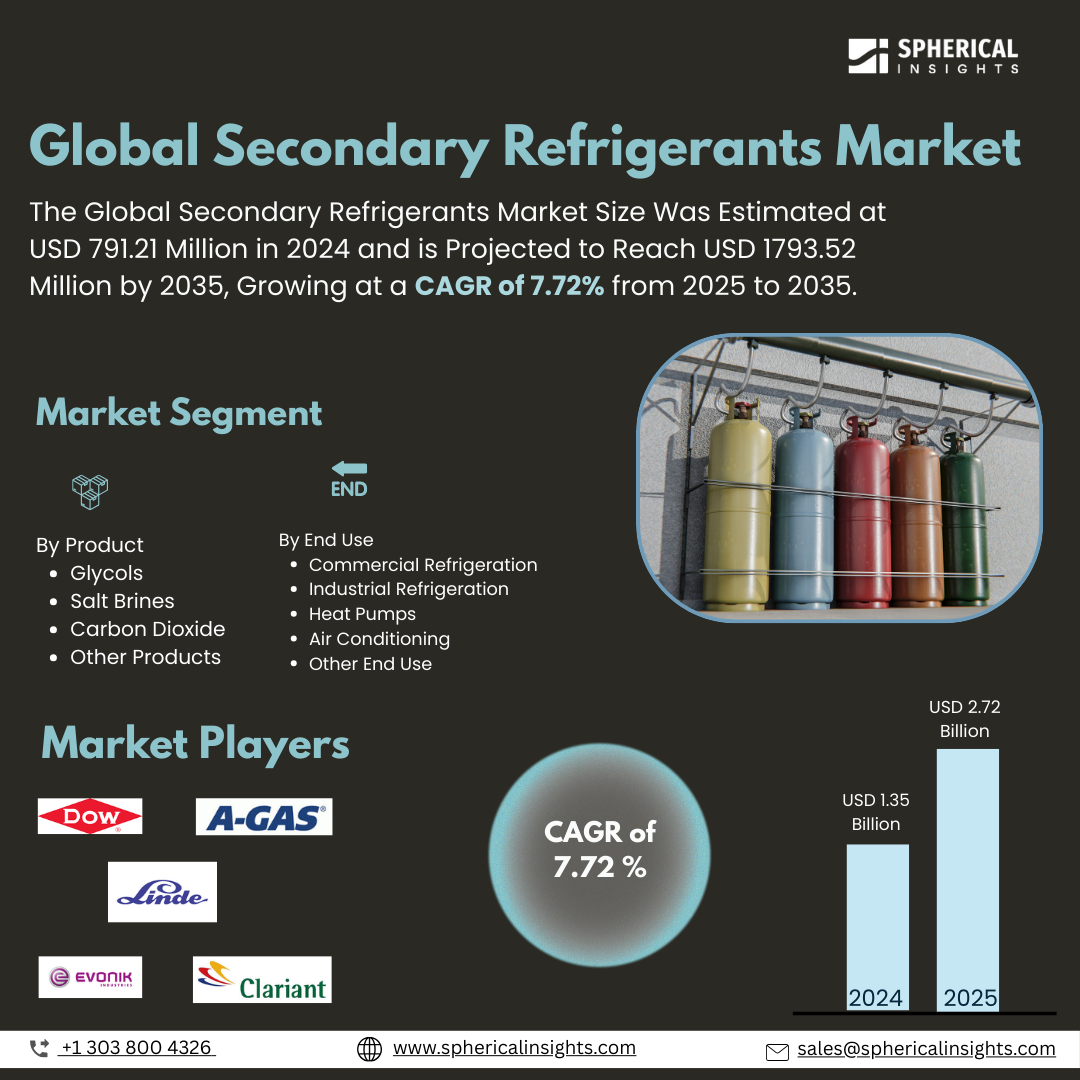

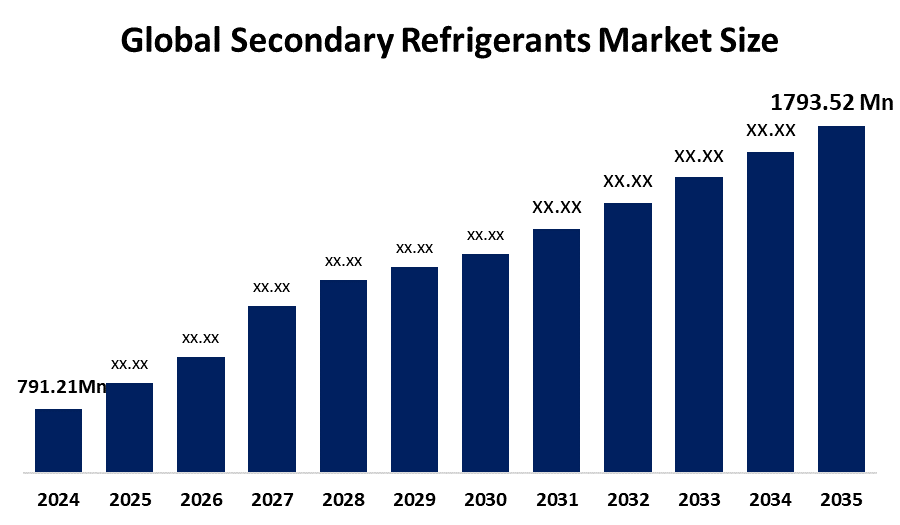

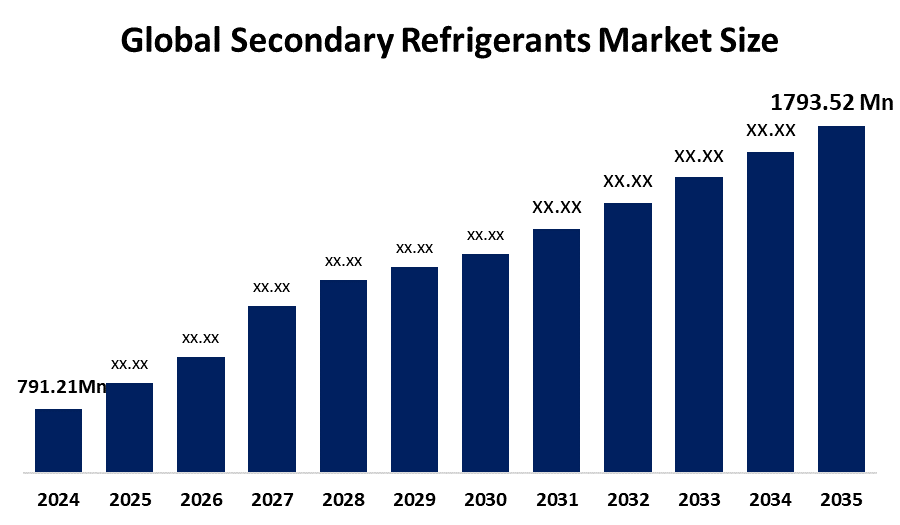

The Global Secondary Refrigerants Market Size Was Estimated at USD 791.21 Million in 2024 and is Projected to Reach USD 1793.52 Million by 2035, Growing at a CAGR of 7.72% from 2025 to 2035. The market for secondary refrigerants is expanding due to the need for more eco-friendly and energy-efficient cooling solutions as well as laws that phase out high-GWP refrigerants.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific secondary refrigerants market accounted for over 49.3% of the market's revenue and dominated the market globally.

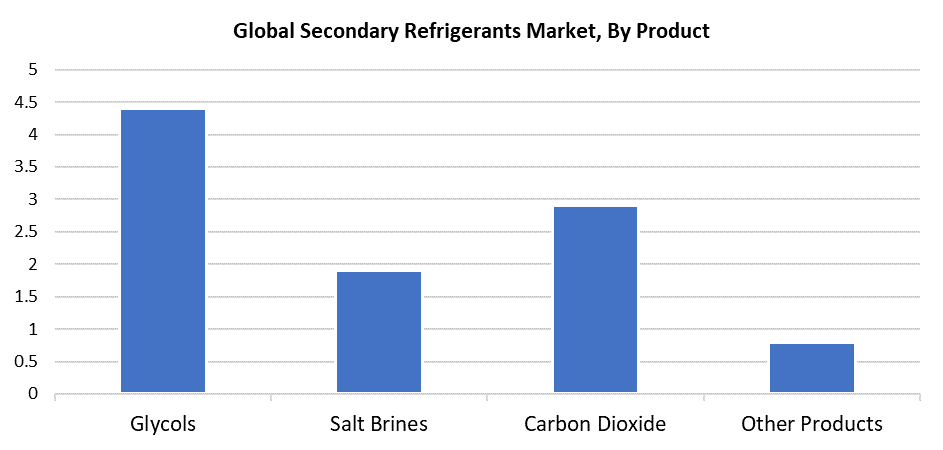

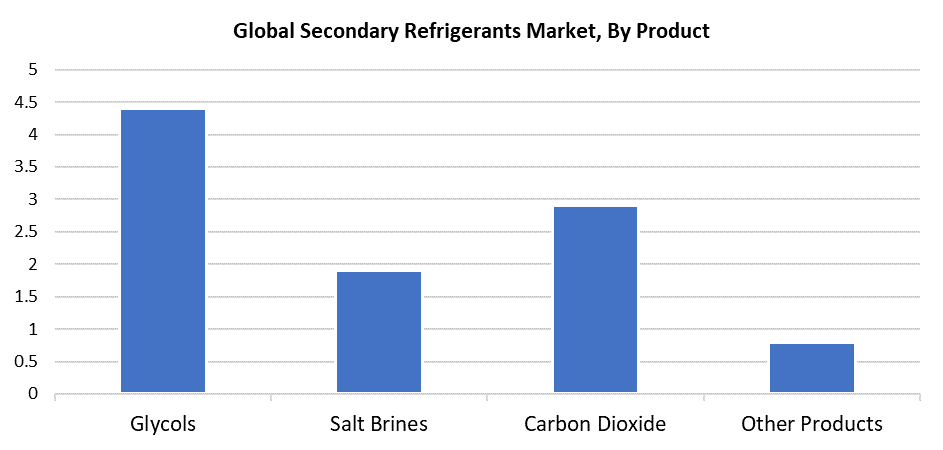

- In 2024, the glycols segment held the largest revenue share by product, accounting for 44.7%.

- In 2024, the Heat pumps category accounted for the greatest market share by end use, accounting for 15.8%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 791.21 Million

- 2035 Projected Market Size: USD 1793.52 Million

- CAGR (2025-2035): 7.72%

- Asia Pacific: Largest market in 2024

The global industry dedicated to fluids that connect primary cooling sources with applications through thermal energy transfer in cooling systems operates as the secondary refrigerants market. The secondary refrigerants market expands due to worldwide demand for environmentally friendly and energy-saving cooling solutions. According to regulations for energy and emissions control, the sectors, including data centres and food and beverage production and healthcare and logistics, are implementing secondary refrigerant systems. These systems use glycols and brines to replace traditional high-GWP refrigerants such as CFCs and HCFCs. Government regulations that aim to cut greenhouse gas emissions speed up the phase-out process of dangerous primary refrigerants, thereby creating favourable conditions for secondary systems to emerge. The transition pushes public and private organisations toward investing in innovative cooling solutions that optimise thermal performance while decreasing environmental footprint to achieve sustainability targets and worldwide climate objectives.

The secondary refrigerant market experiences significant obstacles despite its significant market growth potential because of its high initial cost requirements. Small businesses, together with potential competitors, choose to avoid high capital costs when establishing secondary refrigerant systems. The industry faces a slowdown in technological advancement because competition remains restricted, and market barriers prevent new entrants from participating. Future technology advancements and decreasing costs of operation will allow initial expenses to become outweighed by operational benefits, which include energy efficiency and reduced emissions and system dependability. The market will experience increased adoption through ongoing technological progress and government assistance for environmentally friendly projects. The market shows promising growth possibilities through both the development of cold chain logistics and electric vehicles and heat pumps, and corporate dedication to environmental responsibility.

Product Insights

The glycols segment accounted for 44.7% of total revenue and dominated the secondary refrigerants market in 2024. The better qualities of glycols, such as their high heat conductivity, low freezing temperatures, and ability to fight corrosion, are what propel this domination. The properties of glycols make them highly effective for usage in closed-loop systems, which include HVAC and refrigeration as well as water-based heating and cooling operations. Commercial HVAC systems, together with industrial refrigeration and food processing, rely on glycols because they offer stable temperature control and extended system lifespan. Their constant industry-wide demand for energy-efficient and environmentally friendly cooling solutions mainly results from their adaptability, along with their affordability and compatibility with various system designs.

The secondary refrigerant market experiences growing popularity of the carbon dioxide (CO2) segment because of its environmental advantages and regulatory acceptance. A sustainable alternative to traditional high-GWP refrigerants exists in CO2, which has both minimal global warming impact and zero ozone layer damage potential. The combination of low-temperature excellence and non-toxic properties makes it an ideal option for commercial refrigeration systems and food preservation applications and heat pumps, and industrial cooling operations. The outstanding energy efficiency of CO2 attracts markets with environmental concerns, particularly those following strict climate regulations. The sustainable cooling revolution has established CO2 as a standard refrigerant through its expanding use in heat pump and supermarket refrigeration systems.

End-use Insights

Heat pumps dominated the secondary refrigerant market in 2024 with 15.8% revenue share because people demand sustainable energy-efficient temperature control solutions. Heat pumps achieve thermal energy transfer through their environmental operations. When secondary refrigerants operate heat pumps, they achieve better efficiency while using less energy and generating fewer environmental impacts. Applications within commercial and industrial, and residential environments find heat pumps to be highly versatile because they serve dual functions as both heating and cooling systems. The rising popularity of heat pumps stems from their capacity to decrease greenhouse gas emissions as environmental standards tighten and decarbonization efforts increase. Heat pump performance reaches its peak through secondary refrigerant usage, which positions them as essential elements in eco-friendly heating and cooling systems throughout the world.

The air conditioning sector remains a vital component of the secondary refrigerant market because of its need for cost-effective, environmentally friendly cooling alternatives. Secondary refrigerants such as glycol and water-based solutions function by transferring heat from cooling loads to maintain controlled temperatures. The systems minimise both direct refrigerant usage and leak potential by creating a barrier between the primary refrigerant circuit and the conditioned space. The arrangement produces better energy performance, together with decreased environmental effects and reduced operational costs. The use of secondary refrigerants in air conditioning systems will experience substantial growth because of rising energy constraints and increasing demand for sustainable cooling across residential and commercial, and industrial sectors.

Regional Insights

The market for secondary refrigerants in North America continues to grow steadily because of rising construction activities, which require energy-efficient air conditioning systems. The growing urban population in North America drives increased demand for sustainable climate management systems, especially in the United States and Canada. The expanding food and beverage industry creates a need for advanced refrigeration systems which operate with secondary refrigerants. The implementation of low-GWP substitutes in industry faces regulatory pressure from the American Innovation and Manufacturing (AIM) Act, which regulates HFC phasedowns. Companies are purchasing environmentally friendly refrigeration systems because they align better with sustainability targets. The use of secondary refrigerants continues to grow across North America because of various factors that include industrial developments and governmental enforcement, as well as environmental commitments.

Asia Pacific Secondary Refrigerants Market Trends

The Asia Pacific region led the worldwide secondary refrigerants market in 2024 with 49.3% revenue share because of its rapid industrial development and increasing demand for energy-efficient cooling and refrigeration equipment. The demand for reliable cooling systems continues to increase across manufacturing operations and food processing facilities, and pharmaceutical sectors that operate in China, along with India and Southeast Asian nations. The rising environmental awareness and strengthened regional legislation push industries to transition from their current high-GWP refrigerants to sustainable alternatives. Government programs dedicated to energy efficiency and green infrastructure development are accelerating the market adoption of secondary refrigerants. The sustainability goals of the Asia Pacific match its industrial growth objectives, which makes this region the leading market with the highest growth rate.

Europe Secondary Refrigerants Market Trends

The European market for secondary refrigerants experiences significant growth because of environmental regulations combined with extensive government backing for sustainable technology. The European Union's strict environmental regulations have accelerated the switch from primary refrigerants with high global warming potential to secondary refrigerants with reduced environmental impact. European countries have made the environmental performance of cooling systems and energy efficiency their top priorities, so they drive industrial processing and HVAC and commercial refrigeration markets. The European refrigeration industry leads the technical development of advanced energy-efficient solutions, which enable both sustainability objectives and regulatory requirements. The worldwide market growth will receive substantial support from Europe because of its continued focus on sustainable construction standards and climate objectives.

Key Secondary Refrigerants Companies:

The following are the leading companies in the secondary refrigerants market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- A-Gas International

- BASF SE

- The Linde Group

- The Lubrizol Corporation

- Evonik Industries

- Temper Technology Ab

- Eastman Chemical Company

- Tazzetti S.P.A.

- Clariant

- Others

Recent Developments

- In December 2024, Clariant began construction of a second production line to produce the multifunctional additive Nylostab S-EED at its site in Cangzhou, Hebei Province, China. With this development, Beijing Tiangang Auxiliary Co., Ltd. hopes to satisfy China's growing nylon demand, especially in the packaging, automotive, and textile industries. Operating since 2021, the first production line has achieved full capacity and established a solid reputation for excellence. By increasing process efficiency, heat resistance, and colour stability, Nylostab S-EED improves nylon goods.

- In February 2022, Linde declared a long-term contract with BASF to provide steam and hydrogen to the latter's new hexamethylenediamine (HMD) plant in Chalampé, France. This deal will essentially double Linde's current capacity at the Chalampé chemical park by allowing it to design, construct, own, and run a second hydrogen production facility there. In order to meet the region's increasing demand for hydrogen, the new facility is anticipated to start operations in the first half of 2024 and will also service Linde's local merchant clients.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the secondary refrigerants market based on the below-mentioned segments:

Global Secondary Refrigerants Market, By Product

- Glycols

- Salt Brines

- Carbon Dioxide

- Other Products

Global Secondary Refrigerants Market, By End Use

- Commercial Refrigeration

- Industrial Refrigeration

- Heat Pumps

- Air Conditioning

- Other End Use

Global Secondary Refrigerants Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa