Marine Pipes Market Summary, Size & Emerging Trends

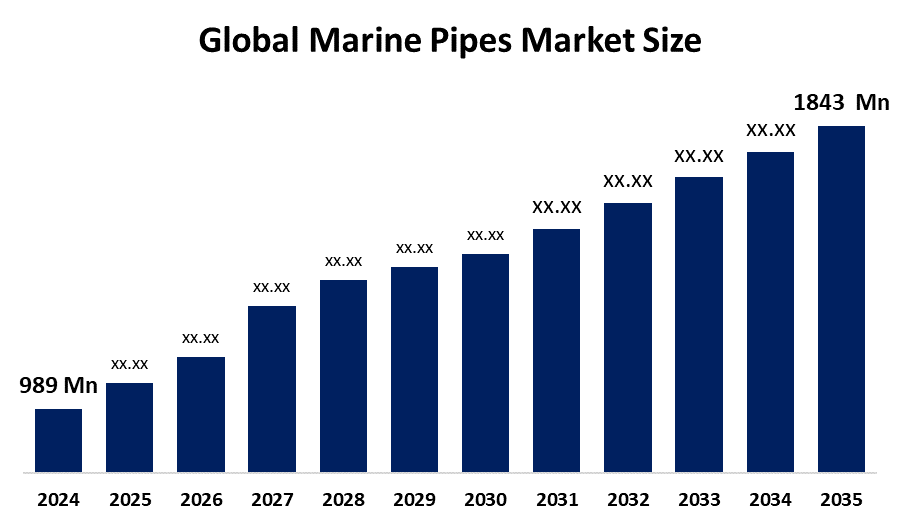

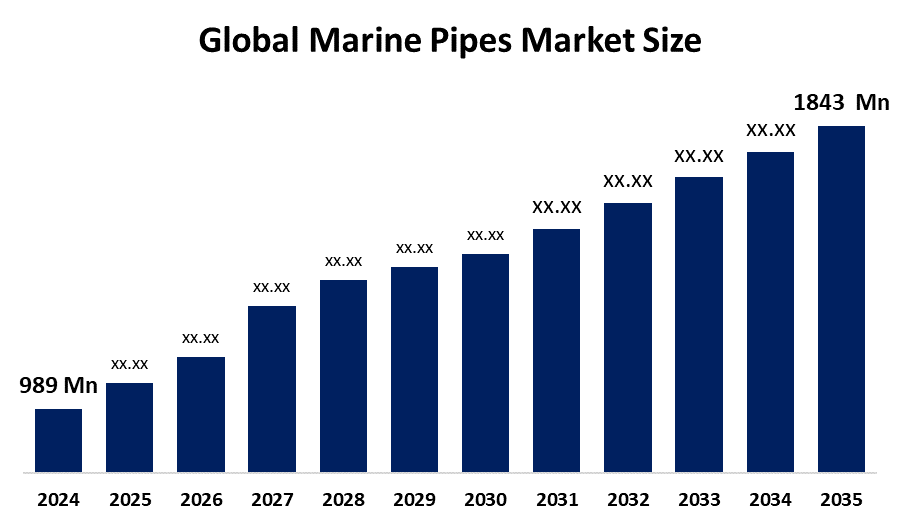

According to Spherical Insights, the Global Marine Pipes Market Size is expected to grow from USD 989 million in 2024 to USD 1843 million by 2035, at a CAGR of 5.82% during the forecast period 2025-2035. The marine pipes market is driven by the growing global shipping industry’s need for reliable and durable piping systems.

Key Market Insights

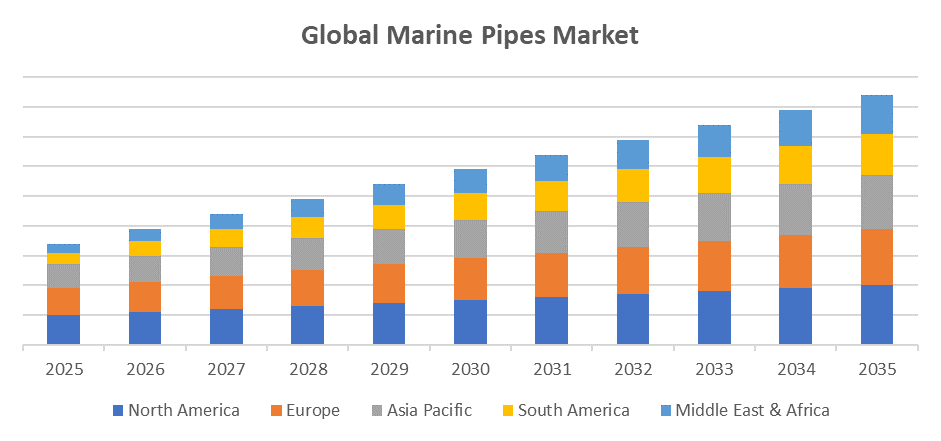

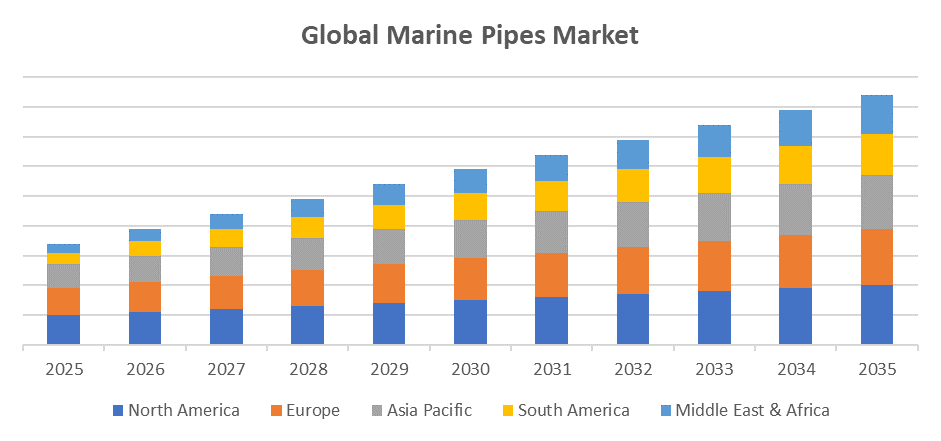

- Asia Pacific is expected to account for the largest share in the marine pipes market during the forecast period.

- In terms of material type, the steel pipes segment is projected to lead the marine pipes market throughout the forecast period

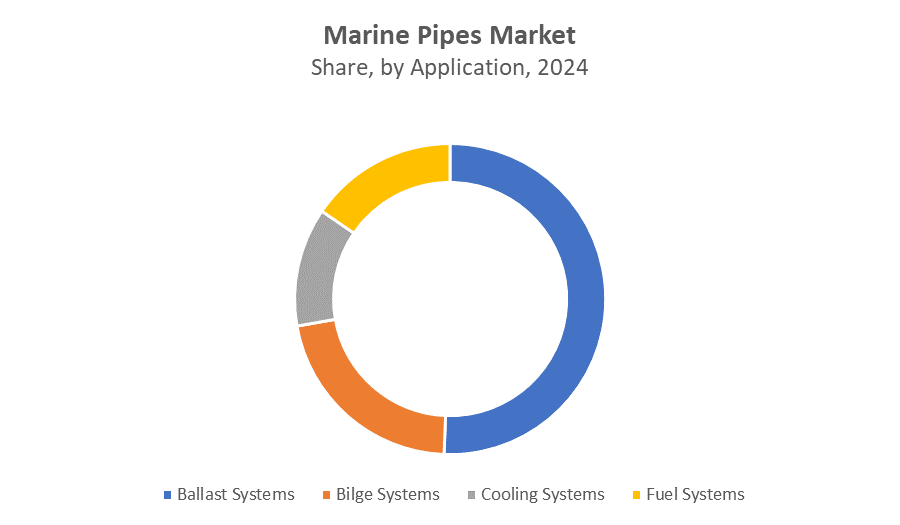

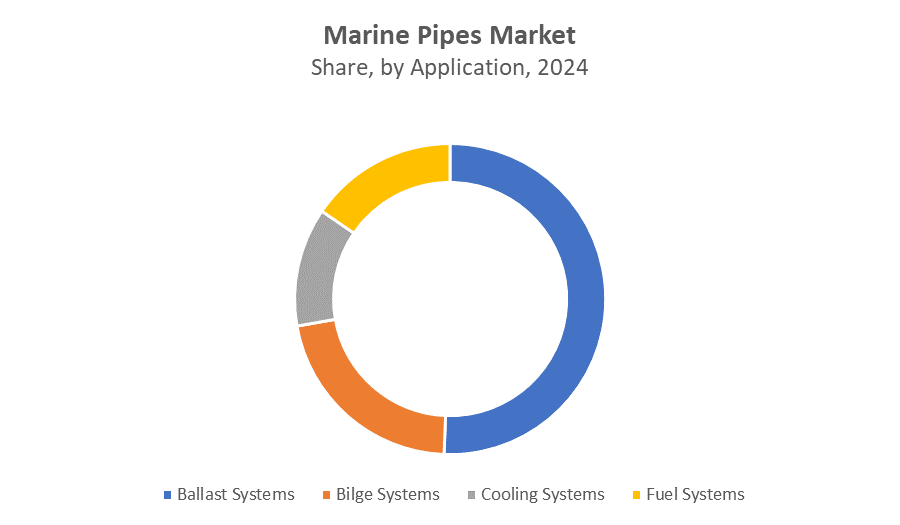

- In terms of application, the ballast systems segment captured the largest portion of the marine pipes market

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 989 Million

- 2035 Projected Market Size: USD 1843 Million

- CAGR (2025-2035): 5.82%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Marine Pipes Market

The global marine pipes market involves the manufacturing and use of specialized piping systems designed for marine applications such as shipbuilding, offshore oil and gas, underwater pipelines, and marine infrastructure. These pipes are built to endure harsh sea conditions, including corrosion, pressure, and temperature variations, using materials like steel, copper, and advanced polymers. Market growth is driven by rising maritime activities, offshore energy exploration, and the expansion of commercial and naval fleets. Governments worldwide are supporting this growth through initiatives focused on maritime infrastructure development, clean energy, and fleet modernization. Technological advancements in pipe materials and design are further improving durability, efficiency, and environmental performance, making marine piping systems a vital component of modern maritime operations.

Marine Pipes Market Trends

- The growing exploration and production of offshore oil, gas, and renewable energy (like offshore wind) are increasing the need for durable, corrosion-resistant marine piping systems.

- There is a shift towards using lightweight, high-strength, and corrosion-resistant materials such as duplex stainless steel, copper-nickel alloys, and thermoplastics to enhance performance and reduce maintenance.

- Environmental regulations are pushing the marine industry toward more sustainable solutions. This includes piping systems that support cleaner fuel technologies like LNG and hydrogen-powered vessels.

- Innovations such as automated pipe welding, 3D modeling, and smart inspection tools are improving production efficiency, quality control, and lifespan of marine piping systems.

Marine Pipes Market Dynamics

Driving Factors: Government investments in the marine pipes market and maritime infrastructure support market expansion

The growth of the marine pipes market is driven by several key factors. Increasing offshore oil, gas, and renewable energy projects require robust and corrosion-resistant piping systems. Expanding global trade and shipbuilding activities, including commercial, cargo, and naval vessels, are also boosting demand. Government investments in maritime infrastructure and fleet modernization support market expansion. Additionally, stricter environmental regulations are encouraging the adoption of advanced, sustainable piping materials. Technological advancements in pipe manufacturing and design are further enhancing performance, reducing maintenance costs, and improving safety, making modern marine piping systems essential in today’s evolving maritime industry.

Restrain Factors: The complex and harsh marine pipes market environment demands frequent inspections

The marine pipes market faces several restraining factors that could hinder its growth. High initial costs associated with the production and installation of specialized marine piping systems can limit adoption, especially for smaller operators. The industry also faces strict regulatory standards regarding safety, environmental impact, and material quality, which can increase compliance costs and delay projects. Additionally, the complex and harsh marine environment demands frequent inspections and maintenance, leading to increased operational expenses. Supply chain disruptions, particularly for raw materials like specialty metals, can further challenge timely production and delivery. These factors collectively impact market expansion and profitability.

Opportunity: Technological advancements in marine pipes materials, like corrosion-resistant composites, enhance durability and cost-effectiveness

The increasing shift toward offshore renewable energy sources, such as offshore wind and hydrogen production, is creating strong demand for advanced and sustainable piping systems. Expansion in global maritime trade and port infrastructure development opens further opportunities for pipe installations in shipping, logistics, and underwater transport systems. Technological advancements in materials like corrosion-resistant composites and thermoplastics are enabling lighter, more durable, and cost-effective solutions. Additionally, the growing focus on green shipping and LNG-powered vessels offers potential for specialized marine pipe applications. Emerging markets with rising naval and commercial shipbuilding activities also present untapped potential for manufacturers and suppliers in the marine piping industry.

Challenges: The marine pipes market requires skilled labor for installation and maintenance

Harsh marine environments demand high-performance materials, leading to increased manufacturing and maintenance costs. Strict international regulations and environmental standards require constant compliance, adding to operational complexity. Supply chain disruptions and fluctuating raw material prices can impact production timelines and profitability. Additionally, the need for skilled labor and specialized equipment for installation and inspection poses logistical difficulties, especially in remote offshore locations, further complicating project execution and cost management.

Global Marine Pipes Market Ecosystem Analysis

The global marine pipes market ecosystem involves key players across the value chain. Raw material suppliers provide corrosion-resistant alloys essential for durable pipes. Manufacturers like Tenaris produce high-performance pipes tailored for marine use. Engineering and EPC contractors handle design, installation, and maintenance. End users include offshore oil and gas, commercial shipping, and naval sectors. Regulatory bodies such as the IMO enforce safety and environmental standards. Technology providers integrate smart sensors and analytics for monitoring and predictive maintenance, fostering innovation and efficiency within the marine piping industry.

Global Marine Pipes Market, By Material Type

Steel pipes segment is led the marine pipes market with the largest market share over the forecast period. This dominance is primarily driven by their high strength, durability, and resistance to harsh marine environments, making them ideal for offshore and underwater applications. Steel pipes are commonly used in the transportation of oil, gas, and other fluids across marine infrastructures, such as pipelines, drilling rigs, and subsea systems. Additionally, advancements in corrosion-resistant coatings and welding technologies have further enhanced the performance and lifespan of steel pipes in marine settings, reinforcing their widespread adoption across the industry.

Copper pipes segment is led the marine pipes market with a significant revenue share over the forecast period. This growth can be attributed to copper’s excellent corrosion resistance, thermal conductivity, and biofouling resistance, which make it highly suitable for marine environments. Copper pipes are widely used in applications such as seawater systems, desalination plants, and heat exchangers aboard ships and offshore platforms. Their durability and low maintenance requirements further enhance their appeal in marine infrastructure.

Global Marine Pipes Market, By Application

The ballast systems segment held the largest revenue share in the marine pipes market during the forecast period, accounting for approximately 50.6% of the total market. This significant share reflects the critical role of ballast systems in maintaining the stability and balance of ships by controlling water intake and discharge through specialized piping. Due to the essential function of these systems in ensuring safe and efficient marine operations, the demand for high-quality pipes in ballast systems remains the highest among all marine pipe segments, driving substantial revenue growth in this area.

The bilge systems segment accounted for a significant share of the marine pipes market, capturing approximately 21.6% of the total revenue during the forecast period. Bilge systems are essential for the safe operation of marine vessels, as they manage the removal of excess water that accumulates in the bilge area of ships. Efficient piping solutions are crucial for these systems to ensure quick and reliable drainage, preventing waterlogging and maintaining vessel stability. The demand for durable, corrosion-resistant pipes in bilge systems has grown in response to stricter maritime safety regulations and the increasing complexity of modern ships.

Asia Pacific is expected to account for the largest share of the marine pipes market during the forecast period, driven by rapid growth in shipbuilding and offshore oil and gas activities in the region. Countries like China, Japan, South Korea, and India are investing heavily in expanding their maritime infrastructure, fueling demand for reliable marine piping systems. Additionally, increasing trade volumes and government initiatives to modernize port facilities further contribute to the market expansion. The region's focus on adopting advanced technologies and materials in marine construction is also expected to boost the demand for high-quality pipes, solidifying Asia Pacific's position as the leading market for marine pipes.

China is experiencing steady growth in the marine pipes market, driven by its expanding shipbuilding industry and increasing offshore oil and gas exploration activities. As one of the world’s largest shipbuilders, China continues to invest in advanced marine infrastructure and modernize its fleet, which boosts demand for high-quality marine pipes. Additionally, government initiatives aimed at strengthening maritime trade routes and port facilities contribute to sustained market growth.

North America is expected to grow at the fastest CAGR in the marine pipes market during the forecast period, driven by increasing offshore oil and gas exploration activities in the Gulf of Mexico and along the Atlantic coast. The region's focus on upgrading aging marine infrastructure and stringent regulatory standards for marine safety and environmental protection are further boosting demand for advanced and corrosion-resistant piping systems. Additionally, investments in shipbuilding and port modernization projects contribute to the rising adoption of high-performance marine pipes.

United States is rapidly expanding in the marine pipes market, fueled by increased offshore drilling activities and growing investments in maritime infrastructure. The country's strategic focus on enhancing port facilities, modernizing naval fleets, and complying with stringent environmental regulations is driving demand for durable and corrosion-resistant marine piping solutions. Furthermore, technological advancements and rising shipbuilding projects along the U.S. coastline are supporting sustained growth in the marine pipes sector.

WORLDWIDE TOP KEY PLAYERS IN THE MARINE PIPES MARKET INCLUDE

- Nippon Steel Corporation

- SeAH Steel Holdings

- EEW Group

- Tenaris S.A.

- Georg Fischer AG

- Welspun Corp Limited

- Amaintit

- Hobas

- HengRun Group

- Sarplast

Product Launches in Marine Pipes Market

- In August 2024, GF Piping Systems announced its participation in the SMM 2024 trade fair, showcasing energy-efficient and long-lasting solutions for the marine industry. The company presented a comprehensive portfolio of valve technology and various piping solutions with marine certifications by leading classification societies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the marine pipes market based on the below-mentioned segments:

Global Marine Pipes Market, By Material Type

Global Marine Pipes Market, By Application

- Ballast Systems

- Bilge Systems

- Cooling Systems

- Fuel Systems

Global Marine Pipes Market, By Regional Analysis

- Asia Pacific

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: Which material type dominates the Global Marine Pipes Market?

A: The steel pipes segment is projected to lead the marine pipes market throughout the forecast period due to its high strength and corrosion resistance.

Q: Which application segment holds the largest revenue share in the marine pipes market?

A: The ballast systems segment holds the largest revenue share, accounting for approximately 50.6% of the market.

Q: Who are the top key players operating in the Global Marine Pipes Market?

A: Key players include Nippon Steel Corporation, SeAH Steel Holdings, EEW Group, Tenaris S.A., Georg Fischer AG, Welspun Corp Limited, Amaintit, Hobas, HengRun Group, and Sarplast.

Q: What are the main drivers of growth in the Global Marine Pipes Market?

A: Growth is driven by increasing offshore oil, gas, and renewable energy projects, expanding global trade and shipbuilding activities, government investments in maritime infrastructure, and technological advancements in pipe materials and design.

Q: What are the key challenges restraining the marine pipes market growth?

A: High initial production and installation costs, strict regulatory standards, harsh marine environmental conditions requiring frequent maintenance, and supply chain disruptions for raw materials are major challenges.

Q: What opportunities exist in the Global Marine Pipes Market?

A: The increasing focus on offshore renewable energy, green shipping technologies, expanding maritime trade and port infrastructure development, and technological innovations in corrosion-resistant materials offer strong growth opportunities.

Q: What trends are emerging in the marine pipes market?

A: Trends include the use of lightweight and corrosion-resistant materials like duplex stainless steel and copper-nickel alloys, adoption of sustainable piping systems supporting LNG and hydrogen vessels, and innovations such as automated welding and smart inspection tools.

Q: How does the market ecosystem of marine pipes operate?

A: The ecosystem includes raw material suppliers, manufacturers, engineering contractors, end-users in offshore oil & gas and shipping, regulatory bodies like IMO, and technology providers offering smart monitoring solutions.

Q: What are the latest product launches or innovations in the marine pipes market?

A: In August 2024, GF Piping Systems showcased energy-efficient, certified valve technology and piping solutions at the SMM 2024 trade fair, emphasizing durability and marine industry certifications.

Q: What is the outlook for the marine pipes market in China and the United States?

A: China’s market is driven by shipbuilding and offshore exploration, while the U.S. market is expanding due to offshore drilling, maritime infrastructure investments, and regulatory compliance requirements.