Global Rail Vehicle Polyurethane Market Size To Exceed USD 2.81 Billion By 2033

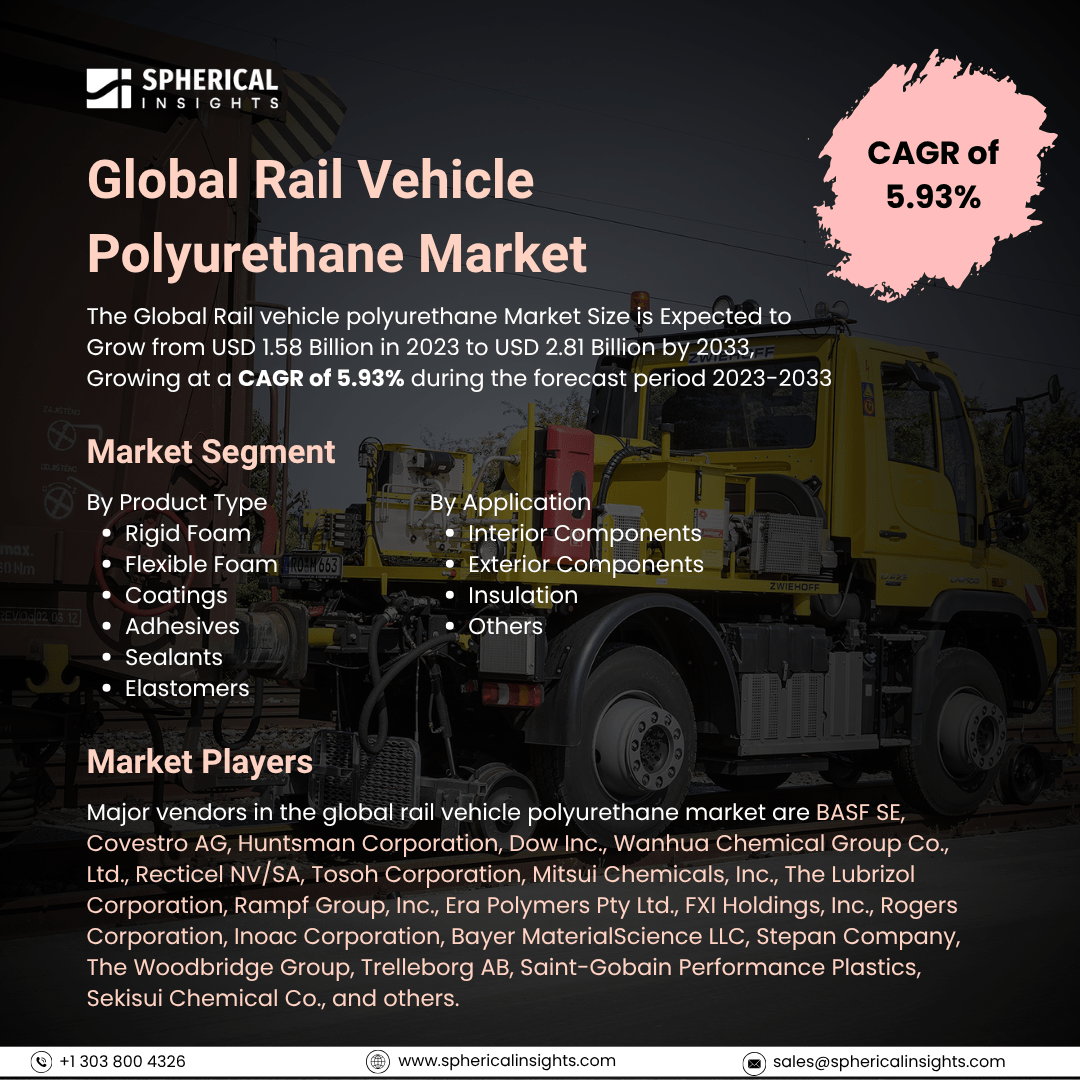

According to a research report published by Spherical Insights & Consulting, The Global Rail vehicle polyurethane Market Size is Expected to Grow from USD 1.58 Billion in 2023 to USD 2.81 Billion by 2033, Growing at a CAGR of 5.93% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Rail Vehicle Polyurethane Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Rigid Foam, Flexible Foam, Coatings, Adhesives, Sealants, and Elastomers), By Application (Interior Components, Exterior Components, Insulation, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, And Africa), Analysis And Forecast 2023 - 2033

The international rail vehicle polyurethane market focuses on the use of polyurethane materials in the manufacturing and upkeep of rail vehicles. Polyurethane is known for its lightweight, durable, and versatile properties, making it ideal for various applications such as seating systems, insulation, interior panels, and exterior components. This market expansion is driven by the increasing need for energy-efficient and sustainable transportation solutions. Additionally, advancements in polyurethane formulations and processing techniques drive the market expansion. Moreover, the rising growth in railway infrastructure and the railway industry due to its ideal choices for transportation propels the market growth. However, the market growth is hampered due to its high cost for manufacturing, strict rules and regulations, and fierce competition tends to volatility of price.

The coatings segment accounted for a significant share of the global rail vehicle polyurethane market in 2023 and is anticipated to grow at a rapid pace over the forecast period.

On the basis of the product type, the global rail vehicle polyurethane market is divided into rigid foam, flexible foam, coatings, adhesives, sealants, and elastomers. Among these, the coatings segment accounted for a significant share of the global rail vehicle polyurethane market in 2023 and is anticipated to grow at a rapid pace over the forecast period. This segment growth is influenced by the high demand for such components due to their offering superior defense against abrasion, corrosion, and adverse climatic circumstances.

The exterior components segment held a significant share of the global rail vehicle polyurethane market in 2023 and is predicted to grow at a rapid pace over the forecast period.

On the basis of the application, the global rail vehicle polyurethane market is categorized into interior components, exterior components, insulation, and others. Among these, the exterior components segment held a significant share of the global rail vehicle polyurethane market in 2023 and is predicted to grow at a rapid pace over the forecast period. This is due to its durable and weatherproof qualities against the environmental variables, with an aesthetic appearance.

Asia Pacific is anticipated to hold the greatest share of the global rail vehicle polyurethane market over the forecast period.

Asia Pacific is predicted to hold the largest share of the global rail vehicle polyurethane market over the forecast period. The regional market growth is influenced by substantial investments in rail infrastructure and the rapid expansion of railway networks in countries like China, India, and Japan. Further, China is known for its vast rail infrastructure and networking in this region, and generating significant revenue across the region and the global level.

Europe is predicted to grow at the fastest CAGR of the global rail vehicle polyurethane market over the forecast period. The market growth throughout the region is further accelerated due to ongoing investments in railway infrastructure and the emphasis on sustainable transportation solutions. Concurrently, the high adoption of advanced materials and technological support to upgrade the performance and overall safety boosts the regional market expansion. Countries like Germany, France, and the United Kingdom highlight the growth opportunities in rail infrastructure development and modernization due to their robust railway system.

Company Profiling

Major vendors in the global rail vehicle polyurethane market are BASF SE, Covestro AG, Huntsman Corporation, Dow Inc., Wanhua Chemical Group Co., Ltd., Recticel NV/SA, Tosoh Corporation, Mitsui Chemicals, Inc., The Lubrizol Corporation, Rampf Group, Inc., Era Polymers Pty Ltd., FXI Holdings, Inc., Rogers Corporation, Inoac Corporation, Bayer MaterialScience LLC, Stepan Company, The Woodbridge Group, Trelleborg AB, Saint-Gobain Performance Plastics, Sekisui Chemical Co., and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development:

- In March 2025, Rampf Advanced Polymers introduced high-performance polyurethane casting systems specifically designed for rail applications. These systems, RAKU® PUR 21-2350 and RAKU PUR 21-2452-2, are certified to meet the stringent European fire protection standard EN 45545-22. They offer features like maximum fire protection, excellent thermal conductivity, low viscosity for easy processing, and the use of non-abrasive fillers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global rail vehicle polyurethane market based on the below-mentioned segments:

Global Rail Vehicle Polyurethane Market, By Product Type

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives

- Sealants

- Elastomers

Global Rail Vehicle Polyurethane Market, By Application

- Interior Components

- Exterior Components

- Insulation

- Others

Global Rail Vehicle Polyurethane Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa