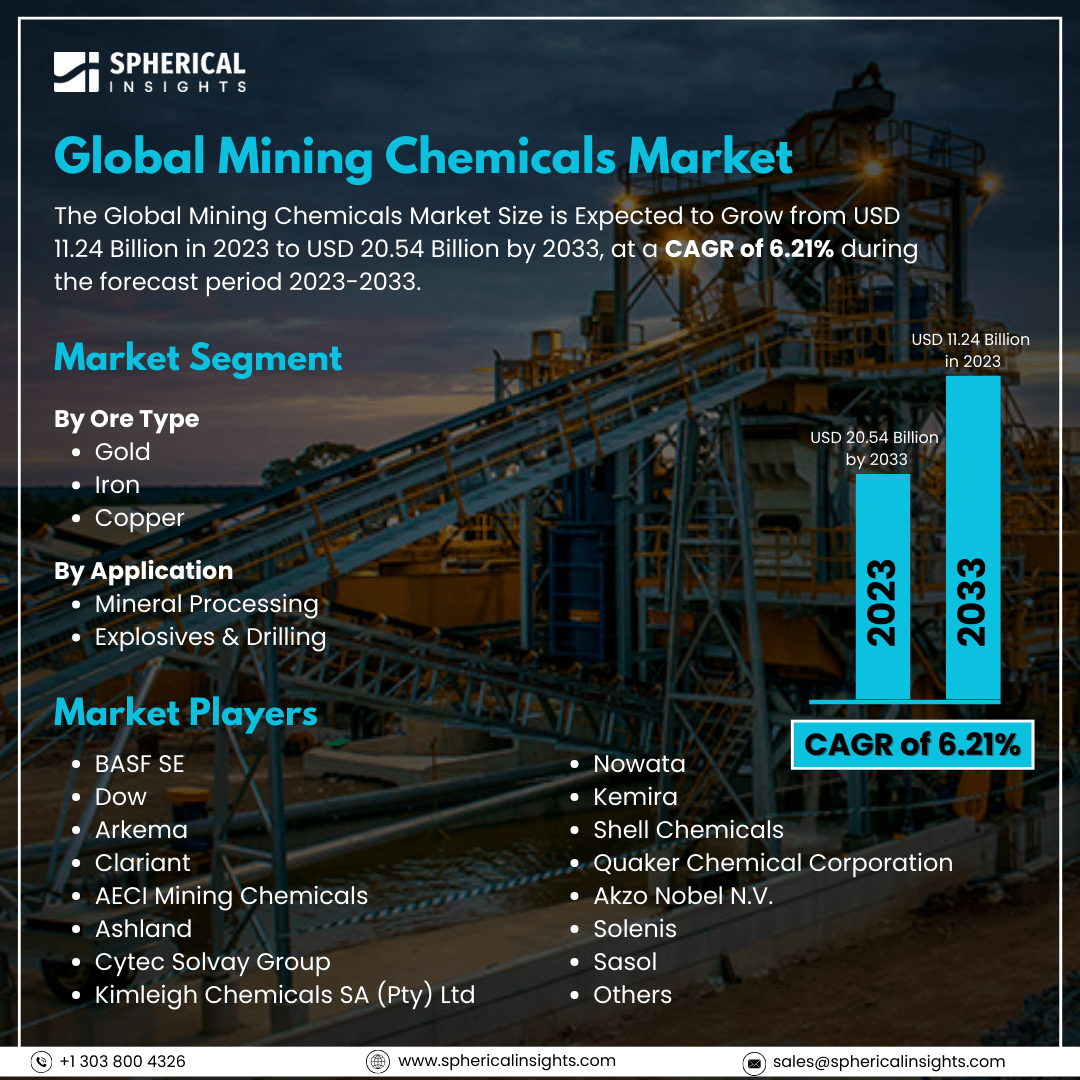

Global Mining Chemicals Market Size to Exceed 20.54 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Mining Chemicals Market Size is Expected to Grow from USD 11.24 Billion in 2023 to USD 20.54 Billion by 2033, at a CAGR of 6.21% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Mining Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Ore Type (Gold, Iron, Copper), By Application (Mineral Processing, Explosives & Drilling), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The mining chemicals market is the worldwide business engaged in the manufacture, distribution, and application of chemical solutions that augment mining activities, such as mineral processing, extraction, and refining. The chemicals, e.g., flotation reagents, grinding aids, and solvent extractants, enhance efficiency, recovery, and environmental stewardship. The major end-users are coal, metal, and industrial mineral mining industries. Moreover, the mining chemicals market is driven by heightened mineral demand, growing metal mining activities, and technological improvements in mineral processing techniques. Increasing scrutiny of resource efficiency and sustainability contributes to the higher demand for environment-friendly chemicals. Increasing infrastructure development, urbanization, and industrialization, especially in developing countries, also push the market towards growth. Growing automation in mines, strict environmental regulations, and the requirement for improved ore recovery rates also enhance innovation and application of specialized chemicals. However, the mining chemicals market is confronted with restraints such as strict environmental regulations, volatile raw material prices, expensive production, and health risks posed by chemical use, which can restrain market growth and adoption.

The gold segment accounted for the largest share of the global mining chemicals market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of ore type, the global mining chemicals market is divided into gold, iron, and copper. Among these, the gold segment accounted for the largest share of the global mining chemicals market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is driven by the strong demand for gold for use in jewelry, investments, and electronics. The demand for specific chemicals such as cyanide, flotation reagents, and leaching agents to improve the efficiency of gold extraction further contributes to its market leadership.

The mineral processing segment accounted for a substantial share of the global mining chemicals market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of the application, the global mining chemicals market is divided into mineral processing, explosives & drilling. Among these, the mineral processing segment accounted for a substantial share of the global mining chemicals market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is propelled by increasing demand for effective ore extraction and refining methods. Chemicals such as flotation reagents, leaching agents, and grinding aids improve recovery levels, thus playing a crucial role in gold, copper, and iron ore processing throughout the mining sector.

Asia Pacific is projected to hold the largest share of the global mining chemicals market over the projected period.

Asia Pacific is projected to hold the largest share of the global mining chemicals market over the projected period. This is spurred by fast industrialization, urbanization, and intense mining operations in economies such as China, India, and Australia. The increasing demand for metals within the region, rising infrastructure schemes, and growth of mineral processing sectors further fuel the market, turning it into a global leading player.

North America is expected to grow at the fastest CAGR of the global mining chemicals market during the projected period. This is driven by sophisticated mining technologies, growing demand for minerals, and the dominant presence of major mining firms. The U.S. and Canada dominate gold, copper, and iron ore mining, with growing investments in sustainable and environmentally friendly mining chemicals further driving market growth.

Company Profiling

Major vendors in the global mining chemicals market are BASF SE, Dow, Arkema, Clariant, AECI Mining Chemicals, Ashland, Cytec Solvay Group, Kimleigh Chemicals SA (Pty) Ltd, Nowata, Kemira, Shell Chemicals, Quaker Chemical Corporation, Akzo Nobel N.V., Solenis, Sasol, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2023, AECI, a South African firm, aims to cement its place as one of the top three providers of integrated mining explosives and chemicals solutions by 2030.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global mining chemicals market based on the below-mentioned segments:

Global Mining Chemicals Market, By Ore Type

Global Mining Chemicals Market, By Application

- Mineral Processing

- Explosives & Drilling

Global Mining Chemicals Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa