Packaging Coatings Market Summary

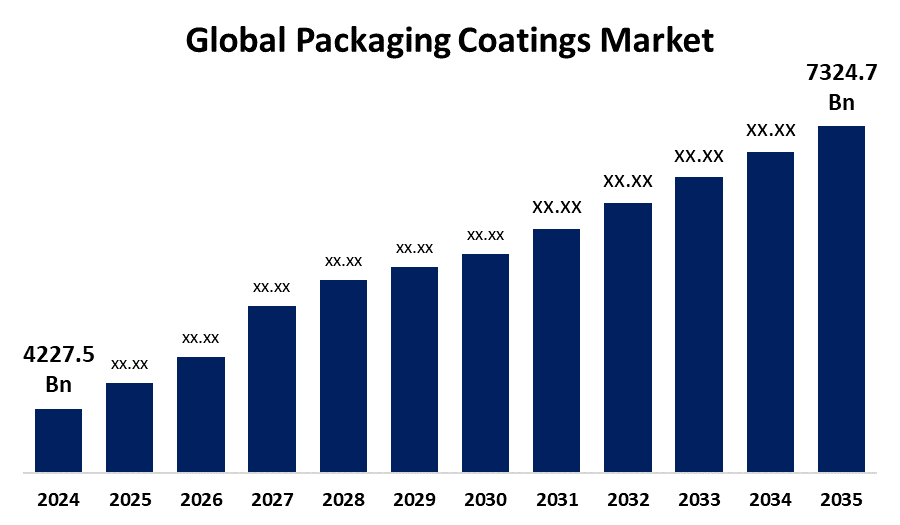

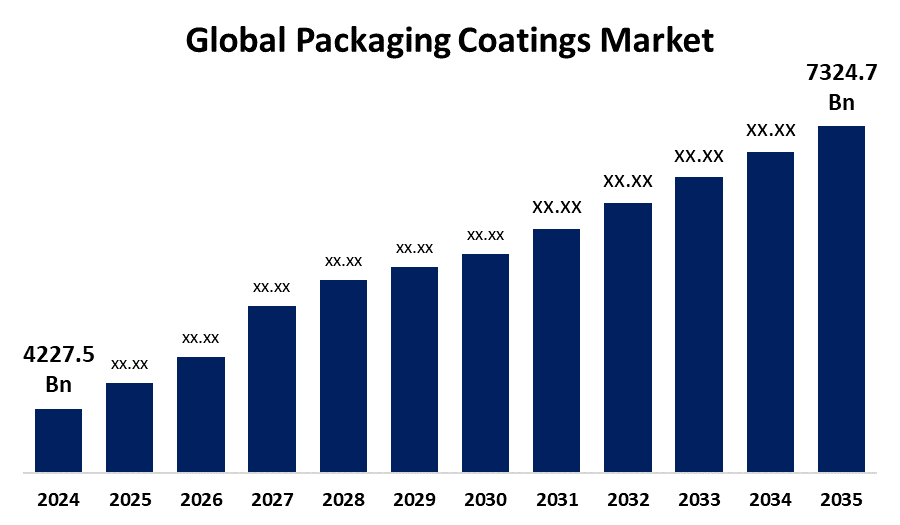

The Global Packaging Coatings Market Size Was Estimated at USD 4227.5 Million in 2024 and is Projected to Reach USD 7324.7 Million by 2035, Growing at a CAGR of 5.12% from 2025 to 2035. The growth of the food and beverage industry, the ascent of e-commerce, and consumers' increasing demand for easy and aesthetically pleasing packaging are the primary drivers of the packaging coatings market's notable expansion.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share of 41.7% in the packaging coatings market.

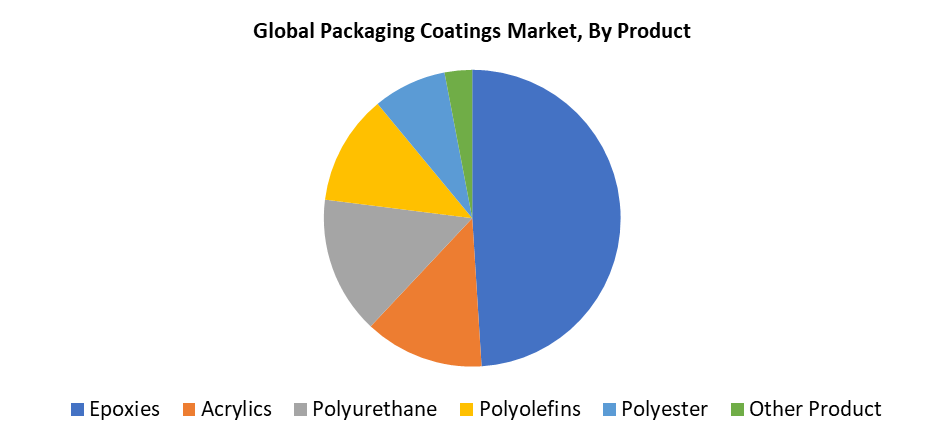

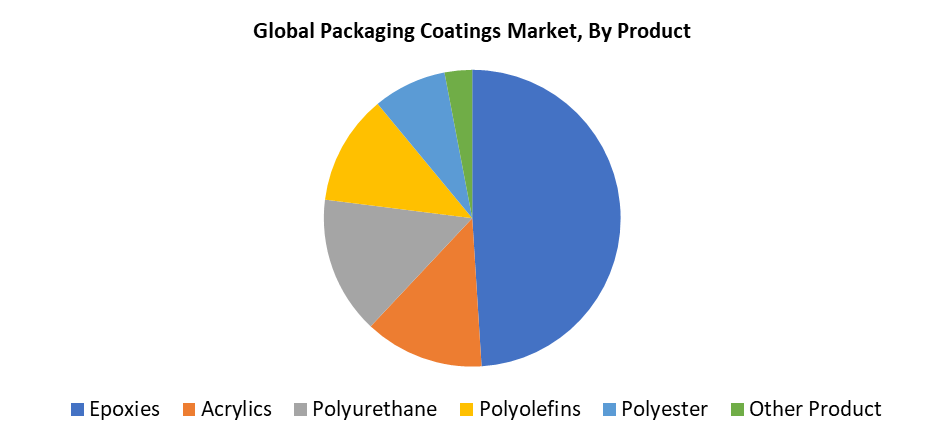

- With a 49.7% revenue share in 2024, epoxy packaging coatings led the market by product.

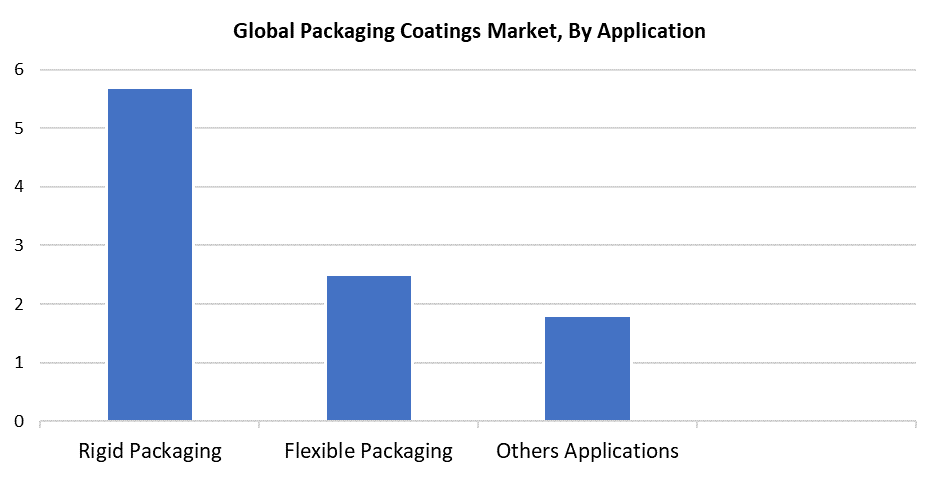

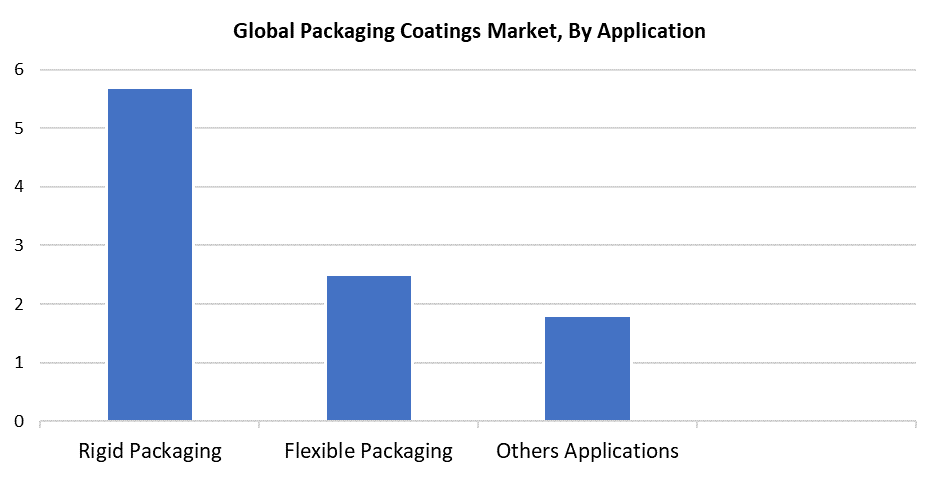

- In 2024, rigid packaging held a 57.5% revenue share, dominating the packaging coatings market by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4227.5 Million

- 2035 Projected Market Size: USD 7324.7 Million

- CAGR (2025-2035): 5.12%

- Asia Pacific: Largest market in 2024

The packaging coatings industry specializes in creating and manufacturing specialty coatings that serve various packaging materials. The packaging coatings market experiences substantial growth because urbanization and population growth, alongside changing consumer preferences, have increased the demand for packaged foods and drinks. The transformation of consumer behavior toward convenience packaging and on-the-go consumption has increased the need for safe, durable coatings. The growing e-commerce industry has played a major role in market expansion by creating higher demand for packaging materials that protect products during shipping. The market shows rapid growth because of the increasing need for coatings that deliver durability alongside extended shelf lives and protective barriers. Multiple industries, including personal care and medicines, need these coatings because customers and manufacturers rely on product safety and compliance with safety protocols.

Sustainability concerns stand as a major influence that drives innovations within the packaging coatings market. The combination of increasing consumer awareness regarding environmental issues and stricter regulations about single-use plastics and volatile organic compounds has forced companies to develop bio-based and eco-friendly coatings. The environmentally conscious solutions improve product recyclability and reduce environmental harm while addressing consumer needs for sustainable alternatives. Technical advancements, together with rising R&D investments, have simplified the development process for high-performance coatings, which offer improved adhesion and resistance and enhanced functionality. Companies are directing their attention toward innovation because of strict food safety standards and environmental objectives, which push the industry toward further development. The packaging industry continues to evolve as companies adopt sustainable packaging solutions alongside circular economy principles.

Product Insights

The epoxies packaging coatings category maintained its position as the market leader with 49.7% revenue share in 2024 because of its outstanding performance characteristics, which include extended durability, together with chemical resistance and strong adhesion qualities. The food and beverage packaging industry relies heavily on these coatings to establish protective barriers between contents and metal surfaces, which prevents contamination and corrosion. The barrier properties of canned goods packaging play an essential role in maintaining product safety as well as preserving its nutritional content and taste. The application of epoxy coatings extends the shelf life of packaged products, which makes them more attractive to both manufacturers and their customers. The use of protective coatings on glass packaging and metal covers boosts consumer interest in these products.

The polyurethane packaging coatings segment is expected to grow at the fastest rate of 4.3% CAGR from 2025 through 2035 because of its outstanding flexibility, chemical resistance, together with moisture barrier properties. The coatings have gained rising popularity because they deliver durable protective layers that resist changes in weather conditions like humidity and temperature swings. Polyurethane coatings find broad application in food packaging, beverage cans, and multiple consumer product packaging solutions due to their excellent adhesion properties, along with impact resistance and weather resistance. The adaptable nature of these coatings enables extended product shelf life while keeping product integrity intact during storage and transportation. The projected benefits are expected to drive strong market demand throughout the next years.

Application insights

Rigid packaging applications dominated the packaging coatings market in 2024, with 57.5% revenue share because they deliver top-tier protection and create premium-looking products. Rigid packaging stands as the primary choice for luxury drinks, spirits, along with cosmetics and health products, because these items need brand reputation protection and product longevity. The market values glass packaging highly because it provides outstanding barrier characteristics, which preserve product quality alongside flavor and freshness. Metal, along with hard polymers, delivers structural strength through its stiff material characteristics, which protect products from damage throughout storage and transportation. Consumer-packaged goods growth depends heavily on rigid packaging because consumers now prefer sophisticated and visually appealing packaging solutions.

Flexible packaging applications of packaging coatings are expected to experience the fastest growth rate between 2025 and 2035 at 4.2% CAGR because they present a lower environmental impact, together with cost-effective solutions compared to rigid packaging alternatives. The increasing use of flexible pouches with resealability features, along with lightweight construction and material efficiency, benefits this market sector. The combination of these features enables manufacturers to lower their storage and transportation costs while simultaneously enhancing consumer convenience. Flexible packaging finds extensive use in packaging products that need both portability and freshness maintenance, such as snacks, coffee, cereals, soups, and energy drinks. The development of coating technologies has driven up demand because it strengthened flexible materials' protective and barrier qualities, which increased shelf life and minimized food spoilage.

Regional Insights

In 2024, the Asia Pacific packaging coatings market dominated the market by holding 41.7% of total revenue from manufacturing, consumer goods, and food and beverage industries. The industrialization, along with urbanization and growing middle-class income, led to dramatic growth in packaged goods consumption across China, India, Japan, and South Korea. The market experienced accelerated growth because the region adopted flexible packaging systems that also prioritize environmental sustainability. Consumer interest in environmentally safe and food-safe products has driven up the market demand for eco-friendly coating solutions. The worldwide market sustains its position through AkzoNobel's Securshield series, which showcases the Asia Pacific region's commitment to sustainable and high-performance packaging solutions.

North America Packaging Coatings Market Trends

In 2024, the North American region acquired 23.7% market share in the worldwide packaging coatings market, because of rising flexible packaging requirements and strong demand for food and beverage applications. The rapid economic growth of the region, together with shifting consumer behaviour and busy lifestyles, drives the rising popularity of packaged and ready-to-eat products. The rising need for advanced packaging coatings emerges from this trend. The market continues to grow because major industry players operate in the market, while sustainable and environment-friendly coating technologies advance. Businesses must adopt secure, compliant coating solutions because of strict environmental impact regulations and food safety standards. The US and Canada remain vital markets because they invest heavily in research and development, along with product innovation and package modernization.

U.S. Packaging Coatings Market Trends

The U.S. packaging coatings business remains an essential and thriving division of the packaging coatings market because food, beverage, pharmaceutical, and personal care industries maintain their leadership. The coatings function to protect materials from corrosion and chemical reactions while extending product durability and maintaining product quality during storage. The adoption of sustainable solutions, including water-based coatings, together with low-VOC and BPA-free coatings, increases as environmental legislation tightens and consumers become more aware of these issues. Industry leaders, including PPG Industries, Sherwin-Williams Axalta, and Michelman, dedicate resources to develop advanced, environmentally sustainable products. The market for advanced barrier coatings expands because of increasing e-commerce needs and convenience packaging preferences. Two developing technologies in the US market include waterborne formulations and nanotechnology, which create opportunities for long-term innovation-driven growth.

Europe Packaging Coatings Market Trends

Europe generated 19.3% of the total packaging coatings market revenue in 2024 because of rising requirements for recyclable and sustainable packaging solutions that align with regulations. The food sector, along with the beverage and personal care industries in Europe, faces strong market influence from EU regulations that require coatings to be free from BPA and low in VOC content and environmentally safe. The European market shows an increasing preference for packaging solutions that combine environmental sustainability with functional performance. The area benefits from ongoing coating technology advancements, which include water-based and UV-curable solutions that deliver strong barrier protection together with attractive finishes. The European market needs high-performance, long-lasting packaging coatings because e-commerce continues its rapid growth and consumers demand both product shelf life extension and attractive packaging design.

Key Packaging Coatings Companies:

The following are the leading companies in the packaging coatings market. These companies collectively hold the largest market share and dictate industry trends.

- Akzo Nobel NV

- Evonik Industries AG

- Chugoku Marine Paints Ltd

- BASF SE

- HEMPEL A/S

- Berger Paints India Limited

- Arkema Group

- DowDuPont

- Henkel AG & Co. KGaA

- Jotun

- Chemetall

- Axalta Coatings

- Kansai Paint Co. Ltd

- Others

Recent Developments

- In June 2025, Jotun has introduced cutting-edge powder coating methods created especially to improve battery packaging in response to the rising demand for electric cars (EVs) and energy storage systems (ESS) worldwide. These coatings provide corrosion protection, fire resistance, temperature management, and electrical insulation—all of which are essential for the longevity, safety, and effectiveness of battery packs. Battery insulation has historically been accomplished with polymers and liquid paints, but Jotun's powder coatings offer a more stable, solvent-free, and economical substitute. To stop thermal runaway, corrosion, mechanical damage, and other threats to battery performance, these are applied to different battery parts and enclosures.

- In September 2024, Solenis and HEIDELBERG worked together to create environmentally friendly barrier coatings for paper packaging that may be printed on. By incorporating Solenis' coatings into HEIDELBERG's flexographic printing process, this breakthrough increases production sustainability and efficiency.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the packaging coatings market based on the below-mentioned segments:

Global Packaging Coatings Market, By Product

- Epoxies

- Acrylics

- Polyurethane

- Polyolefins

- Polyester

- Other Product

Global Packaging Coatings Market, By Application

- Rigid Packaging

- Flexible Packaging

- Other Applications

Global Packaging Coatings Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa