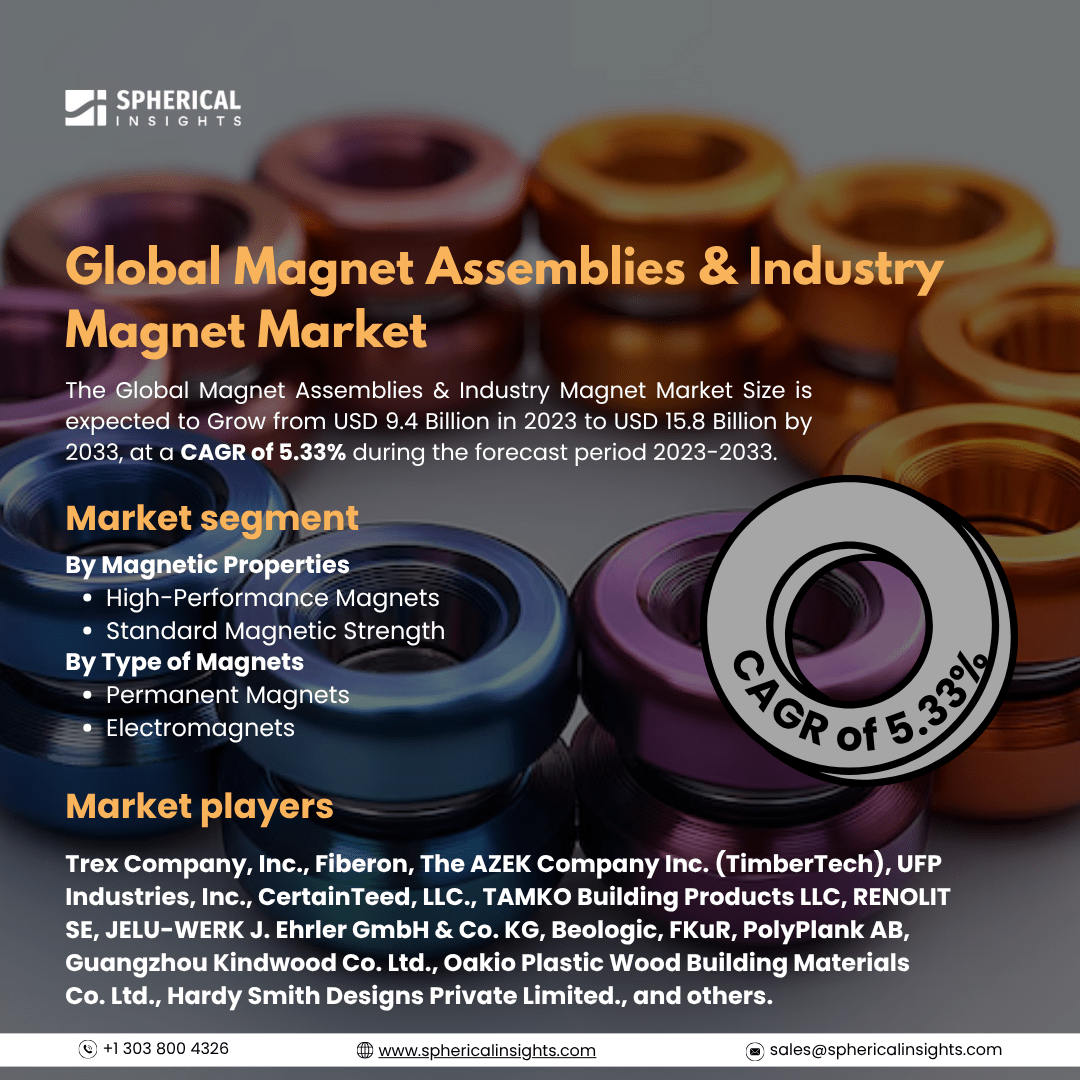

Global Magnet Assemblies & Industry Magnet Market Size To Exceed USD 15.8 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Magnet Assemblies & Industry Magnet Market Size is expected to Grow from USD 9.4 Billion in 2023 to USD 15.8 Billion by 2033, at a CAGR of 5.33% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on The Global Magnet Assemblies & Industry Magnet Market Size, Share, and COVID-19 Impact Analysis, By Type of Magnets (Permanent Magnets and Electromagnets), By Magnetic Properties (High-Performance Magnets and Standard Magnetic Strength), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The magnet assemblies & industry magnet market refers to the global industry focused on the production, integration, and application of Magnetic systems and components, including magnet assemblies (combinations of magnets and other materials like metal or plastic) and industrial magnets used in various sectors. These products serve crucial roles in energy generation, automotive systems, electronics, aerospace, and medical devices. Moreover, the magnet assemblies & industry magnet market is driven by growing demand for energy-efficient motors, rising adoption of electric vehicles, and expanding applications in electronics, medical devices, and renewable energy. Advancements in magnetic materials and automation technologies, along with increased focus on miniaturization and performance optimization, further boost market growth globally. However, the market faces restraints from high raw material costs, particularly rare earth elements, supply chain disruptions, and environmental concerns related to mining and processing, which can hinder consistent production and profitability.

The permanent magnets segment accounted for the largest share of the global magnet assemblies & industry magnet market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type of magnets, the global magnet assemblies & industry magnet market is divided into permanent magnets and electromagnets. Among these, the permanent magnets segment accounted for the largest share of the worldwide magnet assemblies & industry magnet market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is due to their wide usage in electric motors, generators, sensors, and consumer electronics. Their ability to retain magnetism without external power makes them highly efficient and cost-effective for automotive, industrial, and renewable energy applications, driving strong demand.

The building and construction segment accounted for a substantial share of the global magnet assemblies & industry magnet market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of the magnetic properties, the global magnet assemblies & industry magnet market is divided into high-performance magnets and standard magnetic strength. Among these, the building and construction segment accounted for a substantial share of the global magnet assemblies & industry magnet market in 2023 and is anticipated to grow rapidly during the projected period. This is due to their superior strength, durability, and efficiency in demanding applications. These magnets are widely used in automotive, aerospace, electronics, and renewable energy industries, where high magnetic performance is essential for advanced and compact systems.

Asia Pacific is projected to hold the largest share of the global magnet assemblies & industry magnet market over the projected period.

Asia Pacific is projected to hold the largest share of the global magnet assemblies & industry magnet market over the projected period. This is driven by rapid industrialization, high demand for consumer electronics, and significant investments in renewable energy and electric vehicle production. Countries like China, Japan, and South Korea are key players in manufacturing and technological advancements in magnets.

North America is expected to grow at the fastest CAGR of the global magnet assemblies & industry magnet market during the projected period. This is supported by strong demand in automotive, aerospace, and renewable energy sectors. The U.S. plays a key role in advancing technologies like electric vehicles and wind energy, driving the need for high-performance magnets in various industries.

Company Profiling

Major vendors in the global Magnet Assemblies & Industry Magnet market are Trex Company, Inc., Fiberon, The AZEK Company Inc. (TimberTech), UFP Industries, Inc., CertainTeed, LLC., TAMKO Building Products LLC, RENOLIT SE, JELU-WERK J. Ehrler GmbH & Co. KG, Beologic, FKuR, PolyPlank AB, Guangzhou Kindwood Co. Ltd., Oakio Plastic Wood Building Materials Co. Ltd., Hardy Smith Designs Private Limited., and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global magnet assemblies & industry magnet market based on the below-mentioned segments:

Global Magnet Assemblies & Industry Magnet Market, By Type of Magnets

- Permanent Magnets

- Electromagnets

Global Magnet Assemblies & Industry Magnet Market, By Magnetic Properties

- High-Performance Magnets

- Standard Magnetic Strength

Global Magnet Assemblies & Industry Magnet Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa