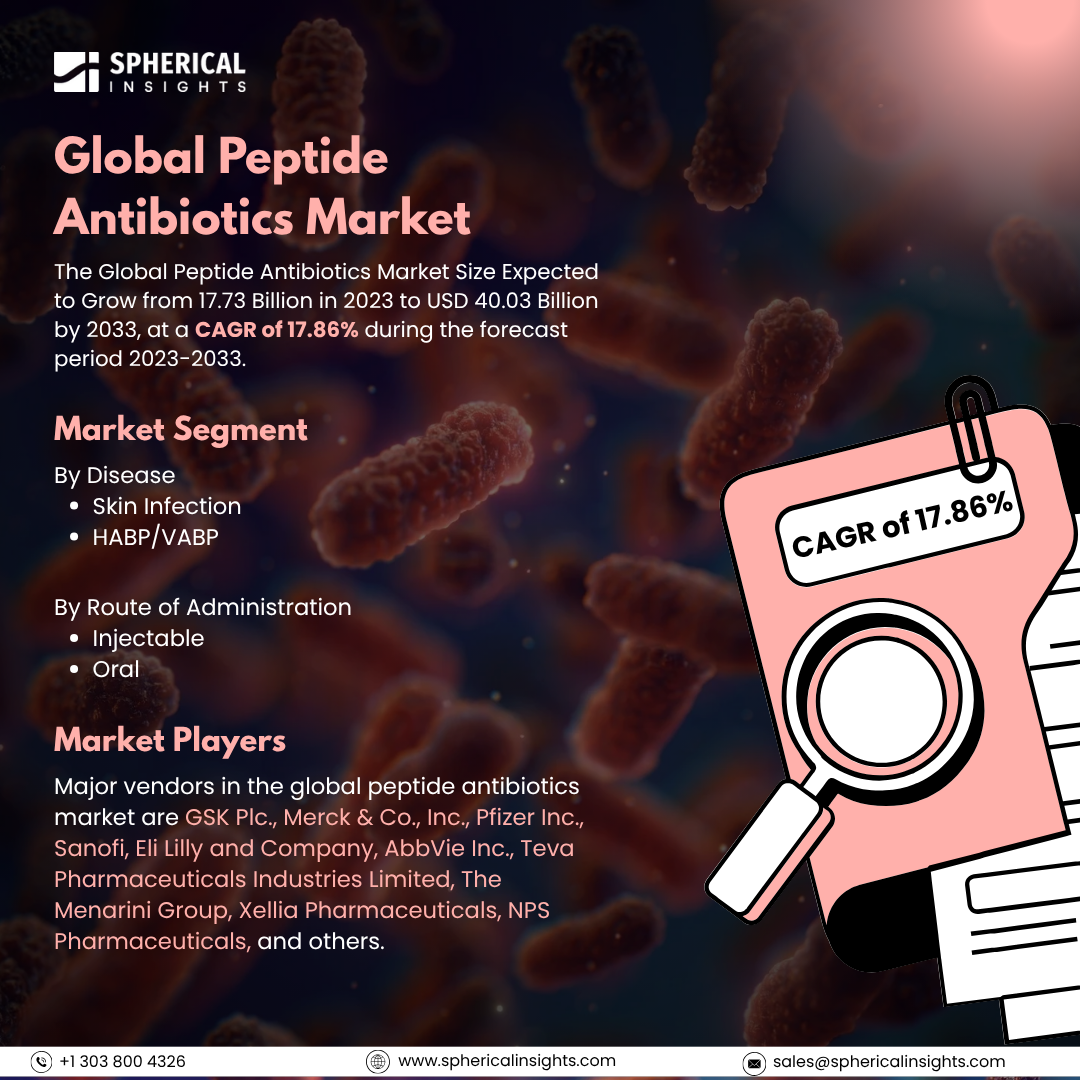

Global Peptide Antibiotics Market Size to Exceed USD 40.03 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Peptide Antibiotics Market Size Expected to Grow from 17.73 Billion in 2023 to USD 40.03 Billion by 2033, at a CAGR of 17.86% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Peptide Antibiotics Market Size, Share, and COVID-19 Impact Analysis, By Disease (Skin Infection and HABP/VABP), By Route of Administration (Injectable and Oral), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The peptide antibiotics market is the global industry that deals with the production, development, and marketing of peptide antibiotics, which are short chains of amino acids with antimicrobial activity used to treat bacterial infections, including drug-resistant bacteria. The antibiotics inhibit bacterial membranes, protein synthesis, or critical cellular processes. Moreover, the peptide antibiotics market is influenced by the escalating risk of antimicrobial resistance (AMR), growing demand for new antibiotics, and R&D spending on peptide-based therapy. Biotech innovations, encouragement by governments in developing antibiotics, and an escalation of hospital-acquired infections are additional drivers contributing to market expansion, rendering peptide antibiotics crucial to the fight against multidrug-resistant bacterial infections. However, the peptide antibiotics market is confronted by constraints like inordinate development expenditure, intricate product manufacturing processes, regulatory issues, and poor commercial viability owing to competition from generic antibiotics and lingering approval periods for novel peptide-class drugs.

The HABP/VABP segment accounted for the largest share of the global peptide antibiotics market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on disease, the global peptide antibiotics market is divided into skin infection and HABP/VABP. Among these, the HABP/VABP segment accounted for the largest share of the global peptide antibiotics market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of their high rates of occurrence, life-threatening nature, and rising antimicrobial resistance. Demand, driven by the need for effective treatment in critical care environments, exceeds that for skin infections in terms of market share.

The injectable segment accounted for a substantial share of the global peptide antibiotics market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of the route of administration, the global peptide antibiotics market is divided into injectable, and oral. Among these, the injectable segment accounted for a substantial share of the global Peptide Antibiotics market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is because it is the most common type of dementia. The high burden of disease, the growing ageing population, and continuous innovation in Alzheimer's disease-specific drug development propel its leadership over Parkinson's disease, vascular dementia, and frontotemporal dementia (FTD) in treatment attention and market shares.

North America is projected to hold the largest share of the global peptide antibiotics market over the projected period.

North America is projected to hold the largest share of the global peptide antibiotics market over the projected period. This is powered by a high rate of drug-resistant infections, state-of-the-art healthcare facilities, significant R&D spending, and government support for new antibiotics. Major pharma companies present and growing hospital-acquired infections further strengthen the region's market leadership.

Asia Pacific is expected to grow at the fastest CAGR of the global peptide antibiotics market during the projected period. This is spurred by surging antimicrobial resistance, surging healthcare spending, and accelerating hospital-acquired infection prevalence. Rising pharmaceutical R&D, the efforts of the government in pursuing antibiotic development, and a substantial patient base are other drivers stimulating market growth to position the region as a hotbed for peptide antibiotic innovation.

Company Profiling

Major vendors in the global peptide antibiotics market are GSK Plc., Merck & Co., Inc., Pfizer Inc., Sanofi, Eli Lilly and Company, AbbVie Inc., Teva Pharmaceuticals Industries Limited, The Menarini Group, Xellia Pharmaceuticals, NPS Pharmaceuticals, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, Beiersdorf and Macro Biologics, Inc. formed a multi-year collaboration to co-develop biodegradable antimicrobial peptides with wide-ranging application opportunities in skincare and healthcare. Concurrently, Beiersdorf becomes an investor in Macro Biologics via its Oscar & Paul Corporate Venture Capital Unit. Through introducing Macro Biologics' state-of-the-art technology in antimicrobial research to the skin care and healthcare space, Beiersdorf once again emphasizes its goal of constantly bringing transformative and sustainable innovations to its consumers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global peptide antibiotics market based on the below-mentioned segments:

Global Peptide Antibiotics Market, By Disease

Global Peptide Antibiotics Market, By Route of Administration

Global Peptide Antibiotics Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa