Lactic Acid Market Summary

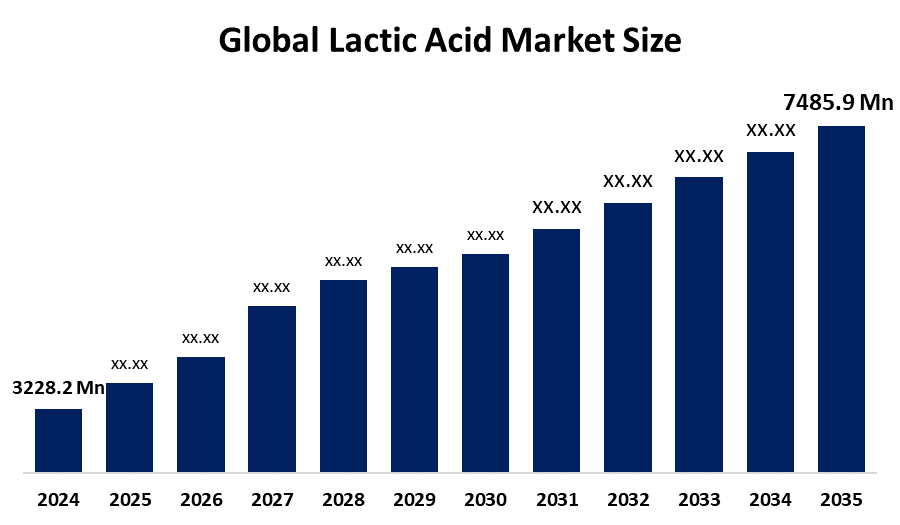

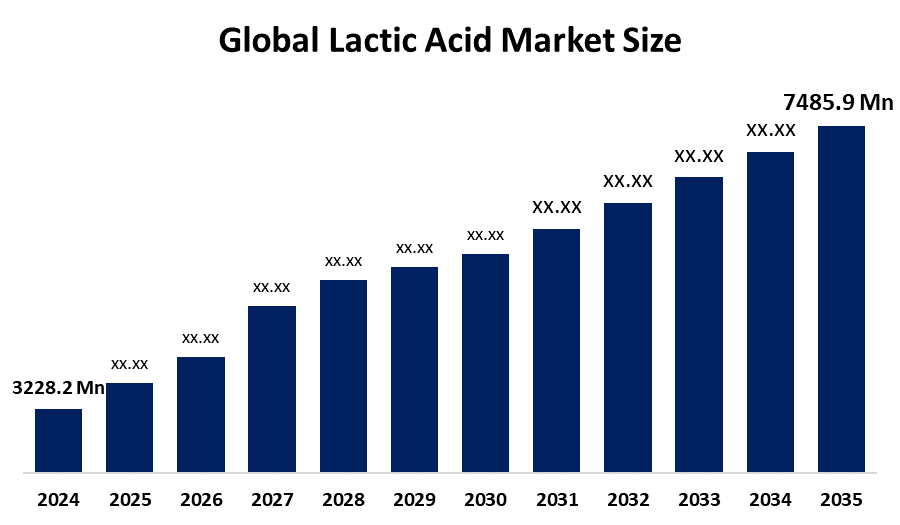

The Global Lactic Acid Market Size Was Estimated at USD 3228.2 Million in 2024 and is Expected to Reach USD 7485.9 Million by 2035, and is Projected to Grow at a CAGR of 7.95% from 2025 to 2035. Because of environmental laws and customer demand for sustainable and biodegradable products, such as Polylactic Acid (PLA), as an alternative to fossil fuel plastics, the lactic acid market is expanding.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 45.4% and dominated the market globally.

- In 2024, the sugarcane segment had the highest market share by raw material, accounting for 37.5%.

- In 2024, the polylactic acid (PLA) segment had the biggest market share by application, accounting for 28.4%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3228.2 Million

- 2035 Projected Market Size: USD 7485.9 Million

- CAGR (2025-2035): 7.95%

- North America: Largest market in 2024

The lactic acid market operates through the production of lactic acid, which is derived mainly from the fermentation of corn, sugarcane, beet, and other natural sources. The substance lactic acid serves multiple purposes in food and drink production, medical applications, cosmetics, and biodegradable polymers made from its derivative polylactic acid (PLA). The market experiences fast growth because both environmental awareness and consumer interest in bio-based alternatives to petroleum-based products are increasing. Customers who prefer natural and clean-label ingredients now drive lactic acid usage across food preservation, personal care, and health goods. Market growth depends heavily on the increasing demand for biodegradable packaging and the expanding applications of PLA across the 3D printing, textile, and agricultural industries.

The lactic acid market experiences substantial growth because of supportive government rules, together with technological progress. Modern fermentation processes utilize genetically modified microorganisms together with ongoing production systems to enhance output and minimize production costs. Worldwide governments promote bio-based economies through financial benefits and rules about disposable plastic usage, and funding assistance. Market growth occurs because of these initiatives, which combine with research activities and public-private partnerships.

Raw Material Insights

The sugarcane raw material segment led the lactic acid market in 2024, accounting for the largest revenue share of 37.5%. The high fermentable sugar content of sugarcane enables affordable lactic acid production at reduced processing costs, which leads to its market dominance. The production of lactic acid benefits from sugarcane because it offers sustainable and profitable feedstock qualities based on its renewable nature and widespread availability in key manufacturing areas. Manufacturing companies choose sugarcane more frequently because it delivers consistent quality and works effectively with large-scale fermentation systems. The increasing demand for sugarcane-derived lactic acid results from both rising environmental awareness and the requirement for bio-based materials, especially for manufacturing biodegradable polylactic acid (PLA) plastics.

During the forecast period, the yeast extract segment is expected to experience the fastest CAGR in the lactic acid market. The production of lactic acid through microbial fermentation achieves higher efficiency because yeast extract supplies essential nitrogen along with vitamins and growth factors. Yeast extract has gained popularity as companies pursue affordable, high-performance nutrient solutions to enhance production yields and minimize manufacturing durations. The natural composition of yeast extract, together with its non-GMO status, aligns with the rising demand for sustainable, clean-label ingredients. The manufacturing of bio-based chemicals together with advanced fermentation technologies will push yeast extract to become a primary growth factor throughout the next several years.

Application insights

In 2024, the polylactic acid (PLA) segment held the highest revenue share of 28.4% in the lactic acid market. The rising demand for biodegradable and compostable plastics across the consumer goods, packaging, textile, and agricultural sectors primarily drove this market growth. The environmental benefits of PLA as a lactic acid derivative make it an attractive replacement for petroleum-based polymers that align with increasing environmental regulations and corporate sustainability targets. The industry dominance of PLA was strengthened through its rising biomedical application usage and 3D printing adoption, and single-use product applications. PLA's market leadership as the main revenue source of the lactic acid industry became secured because rising consumer awareness and corporate sustainability efforts pushed the market toward PLA-based solutions.

The pharmaceuticals segment in the lactic acid market is expected to register the fastest CAGR throughout the forecast timeframe. The rising pharmaceutical applications of lactic acid in drug development and controlled delivery systems, and pharmaceutical pH regulation drive this market growth. Lactic acid serves as an excellent material for creating biodegradable implants and polylactic acid (PLA) surgical sutures since it is non-toxic and biocompatible. The market experiences growth because of rising healthcare expenditure, advanced medication delivery systems, and increased demand for personalized medical treatments. The market growth also benefits from regulations supporting safe bio-based medicinal ingredients, which drives rapid expansion in the lactic acid sector.

Regional Insights

North America led the lactic acid market with the largest revenue share of 45.4% during 2024. The rising need for bio-based sustainable products in the food and beverage, packaging, and pharmaceutical industries drives this market leadership. The region leads the PLA adoption because of its favorable regulatory framework, which includes single-use plastic bans and green innovation incentives. The region demonstrates its market dominance because of its key market players, advanced research capabilities, and developed industrial base. North America's sale of lactic acid grows because consumers become more aware of environmental sustainability and choose products that support health.

Europe Lactic Acid Market Trends

Europe's lactic acid market generated 19.7% revenue share during 2024. The substantial market share of lactic acid in this region results from European environmental regulations, together with its proactive approach to sustainable practices, which promote PLA and other biodegradable materials. The implementation of severe European plastic waste regulations has led to rising lactic acid demand for textile, agricultural, and packaging applications. The personal care sector, along with the pharmaceutical industry in Europe, maintains a stable demand for lactic acid. Market growth in the region receives additional support from the region's green technology focus, together with R&D investments. Consumer demand for natural and environmentally friendly products helps maintain the requirement for lactic acid in specific European sectors.

Asia Pacific Lactic Acid Market Trends

The Asia Pacific lactic acid market secured a substantial market share of 25.3% during 2024. The expanding industrial activities, along with the increasing food and beverage sector and sustainable material usage in China, India, and Japan, drive this market growth. The region possesses an abundant agricultural foundation, which ensures abundant raw material supplies of corn and sugarcane for lactic acid manufacturing. Government initiatives supporting biodegradable polymers, along with rising environmental awareness, drive the accelerated adoption of polylactic acid (PLA). The market demand grows because of the pharmaceutical and personal care sector growth, and increasing consumer demand for natural and eco-friendly products. The market supremacy of this region grows stronger through expanding foreign investments, together with advancements in domestic production technology.

Key Lactic Acid Companies:

The following are the leading companies in the lactic acid market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Henan Jindan Lactic Acid Technology Co. Ltd.

- Galactic

- Jungbunzlauer Suisse AG

- Musashino Chemical (China) Co., Ltd

- Corbion

- thyssenkrupp AG

- Cellulac

- Vaishnavi Bio Tech

- Dow

- Danimer Scientific

- Others

Recent Developments

- In December 2023, the introduction of SULAC technology by Sulzer responds to the increasing market need for lactic acid by making it possible for it to be efficiently converted into lactide, a crucial step in the production of polylactic acid (PLA). By expanding access to premium biopolymers and facilitating the broader use of sustainable plastics, this development strengthens Sulzer's position as a pioneer in the PLA value chain and circular manufacturing.

- In May 2023, the collaboration between Jindan New Biomaterials and Sulzer demonstrates the rising market demand for lactic acid due to its application in the production of polylactic acid (PLA), a biobased plastic. With a projected yearly production of 75,000 tonnes of PLA for use in packaging, molded products, and fiber applications, the agreement shows China's growing bioplastics sector as well as significant momentum toward sustainable, circular manufacturing techniques.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the lactic acid market based on the below-mentioned segments:

Global Lactic Acid Market, By Raw Material

- Corn

- Sugarcane

- Cassava

- Yeast Extract

- Other Crops

Global Lactic Acid Market, By Application

- Industrial

- Food & Beverages

- Pharmaceuticals

- Personal Care

- Polylactic Acid

- Other Applications

Global Lactic Acid Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa