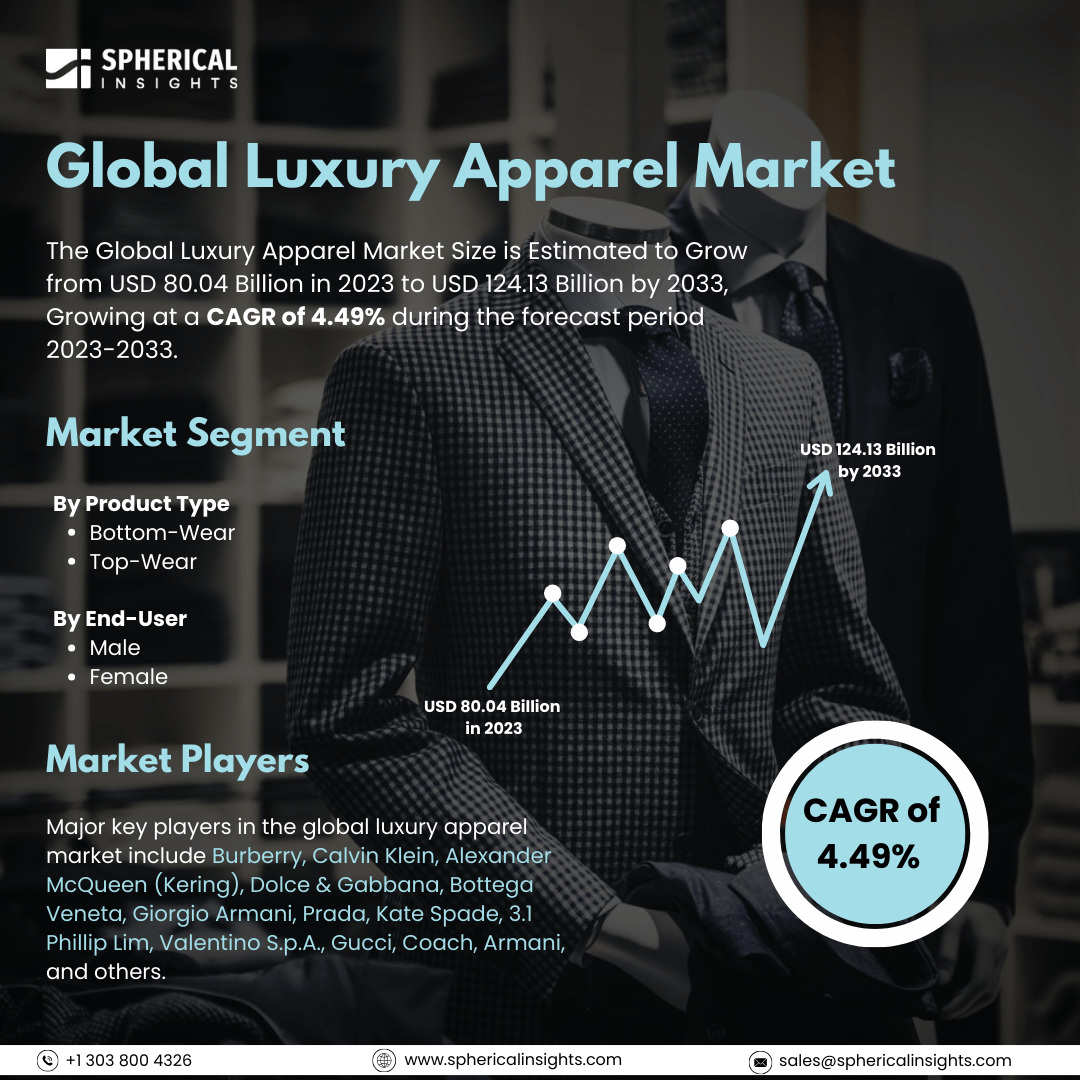

Global Luxury Apparel Market Size to Worth USD 124.13 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Luxury Apparel Market Size is Estimated to Grow from USD 80.04 Billion in 2023 to USD 124.13 Billion by 2033, Growing at a CAGR of 4.49% during the forecast period 2023-2033.

Browse key industry insights spread across 215 pages with 110 Market data tables and figures & charts from the report on the Global Luxury Apparel Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Bottom-Wear and Top-Wear), By End-User (Male and Female), By Distribution Channel (Online and Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The market for luxury apparel and accessories created by premium brands is known as the global luxury apparel market. It consists of high-end apparel, shoes, and accessories including hats, scarves, and belts. The increase in disposable income and shifting lifestyle patterns brought about by rapid urbanization are responsible for the market's expansion, as they have greatly increased consumer spending on luxury products. Additionally, social media's and digital marketing's increasing sway has improved brand awareness and customer interaction, increasing the accessibility and appeal of luxurious apparel. Customers' brand loyalty and the growing number of millionaires are expected to drive the expansion. Another important factor has been the rise in e-commerce sales, which have given customers easy access to a variety of luxury goods. In addition, the industry has been driven by the increasing acceptability of luxury fashion among Gen Z and millennials, who are more drawn to high-end labels and distinctive fashion statements. Furthermore, highlighting premium clothing made ethically and sustainably has drawn eco-aware customers, which has fueled industry expansion. However, the long-term expansion of the industry will be significantly hampered by the high and unstable cost of raw materials.

The top-wear segment dominated the global luxury apparel market share in 2023 and is estimated to grow at a CAGR of 2.19% throughout the projection period.

Based on the product type, the global luxury apparel market is categorized into bottom-wear and top-wear. Among these, the top-wear segment dominated the global luxury apparel shirts market share in 2023 and is estimated to grow at a CAGR of 2.19% throughout the projection period. Since shirts, blouses, and jackets are the most noticeable and attention-grabbing items, the top-wear segment has been controlling the market. Top-wear is adaptable and simple to incorporate into a variety of ensembles and fashions. It can be worn with various bottoms, shoes, and accessories to create a variety of styles and uses. To ensure that customers have access to luxury apparel all year round, luxury businesses can provide a range of top-wear options for all weather situations.

The male segment accounted for the largest share of 54.32% in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the global luxury apparel market is classified into male and female. Among these, the male segment accounted for the largest share of 54.32% in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Rising demand for luxury fashion and high-end brands, as well as men's expanding discretionary money, are some of the causes contributing to the segment's growth. In addition to the greater handmade nature of luxury clothing, men are increasingly pursuing it as a means of expressing their individuality and prestige. The market has seen a great deal of innovation, with companies providing a broad range of goods to meet a variety of tastes and preferences, from casual clothing to custom suits. Additionally, social media and internet shopping have increased accessibility to premium clothes, which has fueled the market's expansion.

The offline segment held the largest share in 2023 and is estimated to grow at a CAGR of 3.78% throughout the projection period.

Based on the distribution channel, the global luxury apparel market is divided into online and offline. Among these, the offline segment held the largest share in 2023 and is estimated to grow at a CAGR of 3.78% throughout the projection period. Purchasing luxury goods is frequently seen as an immersive and sensory experience. Online channels are unable to completely replace the tactile shopping experience that physical stores offer by enabling shoppers to touch, feel, and try on clothing. Luxurious stores are excellent at providing individualized services such as in-store hairdressers, customization choices, and attentive, informed employees. The overall shopping experience is improved and a strong sense of client loyalty is developed due to this individualized treatment.

Europe is expected to hold the largest share of the global luxury apparel market through the forecast period.

Europe is expected to hold the largest share of the global luxury apparel market through the forecast period. Europe was the largest regional market for luxury apparel, with major nations such as Germany, the United Kingdom, and France. Europe is one of the most popular travel destinations, drawing millions of tourists from around the world. While on vacation, everyone from upper-class women to business tycoons purchases expensive clothing, and product sales are rising as a result of the region's new retail concepts and business strategies.

Asia Pacific is predicted to grow at the fastest CAGR of the global luxury apparel market over the forecast period. Important factors include the growing middle and upper classes in the region, a strong desire for luxury brands, and quickly shifting consumer tastes. Countries such as China and Japan, with their substantial consumer bases and high per capita incomes, play important roles. The market has also grown as a result of the move towards digitalization and the rising acceptance of online shopping platforms. Since the Asia Pacific region has the potential for long-term growth and profitability, global luxury companies are paying more attention to it.

Company Profiling

Major key players in the global luxury apparel market include Burberry, Calvin Klein, Alexander McQueen (Kering), Dolce & Gabbana, Bottega Veneta, Giorgio Armani, Prada, Kate Spade, 3.1 Phillip Lim, Valentino S.p.A., Gucci, Coach, Armani, and others.

Recent Developments

- In July 2024, Giorgio Armani recently launched a week-long pop-up with the debut of the Mare 2024 Collection at a private cocktail party at Little Beach House Malibu. A sophisticated summer theme, the event's decor, which reflected the collection's luxurious spirit against the background of the Pacific Ocean, enthralled visitors with its turquoise tropical palm patterns and wood and light gold accents. An immersive experience of Armani's vision of summer appeal was provided by this event, which also highlighted the collection's elegance.

- In July 2023, the luxury apparel company Ralph Lauren, with headquarters in the United States, unveiled a new collection of gear designed in collaboration with G2 Esports.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global luxury apparel market based on the below-mentioned segments:

Global Luxury Apparel Market, By Product Type

Global Luxury Apparel Market, By End-User

Global Luxury Apparel Market, By Distribution Channel

Global Luxury Apparel Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa