Fiberglass Fabric Market Summary

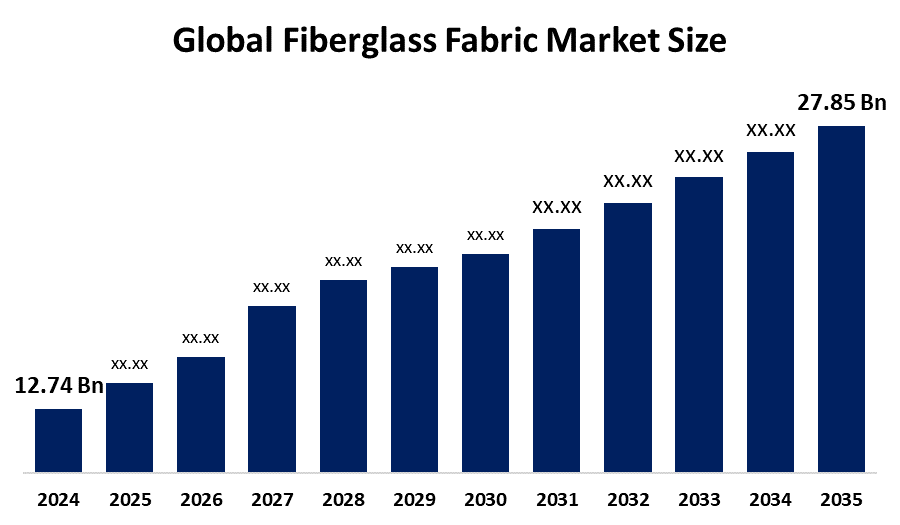

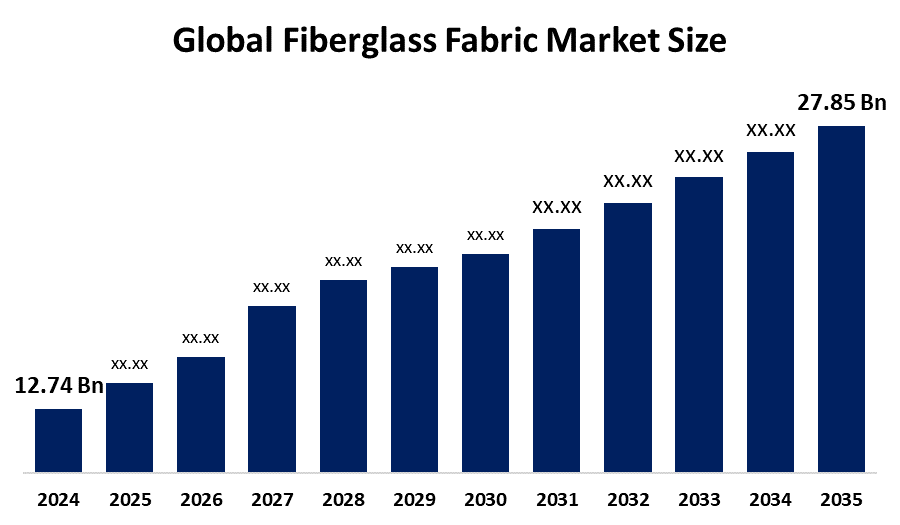

The Global Fiberglass Fabric Market Size Was Estimated at USD 12.74 Billion in 2024 and is Expected to Reach USD 27.85 Billion by 2035, Growing at a CAGR of 7.37% from 2025 to 2035. The market for fiberglass fabric is expanding as a result of rising demand for high-performance, lightweight materials in sectors like construction, automotive, and aerospace.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share of over 40.36% and dominated the market globally.

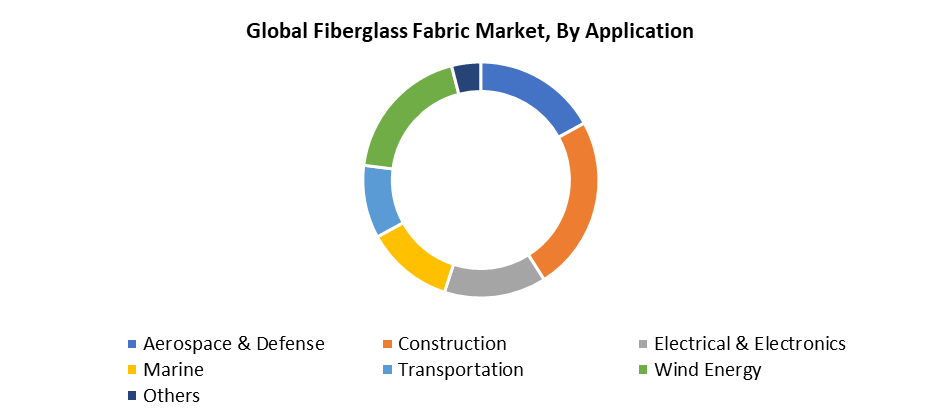

- In 2024, the construction segment had the highest market share by application, accounting for 24.72%.

- In 2024, the E-Glass segment had the biggest market share by product, accounting for 78.61%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 12.74 Billion

- 2035 Projected Market Size: USD 27.85 Billion

- CAGR (2025-2035): 7.37%

- Asia Pacific: Largest market in 2024

The Fiberglass Fabric Market Size represents the industrial sector, which produces and distributes woven glass fiber materials known for their strong and lightweight properties and corrosion resistance, together with thermal insulation capabilities. These materials serve multiple industries, including aerospace and automotive, along with construction, electronics, and marine applications. The market's primary driver is the increasing necessity for lightweight high-strength materials, which enhance performance and fuel economy in automotive and aerospace operations. The market growth stems from both increased infrastructure construction and the rising adoption of composite materials in building projects. Environmental concerns, along with the push for energy-efficient solutions, have led to increased fiberglass utilization in both insulation and wind energy systems.

Modern technological developments have had a substantial influence on the fiberglass fabric market operations. The progress in fiber production methods, combined with new weaving patterns and resin solutions, has expanded product applications while enhancing performance characteristics. Advanced multi-axial and non-crimp textiles now serve as essential components for creating complex structural parts. Government initiatives supporting solar and wind power have increased the demand for composite materials specifically made from fiberglass. The market growth stems from environmental sustainability policies that back up green construction practices and sustainable material usage in North America, Europe, and select Asia-Pacific regions.

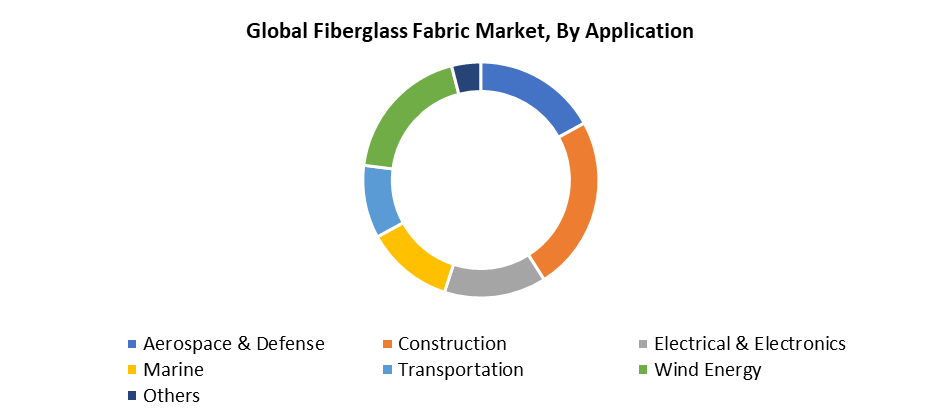

Application Insights

The construction segment dominated the global fiberglass fabric market, holding the largest revenue share of 24.72% in 2024. The material's outstanding properties enable its use for concrete reinforcement and wall reinforcement as well as roofing and insulation applications. The material possesses multiple valuable properties, which include strong tensile resistance and thermal insulation capabilities, and both corrosion resistance and fire retardant characteristics. The increasing infrastructure development in developing countries, together with building sustainability initiatives, has become a major factor boosting product demand. Fiberglass fabric finds widespread use in waterproofing and exterior insulation and finish systems (EIFS), which enhances building durability. Green building standards worldwide will maintain the construction industry as the leading application sector in the future.

The fiberglass fabric market's wind energy segment is anticipated to experience the fastest CAGR during the forecast period. The expanding requirement for wind turbines, along with worldwide increased interest in renewable energy sources, drives this rapid growth. Fiberglass textiles play an essential role in developing lightweight, durable composite materials, which require high strength-to-weight ratios for optimal turbine blade performance. The industry demand for advanced fiberglass textiles will rise because worldwide governments allocate significant funds to wind power infrastructure development while working toward clean energy objectives. The development of advanced fabric technology enables the production of extended lifespan turbine components, which drives market growth in the wind energy sector.

Product Insights

The E-Glass segment held the largest revenue share of 78.61% in 2024 and dominated the worldwide fiberglass fabric market. The electrical-grade glass fiber known as E-Glass is commonly selected because of its outstanding mechanical properties, affordable price, and excellent electrical insulation characteristics. The material possesses qualities that enable multiple sectors, including electronics, automotive, aerospace, and construction, to utilize it effectively. The market dominance of E-Glass results from its flexible nature and predictable results in reinforcement, insulation, and composite material applications. The widespread availability, together with stable production methods of E-Glass, contributes to its wide popularity among consumers. The E-Glass category will maintain its leading position in the fiberglass fabric market because people will continue to require light and strong materials at affordable prices.

The S-Glass segment of the fiberglass fabric market is anticipated to experience the fastest CAGR during the forecast period. The rising popularity of S-Glass in high-performance applications such as aerospace, defense, and advanced automotive components stems from its improved tensile strength and stiffness alongside heat resistance compared to standard glass fibers. Its enhanced mechanical properties make it ideal for demanding environments that require both dependability and longevity. The rapid growth of S-Glass fabric demand results from industries shifting towards sturdy lightweight materials, which enhance productivity and safety measures. High-growth rates in the S-Glass segment stem from technological progress in production methods combined with increased investments in composite materials needed for high-strength applications.

Regional Insights

The Asia Pacific fiberglass fabric industry is led globally by maintaining a 40.36% market share in 2024. The main elements behind this market leadership are the fast-paced infrastructural development, together with urbanization and industrialization activities across China, India, Japan, and South Korea. The expanding automotive sector, along with construction and renewable energy industries, drives a significant increase in fiberglass fabric demand throughout the region. The market continues to grow because governments implement supportive policies, and wind energy investments increase while organizations shift towards lightweight materials with superior performance. The combination of skilled labor availability and cost-effective manufacturing facilities in the Asia Pacific makes it the preferred zone for fiberglass fabric production, which ensures this market segment continues to lead the global market.

North America Fiberglass Fabric Market Trends

The North American fiberglass fabric market demonstrates consistent growth because industrial sectors, including automotive, aerospace, renewable energy, and construction, show strong demand for this material. The market growth of fiberglass fabrics depends on both the region's drive for sustainable materials and sophisticated production process developments. The market experiences expansion because the construction industry adopts durable and energy-saving building materials. Fiberglass composite usage in turbine blades has grown because government programs promote sustainable energy, especially wind power. New fabric production methods, together with improved technology, create products that fulfill the rigorous standards established for the region. The North American fiberglass fabric market will experience steady growth throughout the forecast period because of ongoing infrastructure development, along with increasing green technology investments.

Europe Fiberglass Fabric Market Trends

The European fiberglass fabric market grows significantly because multiple industrial sectors are widely using these materials. The main industries, including automotive, construction, aerospace, and marine sectors, use fiberglass fabrics more frequently because they deliver superior strength combined with lightweight characteristics and corrosion resistance. Fiberglass application in the insulation and wind energy sectors grows because of the shift towards sustainable energy-efficient solutions. The market expands because production technology enhancements both decrease manufacturing costs and enhance material quality. The market expands due to rising infrastructure development and environmental regulations that push for sustainable products. The market faces potential constraints because of expensive raw material costs and competition from alternative composite materials. The market shows strong growth potential because Europe prioritizes sustainable industrial practices alongside innovative approaches.

Key Fiberglass Fabric Companies:

The following are the leading companies in the fiberglass fabric market. These companies collectively hold the largest market share and dictate industry trends.

- Owens Corning

- Hexcel Corporation

- Gurit

- Jushi Group Co. Ltd

- BGF Industries, Inc.

- Others

Recent Developments

- In October 2023, Owens Corning introduced a cutting-edge E-glass fabric designed for wind turbine blade applications that is specifically built for greater strength and fire resistance.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the fiberglass fabric market based on the below-mentioned segments:

Global Fiberglass Fabric Market, By Application

- Aerospace & Defense

- Construction

- Electrical & Electronics

- Marine

- Transportation

- Wind Energy

- Others

Global Fiberglass Fabric Market, By Product

Global Fiberglass Fabric Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa