Meat Processing Equipment Market Summary

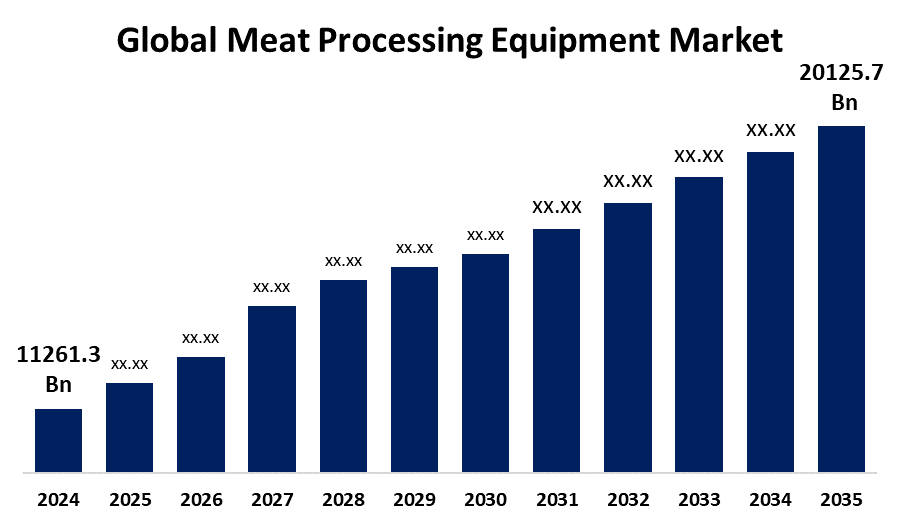

The Global Meat Processing Equipment Market Size Was Estimated at USD 11261.3 Million in 2024 and is Projected to Reach USD 20125.7 Million by 2035, Growing at a CAGR of 5.4% from 2025 to 2035. The market for meat processing equipment is expanding mainly due to the growing demand for processed meat products, which is fueled by variables such as changing lifestyles, increased disposable incomes, and the ease of ready-to-eat options.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the greatest revenue share of 34.74%, dominating the market for meat processing equipment.

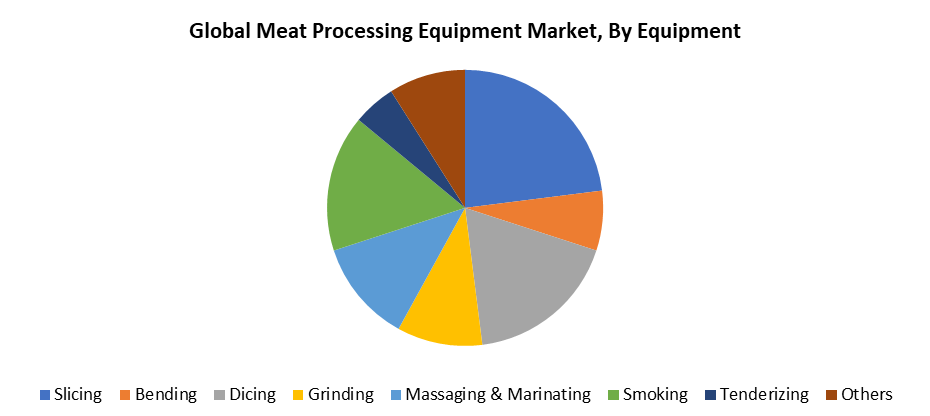

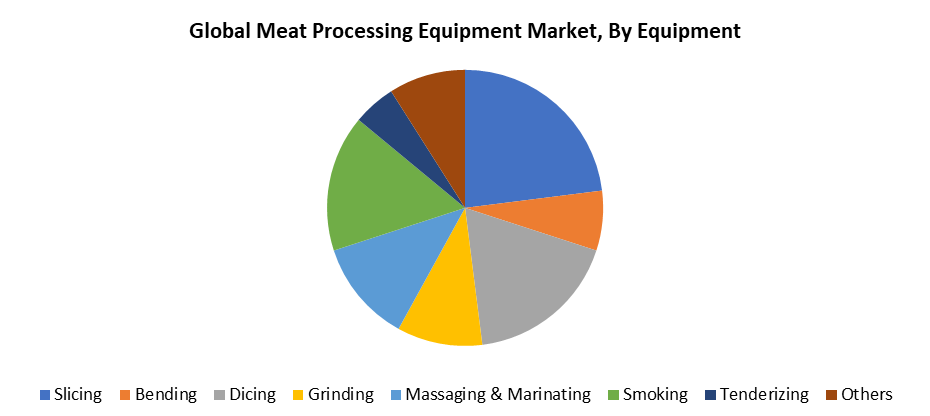

- In terms of equipment, the slicing category dominated the market in 2024, with a revenue share of 23.4%.

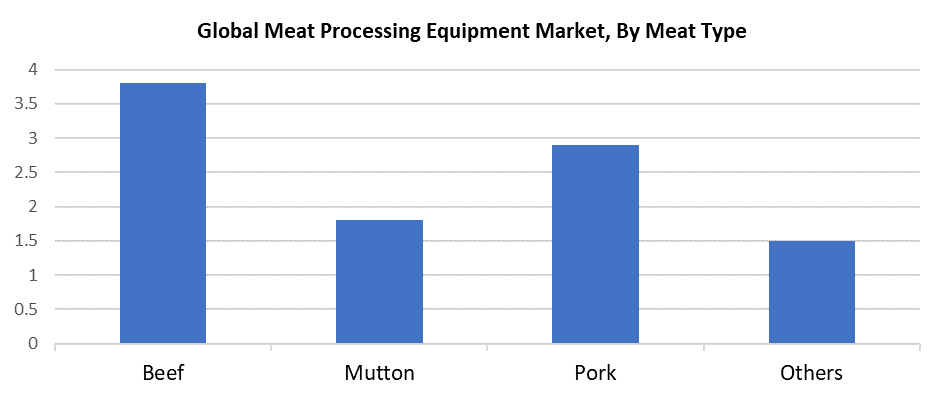

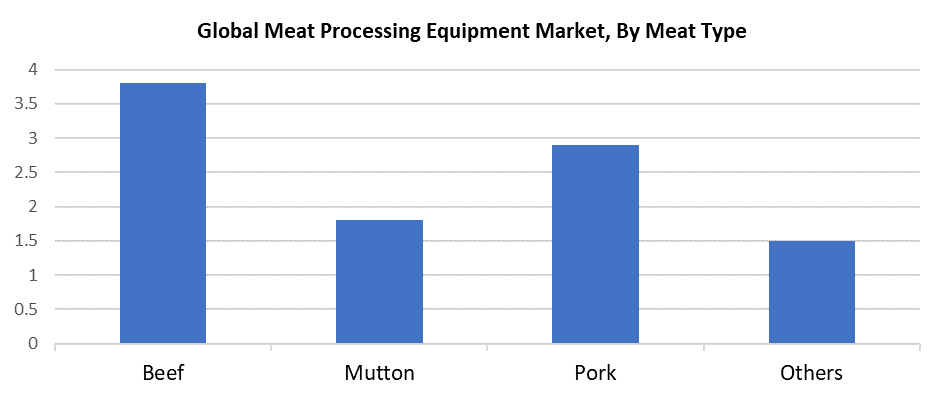

- In terms of meat type, the beef segment dominated the market in 2024 with revenue share at 38.5%.

Global Market Forecast and Revenue Outlook

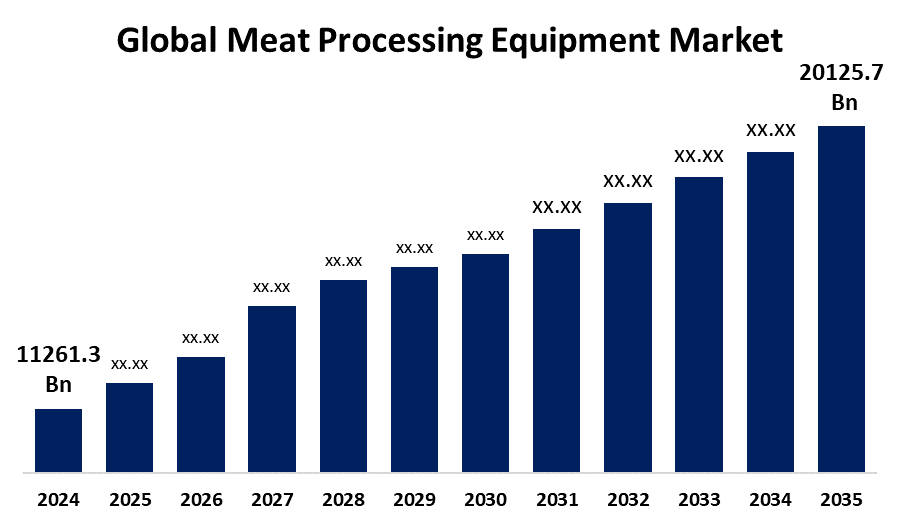

- 2024 Market Size: USD 11261.3 Million

- 2035 Projected Market Size: USD 20125.7 Million

- CAGR (2025-2035): 5.4%

- Asia Pacific: Largest market in 2024

The worldwide industry dedicated to equipment and tools used for meat handling and preparation of processed products exists within the meat processing equipment market. The expanding worldwide demand for processed meat products, because of urbanization and the fast-growing food service industry, represents a significant business driver for meat processing equipment. Restaurants and convenience food stores, together with caterers, require dependable and effective equipment to fulfill customer needs for ready-to-eat and value-added meat products. Health-conscious customers who want cleaner, safer, and higher-quality meat options are pushing the market toward modern equipment that ensures precise processing along with food safety compliance. The market acceptance of technological advancements such as automation and intelligent systems, along with integrated processes including slicing and grinding, continues to grow because they improve operational efficiency and maintain product consistency and comply with rigorous food safety standards.

The rising demand for enhanced meat processing equipment stems from businesses attempting to stay compliant with standards, preserve customer confidence through strict food safety, environmental sustainability, and meat hygiene regulations. The worldwide enforcement of meat handling, transportation, and storage regulations by governments leads to rising requirements for technologically advanced solutions. Processors need to adopt energy-efficient technology with waste-reduction capabilities because consumers want to buy beef from sustainable, ethical sources. Smart technology combined with automation systems produces reduced costs for maintenance and labor while simultaneously boosting production capacity. High research and development investment has led to the development of versatile machines, which enable businesses to sustain their competitive position in growing markets through streamlined processes and quality assurance capabilities.

Equipment Insights

The slicing equipment category dominated the meat processing equipment market in 2024 through a 23.4% revenue share because customers want convenience with pre-packaged meat products. Processors need efficient slicing equipment because sliced meats serve as fundamental components of ready-to-eat foods, including salads, sandwiches, and deli selections. The segment grows because of rising food safety regulations, which force processors to purchase cutting-edge equipment that delivers precise cleaning and low contamination risk during slicing operations. The development of automatic and adjustable slicers brought improved operational flexibility together with enhanced efficiency to meet different consumer meat preferences and textures. The improvements boost production efficiency and reduce waste while supporting the rising market for high-quality processed beef products.

The expanding market for dicing equipment stems from customer requirements for uniform meat product presentation and consistent cooking results. Ready-to-eat meals together with frozen foods and convenience products that suit fast-paced lifestyles regularly feature diced meats. The versatile nature of innovative dicing solutions makes them essential across all meat processing operations. Modern technology has advanced both speed and precision of dicing operations while improving sanitation methods, which allows processors to reduce product waste and fulfill exacting quality requirements. Automated dicing systems boost productivity levels while decreasing manual labor requirements, thus making them attractive investment options. The international growth of the convenience food industry drives higher demand for high-performance dicing equipment, which supports market segment expansion.

Meat Type Insights

The beef segment dominated the meat processing equipment market in 2024 with 38.5% revenue share since beef remains a widely consumed protein in many international culinary traditions. The expanding demand for processed beef products, including ground beef, sausages, and beef jerky, has driven the need for advanced processing systems to deliver both efficiency and hygienic conditions and consistent product quality. The rising popularity of lean meat cuts among health-conscious customers leads processors to invest in equipment that enhances meat quality and production processes. The segment expansion continues because developing nations are experiencing higher beef consumption rates that result from their growing urban populations and rising incomes. Production scale, along with quality and safety standards, receives focus from manufacturers who develop innovative technologies to serve the expanding worldwide demand.

The pork industry experiences rapid growth because of its widespread popularity as a delicious and affordable protein option, mainly in Asian and European markets. The increasing popularity of processed pork products, including sausages, ham, bacon, and cured meats, has triggered a significant investment in modern meat processing equipment in 2024. The demand for high-end specialty pork products pushes customers to influence processors toward implementing technologies that enhance precision, standardization, and sanitary conditions. North American and European consumers prefer pork over beef because pork costs less and mutton lacks the same delicious taste. The expanding market leadership of this segment is supported by the high demand for ready-to-cook pork products that stems from increasing incomes and urban development in emerging economies.

Regional Insights

The demand for meat processing equipment in North America continues to grow because people want more convenient processed foods. The high standards of food safety and quality regulations in this region push manufacturers to adopt complex automated systems that deliver guaranteed compliance and operational efficiency. The United States, together with other North American nations, maintains its leading position in the world as beef and pork producers and consumers because of its large meat consumption rates and its mature meat processing industry. The rising consumer interest in premium beef products with value-added features pushes the market to invest in precise and consistent advanced technological solutions. The expansion of both food service and retail sectors drives demand for processing solutions, which leads to increased market growth.

Asia Pacific Meat Processing Equipment Market Trends

The Asia Pacific region dominated the meat processing equipment market in 2024 with 34.74% revenue share. The market growth occurred due to rising disposable income levels, expanding populations, and urban development, particularly in China, India, and Japan. Modern processing technology investments are rising because of growing processed meat product demand that results from changing eating patterns toward protein-rich diets. Regional customers increasingly choose automated and semi-automated equipment because they want convenient, ready-to-eat products. South Korea and Japan lead the industry because they create innovative smart machinery and automated systems that enhance both production rates and product standards. The market growth across regions receives a boost through government support, together with increasing investments in processing facilities.

Europe Meat Processing Equipment Market Trends

The European market for meat processing equipment experiences significant growth because consumers actively seek products from sustainable, ethically sourced, and healthy meat production methods. The strict EU food safety and environmental regulations require processors to invest in modern technologies that ensure operational efficiency along with traceability and regulatory compliance. The combination of substantial meat consumption rates with advanced food processing industries enables Germany. France and the United Kingdom to generate substantial market contributions. The region supports the utilization of automated equipment that has environmentally friendly features while promoting sustainable activities along with energy efficiency. The combination of advanced processing technology and comprehensive regulatory systems establishes Europe as a primary market for dependable and lawful machinery. These factors combine to drive continuous expansion across the entire territory.

Key Meat Processing Equipment Companies:

The following are the leading companies in the meat processing equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Mepaco

- Equipamientos cárnicos, S.L. (MAINCA)

- RAM Beef Equipment, LLC

- Marel

- Tomra Systems ASA

- The Middleby Corporation

- Nemco Food Equipment, LTD.

- Bettcher Industries, Inc.

- JBT.

- Minerva Omega Group s.r.l.

- Fortifi Food Processing Solutions.

- Others

Recent Developments

- In July 2024, Fortifi Food Processing Solutions purchased LIMA S.A.S., a French business that designs and produces equipment for the manufacturing of meat. This action expands Fortifi's portfolio alongside companies like Frontmatec and Bettcher Industries, strengthening its protein processing capabilities and supporting its growth strategy.

- In May 2022, Bettcher Industries, Inc. acquired Frontmatec as a producer of automated protein processing machinery. The acquisition enables Bettcher to broaden its product offerings and enhance its standing in the protein processing sector. The integration of Frontmatec's technology will enable Bettcher to offer advanced protein processing solutions, which will enhance its market position.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the meat processing equipment market based on the below-mentioned segments:

Global Meat Processing Equipment Market, By Equipment

- Slicing

- Bending

- Dicing

- Grinding

- Massaging & Marinating

- Smoking

- Tenderizing

- Others

Global Meat Processing Equipment Market, By Meat Type

Global Meat Processing Equipment Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa