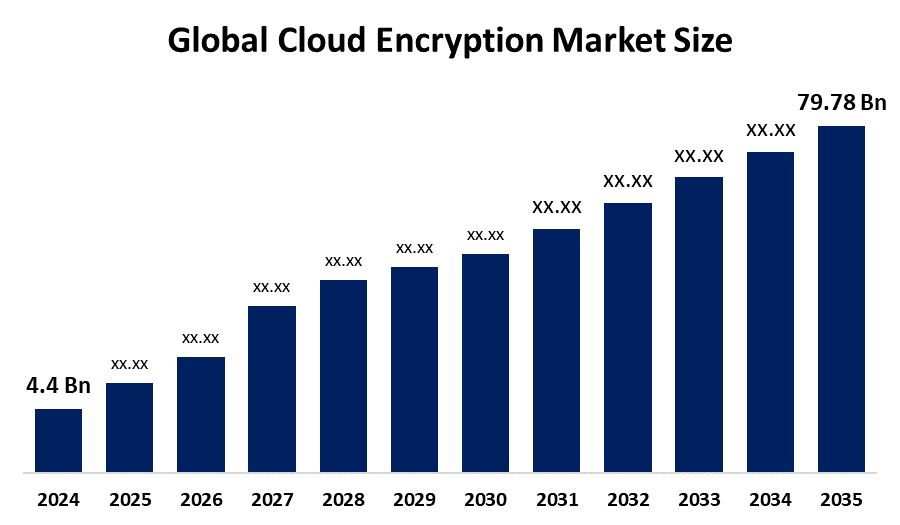

Global Cloud Encryption Market Insights Forecasts to 2035

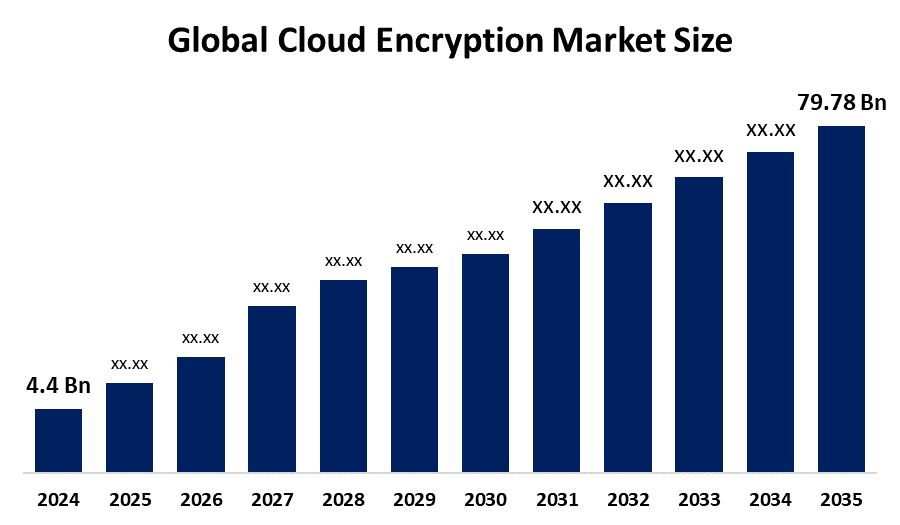

- The Global Cloud Encryption Market Size Was Estimated at USD 4.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 30.14% from 2025 to 2035

- The Worldwide Cloud Encryption Market Size is Expected to Reach USD 79.78 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Cloud Encryption Market

The Cloud Encryption Market Size focuses on providing encryption solutions to protect data stored and processed in cloud environments. As businesses increasingly shift to cloud platforms, ensuring the confidentiality, integrity, and security of sensitive information has become essential. Cloud encryption works by converting data into a secure, unreadable format, which can only be accessed by authorized users with the correct decryption keys. It encompasses various forms of encryption, including data-at-rest, data-in-transit, and data-in-use encryption, each serving a specific purpose in safeguarding cloud data. Additionally, key management services play a significant role in maintaining secure encryption processes. Major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud offer integrated encryption features within their platforms. The market continues to expand as organizations seek to comply with regulatory requirements and protect against unauthorized access or data breaches.

Attractive Opportunities in the Cloud Encryption Market

- Blockchain’s decentralized and immutable nature can significantly enhance data integrity in cloud encryption. It provides a transparent and secure way to manage encryption processes, especially for industries requiring high trust levels, such as finance and healthcare. As blockchain technology matures, its integration with cloud encryption can create new opportunities for secure, verifiable data storage and transactions.

- With the rise of sustainability concerns and green IT practices, there is an emerging opportunity to develop energy-efficient encryption solutions. These solutions would minimize the energy consumption associated with encryption processes, aligning with broader corporate social responsibility (CSR) goals. As organizations focus on reducing their carbon footprints, eco-friendly encryption technologies could cater to the growing demand for environmentally-conscious IT solutions while ensuring data security.

Global Cloud Encryption Market Dynamics

DRIVER: Rapid adoption of cloud computing across industries

Rapid adoption of cloud computing across industries has increased the volume of sensitive data being stored and processed in the cloud, raising the need for robust security measures. Second, the rise in cyber threats, including data breaches and ransomware attacks, is pushing businesses to prioritize encryption to protect valuable information. Third, stringent data protection regulations, such as GDPR, HIPAA, and CCPA, are compelling organizations to adopt encryption solutions to ensure compliance and avoid penalties. Fourth, the growing demand for data privacy and confidentiality, especially in sectors like healthcare, finance, and e-commerce, is driving the need for enhanced encryption. Additionally, the increasing use of hybrid and multi-cloud environments is leading to more complex data security requirements, further boosting the demand for cloud encryption services. These factors collectively fuel the market’s expansion.

RESTRAINT: Organizations often struggle with securely managing and storing encryption keys

One of the primary challenges is the complexity of encryption key management. Organizations often struggle with securely managing and storing encryption keys, which can complicate deployment and increase the risk of human error. Additionally, encryption can introduce performance overhead, potentially slowing down cloud operations and impacting user experience, especially for resource-intensive applications. Another limitation is the high cost associated with implementing comprehensive encryption solutions, particularly for small and medium-sized businesses (SMBs), which may lack the resources to invest in advanced security tools. Furthermore, the lack of standardization across encryption solutions can create interoperability issues, particularly in multi-cloud environments, where businesses must ensure consistent security across different platforms. Lastly, the evolving nature of cyber threats means encryption technologies must continuously adapt, requiring constant updates and innovations, which can strain resources and complicate long-term adoption.

OPPORTUNITY: Integration of blockchain technology with cloud encryption

The cloud encryption market is also poised for unique growth opportunities. One emerging avenue is the integration of blockchain technology with cloud encryption. Blockchain's decentralized, immutable nature can enhance data integrity and provide transparent encryption processes, making it particularly valuable in industries requiring high trust, like finance and healthcare. Additionally, as cloud environments become more automated, the use of smart encryption systems that can adapt to changing workloads and security needs presents a significant opportunity. Another unique opportunity lies in the rise of privacy-enhancing technologies (PETs), such as homomorphic encryption, which allows computations on encrypted data without decrypting it, offering new avenues for secure data analytics in cloud environments. As organizations embrace hybrid cloud setups, encryption services tailored for multi-cloud ecosystems will become increasingly essential. Lastly, the shift towards sustainability and green IT practices presents an opportunity for eco-friendly encryption solutions that minimize energy consumption while ensuring robust data protection.

CHALLENGES: Lack of skilled cybersecurity professionals

One significant challenge is the lack of skilled cybersecurity professionals. The complexity of cloud encryption solutions requires expertise in both cloud architecture and encryption technologies, creating a skills gap that organizations struggle to fill. Another challenge is the difficulty in balancing encryption with scalability. As organizations expand their cloud infrastructure, ensuring that encryption processes can scale without compromising performance or introducing latency is a constant hurdle. Additionally, the rapid evolution of encryption algorithms and standards presents a challenge for businesses in staying up to date with the latest practices and ensuring their systems remain secure against new threats. Vendor lock-in is also a challenge in cloud encryption, where organizations may find it difficult to switch providers or integrate new solutions due to proprietary encryption methods or closed ecosystems. Lastly, encryption often complicates data sharing across platforms or between organizations, hindering collaboration.

Global Cloud Encryption Market Ecosystem Analysis

The global cloud encryption market ecosystem consists of key players like cloud service providers (AWS, Microsoft Azure), encryption solution vendors (Symantec, McAfee), and cybersecurity firms, all collaborating to secure cloud data. Regulatory bodies enforce standards such as GDPR and HIPAA, driving compliance. End-users across industries like finance and healthcare rely on encryption for data protection. Additionally, key management services (AWS KMS, Azure Key Vault) and third-party integrators support seamless deployment. Technological innovations, such as AI-driven and quantum encryption, are shaping the future of the ecosystem, ensuring robust data privacy and security.

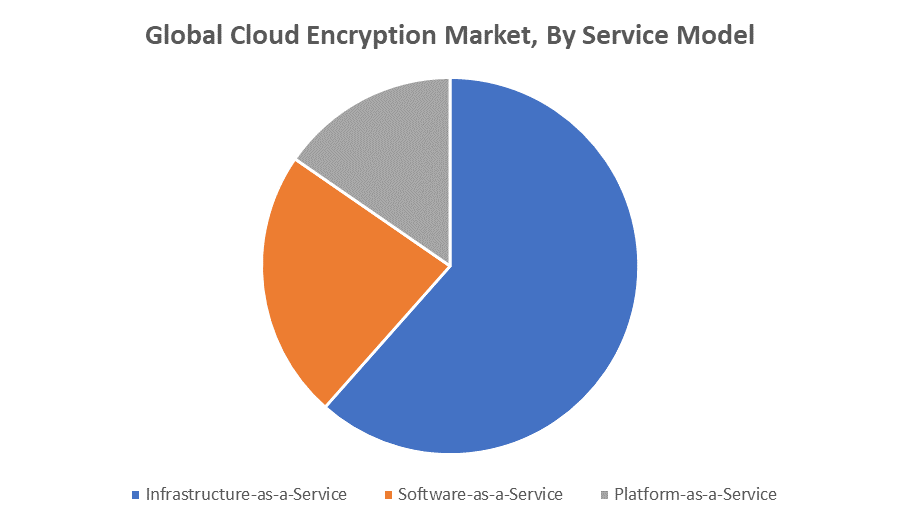

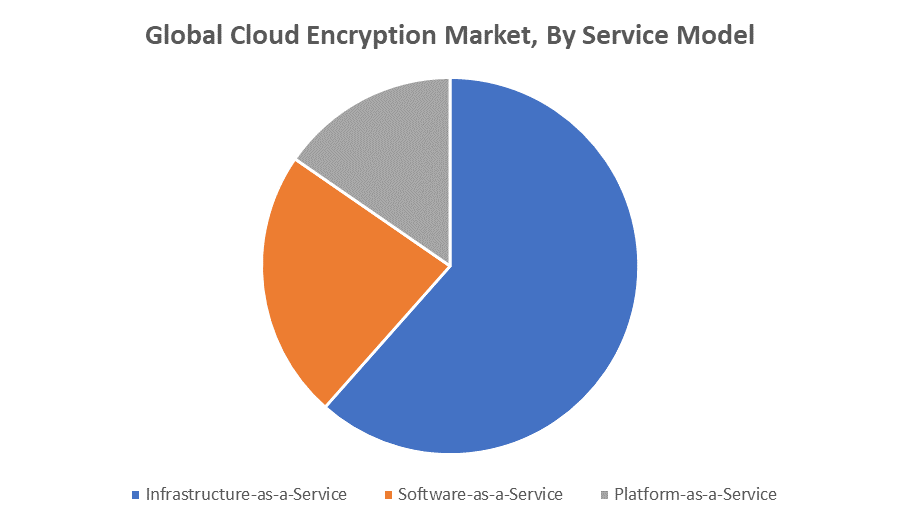

Based on the service model, the infrastructure-as-a-service segment dominated the market and accounted for a revenue share over the forecast period

IaaS provides businesses with virtualized computing resources over the internet, such as virtual machines, storage, and networking, which often require robust encryption to ensure data security. As organizations continue migrating to the cloud, the need to protect vast amounts of sensitive data hosted on IaaS platforms has grown, driving the adoption of encryption solutions. Additionally, IaaS models typically offer flexibility and scalability, making encryption solutions an integral part of maintaining secure, compliant, and efficient cloud infrastructure. This segment's dominance reflects the increasing shift toward cloud computing and the priority businesses place on securing their cloud-based assets and data.

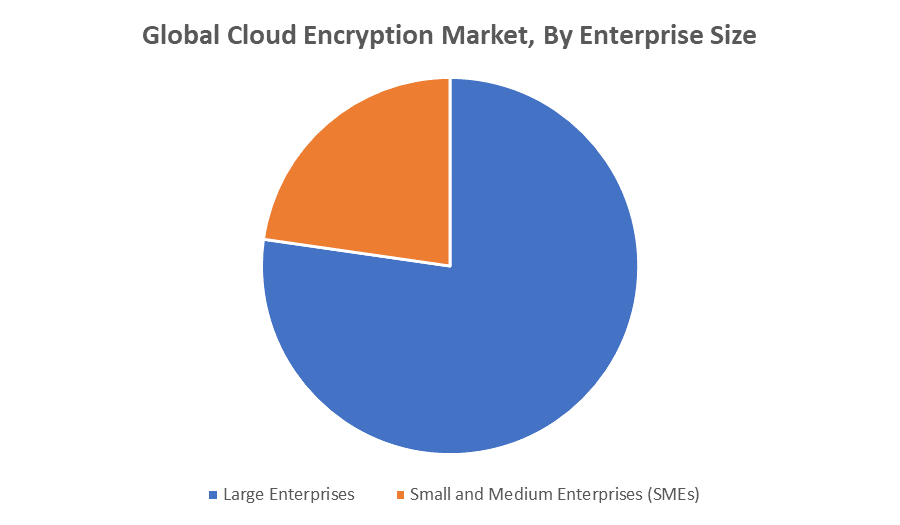

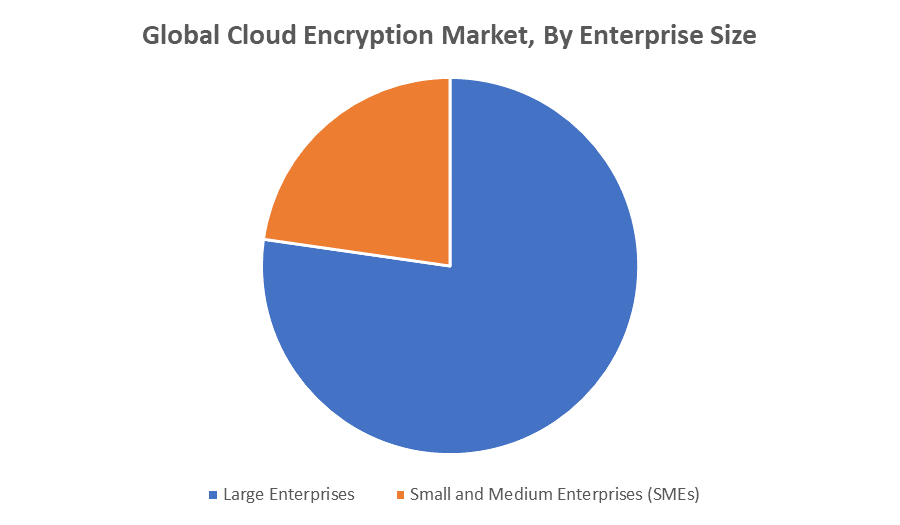

Based on the enterprise size, the large enterprises segment dominated the market and accounted for a revenue share and is expected to grow at a significant CAGR over the forecast period

Large enterprises typically handle vast amounts of sensitive data across multiple departments and regions, making robust encryption a critical aspect of their cloud security strategy. These organizations often have the resources to invest in advanced encryption solutions and comply with stringent regulatory requirements, driving their strong market presence. Moreover, as large enterprises continue to adopt multi-cloud and hybrid cloud environments, the need for comprehensive encryption solutions to secure data-at-rest, data-in-transit, and data-in-use is expected to rise.

North America is anticipated to hold the largest market share of the cloud encryption market during the forecast period

North America is anticipated to hold the largest market share of the global cloud encryption market during the forecast period. The region benefits from a well-established IT infrastructure, a high adoption rate of cloud computing, and a growing emphasis on data security and privacy. The presence of major cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud in North America further fuels the demand for cloud encryption solutions. Additionally, stringent data protection regulations such as the California Consumer Privacy Act (CCPA) and GDPR compliance requirements drive organizations in North America to prioritize data encryption. The region’s highly developed cybersecurity industry, along with a large number of enterprises across industries such as finance, healthcare, and government, are also key factors contributing to North America's dominance in the market. These trends are expected to ensure sustained growth in the North American cloud encryption market.

Asia Pacific is expected to grow at the fastest CAGR in the cloud encryption market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the global cloud encryption market during the forecast period. This growth is driven by the rapid digital transformation across key industries such as IT, telecommunications, healthcare, and finance in countries like China, India, Japan, and South Korea. As organizations in the region increasingly adopt cloud services, the need for robust data encryption solutions to ensure privacy and security is rising. Additionally, governments in the region are implementing stricter data protection regulations, such as the Personal Data Protection Bill in India, which is pushing businesses to adopt encryption solutions to comply with evolving legal requirements. The increasing number of cloud service providers entering the Asia Pacific market and expanding their infrastructure also contributes to the region's growth. With growing awareness about cybersecurity and data privacy, the demand for cloud encryption services in this region is set to increase rapidly over the forecast period.

Recent Development

- In February 2024, Microsoft launched the enhanced Azure Confidential Computing service, which enables customers to process and encrypt data in memory without exposing it to unauthorized users. This product is a game-changer for industries dealing with highly sensitive data, such as finance and healthcare.

- In July 2023, Symantec launched the latest version of its Cloud Workload Protection (CWP) solution, which includes built-in encryption for cloud workloads. This product automates encryption policies and ensures that data remains secure even as it moves between multi-cloud environments.

Key Market Players

KEY PLAYERS IN THE CLOUD ENCRYPTION MARKET INCLUDE

- Amazon Web Services (AWS)

- Microsoft Corporation

- Google Cloud

- IBM Corporation

- Thales Group

- McAfee

- Symantec (Broadcom)

- Fortinet

- Palo Alto Networks

- Varonis Systems

- Trend Micro

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cloud encryption market based on the below-mentioned segments:

Global Cloud Encryption Market, By Service Model

- Infrastructure-as-a-Service

- Software-as-a-Service

- Platform-as-a-Service

Global Cloud Encryption Market, By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Global Cloud Encryption Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa