Monosodium Glutamate Market Summary

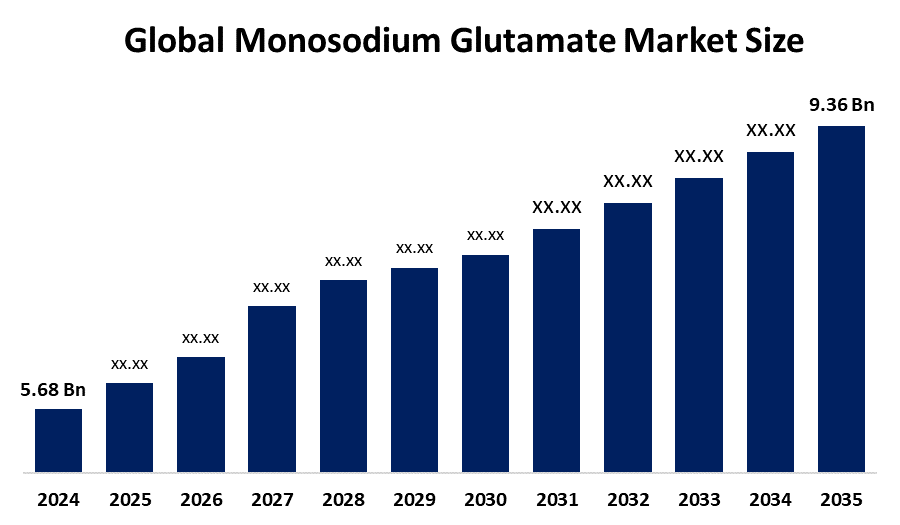

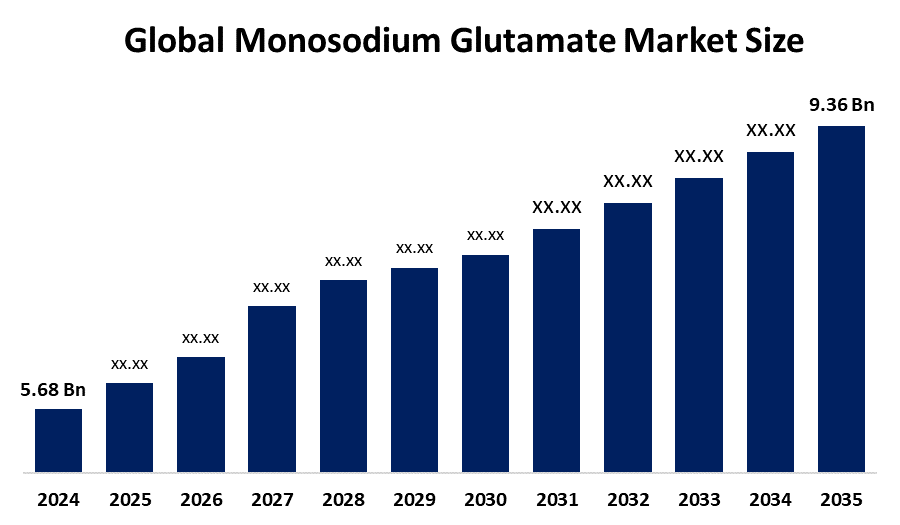

The Global Monosodium Glutamate Market Size Was Estimated at USD 5.68 Billion in 2024 and is Projected to Reach USD 9.36 Billion by 2035, Growing at a CAGR of 4.65% from 2025 to 2035. The market for monosodium glutamate (MSG) is expanding due to the growing need for convenient and processed meals, the growing appeal of Asian food, and the belief that MSG is a flavor enhancer that is both safe and effective.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific region had the largest revenue share, accounting for 47.3%.

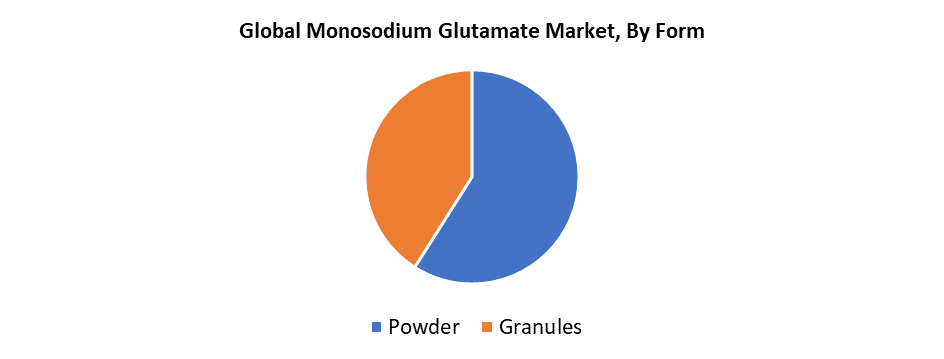

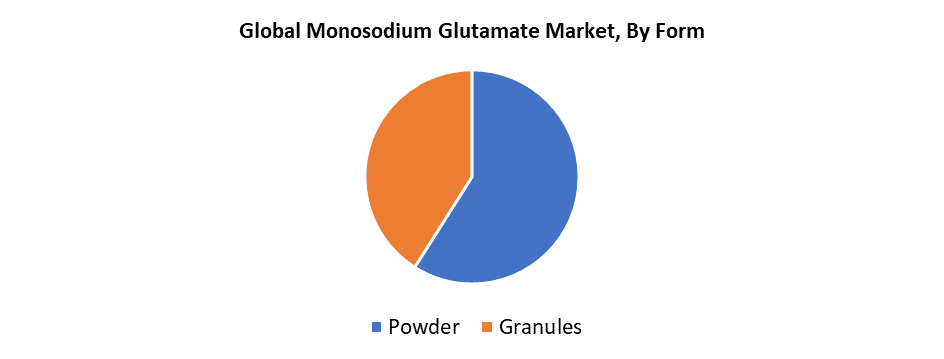

- In 2024, monosodium glutamate's powder form had the most revenue share, accounting for 59.43%.

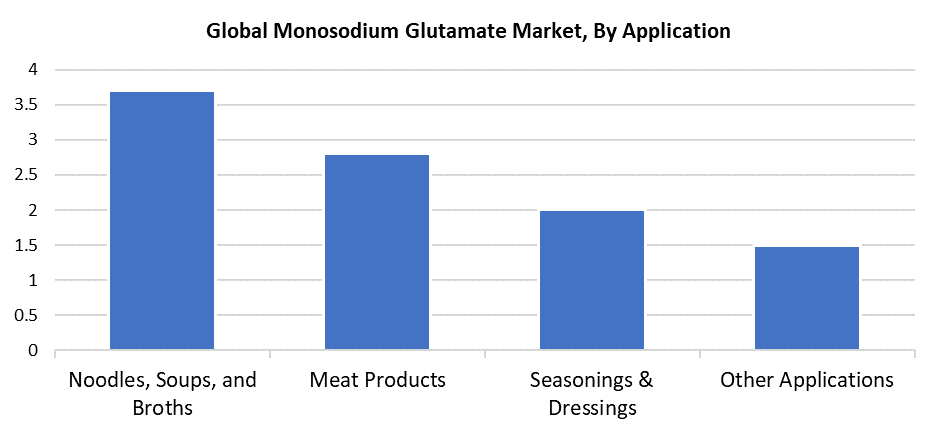

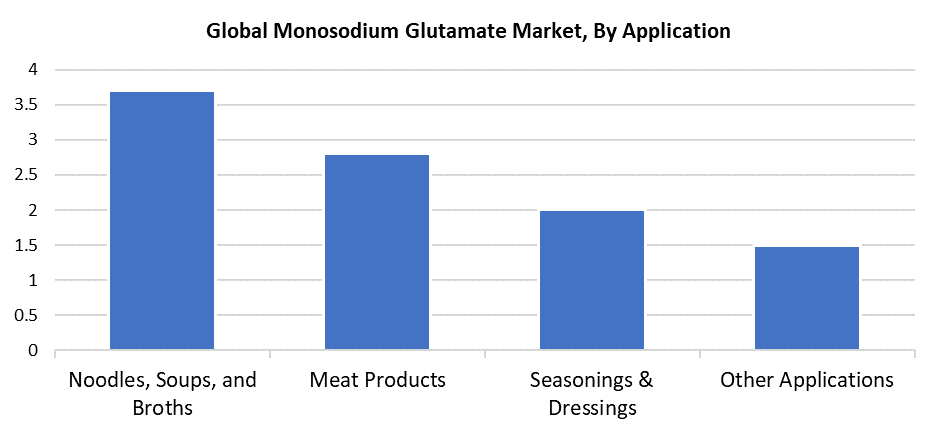

- With a 37.4% revenue share in 2024, the application noodles, soups, and broths sector led the market.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 5.68 Billion

- 2035 Projected Market Size: USD 9.36 Billion

- CAGR (2025-2035): 4.65%

- Asia Pacific: Largest market in 2024

The MSG market encompasses worldwide manufacturing and distribution operations along with retail activities for monosodium glutamate, which functions as a common food product flavor enhancer to enhance the savory "umami" flavor. The expanding market for processed, packaged, and ready-to-eat foods across developing nations drives the ongoing global growth of monosodium glutamate (MSG). MSG serves as a preferred flavor enhancer in convenient food solutions because it delivers cost-effectiveness while maintaining product taste and consistency, which is influenced by urbanization, changing lifestyles, and rising disposable incomes. The acceptance of MSG has been boosted by food safety regulatory approvals from both the FDA and EFSA, which have led to its increased use across multiple food formats. The rise of cloud kitchens and international foodservice chains, together with Asian food's universal appeal, has driven MSG adoption across diverse culinary regions, which supports continuous market development.

The MSG market shows substantial transformation because of technological progress in the industry. The combination of AI, IoT, and blockchain technology brings improved efficiency alongside better traceability and enhanced safety compliance to manufacturing and supply chain operations. Consumer preferences toward clean-label products, together with transparency requirements, match the current market transformation. Machine learning technology enhances resource management and fermentation optimization to decrease waste while producing better flavor output. The development of low-sodium and modified MSG formulations creates new growth possibilities despite current health concerns about MSG consumption and its links to metabolic diseases. The international market growth of processed and plant-based meals drives MSG to expand its reach through applications in natural and vegan-friendly food products.

Form Insights

Powdered monosodium glutamate (MSG) received the highest market share of 59.43% in 2024 through its outstanding solubility and easy application in various food products. The fast dissolution of powdered MSG enables it to be used equally in both cold and hot formulas for home cooking as well as commercial kitchens and food manufacturing operations. The fine texture of powdered MSG allows it to enhance flavors consistently while delivering precise amounts in various products such as instant noodles, soups, sauces, and snacks. The addition of powdered MSG to recipes happens faster and more efficiently compared to granular MSG, which requires additional time to mix. The global foodservice and packaged food industries continue to rely on this product because it works well with automated manufacturing systems that enhance production efficiency.

The granules category accounted for a significant revenue share in 2024 while rapidly becoming the fastest-growing monosodium glutamate variant because its improved handling features benefit specific applications. The industrial use of powdered MSG becomes safer when replaced by granules because they produce minimal dust, which safeguards workers' health and preserves equipment operation. Granular MSG provides controlled solubility, which serves food production methods needing gradual flavor release. The market expansion of granulated MSG occurs because people use it more frequently in non-food industries, including cosmetics and pharmaceuticals, and manufacturing. The increasing demand for granulated MSG in particular industrial sectors comes from specific elements that present high potential for niche applications.

Application Insights

The noodles, soups, and broths product category dominated the 2024 MSG market with 37.4% revenue share because of its strong dependency on umami flavor enhancement. The food products are fundamental elements within multiple cultural traditions, especially in the Asia Pacific, where MSG remains widely accepted for traditional culinary practices. Their extended shelf stability, together with low price points and simple preparation methods, makes them ideal for wide distribution production and market acceptance among budget-conscious consumers in metropolitan areas. The growing market for instant meals in emerging economies such as Nigeria, Indonesia, and India is driving increased MSG sales. The products maintain their dependency on MSG to deliver affordable and consistent flavor, while seasonings and dressings do not rely on it, which enables them to maintain their market dominance and expand their sales.

The meat products sector of the monosodium glutamate (MSG) market experiences rapid growth throughout the forecasted period, because consumers worldwide demand more processed savory meats. Manufacturers use MSG for product taste uniformity as meat consumption rises, particularly in developing nations. MSG serves as an exceptional flavor enhancer for frozen, cured, and ready-to-eat meat products since it enhances the meat's natural umami taste. The production costs decrease since it reduces the need to purchase expensive ingredients such as spices and broths, as well as drawn-out aging methods. The meat product industry worldwide has increased its usage of MSG because of its effectiveness and consumer demand for robust savory flavors.

Regional Insights

In 2024, the Asia Pacific region dominated the global monosodium glutamate (MSG) market with 47.3% revenue share because of both high consumption rates and strong regional cultural adoption of MSG in cooking traditions. The use of MSG remains a staple for residential and business kitchens across China, Indonesia, Vietnam, Thailand, and Japan since it functions as a flavor enhancer for umami tastes. The presence of major corporations like Ajinomoto and Meihua Holdings operating large-scale production facilities gives the region its manufacturing strengths. The market expansion is driven by rising middle-class numbers, together with fast-paced urban development and increasing preference for processed and convenience foods. Through modern retail channels and e-commerce platforms, products have become easier to obtain, while governments provide support and manufacturers benefit from reduced raw material expenses to enhance global competitiveness.

Europe Monosodium Glutamate Market Trends

Europe held 25.3% revenue share in 2024 due to its established processed food sector, rising multicultural food influence, and growing prepared food demand. MSG application within the retail and foodservice sectors expanded because of the growing popularity of Asian and fusion cuisines. Producers apply MSG in prepared foods, frozen dinners, and snacks because urban consumers need quick, affordable, flavorful food solutions. European manufacturers implement MSG in their reduced-sodium products to preserve taste while meeting EU health standards. European food manufacturers, including those in the United Kingdom, Germany, and France, are seeing increased MSG usage because of their modern food processing facilities. The combination of strict labeling regulations and innovative solutions, plant-based products, and retail expansion helps customers adapt to new food labeling standards.

North America Monosodium Glutamate Market Trends

The North American market held a considerable share of the worldwide monosodium glutamate (MSG) industry in 2024 because of population growth in ethnic communities and rising demand for Asian food and processed fast food products. Large food manufacturers, along with quick-service restaurants in the United States, lead the regional MSG consumption because they use it to enhance taste while maintaining consistent product quality. The consumption of ready-to-eat meals, snacks, and soups that contain MSG has grown because consumers are encountering more international cuisines, especially Asian dishes that feature umami flavors. Scientific research confirming MSG safety has led consumers to trust the product more, which has strengthened its market acceptance. The foodservice industry and retail sector are experiencing growth through product innovation, which reintroduces MSG to modern diets by focusing on low-sodium and health-oriented formulations.

Key Monosodium Glutamate Companies:

The following are the leading companies in the monosodium glutamate market. These companies collectively hold the largest market share and dictate industry trends.

- Gremount International Company Limited

- Ajinomoto Co. Inc

- Henan Lotus Flower Gourmet Powder Co.

- Ningxia Eppen Biotech Co., Ltd

- Fufeng Group, Meihua Holdings Group Co. Ltd

- Shandong Qilu Biotechnology Group Co.

- Cargill Incorporated

- COFCO

- Shandong Xinle Monosodium Glutamate Limited Company

- Others

Recent Developments

- In November 2024, to increase its global presence, Fufeng Group declared intentions to invest up to $350 million in a maize processing industrial park in Kazakhstan, where it would produce MSG and other goods.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the monosodium glutamate market based on the below-mentioned segments:

Global Monosodium Glutamate Market, By Form

Global Monosodium Glutamate Market, By Application

- Noodles, Soups, and Broths

- Meat Products

- Seasonings & Dressings

- Other Applications

Global Monosodium Glutamate Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa