Global Hemp Protein Powder Market Size To Exceed USD 818.3 Million by 2033

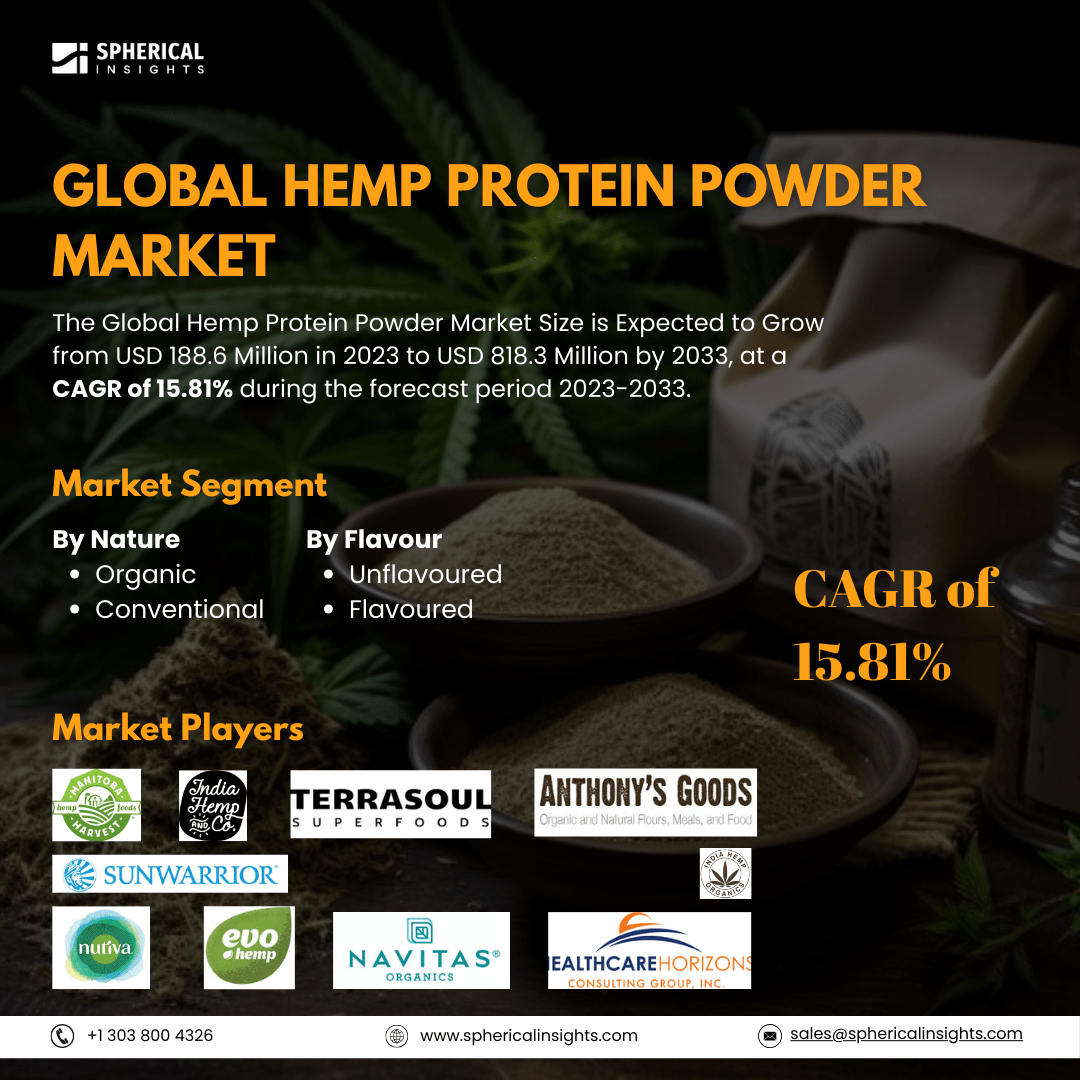

According to a research report published by Spherical Insights & Consulting, The Global Hemp Protein Powder Market Size is Expected to Grow from USD 188.6 Million in 2023 to USD 818.3 Million by 2033, at a CAGR of 15.81% during the forecast period 2023-2033.

Browse 210 Market Data Tables and 45 Figures Spread Through 190 Pages and In-Depth TOC On the Global Hemp Protein Powder Market Size, Share, and COVID-19 Impact Analysis, By Nature (Organic and Conventional), By Flavor (Unflavored and Flavored), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Hemp protein is a good source of all the essential amino acids required to fulfill human protein requirements. This is due to their high fiber content, hemp proteins reduce the risk of heart disease, type-2 diabetes, constipation, and diverticular disease. Hemp proteins are easily digestible and are also used as an active ingredient in smoothies and shakes. Furthermore, the key growth driver towards the hemp protein market is the widespread usage in the manufacturing of several protein-enriched foods and protein supplements. The main driver of demand for hemp protein is the increasing demand for hempseed oil along with growing health awareness among consumers. In addition, increasing demand for nutritional food items and new product launches are also increasing the overall demand for the hemp protein market. The upgraded supply chain to ensure product availability also acts as a leading driver for raising the demand of the hemp protein market on a worldwide level. Moreover, the increasing disposable income and swift change in consumer demand for vegan food items are also propelling the growth of the hemp protein market. However, the cost of production being too high and strict policies and regulations are anticipated to be a constraint towards the development of the hemp protein market; while the volatile prices of raw material can pose a challenge to the growth of the market.

The conventional segment held the largest share in 2023 and is estimated to grow at a significant CAGR during the projected period.

Based on its nature, the global hemp protein powder market is divided into organic and conventional. Among these, the conventional segment held the largest share in 2023 and is estimated to grow at a significant CAGR during the projected period. Traditional hemp protein powder is generally less expensive than organic or specialty hemp protein powder. Its lower price point ensures that it is affordable to a wider consumer base who are looking for value for money when making their purchasing decisions.

The flavored segment held the largest share in 2023 and is estimated to grow at a significant CAGR during the forecast period.

Based on the flavor, the global hemp protein powder market is divided into unflavored and flavored. Among these, the flavored segment held the largest share in 2023 and is estimated to grow at a significant CAGR during the forecast period. Flavored hemp protein powder is more palatable than its unflavored version, which can taste natural and earthy and may be less desirable to some consumers. Chocolate, vanilla, berry, or coffee flavors can cover up the hemp flavor and make the protein powder more palatable to consume.

North America is anticipated to hold the highest share of the global hemp protein powder market over the projected period.

North America is anticipated to hold the highest share of the global hemp protein powder market over the projected period. North America, specifically the United States and Canada, has led the way in innovating and marketing hemp products, such as hemp protein powder. The continent enjoys a longer history of growing hemp and enabling regulations conducive to the manufacture and sale of hemp-derived products. North American firms are product innovators, innovating new formulas, flavors, and package types for hemp protein powder constantly.

Asia Pacific is estimated to grow at the fastest CAGR of the global hemp protein powder market during the forecast period. The growing health and wellness sector in the Asia Pacific involves an increasing population of consumers willing to spend on functional foods and dietary supplements. Hemp protein powder comes under this category as one of the widely used choices for nutritional upgrades. The growing availability of hemp protein powder over the internet and in health food stores has increased its reach among consumers in the Asia Pacific region.

Company Profiling

Major vendors in the global hemp protein powder market are Manitoba Harvest, Navitas Organics, Nutiva, Evo Hemp, Sunwarrior, India Hemp and Co., Terrasoul Superfoods, India Hemp Organics, Anthonys Goods, Health Horizons, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2023, hemperella rolled out a new range of groundbreaking hemp-based superfood products, hemp protein powder, into 900 LIDL outlets in Poland and 400 LIDL outlets throughout the Netherlands. The move was staged to position hemperella as the top hemp Superfood brand for customers who desire to live a healthy lifestyle.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global hemp protein powder market based on the below-mentioned segments:

Global Hemp Protein Powder Market, By Nature

Global Hemp Protein Powder Market, By Flavor

Global Hemp Protein Powder Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa