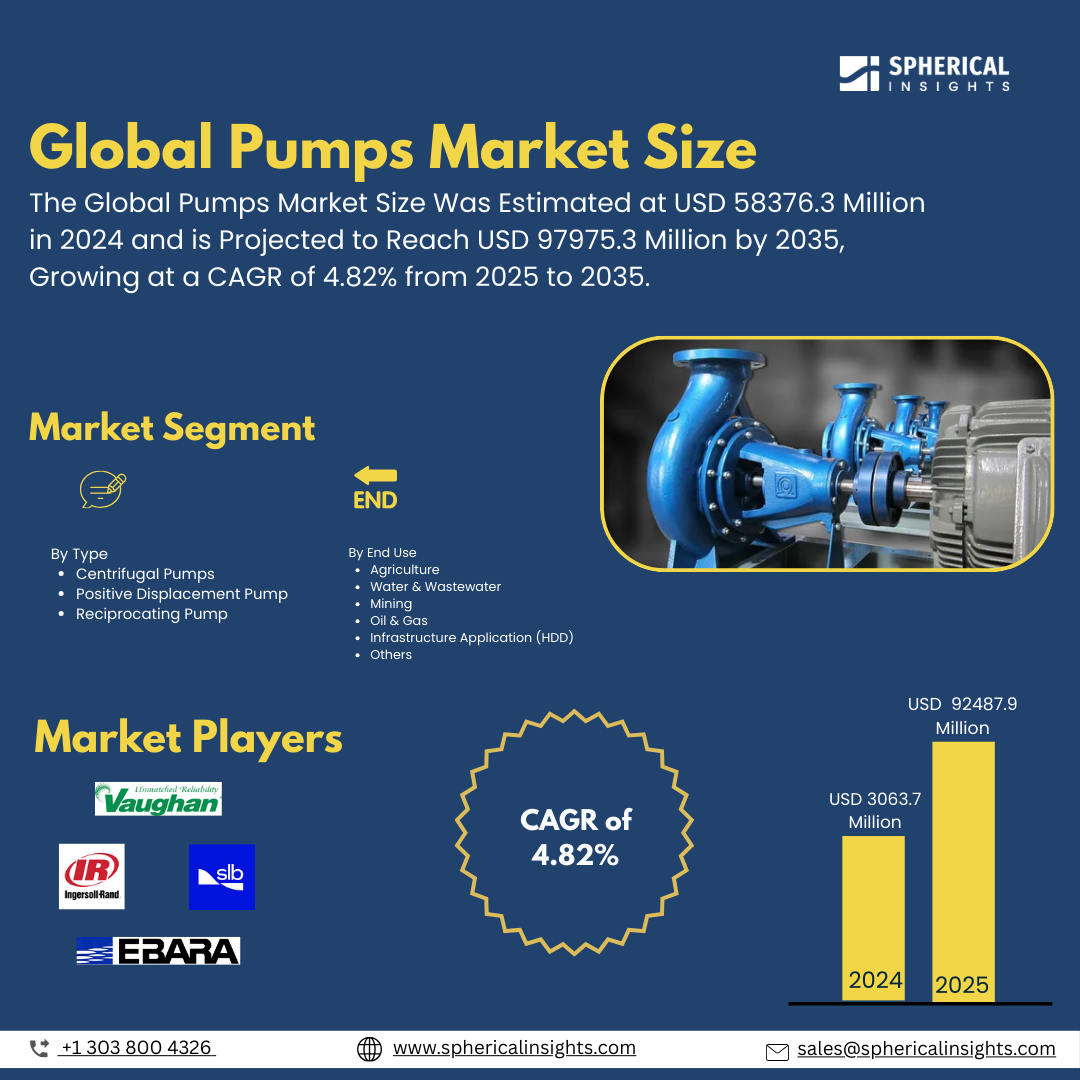

Pumps Market Summary

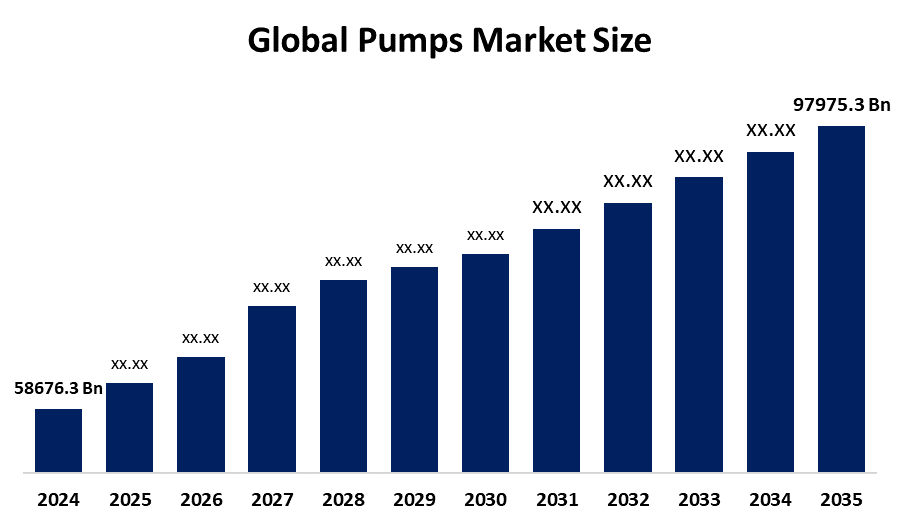

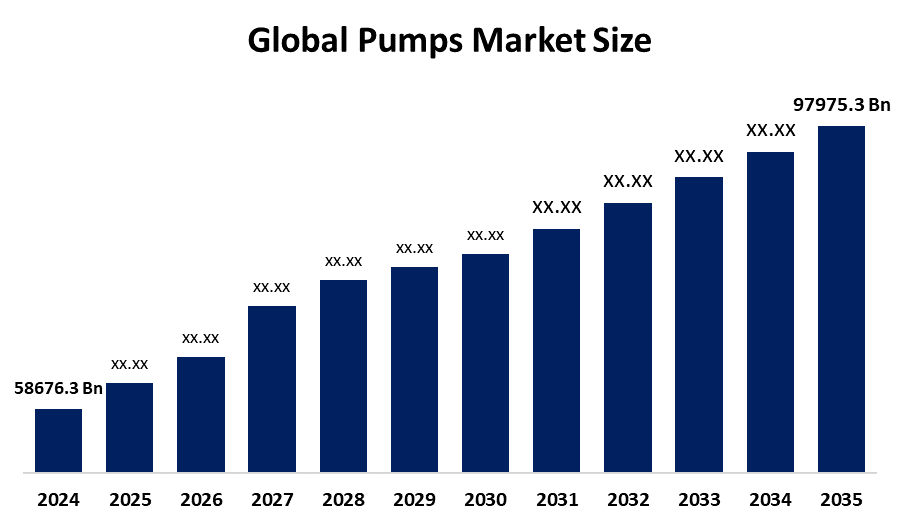

The Global Pumps Market Size Was Estimated at USD 58376.3 Million in 2024 and is Projected to Reach USD 97975.3 Million by 2035, Growing at a CAGR of 4.82% from 2025 to 2035. Rapid urbanisation, rising industrialisation, and a growing focus on wastewater treatment and water conservation are some of the major drivers driving the worldwide pumps market's notable expansion.

Key Market Trends & Insights

- In 2024, Asia Pacific held the largest revenue share of 44.7%, dominating the pumps market.

- By type, the Centrifugal pumps segment accounted for 65.3% market share and dominated the market globally in 2024.

- By end use, the water and wastewater segment led the market with 23.7% market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 58376.3 Million

- 2035 Projected Market Size: USD 97975.3 Million

- CAGR (2025-2035): 4.82%

- Asia Pacific: Largest market in 2024

The Pumps Market Size represents the worldwide industrial sector which produces and distributes mechanical devices that use energy to move fluids (liquids or gases). The worldwide pump market experiences strong growth because industries such as chemicals and power generation and water treatment, and oil and gas need efficient fluid handling solutions. The advancement of cities, along with expanding infrastructure projects mainly in developing countries, generates the demand for advanced pumping systems. The rising popularity of smart energy-efficient pumps with Internet of Things capabilities stems from industrial trends toward automation and sustainability. Centrifugal pumps are gaining popularity in treatment plants because of the increasing demand for wastewater management and reuse due to water scarcity. The demand for reliable low-maintenance pumps continues to increase because nations upgrade their industrial operations and utility infrastructure, thus making them essential components of modern fluid management systems.

The pump industry faces ongoing changes because of technological developments such as remote monitoring and 3D-printed parts that allow for enhanced customisation, together with improved operational efficiency and reduced downtime. The market opens new business opportunities from the increasing usage of pumps in agricultural operations and desalination plants, and renewable energy systems. The market receives support from substantial research investment and government programs that promote sustainable water and energy management, although early expenses and complex maintenance procedures discourage adoption by smaller businesses. The market demonstrates continuous evolution with substantial expansion possibilities throughout the forecast duration. The food and beverage and mining, and offshore oil industries push up the need for advanced pumps which meet regulatory standards.

Type Insights

Centrifugal pumps led the pumps market in 2024 by securing 65.3% market share because of their simple construction and minimal upkeep requirements, along with their superior ability to handle massive fluid quantities. The combination of low cost and flexible design makes them suitable for industrial applications, as well as wastewater treatment systems and HVAC systems and water supply networks. The pumps use centrifugal forces to transform kinetic energy into hydrodynamic energy, which enables them to move water and chemical fluids along with petroleum. The energy efficiency of these pumps reaches its peak during continuous operation, making them the preferred choice for projects in municipal infrastructure and public systems. Technical advancements continually enhance the dependability and robustness, and versatility of these pumps to maintain their industry leadership while delivering optimal performance across various operating conditions.

Positive displacement pumps experience rapid market growth because of their outstanding ability to control high-viscosity fluids and provide exact flow management. The combination of excellent handling for viscous fluids and exact flow control makes these pumps suitable for chemical processing, together with pharmaceutical and food and beverage sectors. The application of these pumps to industries that demand precise dosing and zero pulsation has increased because they suit high-pressure metering functions. Low-speed operation of these pumps maintains steady flow, which reduces energy costs while decreasing pump wear. The oil and gas sector continues to adopt these pumps because they deliver reliable performance for moving heavy or abrasive fluids. The expanding industrial applications market receives additional growth support from increasing attention to process accuracy and product quality maintenance, and sustainability practices.

End Use Insights

The water and wastewater sector led the pump market with 23.7% market domination in 2024 because of rising worldwide environmental concerns about pollution and water scarcity, and sustainable water management requirements. The quick expansion of cities and growing industrial activities, and population numbers have created a higher demand for trustworthy water distribution and sanitation networks. The industrial and municipal sectors depend on pumps for their essential operations, such as water delivery and wastewater recycling and sewage treatment. Infrastructure renovation programs, along with government funding for aged system upgrades and developing nation population-dense areas, have become key drivers of pump system implementation. The vital market experiences accelerated automation of pump technologies through stricter environmental standards and rising water conservation attention.

The oil and gas industry experiences rising pump demand because it requires efficient fluid transfer for multiple operations, including drilling and refining, and distribution. The operations in both upstream and downstream sectors require pumps to sustain optimal pressure levels while protecting system integrity and ensuring safe operations. The ongoing worldwide development of exploration and production facilities mainly targeting unconventional and deepwater deposits maintains a constant demand for pumps. The worldwide expansion of pipeline systems and refining facilities demonstrates the need for robust high-performance pumping solutions. The oil and gas sector leads market growth through its operational focus on advanced pump technologies, which drive efficiency improvements and enhance reliability and environmental standards.

Regional Insights

The North American pump market experiences rapid growth through major investments focused on efficient energy systems and automated processes, as well as facility modernisation. The United States and Canada require high-performance intelligent pumping solutions because they lead the industry through their advanced water and wastewater treatment systems. The oil and gas sector perpetually expands its demand mainly through pipeline infrastructure and shale drilling operations. The adoption of sustainable pump technology advances because of rigorous environmental regulations. The industrial and agricultural sectors are witnessing an increase in the implementation of IoT and smart monitoring systems within pump operations. North America maintains its position as a strong leading market for advanced pump technology because of its powerful industrial base and its focus on innovation, combined with government support for modernisation programs.

Europe Pumps Market Trends

The European pump sector experiences consistent growth because of energy-efficient technological solutions alongside infrastructure modernisation and sustainability programs. The rising popularity of heat pumps stems from their reduced carbon emissions and superior operational efficiency, which reflects the region's pursuit of green solutions. The increasing investment in advanced water and wastewater systems results from EU rules for pollution control and water preservation, which boost the demand for performance-oriented pumps. The industrial sectors of food processing and chemicals, and pharmaceuticals need particular pumps to handle fluids safely and effectively. The market growth receives support from urban redevelopment projects and increased funding towards district heating and cooling systems. Europe's robust research and development environment enables smart pump technologies to deliver improved efficiency together with regulatory compliance.

Asia Pacific Pumps Market Trends

The Asia Pacific pumps market led globally, with the largest revenue share of 44.7% in 2024 because of its strong infrastructure development, together with urbanisation and rapid industrial growth in China and India and Indonesia and Vietnam. The municipal and industrial sectors adopt pumps because of their requirement for reliable water management systems that handle clean drinking water and wastewater treatment. The market continues its growth because of government-sponsored initiatives in clean energy, along with the construction and agricultural sectors. The rising demand for submersible and centrifugal pumps in manufacturing and irrigation processes helps sustain market growth. Smart pump technology adoption accelerates rapidly because of the rising interest in sustainability practices and energy-efficient solutions. The expansion of regional markets, especially in Southeast Asia, relies heavily on infrastructure development.

Key Pumps Companies:

The following are the leading companies in the pumps market. These companies collectively hold the largest market share and dictate industry trends.

- SLB

- EBARA CORPORATION.

- Ingersoll Rand

- Vaughan Company

- ITT INC.

- Sulzer Ltd

- KSB SE & Co. KGaA

- The Weir Group PLC

- Pentair

- Xylem

- Grundfos Holding A/S

- SPX FLOW, Inc.

- Flowserve Corporation.

- IWAKI CO., LTD.

- Titan Manufacturing Inc.

- Others

Recent Developments

- In June 2025, Sentinam established out as a specialised supplier of pump solutions, providing a broad range of systems for sectors like manufacturing, chemicals, and water treatment. The company prioritises customised solutions, dependable service, and high-quality products, supported by MechTronic's industry knowledge. Sentinam strives to provide effective and dependable pumping systems with a robust supply network and technical assistance.

- In July 2024, Flowserve Corporation acquired the intellectual property, together with ongoing research and development for cryogenic Liquefied Natural Gas (LNG) submerged pump technology and packaging and systems from NexGen Cryogenic Solutions, Inc., an Arizona-based company specialising in LNG pump and turbine design engineering and testing.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the pumps market based on the below-mentioned segments:

Global Pumps Market, By Type

- Centrifugal Pumps

- Positive Displacement Pump

- Reciprocating Pump

Global Pumps Market, By End Use

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

- Others

Global Pumps Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa