Global Herbal Shampoo Market Insights Forecasts To 2035

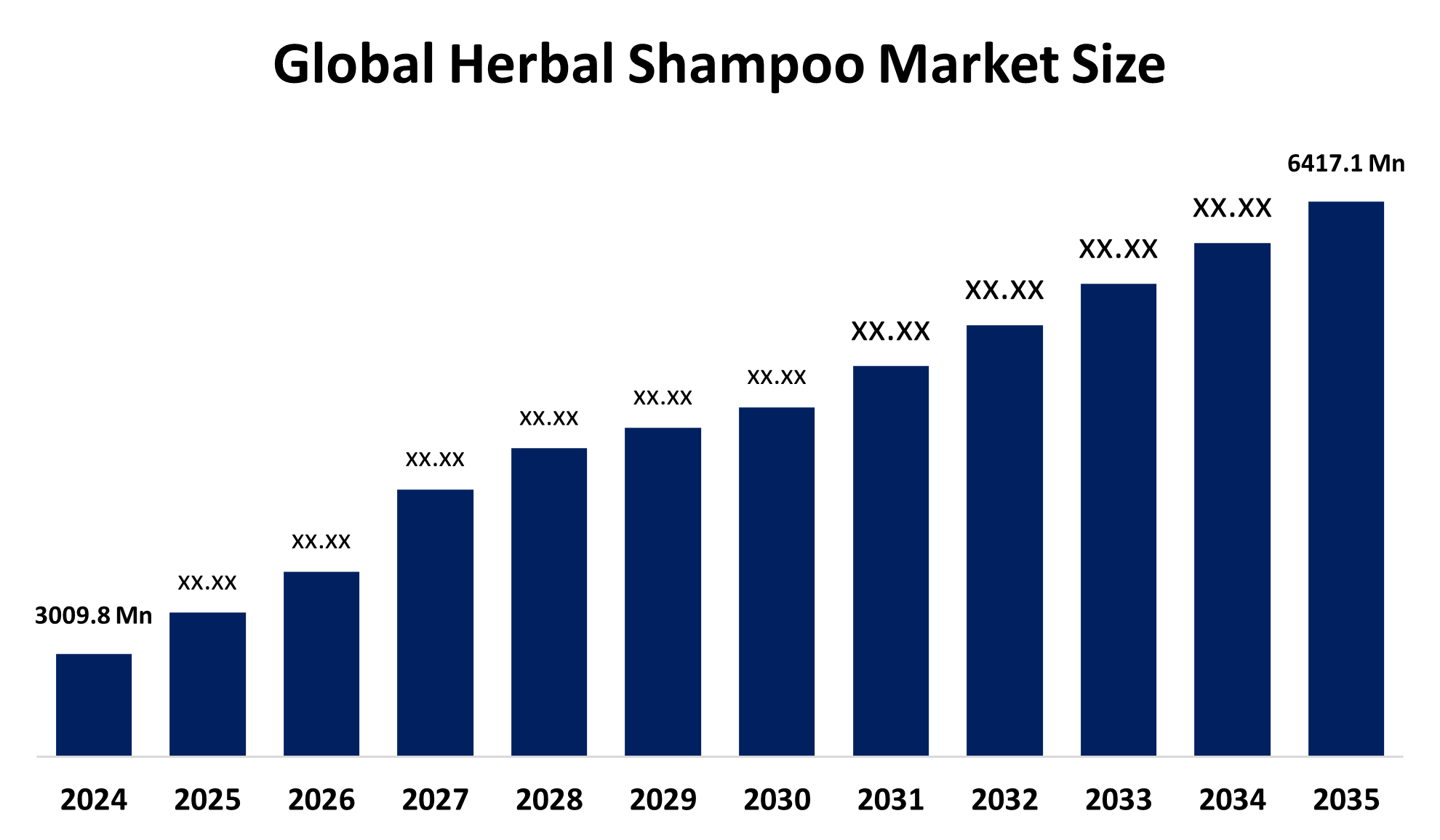

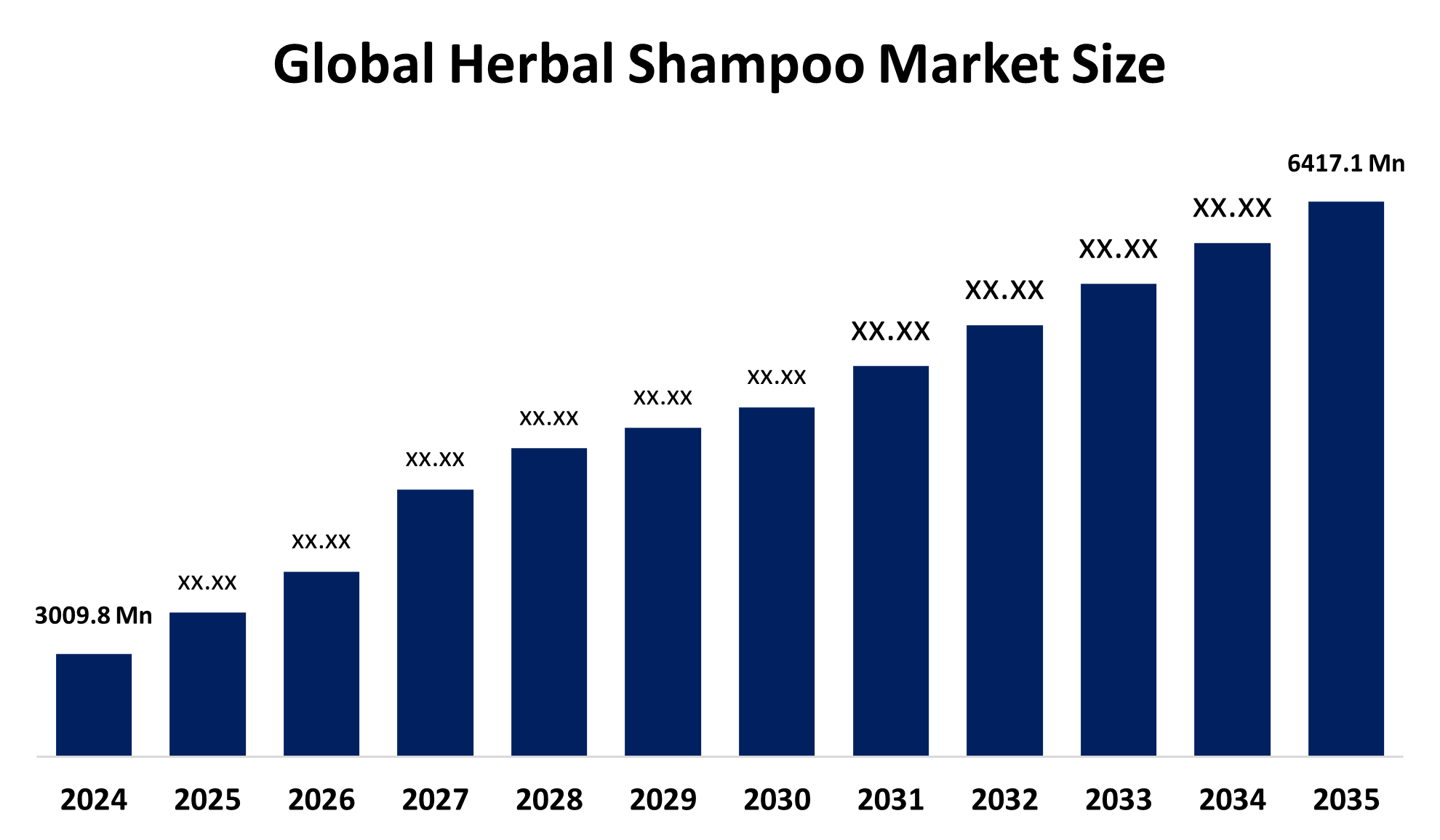

- The Global Herbal Shampoo Market Size Was Estimated at USD 3009.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.13% from 2025 to 2035

- The Worldwide Herbal Shampoo Market Size is Expected to Reach USD 6417.1 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Herbal Shampoo Market

The global herbal shampoo market refers to the segment of the personal care industry that offers shampoos made from natural, plant-based ingredients such as herbs, essential oils, and organic compounds. These products serve as a healthier alternative to traditional shampoos, which often contain synthetic chemicals. Herbal shampoos are designed to cater to a variety of hair care needs, including scalp health, hair growth, and dandruff control. The market features a wide range of offerings, with different formulations targeting specific concerns such as oily hair, dry hair, and sensitive scalps. Major brands and new entrants are increasingly focusing on using high-quality, eco-friendly ingredients to differentiate their products. Innovation in product formulations continues to evolve as brands incorporate exotic herbs and essential oils, creating unique blends to meet consumer demand for natural beauty solutions. As consumer preferences continue to shift toward organic and natural personal care products, the herbal shampoo market remains poised for growth.

Attractive Opportunities in the Herbal Shampoo Market

- Offering customized herbal shampoos tailored to individual hair types, concerns (like dandruff or thinning), or scalp conditions. Consumers are increasingly looking for products that meet their specific needs, creating a niche for personalized formulations.

- There’s a growing demand for eco-friendly packaging (e.g., biodegradable or refillable options) and sustainable ingredient sourcing. Brands that align with sustainability will resonate with consumers seeking environmentally conscious products.

- Developing specialized herbal shampoos for niche groups such as children, aging consumers, or men. This could include products designed for sensitive skin, hair thinning, or scalp rejuvenation, catering to under-served market segments.

- Collaborating with indigenous communities to source authentic, rare herbs for shampoo formulations can provide unique selling points. It also supports fair trade and ethical sourcing, which are increasingly important to consumers.

Global Herbal Shampoo Market Dynamics

DRIVER: Increasing consumer awareness about the harmful effects of synthetic chemicals

The growth of the global herbal shampoo market is primarily driven by increasing consumer awareness about the harmful effects of synthetic chemicals commonly found in traditional hair care products. As more people become conscious of the impact these chemicals can have on health and the environment, there is a growing shift towards natural and organic alternatives. The rising popularity of wellness and self-care also plays a crucial role, as consumers seek products that not only beautify but also promote overall well-being. Additionally, the increasing demand for eco-friendly and sustainable products further supports the market, as consumers look for items that align with their ethical values. The rise of social media and influencer culture has amplified the demand for natural beauty products, with many influencers endorsing herbal and organic solutions. Furthermore, innovation in product formulations, such as the incorporation of rare herbs and plant-based oils, has created diverse options, attracting a broader consumer base.

RESTRAINT: Higher cost of production associated with natural and organic ingredients

Despite the growth of the herbal shampoo market, several factors act as restraints to its expansion. One major challenge is the higher cost of production associated with natural and organic ingredients, which often results in premium pricing for herbal shampoos. This can limit their accessibility to price-sensitive consumers, especially in competitive markets where synthetic shampoos are more affordable. Additionally, some consumers may be skeptical about the effectiveness of herbal shampoos compared to conventional, chemically formulated alternatives, leading to hesitation in adoption. The slow rate of consumer education about the benefits of herbal ingredients also affects market penetration, as traditional hair care products remain deeply ingrained in many routines. Moreover, the variability in the quality and sourcing of herbal ingredients can lead to inconsistencies in product effectiveness, which may impact consumer trust. Lastly, regulatory challenges around the certification and standardization of natural ingredients can complicate production and marketing efforts.

OPPORTUNITY: Rise of personalized hair care

The herbal shampoo market offers unique opportunities beyond traditional growth factors. One key opportunity is the rise of personalized hair care, where brands can create shampoos tailored to individual needs, like hair type or specific scalp concerns. Another chance lies in connecting herbal shampoos with wellness trends, offering bundled treatments or products that combine hair care with aromatherapy. There’s also growing demand for products targeting specific groups, like children's shampoos or options for aging hair. Companies can stand out by focusing on sustainable practices, such as eco-friendly packaging or refillable bottles. Additionally, partnering with indigenous communities to source rare, authentic herbs could strengthen brand credibility and appeal to conscious consumers looking for ethical and sustainable options. These approaches can help brands tap into new markets and build deeper connections with their customers.

CHALLENGES: Limited consumer awareness around the true benefits and effectiveness of herbal ingredients

One significant hurdle is limited consumer awareness around the true benefits and effectiveness of herbal ingredients. Many consumers still associate natural products with being less effective compared to chemical-based alternatives, which can slow market growth. Additionally, supply chain complexities pose challenges, as sourcing high-quality, organic herbs can be inconsistent due to climate conditions or limited availability, affecting production stability. This unpredictability in ingredient supply can lead to delays or quality inconsistencies in products. Moreover, brand differentiation is becoming increasingly difficult in a crowded market, with many brands offering similar formulations, making it challenging for new players to stand out. The market is also affected by consumer skepticism regarding "greenwashing", where brands may falsely claim to be natural or eco-friendly without offering truly sustainable products. Overcoming these challenges requires effective communication, transparency, and innovation to maintain consumer trust and loyalty.

Global Herbal Shampoo Market Ecosystem Analysis

The global herbal shampoo market ecosystem includes various key players. Raw material suppliers provide natural ingredients, while manufacturers create and produce the shampoos. Distributors make these products available through retail and online channels. Consumers drive demand, with more people seeking natural alternatives. Retailers help make these shampoos accessible, and marketing, often powered by influencers, raises awareness. Regulatory bodies ensure the products are safe and meet standards, while sustainability advocates push for eco-friendly practices. Each of these elements works together to grow the market and meet consumer expectations.

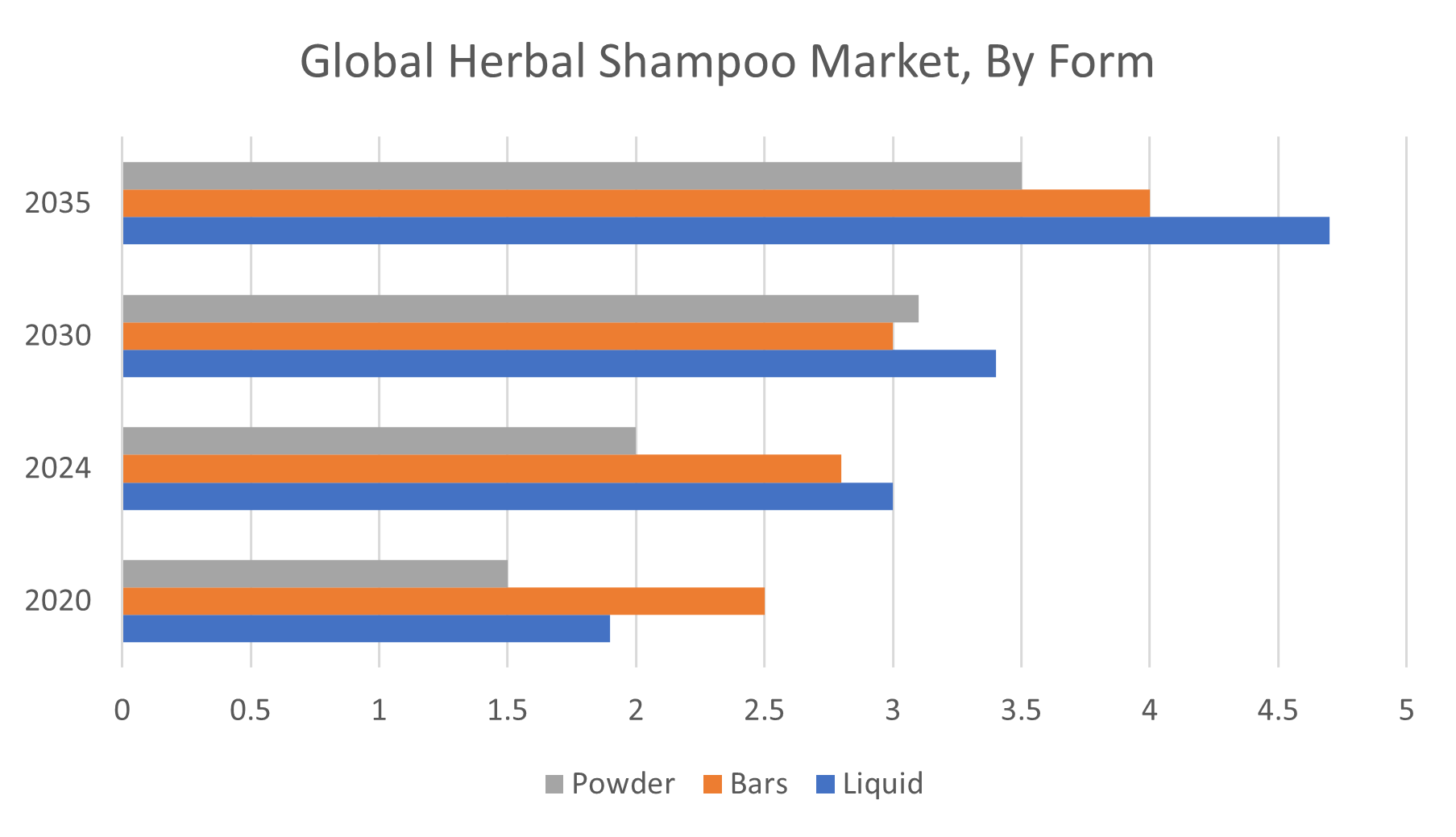

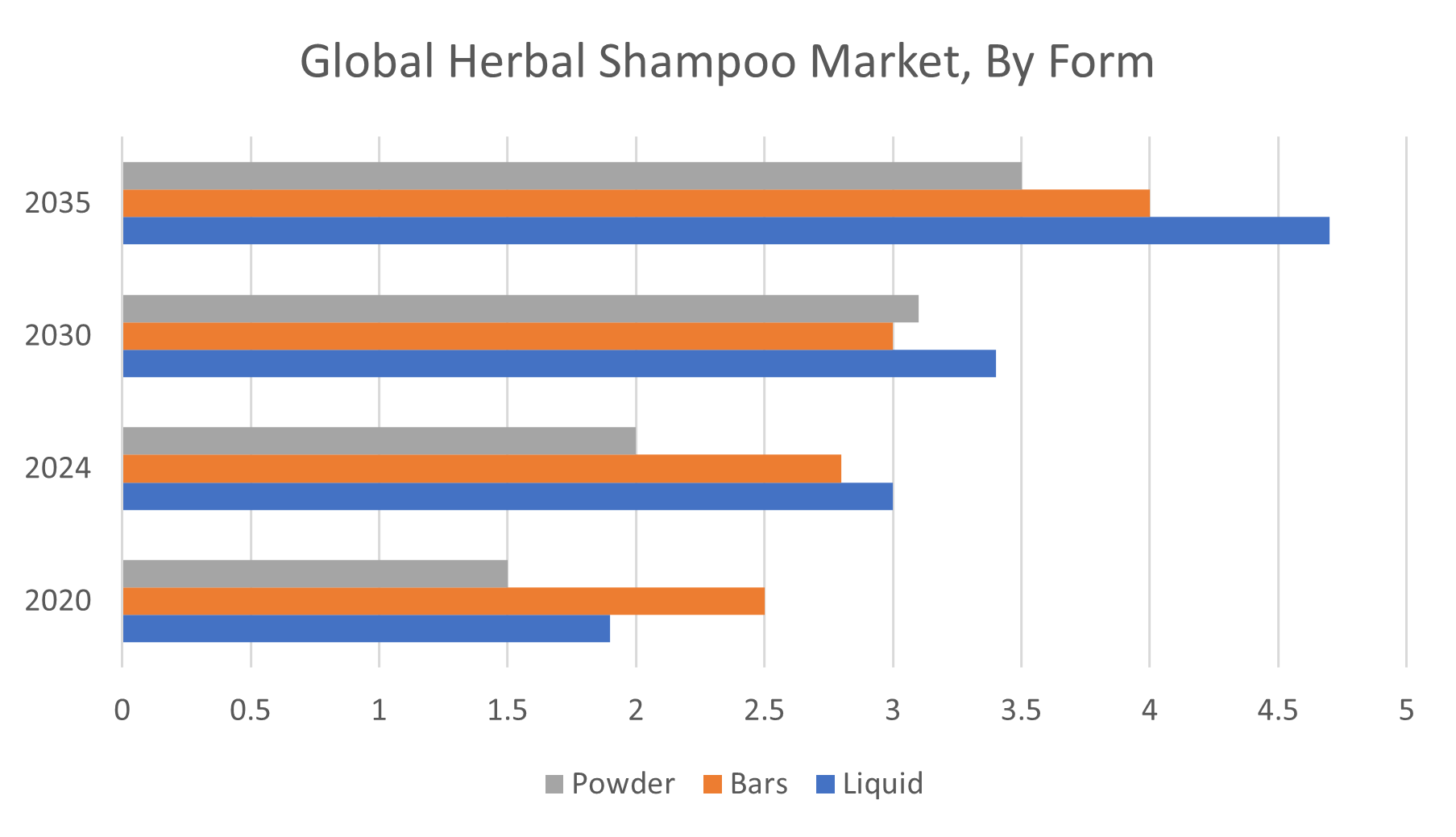

Based on the form, the liquid segment held a significant market share and is expected to grow at a substantial CAGR over the forecast period

Liquid herbal shampoos are popular due to their ease of use, effectiveness, and versatility, making them the preferred choice among consumers. As more people shift towards natural and organic personal care products, liquid herbal shampoos continue to gain traction for their gentle formulations, catering to a variety of hair concerns. The segment's growth is also driven by innovations in liquid shampoo formulations, with brands introducing new herbal ingredients and advanced features to attract a broader consumer base.

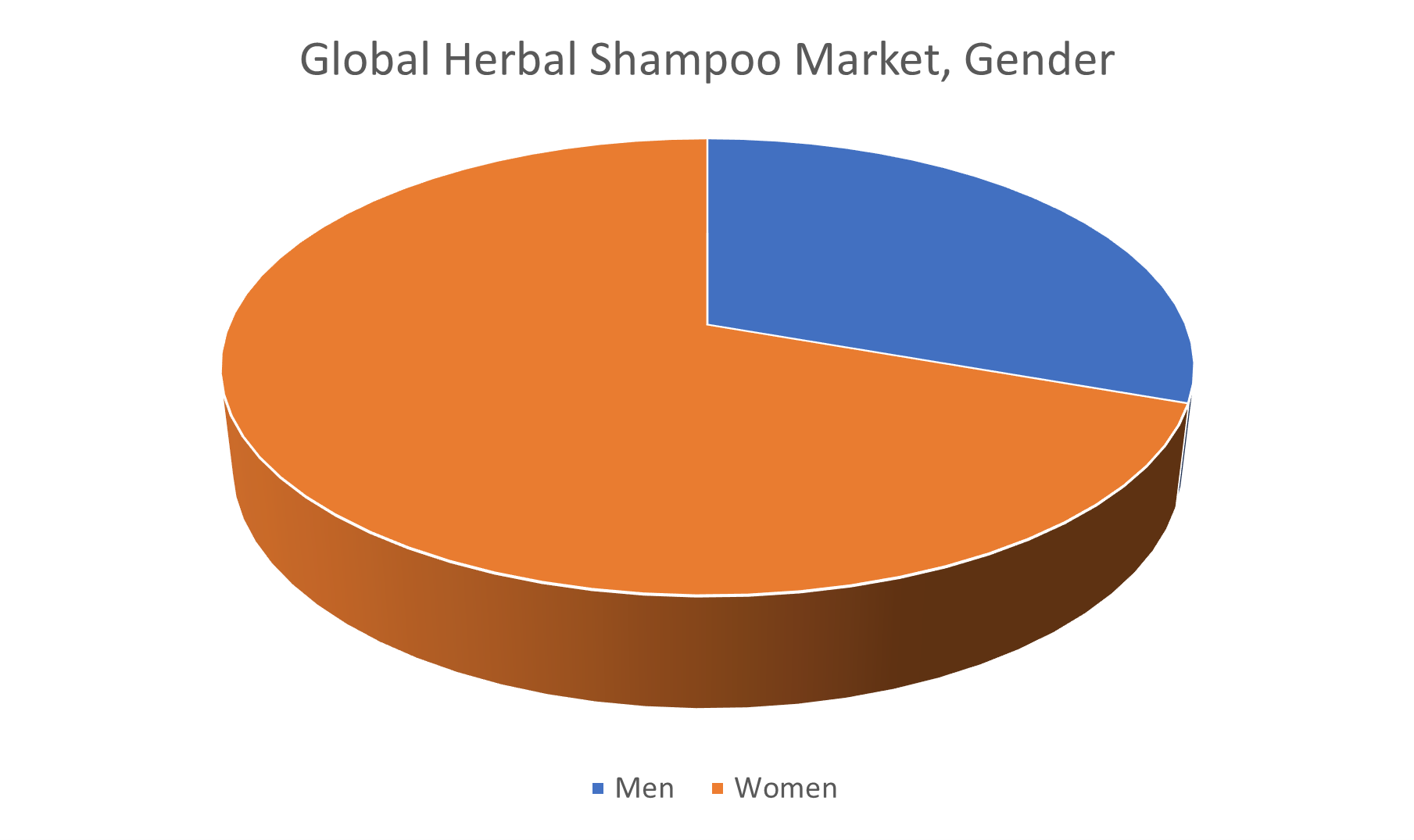

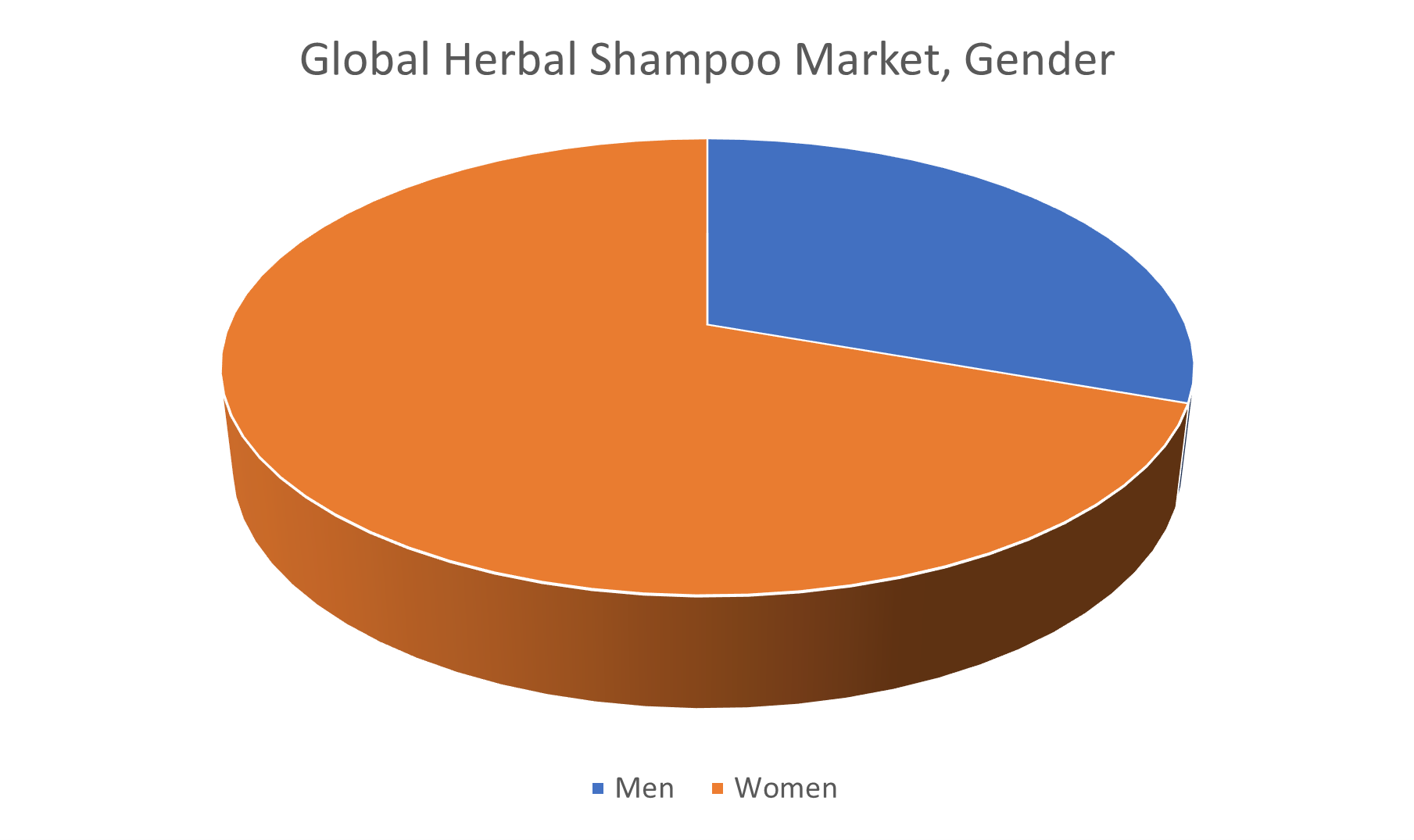

Based on the gender, the women segment held the largest market share and is expected to grow at a significant CAGR over the forecast period

Women are the primary consumers of herbal shampoos due to their heightened focus on hair care and wellness. The growing demand for natural, chemical-free products among women, especially for addressing issues like hair fall, dandruff, and scalp health, is driving this growth. Additionally, the increasing awareness of sustainable beauty products and the preference for organic ingredients are further contributing to the segment's expansion. As brands continue to develop more specialized and innovative formulations for women's hair care needs, this segment is expected to maintain its dominance and see continued growth.

Asia Pacific is anticipated to hold the largest market share of the herbal shampoo market during the forecast period

Asia Pacific is anticipated to hold the largest market share of the herbal shampoo market during the forecast period. This region has seen a significant rise in consumer demand for natural and herbal-based personal care products, driven by increasing awareness of the harmful effects of chemicals in conventional hair care products. The strong cultural tradition of using herbal and natural ingredients in personal care routines also supports the popularity of herbal shampoos. Additionally, the growing middle-class population, rising disposable income, and shift towards healthier lifestyle choices in countries like India, China, and Southeast Asia contribute to the market's growth. As consumers increasingly prioritize eco-friendly, sustainable, and organic products, the demand for herbal shampoos is expected to continue expanding in Asia Pacific.

North America is expected to grow at the fastest CAGR in the herbal shampoo market during the forecast period

North America is expected to grow at the fastest CAGR in the herbal shampoo market during the forecast period. This growth can be attributed to the increasing consumer shift towards natural and organic personal care products, as awareness of the harmful effects of chemicals in conventional shampoos rises. In North America, consumers are becoming more conscious of health and wellness, driving demand for herbal shampoos that promote healthier hair and scalp care. The growing popularity of eco-friendly, sustainable, and cruelty-free products also plays a key role in this growth. Moreover, the strong presence of major herbal shampoo brands and the expanding trend of clean beauty are contributing factors. As consumers in the region continue to seek out products with natural ingredients, the herbal shampoo market in North America is poised for significant expansion.

Recent Development

- In March 2023, Himalaya Herbal Healthcare launched the “Himalaya Gentle Baby Shampoo”, a plant-based product designed specifically for sensitive scalps, marking an expansion in the organic care category.

- In July 2023, Lush Cosmetics launched their “Lush Solid Herbal Shampoos”, offering a more eco-friendly option with fresh, organic ingredients and zero packaging, in line with their sustainability efforts.

Key Market Players

KEY PLAYERS IN THE HERBAL SHAMPOO MARKET INCLUDE

- Himalaya Herbal Healthcare

- Aveda

- L'Oréal

- P&G

- Khadi Natural

- The Body Shop

- Mamaearth

- Biotique

- Lush Cosmetics

- Schwarzkopf

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the herbal shampoo market based on the below-mentioned segments:

Global Herbal Shampoo Market, By Form

Global Herbal Shampoo Market, By Gender

Global Herbal Shampoo Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa