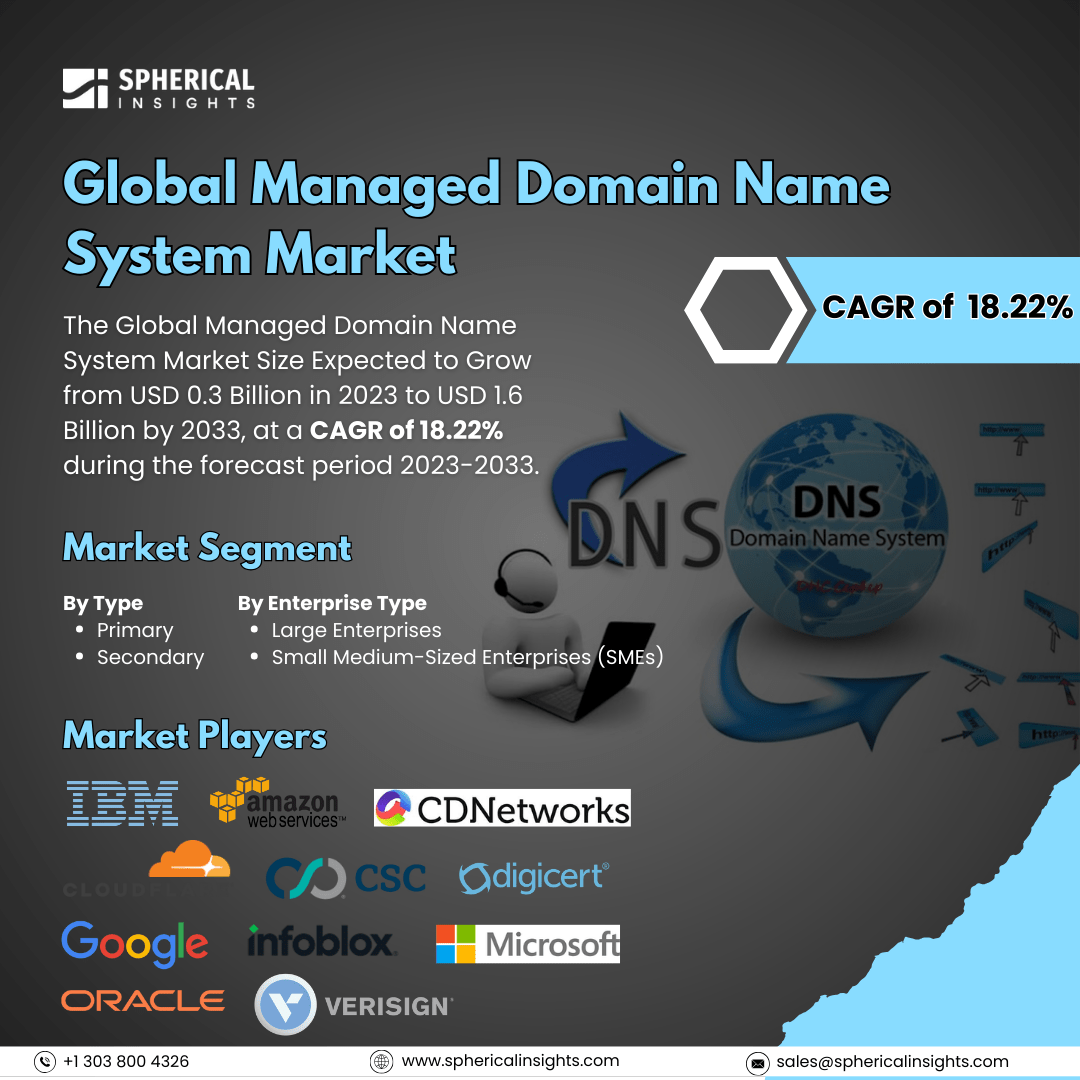

Global Managed Domain Name System Market Size to Exceed USD 1.6 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Managed Domain Name System Market Size Expected to Grow from USD 0.3 Billion in 2023 to USD 1.6 Billion by 2033, at a CAGR of 18.22% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Managed Domain Name System Market Size, Share, and COVID-19 Impact Analysis, By Type (Primary and Secondary), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, IT & Telecom, Healthcare, Retail & E-Commerce, Education, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The managed domain name system market is a third-party service that lets companies contract out the monitoring and administration of Domain Name Systems (DNS). DNS, sometimes referred to as the "phonebook of the internet," converts hostnames and domain names that are readable by humans into IP addresses that are readable by computers. Moreover, one of the main factors propelling the market's expansion is the growing use of cloud computing. DNS is a distributed database that makes it possible to store and search for IP addresses and other data by name. By providing both private and public DNS zones, cloud-based DNS removes the need to maintain dedicated DNS servers. Large anycast networks with several points of presence (PoPs) worldwide are used by DNS service providers. By automatically sending queries to the nearest PoP, these providers speed up DNS resolution and guarantee a consistent user experience worldwide. Because cloud computing offers advantages including scalability, stability, cost-effectiveness, quicker time to market, and resilient designs, businesses are shifting their workloads and applications there. Businesses can get the right degree of automation by using more scalable and agile automation solutions made possible by cloud computing services. However, the fact that DNS is managed centrally by one organization is one of its biggest disadvantages, since it may hinder the expansion of the DNS services market's income.

The primary segment is accounted to hold the largest share in 2023 of the global managed domain name system market during the estimated period.

On the basis of types, the global managed domain name system market is classified into primary and secondary. Among these, the primary segment is accounted to hold the largest share in 2023 of the global managed domain name system market during the estimated period. This is because of its critical role in ensuring website accessibility, performance, and security. Businesses prefer primary DNS services for uninterrupted domain resolution, enhanced load balancing, and protection against cyber threats, which makes it the preferred choice for enterprises and service providers.

The large enterprises segment is accounted to hold the largest share in 2023 of the global managed domain name system market during the estimated period.

On the basis of enterprise type, the global managed domain name system market is classified into SMEs and large enterprises. Among these, the large enterprises segment is accounted to hold the largest share in 2023 of the global managed domain name system market during the estimated period. Generally speaking, DDoS attacks target large organizations. Numerous DNS security companies have introduced technologies for big businesses that can guard against DDoS attack harm. For Instance, in April 2023, as part of its global investment strategy, Akamai Technologies opened two more cleaning centres in Chennai and Mumbai, India. These cutting-edge centers provide Indian companies and international organizations with exceptional performance and DDoS protection.

The BFSI segment is anticipated to hold the largest share in 2023 of the global managed domain name system market during the estimated period.

On the basis of industry, the global managed domain name system market is classified into BFSI, IT and telecom, healthcare, retail & e-commerce, education, and others. Among these, the BFSI segment is anticipated to hold the largest share in 2023 of the global managed domain name system market during the estimated period. The segmental growth due to strong reliance on secure, reliable, and quick online transactions. Financial institutions simply need powerful DNS management to help protect against cyber threats, ensure smooth and seamless digital banking experiences, and offer always-accessible critical financial services.

North America is expected to hold the largest share of the global managed domain name system market over the forecast period.

The need for safe and compliant DNS anycast networks in North America is driven by the growing significance of data protection and regulatory compliance. Strict data privacy laws, such the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA), apply to some sectors in the area, including government, healthcare, and finance. By putting in place safe DNS encryption, data recording, and reporting features, managed DNS providers help companies comply with these regulations by providing compliance-ready anycast networks. This promotes the use of managed DNS distributed denial of service (DDoS) prevention by enabling businesses to preserve data security and privacy while adhering to regulatory requirements.

Asia Pacific is expected to grow at the fastest CAGR of the global managed domain name system market during the forecast period. Asia Pacific has seen a sharp increase in mobile commerce, or m-commerce, which has increased demand for managed DNS distributed denial of service (DDoS) protection. Since smartphones are becoming the main device used for online transactions, companies need to make sure that their websites and mobile apps are optimized for both user experience and performance. By lowering latency and enabling quicker load times, managed DNS distributed denial of service (DDoS) protection assists businesses in improving the performance of mobile apps. In regions like China, India, and Southeast Asia where smartphones are widely used, DNS distributed denial of service (DDoS) prevention makes sure that mobile consumers have a seamless experience interacting with digital platforms by optimizing the routing of mobile traffic.

Company Profiling

Major vendors in the global managed domain name system market are IBM, Amazon Web Distributed Denial of Service (DDoS) Protection, Inc., CDNetworks Inc., Cloudflare, Inc., Corporation Service Company, DigiCert, Inc., Google, Infoblox, Microsoft, Oracle, VeriSign, Inc., Vitalwerks Internet Anycast Networks, and LLC., and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Development

- In October 2024, to combat online scams, Google teamed up with the DNS Research Federation and the Global Anti-Scam Alliance. By combining threat signals from many data sources, this partnership called the Global Signal Exchange, seeks to improve visibility into cybercrime facilitators and produce real-time information on fraud, scams, and other cybercrimes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global managed domain name system market based on the below-mentioned segments:

Global Managed Domain Name System Market, By Type

Global Managed Domain Name System Market, By Enterprise Type

- Large Enterprises

- Small Medium-Sized Enterprises (SMEs)

Global Managed Domain Name System Market, By Industry

- BFSI

- IT & Telecom

- Healthcare

- Retail & E-Commerce

- Education

- Others

Global Managed Domain Name System Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa