Plant Phenotyping Equipment Market Summary, Size & Emerging Trends

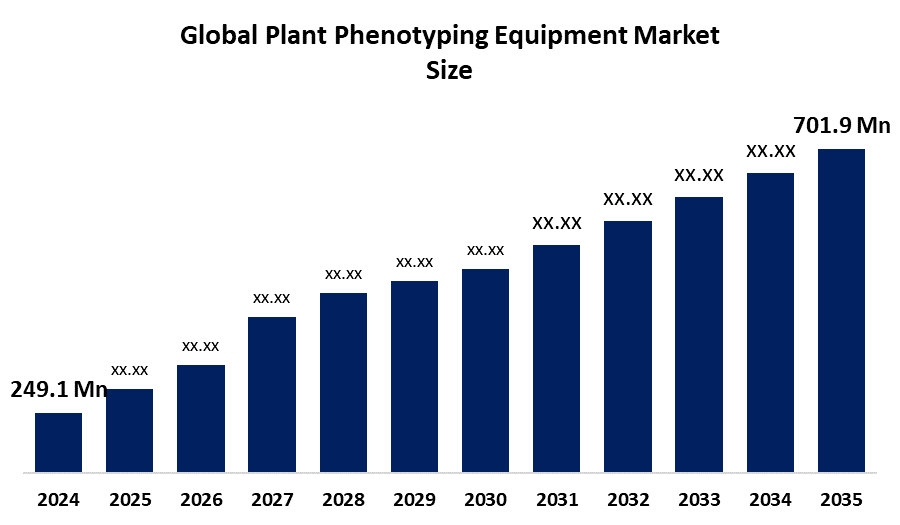

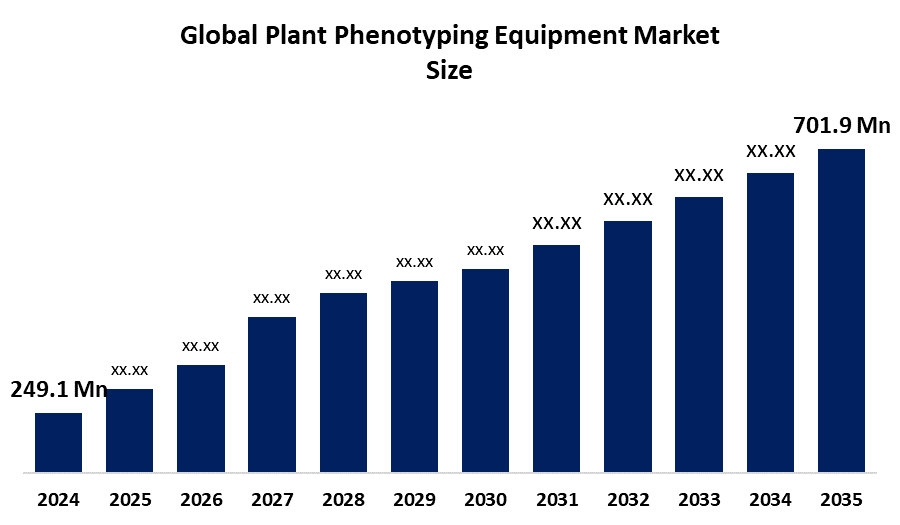

According to Spherical Insights, the Global Plant Phenotyping Equipment Market Size is expected to grow from USD 249.1 Million in 2024 to USD 701.9 Million by 2035, at a CAGR of 9.88% during the forecast period 2025-2035. Rising demand for precision agriculture and data-driven crop breeding is a key growth driver for the global plant phenotyping equipment market.

Key Market Insights

- North America is expected to account for the largest share in the plant phenotyping equipment market during the forecast period.

- In terms of equipment, the hardware segment is projected to lead the Plant Phenotyping Equipment market in terms of equipment throughout the forecast period

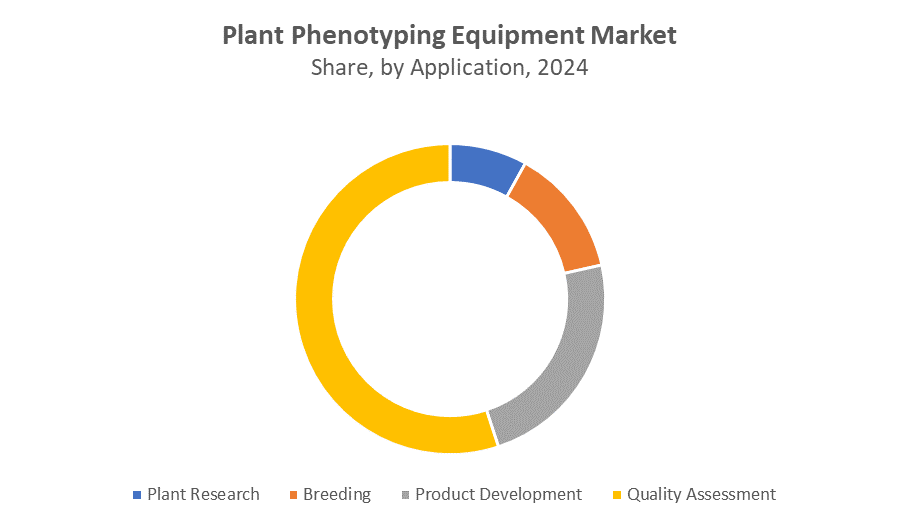

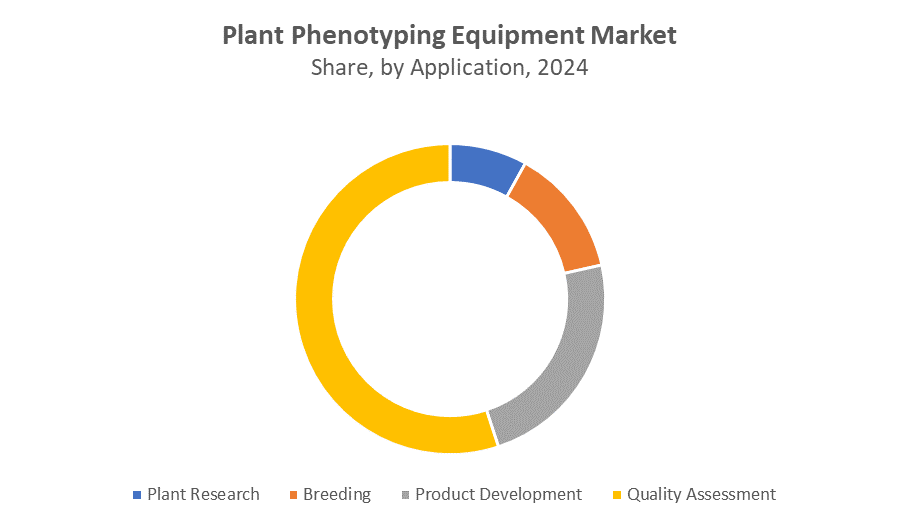

- In terms of application, the quality assessment segment captured the largest portion of the market

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 249.1 Million

- 2035 Projected Market Size: USD 701.9 Million

- CAGR (2025-2035): 9.88%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Plant Phenotyping Equipment Market

The plant phenotyping equipment market involves advanced technologies used to analyze plant traits such as growth, structure, and yield, supporting research and precision agriculture. Key equipment includes imaging systems, sensors, drones, and automated platforms that enable accurate, high-throughput data collection. Growing demand for sustainable agriculture and food security is driving adoption across research institutions and agribusinesses. Governments are actively supporting innovation through funding and initiatives focused on modernizing agricultural practices. Integration of artificial intelligence (AI), machine learning, and Internet of Things (IoT) technologies is further enhancing phenotyping capabilities. As the need for efficient crop monitoring, climate adaptation, and genetic improvement grows, the plant phenotyping equipment market continues to expand, fostering advancements in agricultural productivity and innovation.

Plant Phenotyping Equipment Market Trends

- AI is used to analyze large phenotypic datasets, automate trait detection, and support predictive modeling in crop breeding.

- There’s a shift toward compact, mobile platforms like drones, handheld sensors, and phenomobiles for real-time data collection in field conditions.

- Advanced sensors, including hyperspectral, thermal, and LiDAR, are being combined to capture complex plant traits with greater accuracy.

- Autonomous robots and ground vehicles are increasingly used to streamline high-throughput phenotyping tasks in both lab and field environments.

Plant Phenotyping Equipment Market Dynamics

Driving Factors: Advances in precision agriculture are driving growth in the plant phenotyping equipment market

The growth of the plant phenotyping equipment market is driven by increasing demand for high-yield, climate-resilient crops amid global food security concerns. Advances in precision agriculture, supported by AI, IoT, and automation, are enhancing phenotyping capabilities and data accuracy. Government funding and research initiatives are promoting innovation in crop improvement technologies. Rising adoption of smart farming tools by agribusinesses and research institutions is further fueling market expansion. Additionally, the growing need to optimize resource use, improve crop monitoring, and accelerate breeding cycles contributes to the rising demand for advanced phenotyping equipment in both controlled environments and open-field applications.

Restrain Factors: The plant phenotyping equipment market faces challenges due to the lack of standard ways to share and integrate data

The high cost of advanced equipment makes it difficult for smaller farms and research groups to invest. Many tools require skilled users, and not every region has easy access to trained experts. Additionally, the lack of standard ways to share and integrate data slows down adoption. In some areas, people still don’t fully understand the benefits of this technology. These challenges can slow the market’s growth despite its strong potential.

Opportunity: Growing investments in precision farming are creating new opportunities in the plant phenotyping equipment market

Growing investments in precision farming and smart agriculture technologies create demand for advanced phenotyping tools that improve crop yield and resilience. Integration of AI, machine learning, and IoT in phenotyping systems offers potential for more accurate, high-throughput data collection and analysis. Expanding government support and research funding worldwide further fuel innovation and adoption. Additionally, the rise of affordable, portable, and user-friendly phenotyping equipment opens new markets among small-scale farmers and developing regions. Collaborations between tech companies, research institutions, and agribusinesses also provide opportunities to develop customized solutions, enhancing market growth and accelerating advancements in crop breeding and climate adaptation.

Challenges: In the plant phenotyping equipment market, many users find the technology complex

Despite its potential, the plant phenotyping equipment market struggles with several obstacles. The steep investment needed for cutting-edge tools restricts adoption beyond well-funded labs and large farms. Many users find the technology complex, requiring specialized skills not always accessible. Fragmented data formats and lack of universal standards create barriers in combining and interpreting results across platforms. Furthermore, in many regions, a gap remains in understanding how these technologies can transform agriculture, slowing widespread acceptance and use.

Global Plant Phenotyping Equipment Market Ecosystem Analysis

The Global Plant Phenotyping Equipment Market ecosystem includes technology providers, software developers, research institutions, and end users like breeders and agribusinesses. Key technologies involve advanced imaging, sensors, and automation tools such as drones and robotics for high-throughput data collection. Collaborative networks like the European and North American Plant Phenotyping Networks promote standardization and innovation. Market growth is driven by demand for climate-resilient crops and AI integration, while high costs and technical expertise requirements remain challenges. Opportunities lie in emerging markets and affordable, portable solutions.

Global Plant Phenotyping Equipment Market, By Equipment

The hardware segment led the plant phenotyping equipment market, generating the largest revenue share. This dominance can be attributed to the essential nature of hardware components such as sensors, imaging devices, drones, and automated systems that are required for capturing and analyzing plant traits in both laboratory and field environments. These tools enable researchers and agricultural professionals to gather precise data on plant growth, stress responses, and productivity, which are vital for crop improvement and sustainable farming.

The software segment in the plant phenotyping equipment market is expected to grow at the fastest CAGR over the forecast period, driven by the increasing need for advanced data analysis, image processing, and machine learning algorithms to interpret the complex datasets generated by phenotyping hardware. As researchers and agronomists seek more efficient and accurate methods to analyze plant traits, the demand for sophisticated software solutions is rising.

Global Plant Phenotyping Equipment Market, By Application

The quality assessment segment held the largest market share in the plant phenotyping equipment market, due to the growing emphasis on evaluating crop quality traits such as texture, color, nutrient content, and overall appearance, which are critical for meeting industry standards and consumer preferences. Advanced phenotyping tools used in quality assessment help researchers and producers monitor and improve the physical and chemical characteristics of plants, ensuring higher crop value and market competitiveness.

The product development segment in the plant phenotyping equipment market is projected to register the fastest CAGR, driven by increasing investments in research and development aimed at creating innovative phenotyping technologies and equipment. As agricultural industries and research institutions seek more efficient and precise tools to enhance crop breeding and performance evaluation, demand for advanced product development intensifies.

North America is expected to account for the largest share of the plant phenotyping equipment market during the forecast period, driven by the region’s strong focus on agricultural research and development, well-established infrastructure, and widespread adoption of advanced technologies in farming practices. Additionally, the presence of major market players, government initiatives supporting precision agriculture, and increasing investments in sustainable farming solutions contribute to the region’s dominance.

The United States is experiencing steady growth in the plant phenotyping equipment market, fueled by increasing investments in agricultural research, a strong emphasis on precision farming, and the adoption of innovative technologies to improve crop productivity and sustainability. Additionally, government support and funding for advanced phenotyping initiatives, along with collaboration between research institutions and private companies, are driving market expansion.

Asia Pacific is expected to grow at the fastest CAGR in the plant phenotyping equipment market during the forecast period. This rapid growth is driven by increasing agricultural modernization efforts, rising investments in research and development, and a growing focus on improving crop yields to meet the demands of a rapidly expanding population. Additionally, countries in the region are increasingly adopting advanced phenotyping technologies to enhance crop breeding and ensure food security. Supportive government policies, expanding agritech infrastructure, and rising awareness about precision agriculture further contribute to the region’s accelerated market growth.

India is rapidly expanding in the plant phenotyping market, due to its increasing focus on agricultural innovation and the need to enhance crop productivity to support its large and growing population. The country is investing heavily in advanced phenotyping technologies to improve crop breeding, stress resistance, and yield optimization. Government initiatives promoting precision agriculture, coupled with collaborations between research institutions and private enterprises, are accelerating market growth.

WORLDWIDE TOP KEY PLAYERS IN THE PLANT PHENOTYPING EQUIPMENT MARKET INCLUDE

- LemnaTec GmbH

- Delta-T Devices Ltd.

- Heinz Walz GmbH

- Phenospex B.V.

- KeyGene N.V.

- Qubit Phenomics

- Photon Systems Instruments

- Rothamsted Research

- BASF SE

Product Launches in Plant Phenotyping Equipment

- In April 2025, PhenoAssistant was launched as a conversational AI platform to automate plant phenotyping workflows. It allows researchers to interact using natural language, simplifying data collection and analysis. This reduces the need for specialized skills and speeds up data processing while improving accuracy. PhenoAssistant makes plant phenotyping more accessible and efficient, aiding faster crop improvement.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the plant phenotyping equipment market based on the below-mentioned segments:

Global Plant Phenotyping Equipment Market, By Equipment

Global Plant Phenotyping Equipment Market, By Application

- Plant Research

- Breeding

- Product Development

- Quality Assessment

Global Plant Phenotyping Equipment Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

1. What factors are driving the growth of the plant phenotyping equipment market?

Growth is driven by rising demand for precision agriculture, advances in AI and IoT integration, government funding for crop improvement, and the need for climate-resilient, high-yield crops amid global food security concerns.

2. Why does the hardware segment dominate the plant phenotyping equipment market?

Hardware dominates because sensors, imaging systems, drones, and automated platforms are essential for accurate data collection on plant growth and traits, making them fundamental tools in both research and commercial agriculture.

3. How is the software segment expected to evolve in the coming years?

The software segment is projected to grow fastest due to increasing demand for sophisticated data analysis, image processing, and machine learning solutions that help interpret complex phenotyping data efficiently.

4. What are the main challenges restricting wider adoption of plant phenotyping technologies?

Challenges include the high cost of advanced equipment, the need for skilled operators, lack of standardized data-sharing protocols, and limited awareness or understanding of the technology’s benefits in some regions.

5. Which application area holds the largest market share, and why?

Quality assessment holds the largest share because evaluating crop quality traits such as texture, color, and nutrient content is critical for meeting industry standards and consumer preferences, driving demand for advanced phenotyping tools.

6. What regional trends are expected to influence the market during the forecast period?

North America leads due to strong R&D infrastructure and adoption of advanced tech, while Asia Pacific is expected to grow fastest, fueled by agricultural modernization, government support, and expanding precision farming practices.

7. How are recent innovations like AI platforms impacting the plant phenotyping market?

Innovations like the AI-driven PhenoAssistant platform simplify workflows by enabling natural language interactions, reducing the need for specialized skills, accelerating data processing, and making phenotyping more accessible and efficient.