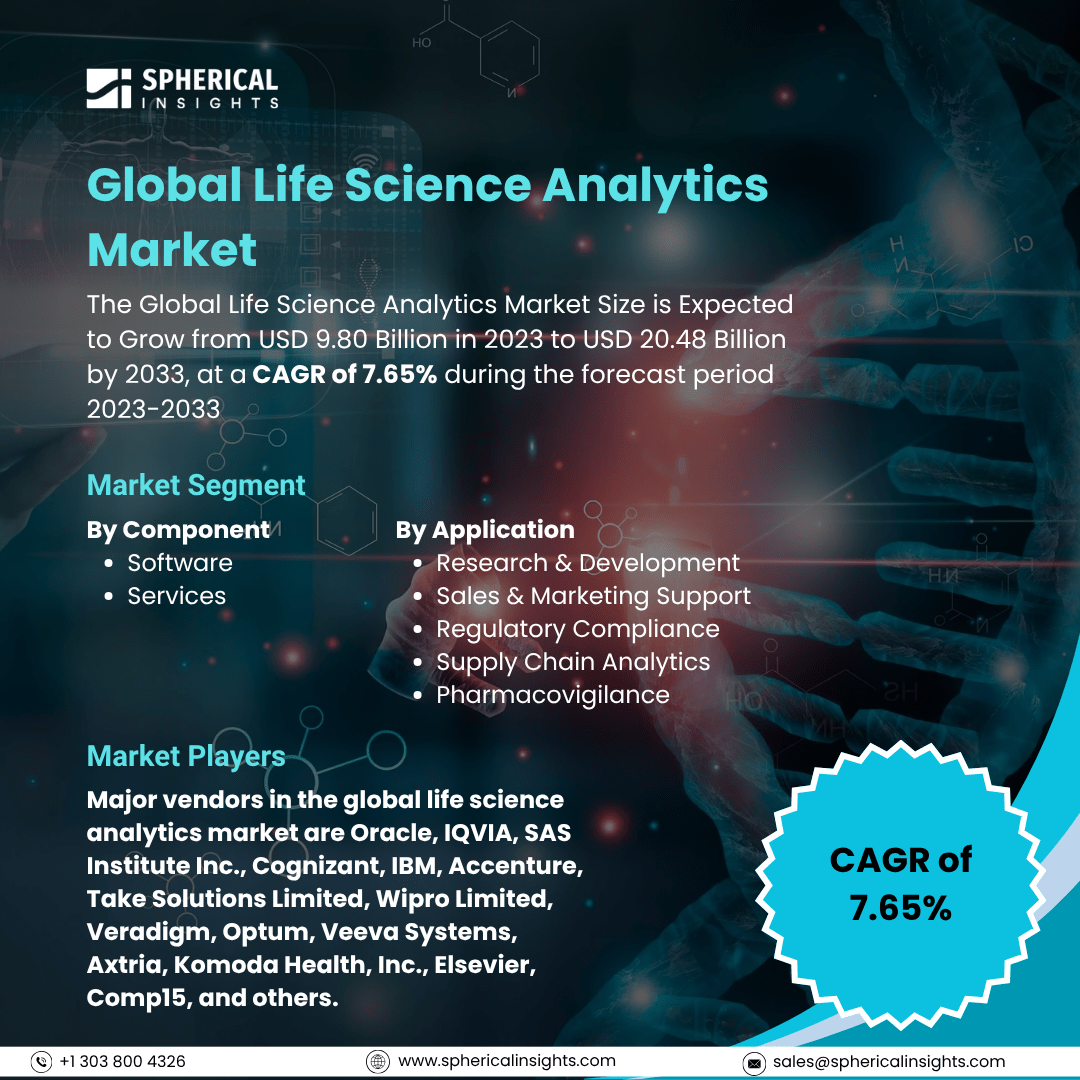

Global Life Science Analytics Market Size To Exceed USD 20.48 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Life Science Analytics Market Size is Expected to Grow from USD 9.80 Billion in 2023 to USD 20.48 Billion by 2033, at a CAGR of 7.65% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Life Science Analytics Market Size, Share, and COVID-19 Impact Analysis, By Component (Software and Services), By Application (Research & Development, Sales & Marketing Support, Regulatory Compliance, Supply Chain Analytics, and Pharmacovigilance), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The global life science analytics market encompasses the application of advanced data analysis techniques such as descriptive, predictive, and prescriptive analytics to the life sciences sector, including pharmaceuticals, biotechnology, healthcare, and medical devices. These analytics tools are instrumental in enhancing decision-making processes, optimizing clinical trials, improving patient outcomes, and streamlining operations across research and development, sales, marketing, and regulatory compliance. Furthermore, the global life science analytics market is driven by increasing demand for data-driven insights to improve healthcare outcomes, enhance operational efficiency, and support regulatory compliance. Advancements in artificial intelligence, machine learning, and big data analytics are enabling better decision-making in drug development, clinical trials, and personalized medicine. Growing investments in healthcare IT, coupled with rising demand for cost-effective solutions, also contribute to market growth. However, the global life science analytics market faces restraining factors such as data privacy concerns, high implementation costs, complex regulatory requirements, lack of skilled professionals, and challenges in integrating disparate data systems across organizations.

The services segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of the component, the global life science analytics market is divided into software and services. Among these, the services segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to increasing demand for data management, analytics consulting, and system integration services among life science companies. Outsourcing analytics services helps organizations reduce operational costs, enhance data-driven decision-making, and focus on core activities, driving strong growth potential throughout the forecast period.

The regulatory compliance segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

On the basis of the application, the global life science analytics market is divided into research & development, sales & marketing support, regulatory compliance, supply chain analytics, and pharmacovigilance. Among these, the regulatory compliance segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is attributed to growing pressure on life sciences companies to meet stringent global regulatory standards. Increasing audits, evolving compliance requirements, and the need for accurate, real-time data reporting are driving the adoption of analytics solutions, fueling significant growth in this segment during the forecast period.

North America is projected to hold the largest share of the global life science analytics market over the forecast period.

North America is projected to hold the largest share of the global life science analytics market over the forecast period. The regional growth is attributed to the strong presence of major pharmaceutical and biotechnology companies, advanced healthcare infrastructure, and widespread adoption of data-driven technologies. Supportive government initiatives, increasing R&D investments, and strict regulatory frameworks further drive the demand for analytics solutions across the region’s life sciences sector.

Asia Pacific is expected to grow at the fastest CAGR in the global life science analytics market during the forecast period. The regional growth is attributed to rapid expansion of healthcare infrastructure, increasing clinical trials, and growing investments in biotechnology and pharmaceuticals. Rising adoption of digital health solutions, government support for healthcare modernization, and a large patient population further accelerate analytics demand across emerging economies in the region.

Company Profiling

Major vendors in the global life science analytics market are Oracle, IQVIA, SAS Institute Inc., Cognizant, IBM, Accenture, Take Solutions Limited, Wipro Limited, Veradigm, Optum, Veeva Systems, Axtria, Komoda Health, Inc., Elsevier, Comp15, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2024, Salesforce and Cognizant partnered to create Salesforce Life Sciences Cloud, which will boost innovation in the life sciences industry.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global life science analytics market based on the below-mentioned segments:

Global Life Science Analytics Market, By Component

Global Life Science Analytics Market, By Application

- Research & Development

- Sales & Marketing Support

- Regulatory Compliance

- Supply Chain Analytics

- Pharmacovigilance

Global Life Science Analytics Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa