Leather Footwear Market Summary

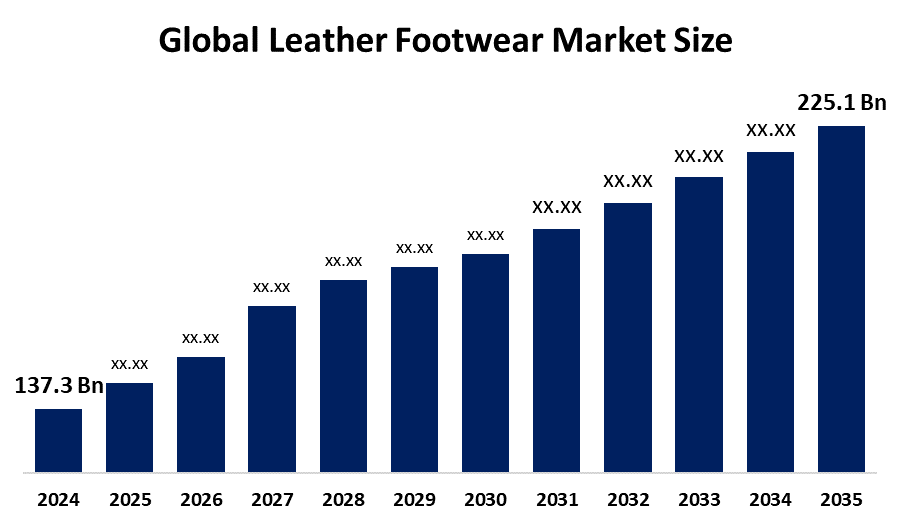

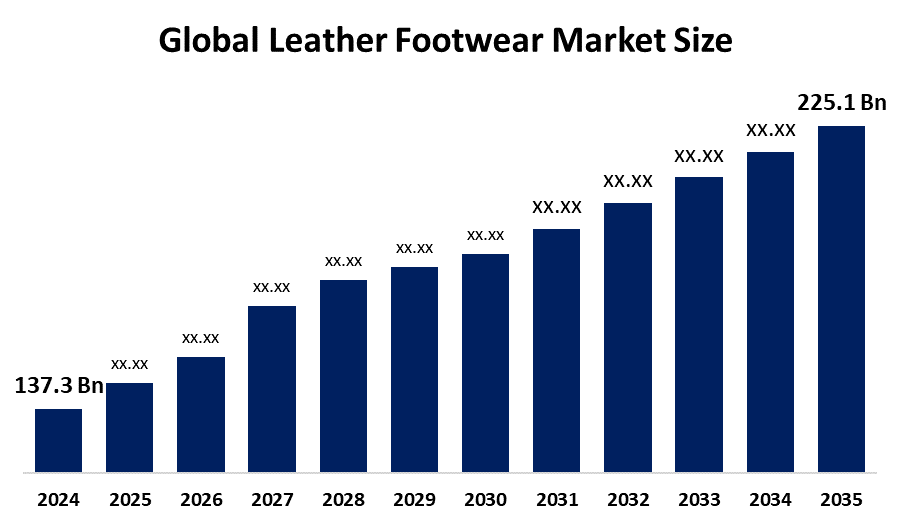

The Global Leather Footwear Market Size Was Valued at USD 137.3 Billion in 2024 and is Expected to Reach USD 225.1 Billion by 2035, Growing at a CAGR of 4.6% from 2025 to 2035. Rising disposable incomes, growing fashion consciousness, the need for long-lasting, high-end products, the growth of e-commerce, and the growing global preference for branded and sustainable leather footwear across the formal, casual, and luxury segments are all driving the leather footwear market.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific leather footwear market held the largest revenue share of 52.5% and dominated the global market.

- In 2024, the male segment held the highest revenue share of 53.6% and dominated the global market by end use.

- With the biggest revenue share of 72.8% in 2024, the offline segment led the worldwide leather footwear market by distribution channel.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 137.3 Billion

- 2035 Projected Market Size: USD 225.1 Billion

- CAGR (2025-2035): 4.6%

- Asia Pacific: Largest market in 2024

The Leather Footwear Market Size provides an extensive range of footwear products, which include genuine and artificial leather options for men, women, and children. The product selection consists of formal shoes and boots, and casual footwear and sandals. The market growth stems from two main factors, which include expanding disposable income and rising fashion awareness. Increasing need for durable, fashionable footwear. The worldwide fashion industry uses celebrity endorsements to increase its influence, while e-commerce platforms have expanded their product visibility and accessibility. The need for comfortable footwear with high-quality standards exists in both developed and developing nations because of fast lifestyle changes and expanding urban areas.

The market undergoes significant changes because of technological advancements, which focus on sustainable manufacturing, design automation, and leather processing methods. The combination of 3D printing technology with recycled leather materials and eco-friendly tanning methods produces better products that generate lower environmental damage. The leather sector receives support from governments and industry associations through talent development programs, export incentives, and sustainable production support measures. The worldwide leather footwear market continues to expand while becoming more competitive because of increased funding for research and development, smart manufacturing approaches, and ethical supply chain practices.

End Use Insights

How Did the Male Segment Achieve the Largest Revenue Share of 53.6% in the Leather Footwear Market in 2024?

The male segment dominated the leather footwear market during 2024 by holding the largest revenue share of 53.6%. The market leadership exists because men require formal, casual, and sports footwear which combines durability with stylish design. They develop their fashion sense and meet their professional requirements. The segment continues to grow because luxury brands now offer more material options and design choices which match male footwear preferences. Sales growth occurs through the combination of fast urban growth, increasing personal wealth, and global fashion trend adoption. Online retail channels continue to expand their presence while customers choose premium handcrafted leather footwear, which drives male footwear sales globally.

The female segment is expected to grow at the fastest CAGR during the forecast period because disposable incomes are rising, and consumers want fashionable, comfortable, high-end footwear. The combination of domestic and international business product launches has triggered fast changes in women's footwear designs, materials, and colour trends. Social media marketing, together with e-commerce platforms, has made female consumers more accessible to brands while increasing their awareness of different brands. The market adoption of these products continues to rise because more consumers seek environmentally friendly leather footwear options that allow them to express their personal style. The worldwide leather footwear market experiences growth in its female segment because women now work more, and their lifestyle choices have evolved.

Distribution Channel Insights

What Factors Enabled the Offline Segment to Hold the Largest Revenue Share of 72.8% and Lead the Leather Footwear Market in 2024?

The offline segment held the largest revenue share of 72.8% and led the leather footwear market during 2024. The main reason for this market dominance comes from customers who prefer shopping in physical stores because they want to test product quality, comfort, and fit before they buy. Speciality shoe shops, department stores, hypermarkets, and branded retail establishments operate through offline channels, which continue to play a crucial role in enhancing both customer experience and brand visibility. The channel sales get a boost from offering a wide range of products along with personalised services and fast order fulfilment. The worldwide market shows offline segments as dominant players. High-end and luxury leather footwear brands depend on physical stores to build strong customer relationships.

The online segment is expected to grow at a significant rate during the forecast period because e-commerce platforms continue to expand quickly and internet access spreads across the globe. Online channels attract consumers because they provide easy access to products and deliver them at affordable prices. Online sales of leather footwear have experienced growth because digital marketing has become more popular, and virtual try-on features and easy return options have become standard in online shopping. The online visibility of local and international businesses gets better through dedicated websites and their partnerships with major e-commerce platforms. Social media's rising influence, together with mobile shopping apps and personalised recommendations, enables better customer interaction. This drives the internet sector to become the leading growth force in the global leather shoe market.

Regional Insights

The North American leather footwear market experiences steady growth because consumers seek high-end, stylish, durable footwear for formal, casual, and luxury needs. The main factors that drive development in this area consist of a strong fashion culture, high consumer spending power, and increasing interest in ethically produced, sustainable leather goods. Top brands now focus on comfort, eco-friendly production methods, and innovative designs to attract environmentally conscious consumers. The growth of e-commerce platforms, together with online purchasing acceptance, creates additional sales opportunities. The North American leather footwear market gains strength through international fashion house alliances with local designers and new manufacturing techniques that produce better quality and wider product options.

Europe Leather Footwear Market Trends

The European leather footwear market held 27.2% market share in 2024 because of the area's rich design heritage and strong consumer interest in luxury products, and growing preference for artisanal leather footwear. The main contributors to this industry include Italy, Spain, France, and the United Kingdom because these countries produce innovative designs and superior craftsmanship, and use premium materials. The footwear industry experiences market trends through increased demand for sustainable, ethical production and government initiatives that promote environmentally friendly manufacturing practices. The fashion industry has become more accessible to consumers through the combination of fashion events and designer partnerships, and online shopping platforms. The European leather footwear industry expands because of its sustainability initiatives, stylish products, and comfortable designs.

Asia Pacific Leather Footwear Market Trends

The Asia Pacific leather footwear market led globally with the largest revenue share of 52.5% in 2024. The region maintains its leadership position because of its large population and expanding middle class, along with increasing disposable income, which drives demand for fashionable, affordable, durable leather footwear. The manufacturing sector in China, India, Vietnam, and Indonesia benefits from their abundant raw materials, skilled workforce, and low production costs. Market growth receives support from rising urbanisation, changing fashion preferences, and growing international brand influence. The expansion of retail networks, together with e-commerce platforms, has made products more reachable to customers. The Asia Pacific region leads the worldwide leather footwear market because of its environmentally friendly leather processing methods. It also leads through innovative design approaches.

Key Leather Footwear Companies:

The following are the leading companies in the leather footwear market. These companies collectively hold the largest market share and dictate industry trends.

- PRADA S.P.A.

- Salvatore Ferragamo S.P.A.

- Bruno Magli

- LVMH

- Genesco

- Hermès

- KERING

- Allen Edmonds Corporation.

- Cole Haan

- Crockett & Jones.

- Others

Recent Developments

- In June 2025, LeMieux spent two years developing its first leather riding boots before releasing them. For riders of all skill levels, the line featured junior and zip paddock versions in addition to high-end all-leather field boots with ergonomic designs, YKK zips, elastic gussets, and traction bottoms.

- In June 2025, Prada made a monetary investment and transferred ownership of two tanneries, Tannerie Limoges and Conceria Superior, to get a 10% equity position in the Rino Mastrotto Leather Group. This action strengthened Prada's strategic control over the leather industry and strengthened its alliance with a reliable Italian supplier known for sustainability, creativity, and quality.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the leather footwear market based on the below-mentioned segments:

Global Leather Footwear Market, By End Use

Global Leather Footwear Market, By Distribution Channel

Global Leather Footwear Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa