Global Online Food Delivery in Train Market Size to Exceed USD 3.87 Billion By 2033

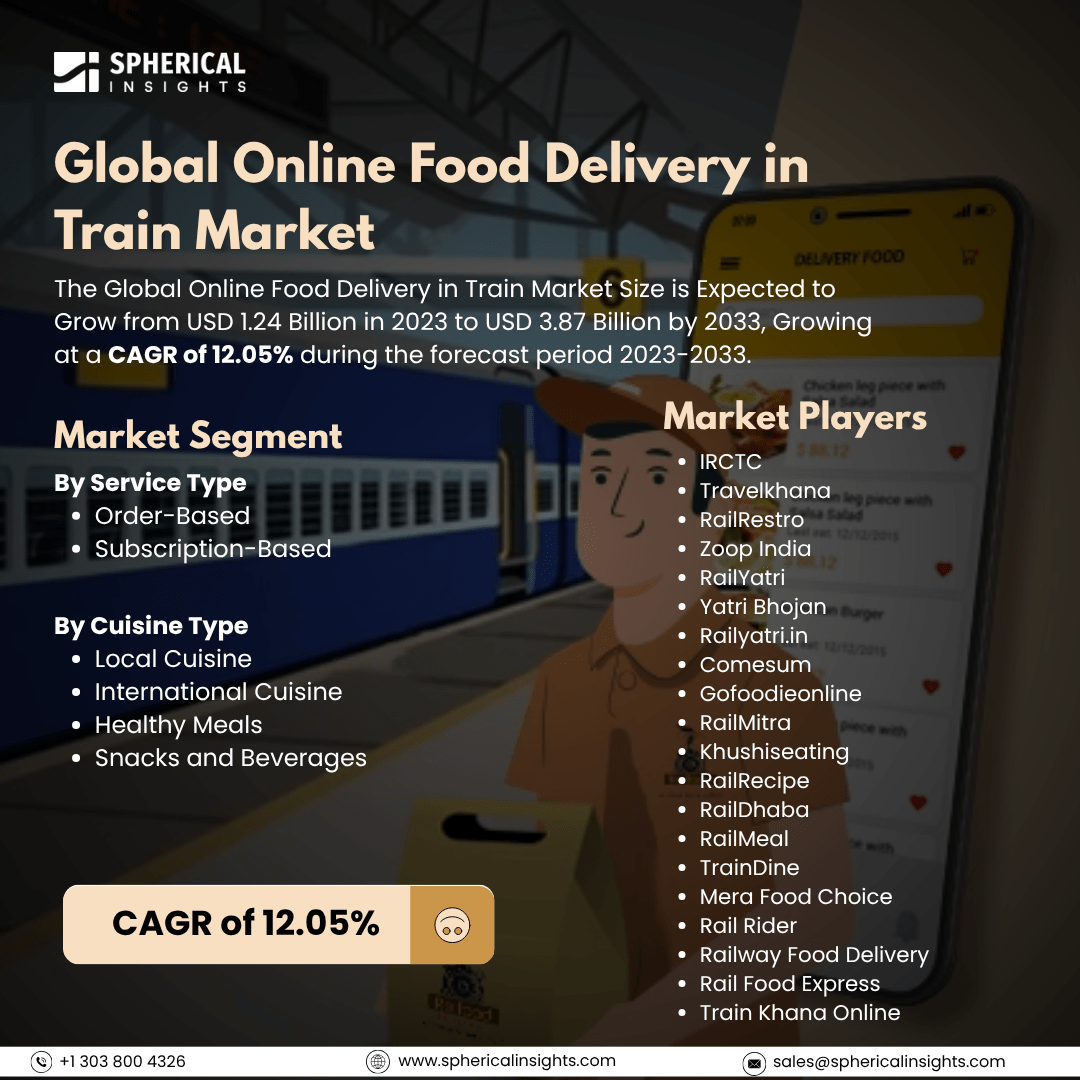

According to a research report published by Spherical Insights & Consulting, The Global Online Food Delivery in Train Market Size is Expected to Grow from USD 1.24 Billion in 2023 to USD 3.87 Billion by 2033, Growing at a CAGR of 12.05% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Online Food Delivery In Train Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Order-Based, Subscription-Based), By Cuisine Type (Local Cuisine, International Cuisine, Healthy Meals, Snacks and Beverages), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

The international online food delivery in train market notifies the business that supports the rail industry through distributing meals to passengers during their train journeys. This market involves partnerships between food delivery suppliers and railway service officials to offer a variety of meal alternatives that can be ordered online and delivered directly to passengers' seats. The rising popularity of phones and internet access, which enables ordering meals online for passengers, is one of the main factors propelling online meal delivery in the train business. Moreover, another factor supporting this development is the partnership between train officials and food delivery service companies with the interference of technology developments. Beyond this, the growing tourism industry propels the market revenue at a high spike. However, market acquisition faces several obstacles, such as time uncertainty, a chance for cyber-attacks due to high IoT things, and question marks on the quality of food.

The order-based segment held the largest share of the global online food delivery in train market in 2023 and is anticipated to grow at a substantial CAGR over the forecast period.

On the basis of the service type, the global online food delivery in train market is divided into order based and subscription based. Among these, the order-based segment held the largest share of the global online food delivery in train market in 2023 and is anticipated to grow at a substantial CAGR over the forecast period. This is due to provide passengers with flexibility and accessibility services place orders according to their needs. Furthermore, the collaborations between prominent restaurants and food delivery businesses with rail authorities guarantee a varied menu, which propels the market expansion for online food.

The local cuisine accounted for the largest share of the global online food delivery in train market in 2023 and is predicted to grow at a significant CAGR during the forecast period.

On the basis of the cuisine type, the global online food delivery in train market is segmented into local cuisine, international cuisine, healthy meals, snacks, and beverages. Among these, the local cuisine segment accounted for the largest share of the global online food delivery in train market in 2023 and is predicted to grow at a significant CAGR during the forecast period. This is because passengers or travelers would try regional food with luxurious travel experience along with their lots of variety.

Asia Pacific is projected to hold the greatest share of the global online food delivery in train market over the forecast period.

Asia Pacific is anticipated to hold the largest revenue share of the global online food delivery in train market over the forecast period. The regional market for online food delivery in trains has flourished due to the robust rail network across the region, especially in densely populated areas like India and China. Further, the growing popularity of e-commerce and online platforms expands the market acquisition. Moreover, diversification of the consumers mong the local or regional with their need could open up wide range of opportunities for market development.

Europe is anticipated to grow at the fastest CAGR growth of the global online food delivery in train market over the forecast period. The market expansion across the region is further accelerated due to the rising tourism sector because of the scenic landscape and tourist spots. Moreover, the regional rail authorities emphasize catering quality and hygiene food products, so it becomes new opportunities for strengthed the development of market expansion.

Company Profiling

Major vendors in the global online food delivery in train market are IRCTC, Travelkhana, RailRestro, Zoop India, RailYatri, Yatri Bhojan, and Railyatri.in, Comesum, Gofoodieonline, RailMitra, Khushiseating, RailRecipe, RailDhaba, RailMeal, TrainDine, Mera Food Choice, Rail Rider, Railway Food Delivery, Rail Food Express, Train Khana Online, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Swiggy expanded its food delivery service to 100 railway stations across 20 states in India. This expansion is teamed up with the Indian Railway Catering and Tourism Corporation (IRCTC), allowing passengers to enjoy a diverse range of meals delivered right to their train seats. Swiggy's initiative aims to enhance travel convenience and provide passengers with greater access to a variety of meals from across the country.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global online food delivery in train market based on the below-mentioned segments:

Global Online Food Delivery in Train Market, By Service Type

- Order-Based

- Subscription-Based

Global Online Food Delivery in Train Market, By Cuisine Type

- Local Cuisine

- International Cuisine

- Healthy Meals

- Snacks and Beverages

Global Online Food Delivery in Train Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa