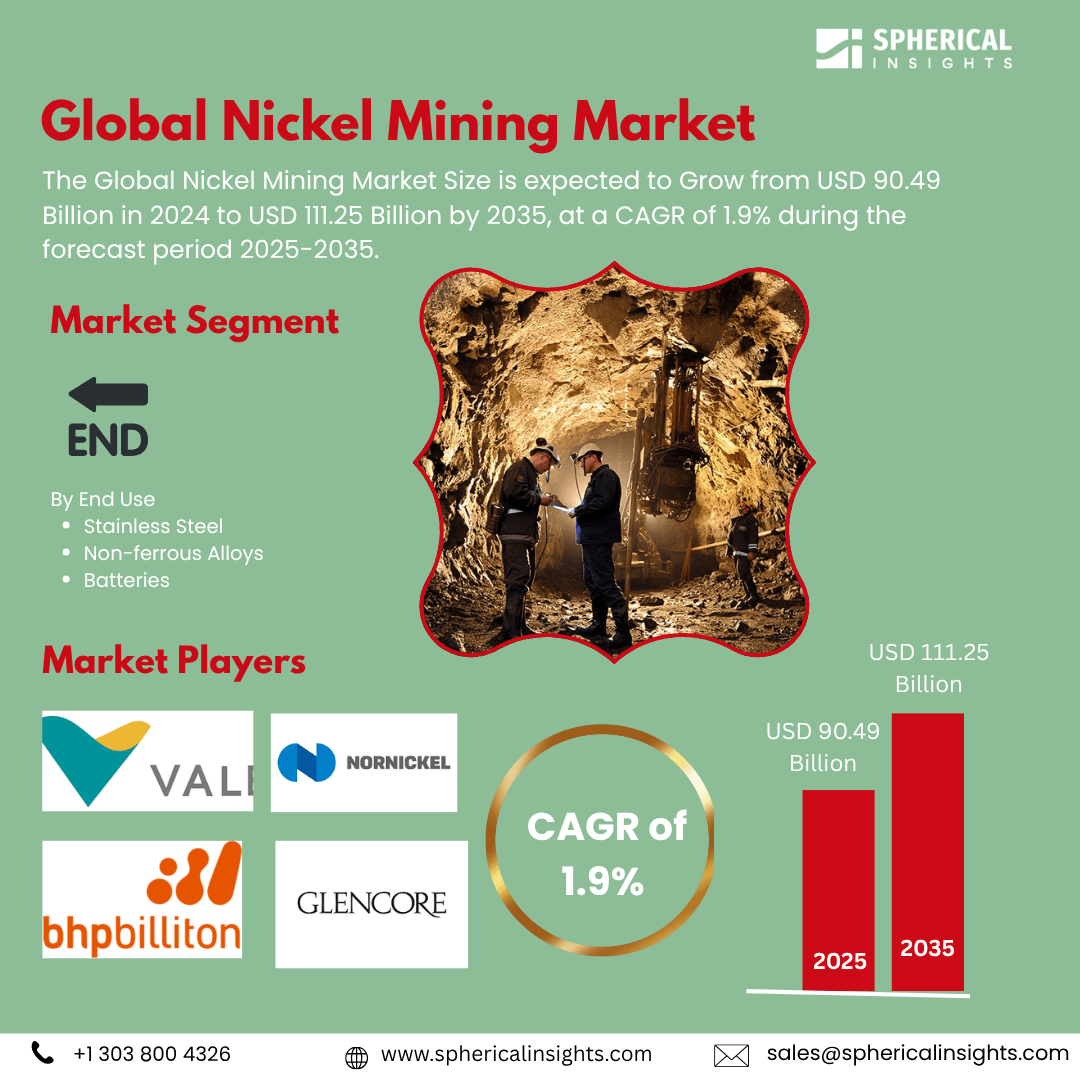

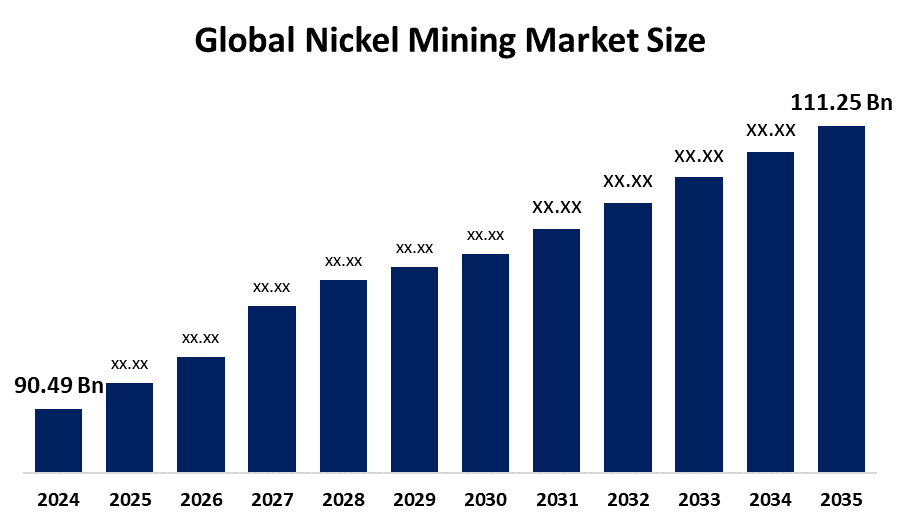

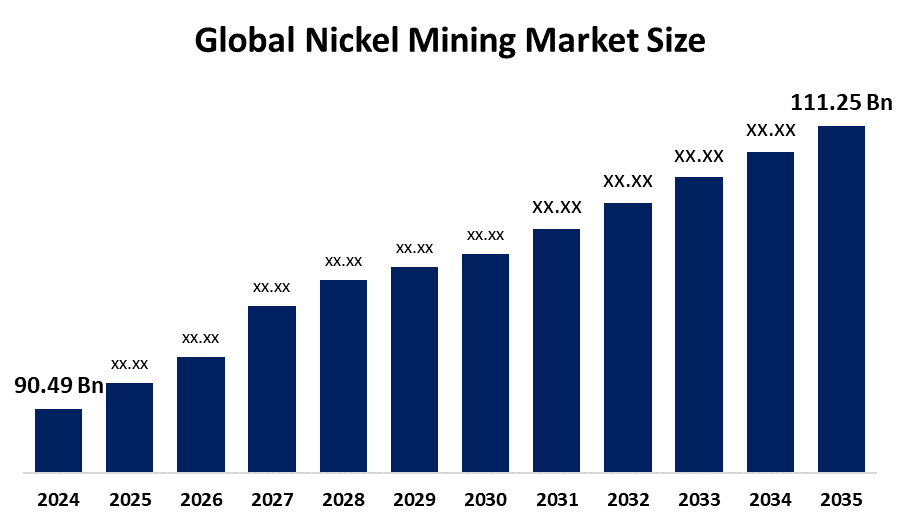

Global Nickel Mining Market Insights Forecasts to 2035

- The Global Nickel Mining Market Size Was Estimated at USD 90.49 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.9% from 2025 to 2035

- The Worldwide Nickel Mining Market Size is Expected to Reach USD 111.25 Billion by 2035

- Europe is expected to grow the fastest during the forecast period.

Nickel Mining Market

The global nickel mining market plays a crucial role in industries such as electric vehicle (EV) production, stainless steel manufacturing, and energy storage, as nickel is a key material for batteries and alloys. The rising demand for EVs and renewable energy solutions has significantly increased the need for nickel, especially for high-performance batteries. Nickel is primarily extracted from laterite and sulfide ores, with major producers including Indonesia, the Philippines, and Russia. Governments worldwide are implementing initiatives to promote sustainable mining practices, encourage cleaner extraction technologies, and regulate environmental impact. These policies also focus on supporting local communities and managing natural resources responsibly. As a result, the market is poised for strong growth, driven by the continued transition to green technologies and the increasing global demand for battery metals, particularly in the context of the energy transition and electric mobility.

Attractive Opportunities in the Nickel Mining Market

- Nickel is a key component in the production of high-performance batteries for electric vehicles (EVs) and energy storage systems. As the global transition to electric mobility accelerates, the demand for nickel, particularly for use in lithium-ion batteries, is expected to surge.

- There is a significant potential for growth in sustainable mining technologies, such as automation, cleaner extraction techniques, and carbon reduction initiatives. These advancements can help mitigate environmental concerns associated with traditional mining, such as water contamination and deforestation.

Global Nickel Mining Market Dynamics

DRIVER: Increasing demand for stainless steel

The rapid expansion of electric vehicle (EV) production, which relies heavily on nickel for high-capacity batteries, is a primary driver. Additionally, the increasing demand for stainless steel, used in construction and manufacturing, bolsters nickel consumption. Technological advancements in mining processes, aimed at improving efficiency and sustainability, also contribute to market growth. Government policies supporting green technologies, such as electric mobility and renewable energy storage, further accelerate demand for nickel. The global shift toward decarbonization and energy transition also strengthens the outlook for the nickel market.

RESTRAINT: Volatility of nickel prices

Environmental concerns are a major challenge, as mining activities can lead to deforestation, water contamination, and habitat destruction. Strict regulations aimed at reducing environmental impacts can limit mining operations. Additionally, the volatility of nickel prices, influenced by global supply-demand imbalances and geopolitical factors, creates market uncertainty. The high capital investment required for exploration, infrastructure development, and sustainable mining technologies also hinders expansion. Moreover, supply chain disruptions, such as those caused by political instability or trade restrictions in major producing countries, can impact the market's stability and growth.

OPPORTUNITY: Advancements in mining technologies

The global nickel mining market presents several growth opportunities, primarily driven by the increasing demand for electric vehicles (EVs) and renewable energy storage. As the shift to clean energy accelerates, nickel's role in batteries, particularly for EVs, offers substantial growth potential. Additionally, advancements in mining technologies, such as automation and sustainable extraction methods, provide opportunities to reduce environmental impact and improve efficiency. New exploration opportunities in underdeveloped regions, particularly in Africa and Latin America, can expand supply. Governments’ growing focus on supporting green industries and offering incentives for clean mining technologies creates favorable conditions for market expansion. Furthermore, the rising trend of recycling nickel from used batteries and scrap materials offers a sustainable source of supply, contributing to a more circular economy.

CHALLENGES: Sustainable practices can limit investment

The global nickel mining market faces several challenges, including environmental concerns such as habitat destruction and water pollution, which lead to stricter regulations. Price volatility, influenced by supply-demand fluctuations and geopolitical factors, creates uncertainty for producers. The high capital requirements for exploration, development, and sustainable practices can limit investment. Additionally, supply chain disruptions due to political instability in major producing regions and trade restrictions may affect production consistency, while the long-term sustainability of nickel resources remains a concern.

Global Nickel Mining Market Ecosystem Analysis

The global nickel mining market ecosystem involves key players including mining companies, equipment suppliers, and refineries. Governments regulate sustainable mining practices, while end-use industries like stainless steel manufacturing and battery production drive demand. The recycling sector is growing, offering a sustainable alternative to primary extraction. Environmental NGOs and local communities influence mining practices through advocacy and demands for better safety and environmental standards. Technological advancements, such as automation and cleaner mining processes, are shaping the market’s future, alongside geopolitical factors affecting supply chains.

Based on the end use, the stainless steel accounted for the largest market revenue share over the forecast period

Nickel is a crucial component in stainless steel production, providing strength, corrosion resistance, and durability. The demand for stainless steel is driven by its widespread use in construction, automotive, industrial equipment, and household goods. As urbanization and infrastructure development continue to grow globally, particularly in emerging markets, the need for stainless steel remains strong, solidifying its role as the largest consumer of nickel.

Asia Pacific is anticipated to hold the largest market share of the nickel mining market during the forecast period

Asia Pacific is expected to hold the largest market share in the nickel mining industry during the forecast period, driven by several key factors. The region is home to major nickel-producing countries like Indonesia, the Philippines, and China, which play a significant role in global supply. Additionally, the growing demand for nickel in industries such as electric vehicle (EV) battery manufacturing, stainless steel production, and renewable energy technologies is fueling market growth. As Asia Pacific continues to expand its infrastructure and industrial sectors, its demand for nickel is projected to remain robust, further solidifying its dominant position in the global market.

Europe is expected to grow at the fastest CAGR in the nickel mining market during the forecast period

Europe is expected to grow at the fastest CAGR in the nickel mining market during the forecast period, primarily driven by the increasing demand for nickel in electric vehicle (EV) battery production and the region's focus on green energy and sustainability. European countries are investing heavily in the transition to renewable energy and electric mobility, both of which require significant amounts of nickel. Additionally, Europe's push for reducing carbon emissions and achieving net-zero targets has led to higher demand for EVs, further boosting the need for nickel. The region is also fostering advancements in recycling technologies, supporting a more sustainable supply chain.

Recent Development

- In April 2023, Norilsk Nickel, one of the world's largest producers of nickel, launched a high-purity nickel product specifically designed for the electric vehicle (EV) battery market. This product is tailored to meet the increasing demand for high-quality materials in lithium-ion batteries, which are crucial for powering electric vehicles. The high-purity nickel, with a higher nickel content and fewer impurities, enhances battery performance, offering greater energy density and longer driving ranges for EVs.

Key Market Players

KEY PLAYERS IN THE NICKEL MINING MARKET INCLUDE

- Norilsk Nickel

- Vale S.A.

- BHP

- Glencore

- Anglo American

- Jinchuan Group

- Sherritt International

- Sumitomo Metal Mining

- MMC Norilsk Nickel

- Vale Indonesia

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the nickel mining market based on the below-mentioned segments:

Global Nickel Mining Market, By End Use

- Stainless Steel

- Non-ferrous Alloys

- Batteries

Global Nickel Mining Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What are the major drivers of growth in the Nickel Mining Market?

A: Major drivers include the increasing demand for stainless steel, the rapid growth of electric vehicle (EV) production, and technological advancements in mining processes. Additionally, government policies supporting green technologies and the global shift toward decarbonization further contribute to market growth.

Q: What is the role of nickel in electric vehicles (EVs)?

A: Nickel is a key component in the production of high-performance batteries used in electric vehicles, particularly lithium-ion batteries. As the demand for EVs increases, so does the need for nickel.

Q: What are the market opportunities in the Global Nickel Mining Market?

A: Opportunities include advancements in sustainable mining technologies, the growing demand for nickel in EV batteries and renewable energy storage, and the rise of recycling nickel from used batteries. Additionally, new exploration opportunities in regions like Africa and Latin America present potential for growth.

Q: How is Asia-Pacific performing in the Nickel Mining Market?

A: Asia-Pacific is expected to hold the largest market share during the forecast period due to the presence of major producers like Indonesia and the Philippines, as well as increasing demand from industries such as EV battery manufacturing, stainless steel production, and renewable energy technologies.

Q: What are the latest developments in the Nickel Mining Market?

A: In April 2023, Norilsk Nickel launched a high-purity nickel product specifically designed for the EV battery market, aimed at meeting the growing demand for high-quality materials in lithium-ion batteries.

Q: How does the recycling of nickel contribute to the market?

A: Recycling of nickel from used batteries and scrap materials offers a sustainable source of supply, helping to reduce the environmental impact of primary extraction and contributing to a more circular economy.