Global Fluid Catalytic Cracking Market Insights Forecasts to 2035

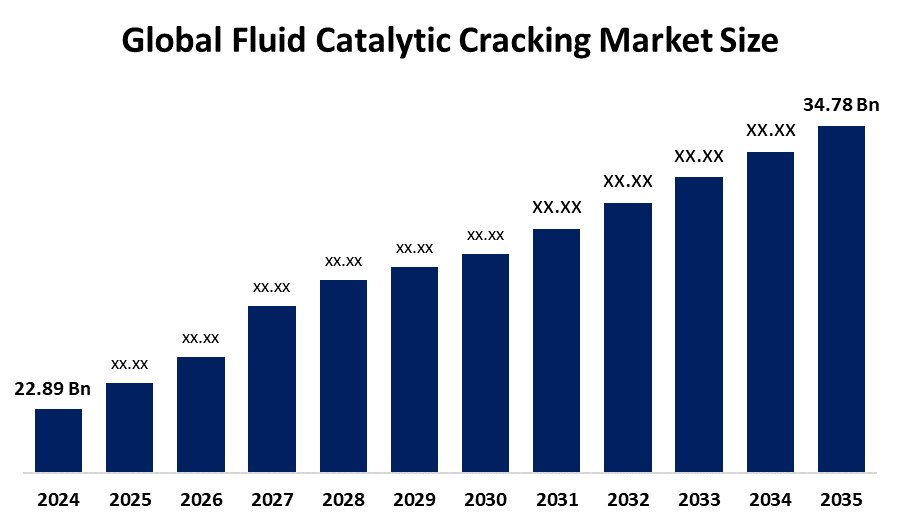

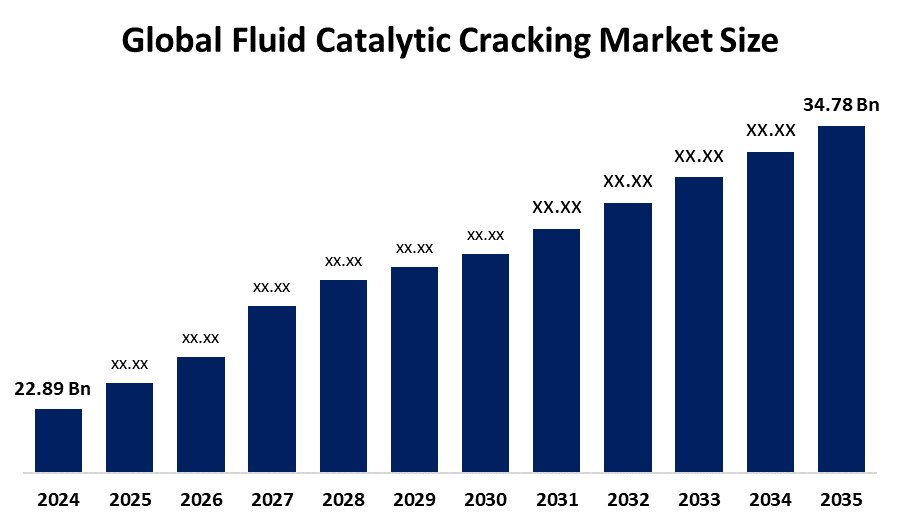

- The Global Fluid Catalytic Cracking Market Size Was Estimated at USD 22.89 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.88% from 2025 to 2035

- The Worldwide Fluid Catalytic Cracking Market Size is Expected to Reach USD 34.78 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Fluid Catalytic Cracking Market

The global fluid catalytic cracking market centers around a refining process that breaks down heavy hydrocarbon fractions into lighter, more valuable products like gasoline, diesel, and petrochemical feedstocks. FCC is a key technology used in petroleum refineries to improve the yield of high-demand fuels and chemicals by using a catalyst to crack large molecules at high temperatures. The process increases refinery efficiency and helps produce cleaner fuels that comply with environmental standards. FCC units consist of reactors, regenerators, and catalyst circulation systems that work continuously to maximize output. Innovations in catalyst formulations and process optimization have enhanced the selectivity and longevity of FCC operations. This market includes equipment manufacturers, catalyst producers, and refinery operators who collaborate to maintain and upgrade FCC units. Overall, the FCC market plays an essential role in the refining industry by enabling the transformation of crude oil into essential fuels and chemical intermediates used globally.

Attractive Opportunities in the Fluid Catalytic Cracking Market

- Advanced catalysts designed for heavier, lower-quality crude oils improve fuel yield and efficiency. They offer higher resistance to deactivation and reduce coke formation. This helps refineries cut costs and meet stricter fuel and emission standards.

- Upgrading old FCC units with modern technologies boosts efficiency and reduces emissions. Retrofitting is more cost-effective than building new units and extends refinery life. It enables compliance with evolving environmental regulations while increasing output.

Global Fluid Catalytic Cracking Market Dynamics

DRIVER: Technological advancements in catalyst development

The growth of the global fluid catalytic cracking market is primarily driven by the increasing demand for high-quality fuels such as gasoline and diesel, which are essential for transportation and industrial applications. As global energy consumption rises, refineries are investing in advanced FCC units to enhance fuel yield and improve processing efficiency. Technological advancements in catalyst development have also contributed significantly by increasing catalyst activity, selectivity, and durability, resulting in better conversion rates and reduced operational costs. Additionally, stringent environmental regulations worldwide encourage the production of cleaner fuels with lower sulfur content, pushing refineries to upgrade their FCC technologies. The expansion of petrochemical industries further fuels demand for FCC-derived products like olefins, which are key raw materials. Overall, the combination of rising fuel consumption, catalyst innovation, and regulatory compliance fosters steady growth in the FCC market, supporting the refining sector’s ability to meet evolving energy needs sustainably.

RESTRAINT: Aging refinery infrastructure in some regions poses challenges for integrating advanced FCC technologies

High capital and operational costs associated with installing and maintaining FCC units can be a significant barrier, especially for smaller or mid-sized refineries. Additionally, fluctuations in crude oil prices create uncertainty, affecting refinery investments and profitability. The complexity of FCC technology requires skilled personnel and stringent safety measures, increasing operational challenges. Environmental concerns, including emissions from FCC units, necessitate costly upgrades and adherence to strict regulations, which can strain refinery budgets. Moreover, the shift towards renewable energy sources and alternative fuels may reduce long-term reliance on traditional petroleum refining processes, potentially limiting FCC demand. Lastly, aging refinery infrastructure in some regions poses challenges for integrating advanced FCC technologies, slowing market expansion. These factors collectively create hurdles for rapid growth in the FCC market despite its essential role in fuel production.

OPPORTUNITY: Development and adoption of next-generation catalysts that can handle heavier and more complex feedstocks

One key opportunity lies in the development and adoption of next-generation catalysts that can handle heavier and more complex feedstocks, enabling refineries to process lower-quality crude oils efficiently. Additionally, digitalization and automation in refinery operations offer potential for optimizing FCC unit performance, reducing downtime, and cutting operational costs. The rising demand for petrochemical feedstocks, especially olefins and aromatics derived from FCC processes, opens avenues for expanding FCC applications beyond traditional fuel production. There is also growing potential in retrofitting existing refineries with advanced FCC technologies to meet evolving environmental standards and improve fuel quality. Moreover, emerging markets with expanding refining capacity provide opportunities for new FCC unit installations. Collaborations between catalyst manufacturers and refinery operators to innovate sustainable solutions further enhance market prospects, positioning the FCC sector for long-term growth amid changing energy landscapes.

CHALLENGES: Managing catalyst deactivation caused by contaminants like metals and coke

One major challenge is managing catalyst deactivation caused by contaminants like metals and coke, which reduces efficiency and increases costs for regeneration or replacement. Maintaining optimal operating conditions in FCC units is complex, requiring precise control over temperature, pressure, and catalyst circulation to ensure consistent product quality and prevent equipment damage. The integration of FCC units with other refinery processes also poses engineering challenges, especially when upgrading older plants to meet modern standards. Additionally, fluctuating feedstock quality demands flexible FCC systems capable of handling diverse crude inputs without compromising performance. Safety concerns related to high-temperature operations and the handling of catalysts require stringent monitoring and maintenance protocols. Finally, balancing environmental compliance with economic feasibility remains a continuous challenge, as refineries strive to reduce emissions without significantly increasing operational costs. These challenges necessitate ongoing innovation and expertise in the FCC sector.

Global Fluid Catalytic Cracking Market Ecosystem Analysis

The global fluid catalytic cracking market ecosystem includes refinery operators who use FCC units to produce fuels and petrochemicals. Catalyst manufacturers develop advanced catalysts to improve efficiency. Equipment and technology providers supply vital FCC components and automation systems. Engineering, procurement, and construction (EPC) firms design and build FCC units. Regulatory bodies enforce environmental and safety standards, influencing operations. Research institutions drive innovation in catalysts and processes. Together, these stakeholders collaborate to support and advance the FCC market amid changing energy needs.

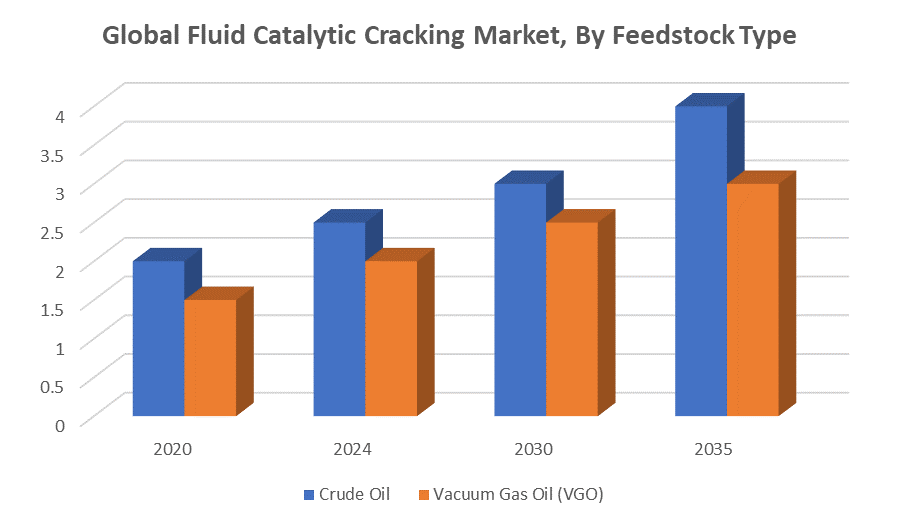

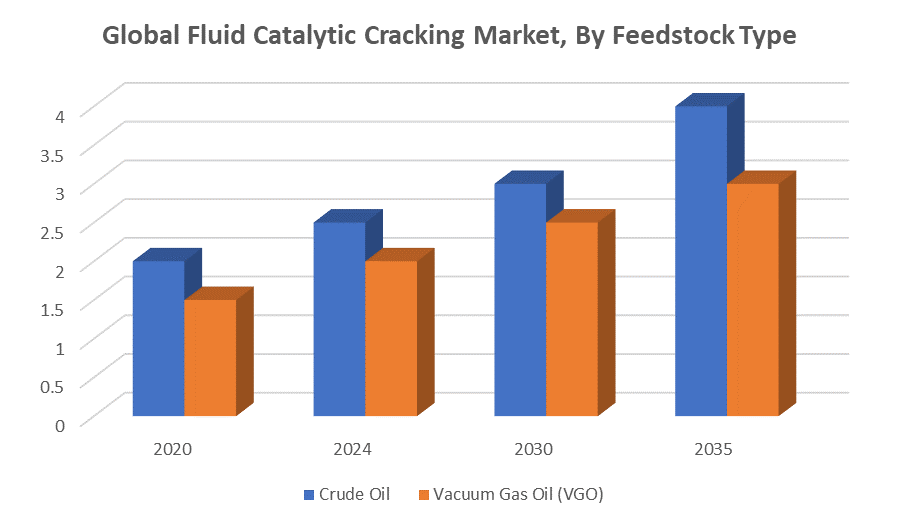

Based on the feedstock type, the crude oil segment in the fluid catalytic cracking market is expected to grow at the highest CAGR over the forecast period

Crude oil segment growth is largely driven by the continued reliance of refineries on crude oil as the primary raw material for producing valuable fuels like gasoline and diesel. FCC units are essential for processing heavy crude fractions into lighter, high-demand products, which makes crude oil feedstock crucial for refinery operations. Additionally, advances in FCC technology enable better handling of heavier and more complex crude oils, increasing the segment’s attractiveness. As global energy demand rises and refineries seek to maximize output from available crude resources, the crude oil feedstock segment will maintain a leading position in the FCC market’s growth trajectory.

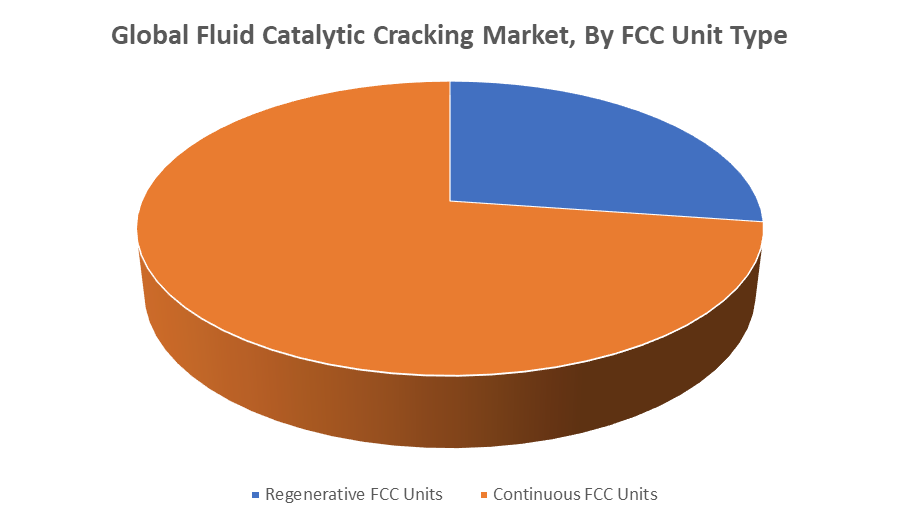

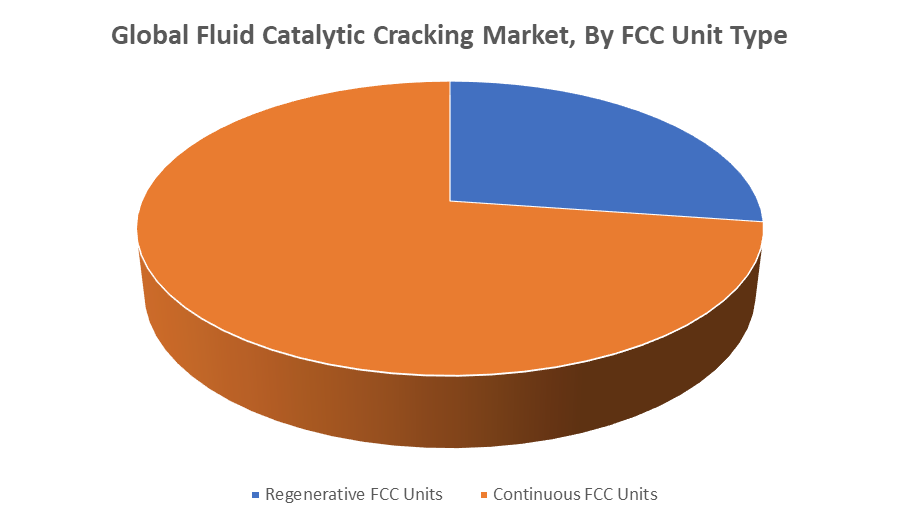

Based on the FCC unit type, the continuous FCC units segment held the largest revenue share and is expected to grow at a significant CAGR over the forecast period

Continuous FCC units operate nonstop, allowing for higher processing capacity and improved efficiency compared to batch or semi-continuous units. This makes them the preferred choice for large-scale refineries aiming to maximize fuel production and maintain steady operations. Their ability to provide consistent output and better catalyst regeneration contributes to lower downtime and operational costs. Additionally, ongoing technological advancements in continuous FCC units enhance their performance and environmental compliance, further driving market growth. As refineries focus on optimizing production and meeting stringent regulations, the demand for continuous FCC units is expected to increase steadily throughout the forecast period.

North America is anticipated to hold the largest market share of the fluid catalytic cracking market during the forecast period

North America is anticipated to hold the largest market share in the fluid catalytic cracking market during the forecast period. This is due to the region’s well-established refining infrastructure and the presence of major petroleum refining companies. Additionally, increasing demand for high-quality fuels and petrochemical products drives investments in upgrading and expanding FCC units. Technological advancements and strict environmental regulations in North America also encourage the adoption of advanced FCC technologies that improve efficiency and reduce emissions. These factors collectively position North America as a leading region in the FCC market, maintaining a dominant share throughout the forecast period.

Asia Pacific is expected to grow at the fastest CAGR in the fluid catalytic cracking market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the fluid catalytic cracking (FCC) market during the forecast period. Rapid industrialization, urbanization, and increasing energy demand in countries like China, India, and Southeast Asia are driving the expansion of refining capacities. Growing transportation sectors and rising consumption of gasoline and diesel further boost the need for efficient FCC units. Additionally, many refineries in the region are upgrading their facilities to meet stricter environmental regulations, adopting advanced FCC technologies. Investments by both public and private sectors in new refinery projects contribute to the accelerating market growth. These factors combined make Asia Pacific the fastest-growing region in the FCC market throughout the forecast period.

Key Market Players

KEY PLAYERS IN THE FLUID CATALYTIC CRACKING MARKET INCLUDE

- BASF SE

- W. R. Grace & Co.

- Albemarle Corporation

- Shell Catalyst & Technologies

- Clariant AG

- Haldor Topsoe

- Axens

- Honeywell UOP

- Johnson Matthey

- China Petrochemical Corporation

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the fluid catalytic cracking market based on the below-mentioned segments:

Global Fluid Catalytic Cracking Market, By Feedstock Type

- Crude Oil

- Vacuum Gas Oil (VGO)

Global Fluid Catalytic Cracking Market, By FCC Unit Type

- Regenerative FCC Units

- Continuous FCC Units

Global Fluid Catalytic Cracking Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa