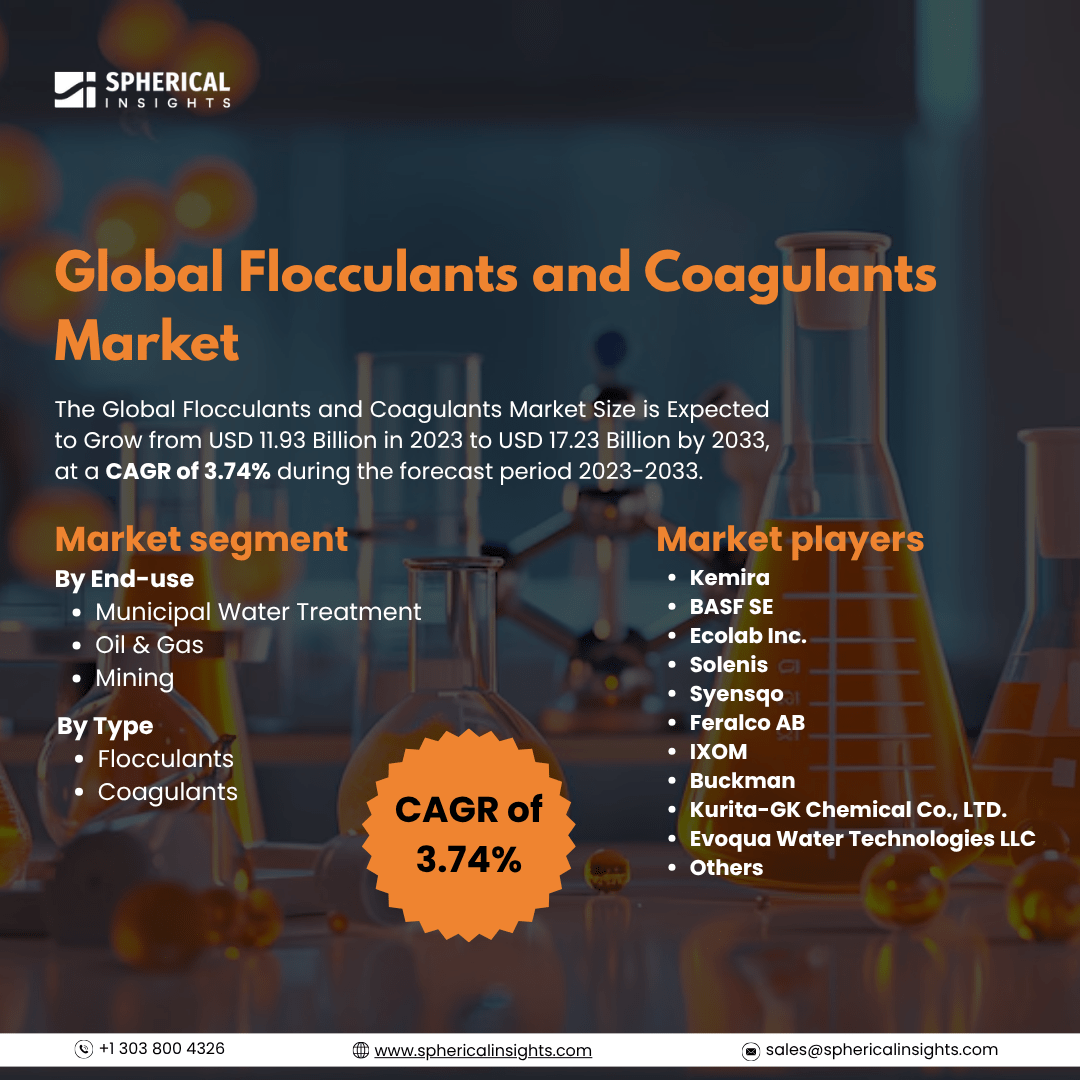

Global Flocculants and Coagulants Market Size To Exceed USD 17.23 Billion By 2033

According to a research report published by Spherical Insights & Consulting, The Global Flocculants and Coagulants Market Size is Expected to Grow from USD 11.93 Billion in 2023 to USD 17.23 Billion by 2033, at a CAGR of 3.74% during the forecast period 2023-2033.

Browse 210 Market Data Tables And 45 Figures Spread Through 190 Pages and In-Depth TOC On The Global Flocculants and Coagulants Market Size, Share, and COVID-19 Impact Analysis, By Type (Flocculants and Coagulants), By End-use (Municipal Water Treatment, Oil & Gas, Mining), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

The market for flocculants and coagulants includes the supply of chemicals used for wastewater and water treatment, mainly for the removal of suspended particles and other contaminants. Similar to polymers, these substances are employed in flocculation and coagulation processes to destabilize, agglomerate, and bind water particles together, making them simpler to remove and separate. The process of flocculation is the formation of larger clumps (flocs) from smaller particles, which facilitates their removal from a liquid. The first stage of coagulation is when a coagulant balances the charge of suspended particles, enabling them to assemble. Furthermore, the global market is mostly driven by strict environmental restrictions. These rules are enforced by governments and regulatory agencies to guarantee the preservation of the environment and water bodies. By making it easier to remove contaminants and suspended solids from wastewater, flocculants and coagulants play a critical role in fulfilling these requirements. However, the high price of these chemicals is one of the main factors limiting the global market.

The coagulants segment dominated the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the global flocculants and coagulants market is divided into flocculants and coagulants. Among these, the coagulants segment dominated the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Chemical compounds called coagulants are used to help particles in a liquid aggregate and create larger particles called flocs. Flotation, filtration, or sedimentation can then be used to easily separate these flocs from the liquid.

The municipal water treatment segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the global flocculants and coagulants market is divided into municipal water treatment, oil & gas, and mining. Among these, the municipal water treatment segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. To guarantee that communities have access to safe and clean drinking water, municipal water treatment is essential. To remove contaminants and suspended particles from the water, coagulants and flocculants are crucial parts of the treatment process.

North America is anticipated to hold the highest share of the global flocculants and coagulants market over the projected period.

North America is anticipated to hold the highest share of the global flocculants and coagulants market over the projected period. Strict government regulations and the presence of major players drive the industry. The expansion of the oil and gas sector has raised the need for coagulants and flocculants, especially in the US market, where shale gas is being used. Additionally, the industry benefits from the region's extensive industrial infrastructure.

Asia Pacific is estimated to grow at the fastest CAGR of the global flocculants and coagulants market during the forecast period. The demand for flocculants and coagulants has increased as a result of Asia Pacific's emergence as a major supplier of clean water resources. It is anticipated that the sector in the region will continue to expand. It is anticipated that the growing use of coagulants in the pharmaceutical and wastewater treatment industries will support market growth. China, Japan, India, and other nations are propelling the Asia Pacific market's expansion.

Company Profiling

Major vendors in the global flocculants and coagulants market are Kemira, BASF SE, Ecolab Inc., Solenis, Syensqo, Feralco AB, IXOM, Buckman, Kurita-GK Chemical Co., LTD., and Evoqua Water Technologies LLC, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, the CURE chemicals product line was introduced by wastewater treatment solutions vendor Gradiant. More than 300 formulations of coagulants and flocculants used in water treatment procedures would be part of the product line.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global flocculants and coagulants market based on the below-mentioned segments:

Global Flocculants and Coagulants Market, By Type

Global Flocculants and Coagulants Market, By End-use

- Municipal Water Treatment

- Oil & Gas

- Mining

Global Flocculants and Coagulants Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa