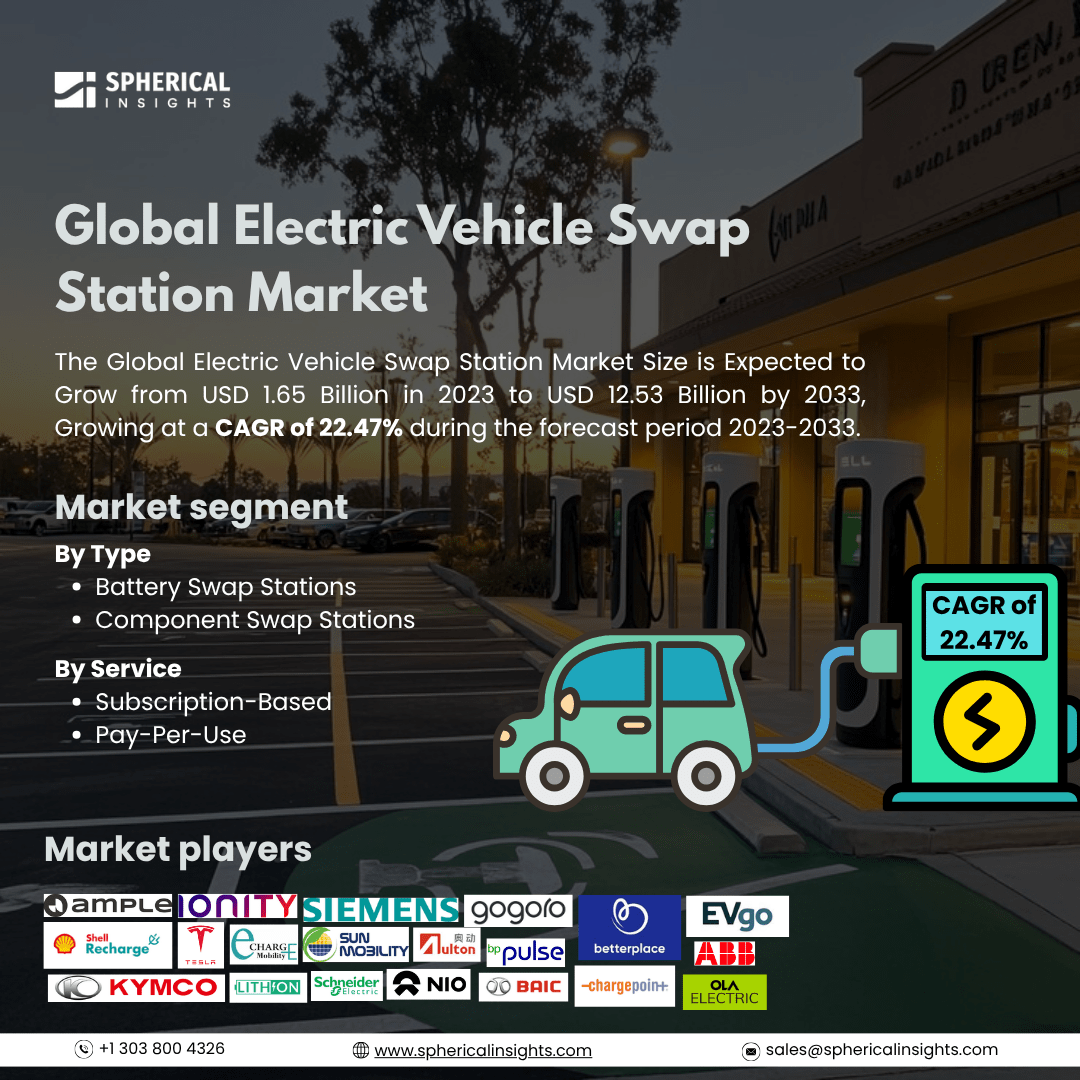

Global Electric Vehicle Swap Station Market Size To Exceed USD 12.53 Billion By 2033

According to a research report published by Spherical Insights & Consulting, The Global Electric Vehicle Swap Station Market Size is Expected to Grow from USD 1.65 Billion in 2023 to USD 12.53 Billion by 2033, Growing at a CAGR of 22.47% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on The Global Electric Vehicle Swap Station Market Size, Share, and COVID-19 Impact Analysis, By Type (Battery Swap Stations, Component Swap Stations), By Service (Subscription-Based, Pay-Per-Use), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

The worldwide electric vehicle swap station market focuses on building an infrastructure designed for the swift exchange of depleted batteries with fully charged ones, with other related components primarily for electric vehicles (EVs). This creative concept provides a substitute for conventional charging techniques by addressing issues like long charging periods. Swap stations are especially helpful in urban settings where energy solutions must be available quickly. The market growth is driven by the growing acceptance of EVs as a sustainable solution for transportation and the automotive industry as well. Another important factor propelling the EV swap station business is government subsidies and laws. Further, many nations are accelerating the transition to electric transportation by enacting strict pollution standards and providing subsidies to consumers and manufacturers as well. However, the market expansion is restricted due to high upfront costs and strict regulatory norms.

The component swap stations segment accounted for a significant share of the global electric vehicle swap station market in 2023 and is anticipated to grow at a rapid pace over the forecast period.

On the basis of the type, the global electric vehicle swap station market is divided into battery swap stations, component swap stations. Among these, the component swap stations segment accounted for a significant share of the global electric vehicle swap station market in 2023 and is anticipated to grow at a rapid pace over the forecast period. This segment growth is propelled by providing a full maintenance and upgrade solution, such as motors, controllers, or even full chassis modules.

The subscription-based segment dominated the global electric vehicle swap station market in 2023 and is expected to grow at a remarkable CAGR over the forecast period.

On the basis of the service, the global electric vehicle swap station market is classified into subscription-based, pay-per-use. Among these, the subscription-based segment dominated the global electric vehicle swap station market in 2023 and is expected to grow at a remarkable CAGR over the forecast period. This segment growth is influenced by their value-added features like real-time battery monitoring, upkeep, and roadside assistance, along with unlimited access to battery switching services or a certain number of swaps with affordable prices.

Asia Pacific is anticipated to hold the largest share of the global electric vehicle swap station market over the forecast period.

Asia Pacific is expected to hold the greatest revenue share of the global electric vehicle swap station market over the forecast period. The regional market growth is propelled by the substantial investments in infrastructure development and electric mobility, with government support and several laws and incentives. Nations like China, India, and Japan encourage the use of electric vehicles and the growth of networks of swap stations, which is propelling market expansion.

Europe is predicted to grow at the fastest CAGR of the global electric vehicle swap station market over the forecast period. The market growth throughout the region is further accelerated due to strict environmental rules and regulations, and awareness among consumers that has shifted towards electric transit. Moreover, nations like Norway, the Netherlands, and Germany are known for the construction of infrastructure for electric vehicles that propels the market growth.

Company Profiling

Major vendors in the global electric vehicle swap station market are Tesla, NIO, BAIC Group, Gogoro, Better Place, Sun Mobility, Ample, Ola Electric, KYMCO, Aulton New Energy Automotive Technology, Lithion Power, Echarge, EVgo, ChargePoint, Shell Recharge, BP Pulse, Ionity, ABB, Siemens, Schneider Electric, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development:

- In April 2025, CATL and Sinopec announced a groundbreaking partnership to establish 10,000 EV battery swapping stations across China. This initiative aimed to revolutionize green mobility by providing a seamless and rapid battery swap experience, comparable to conventional refueling. The collaboration also included the development of smart energy microgrids, integrating solar power, energy storage, and real-time battery diagnostics.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global electric vehicle swap station market based on the below-mentioned segments:

Global Electric Vehicle Swap Station Market, By Type

- Battery Swap Stations

- Component Swap Stations

Global Electric Vehicle Swap Station Market, By Service

- Subscription-Based

- Pay-Per-Use

Global Electric Vehicle Swap Station Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa