Potassium Hydroxide Market Summary

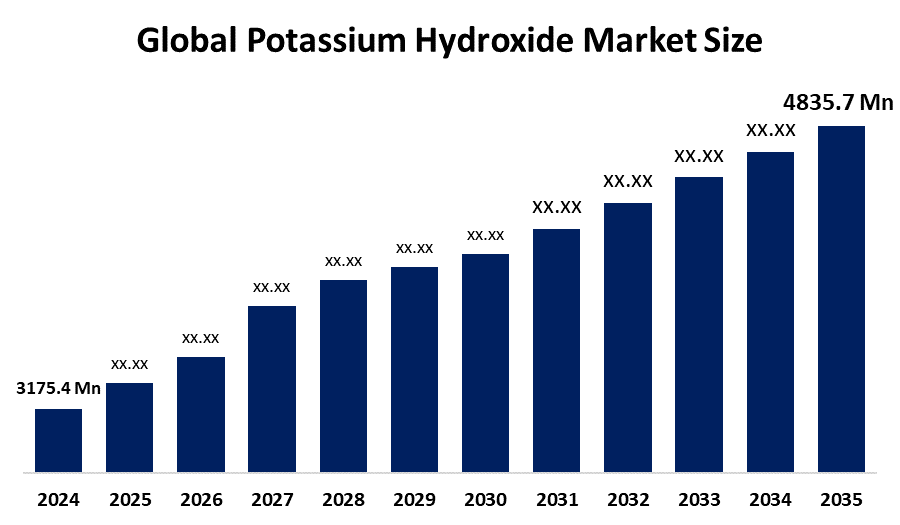

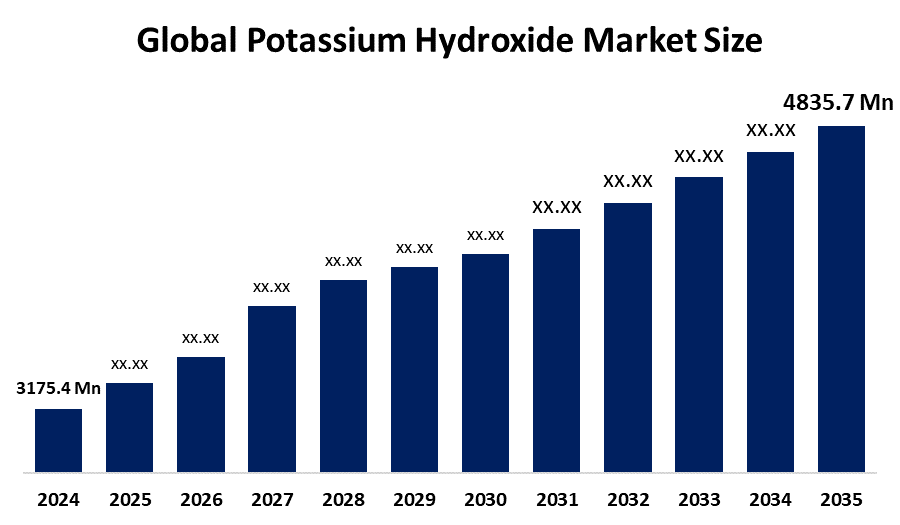

The Global Potassium Hydroxide Market Size Was Estimated at USD 3175.4 Million in 2024 and is Projected to Reach USD 4835.7 Million by 2035, Growing at a CAGR of 3.9% from 2025 to 2035. The market for potassium hydroxide is expanding due to growing demand in personal care products, alkaline batteries, agriculture, chemical manufacturing, and more environmentally friendly applications, all of which are facilitated by innovation and industrial growth.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share of over 38.6% and dominated the market globally.

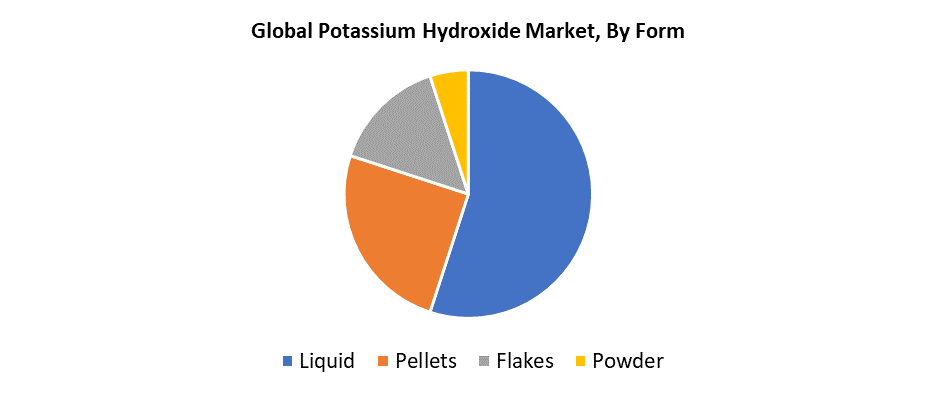

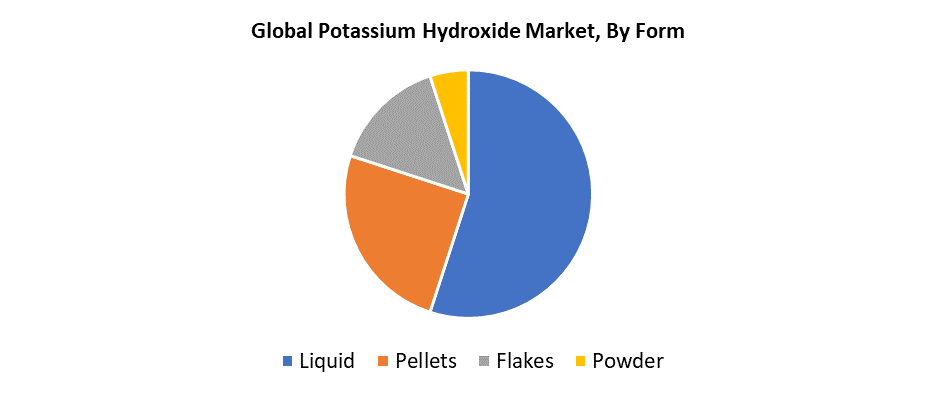

- In 2024, the liquid segment had the highest market share by form, accounting for 55.6%

- In 2024, the industrial grade segment had the biggest market share by grade, accounting for 66.7%

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3175.4 Million

- 2035 Projected Market Size: USD 4835.7 Million

- CAGR (2025-2035): 3.9%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

The potassium hydroxide market functions through the production and distribution of this highly alkaline chemical, which serves multiple industries, including biodiesel manufacturing, fertilizer, and pharmaceutical sectors. The chemical serves as a fundamental element in numerous industrial manufacturing operations, which create detergents and soaps. Market growth results from rising industrial usage as well as increasing agricultural fertilizer use and expanding consumer interest in bio-based products. The growing utilization of potassium hydroxide in chemical processing and energy storage systems creates a greater market potential for this compound. The worldwide market demand continues to rise because of urbanization, along with industrialization and the shift toward environmentally friendly products.

The production process of potassium hydroxide undergoes technological advancements that focus on enhancing operational efficiency and reducing environmental harm. Membrane cell technology, together with advanced electrolysis methods, enables higher purity levels and lower energy requirements in potassium hydroxide production. The advancements in production technology reduce operational expenses while enabling larger potassium hydroxide manufacturing operations. Market growth in sustainable agriculture and green chemicals benefits from government programs that support these initiatives. The demand for potassium hydroxide grows because of policies that encourage sustainable fertilizer use and environmentally friendly industrial practices. Global production of potassium hydroxide experiences enhanced market conditions through regulations that focus on emissions control and hazardous waste management to ensure safer production methods.

Form Insights

The liquid category led the potassium hydroxide market with 55.6% revenue share in 2024. The liquid segment dominates the market because it offers flexibility, together with easy implementation across different industries such as agriculture, water treatment, and chemical production. The industrial operations benefit from liquid potassium hydroxide because it delivers faster dissolution and enhanced control for applications including pH adjustment, soap production, and biodiesel synthesis. The market leadership of potassium hydroxide stems from its simple handling, transportation, and storage methods for large-scale operations. The widespread application of liquid potassium hydroxide depends on its consistent quality and simple mixing process, which sustains its position as the top choice in the market.

The pellets segment of the potassium hydroxide market will experience the fastest growth rate throughout the projection period. The rapid growth of pellets as solid potassium hydroxide stems from increasing demand from specialized chemical, food processing, and medicinal applications that require precise dosage control. The solid form of pellets provides a better handling experience, together with improved storage safety and reduced risks of contamination or leakage compared to liquid potassium hydroxide. The extended shelf life of pellets makes them ideal for situations that need controlled disintegration. The pellets segment is set to experience substantial growth during the upcoming years as companies shift their focus toward operational efficiency and safety measures.

Grade Insights

The industrial grade segment led the potassium hydroxide market with 66.7% of revenue share in 2024. The high market dominance of this category stems from its various industrial applications that span pulp and paper, textile production, chemical manufacturing, and petroleum refining. The high alkalinity, affordability, and adaptable nature of industrial-grade potassium hydroxide make it ideal for large-scale production operations such as chemical synthesis, saponification, and neutralization. Biodiesel production and potassium-based chemical manufacturing depend on this essential component, which maintains consistent worldwide demand. The market leadership of this segment in volume and revenue continues to grow because it meets industrial quality standards, while emerging nations industrialization increases.

The food grade category is anticipated to experience the fastest CAGR growth in the potassium hydroxide market during the forecast period. The rapid expansion of food-grade potassium hydroxide usage results from its food additive functions in the food and beverage sector, which include pH control and product stabilization. Producers now use high-purity food-grade potassium hydroxide because of stricter regulations and rising consumer awareness about food safety and quality standards. The food processing industry's growth in developing nations supports the rising demand for this specific grade of potassium hydroxide. The food-grade potassium hydroxide market is growing rapidly because of rising consumer interest in convenient meals and beverages.

Regional Insights

The Asia Pacific region dominated the global potassium hydroxide market with 38.6% revenue share in 2024. The region maintains its leadership position through its expanding industrial base, together with strong industrial demand from water treatment, chemical, textile, and agricultural sectors, and its manufacturing hubs located in China, India, and South Korea. The agricultural sector expansion through increased food demand and fertilizer usage continues to boost potassium hydroxide consumption. Market expansion occurs because of government initiatives that encourage infrastructure development alongside industrial production growth. The Asia Pacific region stands as the leading potassium hydroxide market globally because of its growing chemical industry spending and its low-cost workforce, and basic material resources.

Europe Potassium Hydroxide Market Trends

The potassium hydroxide market in Europe will experience the fastest growth during the forecast period because of increasing requirements from the pharmaceutical and food processing sectors, as well as renewable energy applications. The manufacturing of biodiesel and water treatment benefits from the region's environmental regulations and sustainability initiatives, which promote potassium hydroxide as an environmentally friendly chemical. The rising demand for food and reagent-grade potassium hydroxide stems from the increasing demand for high-purity food and pharmaceutical ingredients. Market expansion receives an additional boost from technological advancements and progressive EU regulations, which promote environmentally friendly manufacturing practices. Europe stands to become one of the leading regions in the global potassium hydroxide market because industries focus on innovation along with environmentally friendly alternatives.

North American Potassium Hydroxide Market Trends

The North American potassium hydroxide market shows continuous growth because the personal care, chemical, agricultural, and pharmaceutical industries need it. The strong alkali compound potassium hydroxide serves multiple industrial purposes, including detergent and soap production as well as fertilizer creation and alkaline battery electrolyte applications. The United States maintains its position as the leading region because of its strong industrial foundation and technological advancements. Environmental concerns are driving increased usage of potassium compounds in green applications. The market competition pushes participants to focus on expanding capacity while developing innovative solutions and sustainable practices. Progress faces challenges from raw material price fluctuations and regulatory compliance issues. Despite these challenges, the market exhibits positive growth potential because of its diverse product range and industrial requirements.

Key Potassium Hydroxide Companies:

The following are the leading companies in the potassium hydroxide market. These companies collectively hold the largest market share and dictate industry trends.

- Solvay

- Gujarat Alkalies and Chemicals Limited

- BASF

- Airedale Chemical Company Limited

- Occidental Petroleum Corporation (OxyChem)

- Olin Corporation

- ERCO Worldwide

- UNID

- INEOS KOH Inc.

- American Elements

- Merck KGaA

- Altair Chemical S.r.l.

- Dow

- HAINAN HUARONG CHEMICAL CO., LTD.

- Others

Recent Development

- In February 2024, to dramatically lower product carbon footprints, INEOS Inovyn introduced an Ultra-Low-Carbon chlor-alkali line that includes caustic potash. The program is certified under the ISCC PLUS program and uses renewable energy at strategic locations. Helping downstream users reach sustainability goals is the goal. The global market's low-carbon positioning is strengthened by this action.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the potassium hydroxide market based on the below-mentioned segments:

Global Potassium Hydroxide Market, By Form

- Liquid

- Pellets

- Flakes

- Powder

Global Potassium Hydroxide Market, By Grade

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

Global Potassium Hydroxide Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa