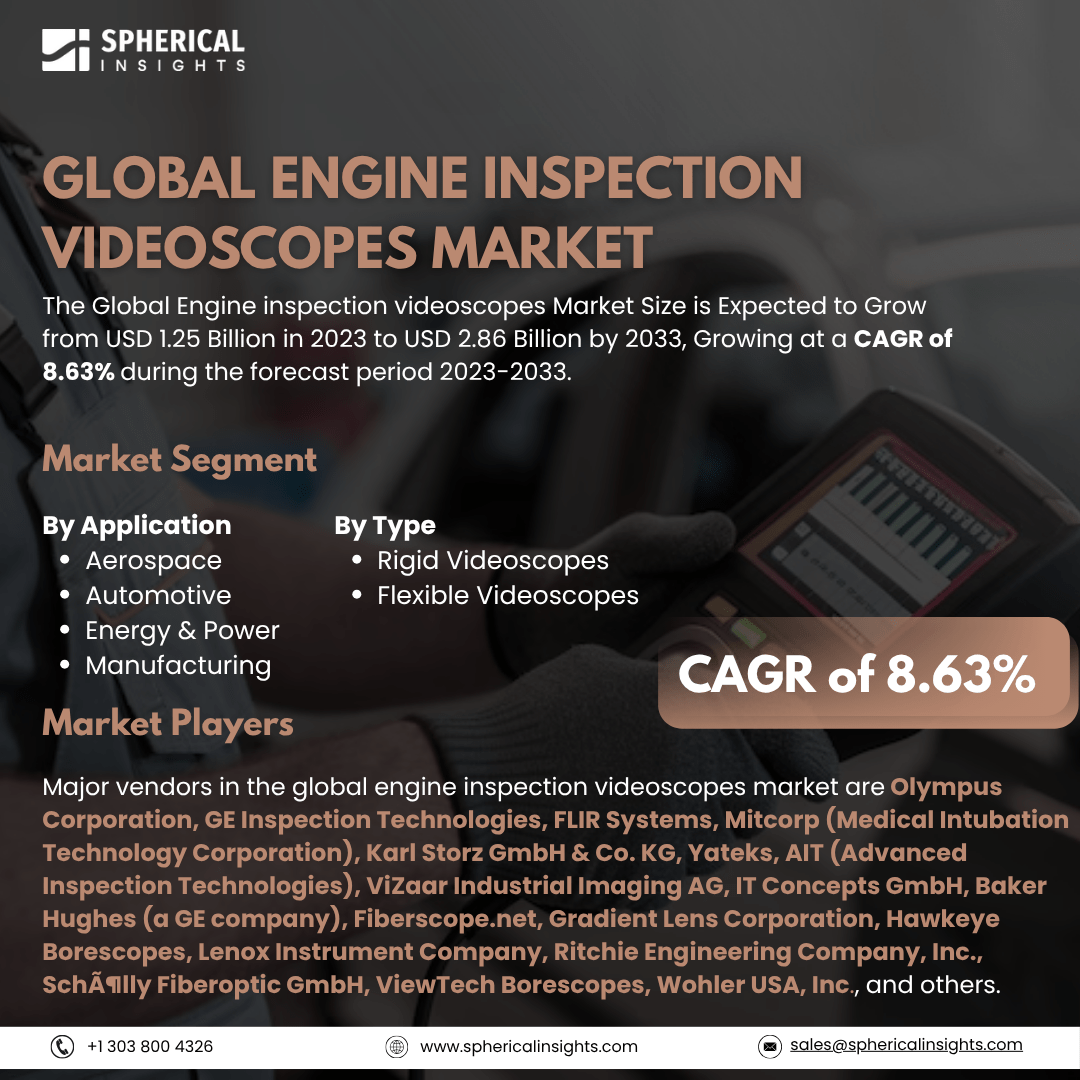

Global Engine Inspection Videoscopes Market Size To Exceed USD 2.86 Billion By 2033

According to a research report published by Spherical Insights & Consulting, The Global Engine inspection videoscopes Market Size is Expected to Grow from USD 1.25 Billion in 2023 to USD 2.86 Billion by 2033, Growing at a CAGR of 8.63% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Engine Inspection Videoscopes Market Size, Share, and COVID-19 Impact Analysis, By Type (Rigid Videoscopes, Flexible Videoscopes), By Application (Aerospace, Automotive, Energy & Power, Manufacturing, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

The worldwide engine inspection videoscopes market refers to the business that focuses on the production and distribution of videoscopes, which are specifically designed for inspecting engines and other vital parts of the engine system. These gadgets are essential for non-destructive testing and maintenance in industries like aviation, automotive, and manufacturing. The growing need for advanced diagnostic equipment across an array of businesses, particularly in the automotive and aerospace sectors, where reliability and precision are critical, is one of the major growth factors propelling this market. The market is growing as such t of the incorporation of artificial intelligence (AI) and machine learning technology into videoscopes, which opens up possibilities for automatic and proactive upkeep solutions. However, the high cost of deployment and their manufacturing might limit their growth pace.

The flexible videoscopes segment held a significant share of the global engine inspection videoscopes market in 2023 and is predicted to grow at a rapid pace over the forecast period.

On the basis of the type, the global engine inspection videoscopes market is divided into rigid videoscopes, flexible videoscopes. Among these, the flexible videoscopes segment held a significant share of the global engine inspection videoscopes market in 2023 and is predicted to grow at a rapid pace over the forecast period. This segment growth is driven because of provide greater mobility and allowing entry to intricate places inside engines and other machinery to find out the fault with precision.

The aerospace segment accounted for the highest share of the global engine inspection videoscopes market in 2023 and is expected to grow at a substantial CAGR over the forecast period.

On the basis of the application, the global engine inspection videoscopes market is segmented into aerospace, automotive, energy & power, manufacturing, and others. Among these, the aerospace segment accounted for the highest share of the global engine inspection videoscopes market in 2023 and is expected to grow at a substantial CAGR over the forecast period. This is due to the industry's ongoing need for dependable and effective maintenance solutions, and they are an essential tool for inspecting and maintaining turbines, engines, and other vital parts.

Asia Pacific is estimated to hold the highest share of the global engine inspection videoscopes market over the forecast period.

Asia Pacific is projected to hold the highest share of the global engine inspection videoscopes market over the forecast period. The regional market growth is influenced by developing automotive and aerospace industries, rapid industrialization, and rising infrastructure investments. Further, countries like China, Japan, and India are emphasizing raising safety requirements and implementing cutting-edge maintenance equipment, which stimulates the market expansion for engine inspection videoscopes.

North America is estimated to grow at the fastest CAGR of the global engine inspection videoscopes market over the forecast period. The regional market growth is accelerated because of the region's thriving automotive and aerospace industries. Moreover, the strong demand for sophisticated inspection instruments because to the requirement for regular inspections and maintenance due to strict safety and maintenance rules will support market expansion.

Company Profiling

Major vendors in the global engine inspection videoscopes market are Olympus Corporation, GE Inspection Technologies, FLIR Systems, Mitcorp (Medical Intubation Technology Corporation), Karl Storz GmbH & Co. KG, Yateks, AIT (Advanced Inspection Technologies), ViZaar Industrial Imaging AG, IT Concepts GmbH, Baker Hughes (a GE company), Fiberscope.net, Gradient Lens Corporation, Hawkeye Borescopes, Lenox Instrument Company, Ritchie Engineering Company, Inc., Schölly Fiberoptic GmbH, ViewTech Borescopes, Wohler USA, Inc., and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, GE Aerospace and Waygate Technologies collaborated to develop an innovative AI-assisted borescope inspection solution for commercial jet engines. This technology enhances defect recognition by integrating advanced machine vision and AI techniques. It specifically targets high-pressure compressor (HPC) inspections, which are critical and time-consuming in the Maintenance, Repair, and Overhaul (MRO) process.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global engine inspection videoscopes market based on the below-mentioned segments:

Global Engine inspection videoscopes Market, By Type

- Rigid Videoscopes

- Flexible Videoscopes

Global Engine inspection videoscopes Market, By Application

- Aerospace

- Automotive

- Energy & Power

- Manufacturing

- Others

Global Engine inspection videoscopes Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa