Marine Vessel Market Summary

The Global Marine Vessel Market Size Was Estimated at USD 108.74 Billion in 2024, and is Projected to Reach USD 165.23 Billion by 2035, Growing at a CAGR of 3.88% from 2025 to 2035. Increasing international trade, technological improvements, and the maritime industry's emphasis on sustainability are some of the reasons driving the growth of the marine vessel market.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific marine vessel market held the largest revenue share of 46.5% and dominated the market worldwide.

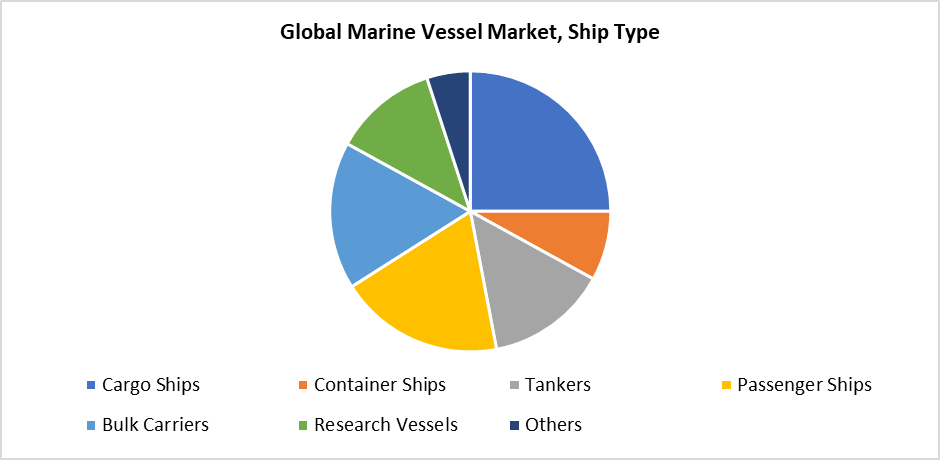

- In 2024, the cargo ships segment led the market by ship type, accounting for 25.8%.

- In 2024, the seafaring segment led the market by operations.

Global Market Forecast and Revenue Outlook

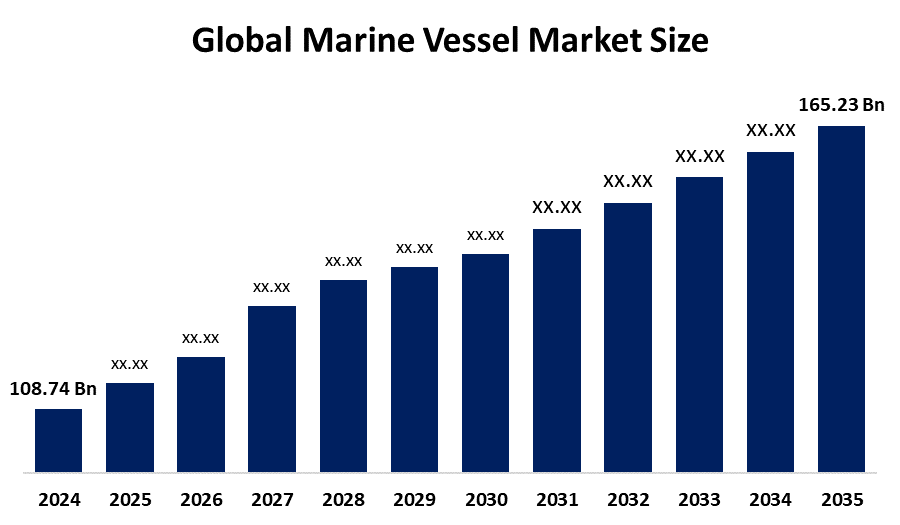

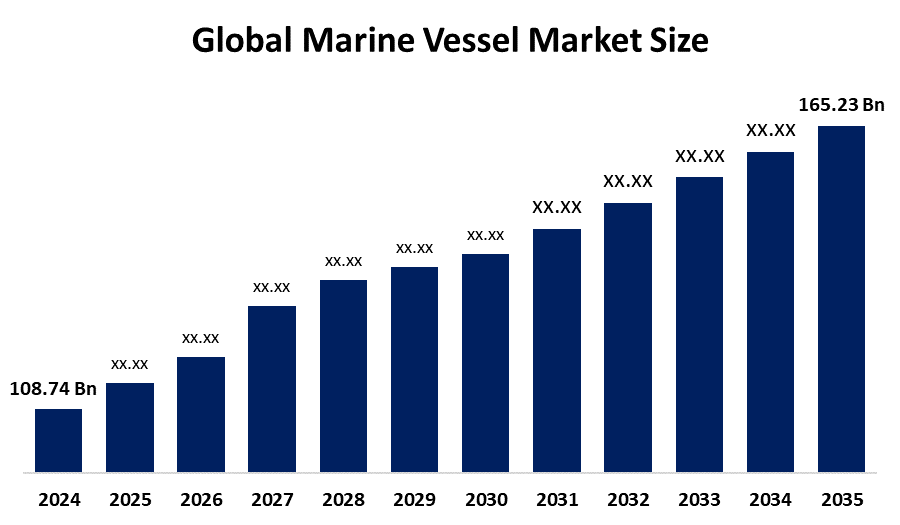

- 2024 Market Size: USD 108.74 Billion

- 2035 Projected Market Size: USD 165.23 Billion

- CAGR (2025-2035): 3.88%

- Asia Pacific: Largest market in 2024

The worldwide industry responsible for designing and maintaining ships and boats across commercial, military, and recreational sectors belongs to the marine vessel market. The market includes tankers, passenger ships, together with cargo ships and naval ships. Market expansion primarily results from the rising offshore exploration activities, as well as the expanding requirement for energy transportation and the growing global trade network. The market receives substantial demand because of expanding marine tourism, together with rising maritime security measures. The industry receives additional backing from new economic developments, which result in major port infrastructure investments and fleet expansion initiatives mainly occurring throughout Asia-Pacific. Environmental concerns are driving the demand for vessels that use cleaner and more efficient fuel and promote sustainable marine operations.

The marine industry is undergoing transformation through technological advancements such as autonomous ships, together with integrated navigation systems and alternative fuel propulsion systems. LNG-powered and hybrid tankers are becoming more popular because of stricter emission regulations and reduced operating costs. Blockchain, together with AI and IoT technologies, enhances real-time decision-making capabilities while boosting safety measures and improving logistical operations. Multiple governments throughout the world actively support the industry through strict environmental regulations combined with green shipping incentives and beneficial policies. The International Maritime Organization's decarbonization targets drive the advancement of global marine vessel sector innovation while enforcing compliance standards that accelerate the adoption of sustainable alternatives.

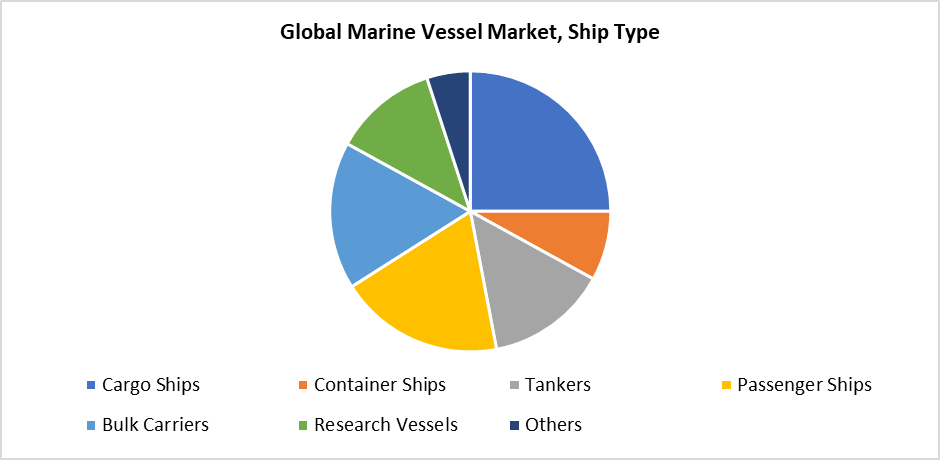

Ship Type Insights

The cargo ships segment dominated the marine vessel market in 2024 by securing 25.8% revenue share. The ongoing international trade growth, along with rising commodity shipping requirements, drives the continuous industry expansion. These vessels handle the transportation of consumer goods along with manufactured products and unprocessed resources, among other diverse commodities. The surge in cargo ship demand stems from e-commerce growth, alongside supply chain globalization and rising international trade, particularly from developing economies. Enhanced fuel efficiency and increased capacity, together with improved safety measures in cargo ship design, have driven their popularity among operators while establishing them as the leading vessels across the maritime industry.

The passenger ship segment is projected to experience the fastest CAGR during the forecast period because cruise tourism continues to expand while disposable income levels increase, particularly in developing economies. The expanding availability of luxury travel experiences and growing cruise destinations attract a larger variety of customers to the market. The development of technologically advanced passenger ships, which feature smart amenities and enhanced safety features, together with sustainable propulsion systems, makes the market more attractive. Both government agencies and private organizations are making major investments in port infrastructure development and tourism promotion, which supports market expansion. Global passenger ship operations will experience an accelerated growth rate because of increasing attention to sustainable tourism and environmentally friendly ship technology developments.

Operation Insights

The seafaring segment led the marine vessel market in 2024 because of the wide use of traditional crewed ships in commercial, defense, and passenger industry applications. International trade, along with naval operations and tourism, relies on seafaring ships as its fundamental vessels, despite autonomous vessels entering the market. Operations under management remain the top choice because of complex marine navigation systems, maintenance needs, and human oversight during unpredictable maritime situations. Most of the current global fleet consists of seafaring vessels because established certification systems, trained personnel, and labor availability support their operation. The operational approach increases its dominant market position by providing operational flexibility to handle client demands and regulatory changes.

The inland segment of the marine vessel market will experience the fastest CAGR during the forecast period because of rising inland waterway transportation spending and the rising need for environmentally responsible and cost-effective logistics options. Inland vessels have gained increasing importance for product transportation across nations, especially throughout North America and European regions, and certain Asian areas that contain extensive river systems. Governments support inland waterways through funding programs and financial incentives to modernize fleets and enhance infrastructure because these waterways are sustainable replacements for road and rail transport. Technological progress in vessel design, together with better navigational systems and reduced fuel usage, makes inland shipping more efficient and appealing, which drives its fast-paced future development.

Regional Insights

North America held a significant revenue share of the marine vessel market in 2024 because of its large commercial and defense fleets, combined with advanced shipbuilding facilities and strong maritime infrastructure. The major ports of this region handle substantial international traffic, especially in the United States, which drives the need for tanker and cargo vessels. The cruise industry in North America, particularly in the Caribbean and the United States, drives strong demand for passenger ships. Government funding for naval modernization, together with environmental regulations, drives the rising popularity of state-of-the-art environmentally conscious vessels. Technological progress continues to position North America as a key player in the global marine vessel market through its focus on energy transportation and maritime security.

Europe Marine Vessel Market Trends

The European marine vessel market accounted for a substantial revenue share in 2024 because of its robust shipbuilding industry and advanced maritime technologies, together with stringent environmental standards. The national maritime leaders of the Netherlands, Norway, and Germany drive forward green maritime innovation while focusing on electric hybrid and LNG-powered vessels. Europe maintains its extensive waterway infrastructure, which enables the support of passenger and cargo vessels, inland and seaport operations to facilitate regional trade. The cruise tourism sector in this region remains significant since Northern European and Mediterranean cruise destinations remain popular among travelers. The EU's initiatives for digitalization and sustainable maritime transportation help expand the market while strengthening Europe's role as a leader in environmentally friendly, cutting-edge marine vessel solutions.

Asia Pacific Marine Vessel Market Trends

The Asia Pacific marine vessel market held the largest revenue share of 46.5% in 2024 because of its strong shipbuilding industry, together with rapid industrial development and expanding international trade activities. China, together with South Korea and Japan, leads worldwide shipbuilding through their production of diverse vessels, which include state-of-the-art passenger vessels along with cargo ships and tankers. The region demands extensive marine transportation because it holds critical maritime connections along with growing exports and population density near coastal areas. The commercial and defense sectors experience rising demand because governments increase their investments in port facilities and naval modernization projects. The Asia Pacific region maintains its global marine vessel market leadership because of its growing focus on green technologies alongside the adoption of smart vessel systems.

Key Marine Vessel Companies:

The following are the leading companies in the marine vessel market. These companies collectively hold the largest market share and dictate industry trends.

- HD Hyundai Heavy Industries Co., Ltd.

- Kongsberg Maritime

- Rolls-Royce plc

- Hanwha Ocean co., Ltd.

- General Dynamics NASSCO

- FINCANTIERI S.p.A.

- Samsung Heavy Industries Co., Ltd

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Damen Shipyards Group

- Oshima Shipbuilding co., Ltd.

- Others

Recent Developments

- In July 2025, the leading state-owned shipbuilding company in India, Cochin Shipyard Limited (CSL), and South Korea's HD Hyundai have signed a strategic Memorandum of Understanding (MoU) through HD Korea Shipbuilding & Offshore Engineering Co. Ltd. (HD KSOE). Strengthening India's shipbuilding capabilities and increasing its presence in the international maritime industry are the goals of the partnership. In line with government programs like the 'Maritime Amrit Kaal Vision 2047' and 'Maritime India Vision 2030,' the cooperation aims to promote development, innovation, and independence in the Indian maritime industry. The cooperative pursuit of shipbuilding prospects in India and overseas, the transfer of cutting-edge Korean shipbuilding technologies, efficiency improvement, and worker skill development are important areas of collaboration.

- In April 2025, U.S. defense business Eureka Naval Craft partnered with Australian marine technology startup Greenroom Robotics to create the next generation of autonomous navy ships. The result of their partnership is the debut of the 36-meter, multi-mission Surface Effect Ship (SES) designed for completely autonomous operations, the AIRCAT Bengal. By providing ships that are quicker, cheaper, and easier to build than traditional ships, the collaboration hopes to revolutionize the naval industry.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the marine vessel market based on the below-mentioned segments:

Global Marine Vessel Market, By Ship Type

- Cargo Ships

- Container Ships

- Tankers

- Passenger Ships

- Bulk Carriers

- Research Vessels

- Others

Global Marine Vessel Market, By Operation

Global Marine Vessel Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa