Global Electric Power Distribution Automation Systems Market Insights Forecasts to 2035

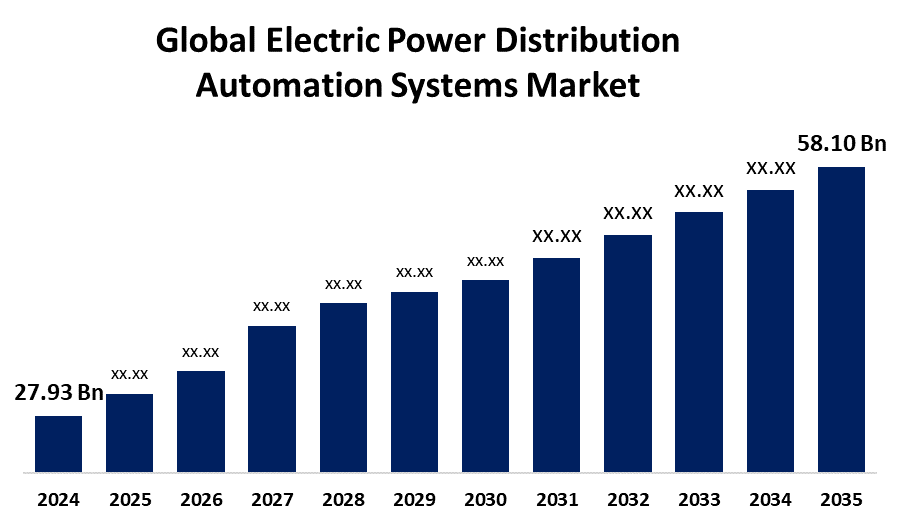

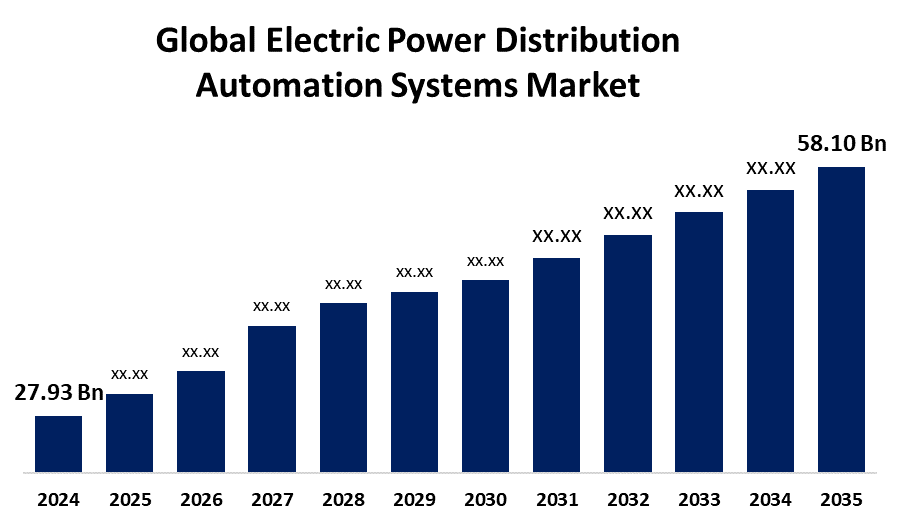

- The Global Electric Power Distribution Automation Systems Market Size Was Estimated at USD 27.93 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.89% from 2025 to 2035

- The Worldwide Electric Power Distribution Automation Systems Market Size is Expected to Reach USD 58.10 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Electric Power Distribution Automation Systems Market

The global electric power distribution automation systems market focuses on technologies that automate the control, monitoring, and management of electrical power distribution networks. These systems use intelligent electronic devices, communication networks, and centralized control systems to enhance the efficiency, reliability, and flexibility of power delivery. By enabling real-time data exchange and automated responses to changing grid conditions, distribution automation systems help reduce outages, improve power quality, and streamline operations. Key components of these systems include sensors, switches, reclosers, and communication protocols that work together to ensure seamless coordination across the distribution network. Automation in power distribution also facilitates better asset management, predictive maintenance, and load balancing. Utilities and power companies implement these systems to modernize infrastructure and meet growing operational demands. As power grids become more complex, automation solutions play a crucial role in ensuring consistent energy delivery while reducing manual intervention and operational errors across distribution networks.

Attractive Opportunities in the Electric Power Distribution Automation Systems Market

- The increasing deployment of microgrids and decentralized energy resources requires advanced automation solutions for seamless integration and efficient operation. This trend opens new avenues for automation technologies to manage distributed energy generation, enhance grid resilience, and support localized power management.

- As electric vehicles gain popularity worldwide, the electric power distribution network faces increased demand and load variability. Automated distribution systems offer solutions for intelligent load management, enabling smart EV charging, peak load shifting, and grid stability, presenting significant growth potential.

- Advances in AI and ML enable predictive maintenance, self-healing grids, and real-time analytics. Integrating these technologies into distribution automation systems improves operational efficiency, reduces outages, and supports proactive asset management, creating valuable opportunities for innovation and market differentiation.

Global Electric Power Distribution Automation Systems Market Dynamics

DRIVER: Shift toward smart grid development and digital transformation

One of the primary drivers is the increasing demand for reliable and uninterrupted power supply, which encourages utilities to adopt advanced automation technologies. The rising integration of renewable energy sources into power grids also necessitates more flexible and responsive distribution systems. In addition, aging electrical infrastructure in many regions requires modernization, pushing investment in automation solutions. The global shift toward smart grid development and digital transformation further fuels market expansion, as automation systems are essential components of smart grids. Government regulations and policies promoting energy efficiency, grid stability, and carbon emission reduction support wider adoption of distribution automation. Technological advancements in communication networks, IoT, and data analytics enable real-time control and predictive maintenance, enhancing operational efficiency. Overall, the need for improved grid performance, reduced operational costs, and enhanced energy management continues to drive demand for automation systems.

RESTRAINT: Technical challenges such as interoperability issues between legacy and new systems

Despite the promising growth, the global electric power distribution automation systems market faces several restraining factors. One of the primary challenges is the high initial investment required for implementing automation systems, which includes costs for hardware, software, installation, and training. Many utilities, particularly in developing regions, may lack the financial resources or infrastructure to adopt these technologies. Additionally, integrating automation into existing, often outdated, grid systems can be complex and time-consuming, leading to delays and increased project costs. Cybersecurity concerns also pose a significant barrier, as increased connectivity and digitization expose power networks to potential cyber threats and data breaches. Technical challenges such as interoperability issues between legacy and new systems, can hinder seamless deployment. Furthermore, a shortage of skilled professionals with expertise in both power systems and digital technologies may slow down implementation. Regulatory uncertainties and slow approval processes in some regions also contribute to limited adoption and market growth.

OPPORTUNITY: Expansion of microgrids and decentralized energy systems

One significant opportunity lies in the expansion of microgrids and decentralized energy systems, which require advanced automation for efficient operation and integration with the main grid. The rising trend of electric vehicle (EV) adoption also creates new possibilities, as automated distribution systems can help manage the increased load and enable smart charging infrastructure. Emerging economies offer untapped potential, where infrastructure development can incorporate automation from the outset, avoiding the limitations of legacy systems. Additionally, advancements in artificial intelligence and machine learning present opportunities to enhance automation capabilities, enabling predictive analytics and self-healing grids. Strategic partnerships between technology providers, utilities, and governments can lead to innovative deployment models and cost-sharing structures. Furthermore, the growing focus on sustainability and environmental responsibility opens doors for automation solutions that support low-carbon, energy-efficient power distribution systems tailored to future energy demands.

CHALLENGES: Navigating differing regulatory frameworks and compliance requirements across countries

Managing the vast amounts of data generated by automated systems also presents difficulties in terms of storage, analysis, and real-time decision-making. As power grids become increasingly digital and complex, maintaining system reliability while incorporating automation is technically demanding. Ensuring workforce readiness is another challenge, as employees need continuous training to operate and maintain evolving technologies. Additionally, coordinating automation across distributed energy resources, such as solar and wind, requires highly adaptive control strategies. Resistance to organizational change within traditional utility companies can slow implementation and innovation. Finally, navigating differing regulatory frameworks and compliance requirements across countries or regions can complicate global deployment strategies, making it difficult for companies to scale effectively.

Global Electric Power Distribution Automation Systems Market Ecosystem Analysis

The global electric power distribution automation systems market ecosystem includes utility providers, technology suppliers, system integrators, regulators, and end-users. It comprises smart hardware (meters, sensors), software (DMS, SCADA), communication technologies (IoT, fiber optics), and cybersecurity systems. These components work together to automate monitoring, control, and fault detection across power distribution networks. Data analytics, AI, and cloud computing enhance grid performance and enable predictive maintenance. Collaboration among stakeholders ensures efficient, reliable, and intelligent power delivery within a modern, sustainable energy infrastructure.

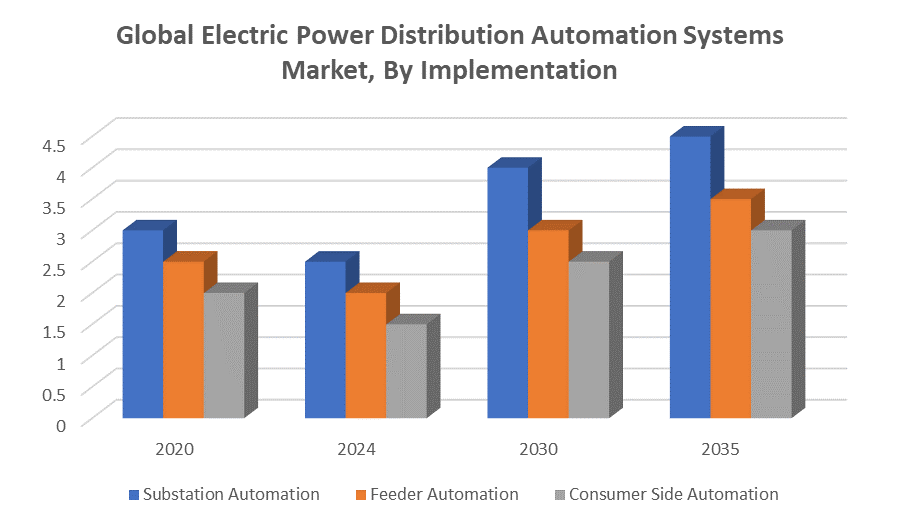

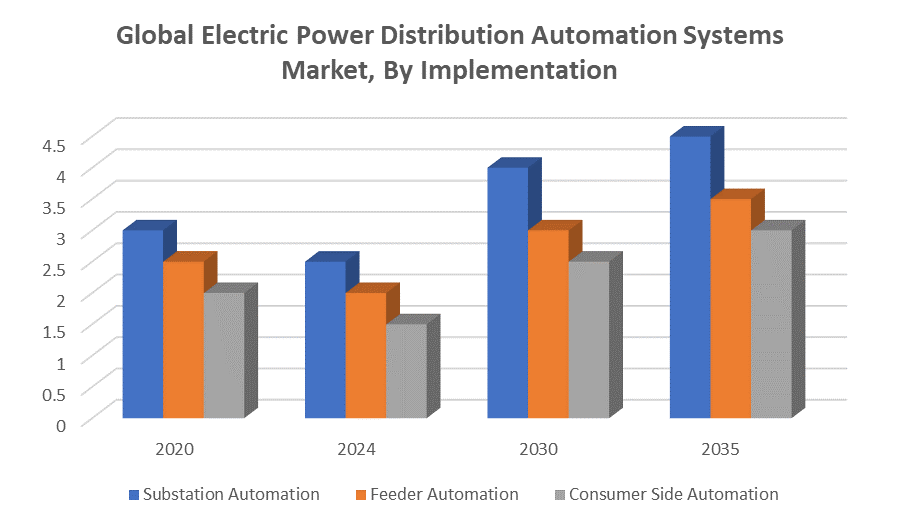

Based on the implementation, the substation automation segment led the market with the highest share over the forecast period

The substation automation dominance is attributed to the critical role substations play in power distribution, acting as key nodes for voltage transformation, load management, and fault isolation. Substation automation enhances operational efficiency, enables real-time monitoring and control, and reduces outage durations through rapid fault detection and response. The increasing demand for reliable power supply and the modernization of aging grid infrastructure further supports the strong growth of this segment.

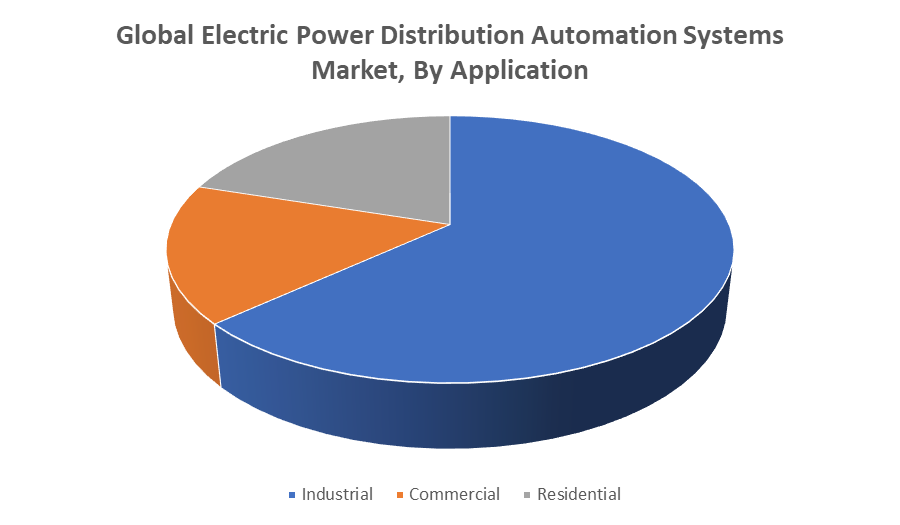

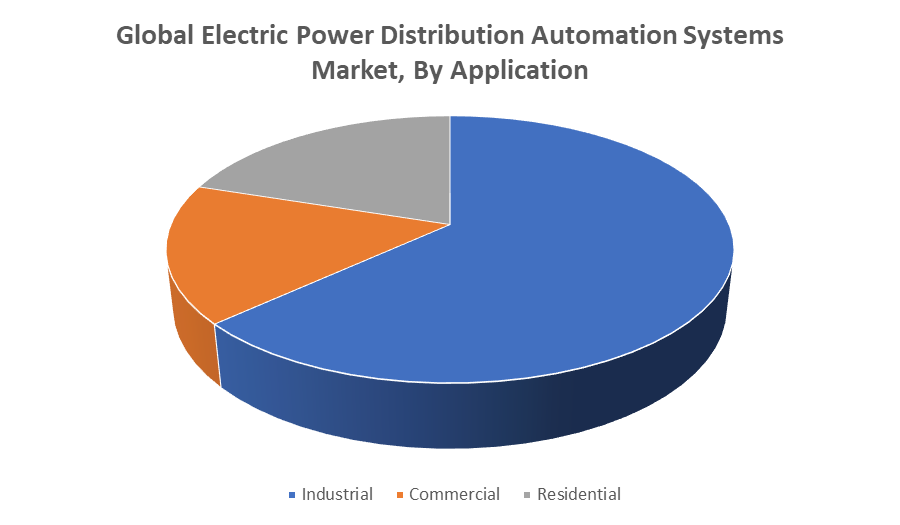

Based on the application, the industrial segment dominated the global electric power distribution automation systems market during the forecast period

The industrial segment dominance is due to the high and continuous power demand in industrial operations, where even minor disruptions can lead to significant productivity and financial losses. Industries prioritize automation to ensure uninterrupted power supply, improve energy efficiency, and enhance operational safety. Additionally, the adoption of smart technologies, process automation, and integration of renewable energy sources within industrial facilities further drives the demand for advanced distribution automation systems in this segment.

North America is anticipated to hold the largest market share of the electric power distribution automation systems market during the forecast period

North America is anticipated to hold the largest market share in the electric power distribution automation systems market during the forecast period. This leadership is driven by the region’s advanced power infrastructure, significant investments in smart grid technologies, and strong regulatory support for grid modernization. The presence of major utility companies and technology providers also accelerates adoption. Additionally, increasing focus on improving grid reliability, integrating renewable energy, and enhancing energy efficiency contributes to North America’s dominant position in the market.

Asia Pacific is expected to grow at the fastest CAGR in the electric power distribution automation systems market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the electric power distribution automation systems market during the forecast period. Rapid urbanization, industrialization, and increasing electricity demand are driving the adoption of advanced automation technologies in the region. Governments are investing heavily in modernizing aging power infrastructure and developing smart grid projects. Additionally, growing integration of renewable energy sources and expanding electrification in rural areas further boost market growth. The region’s large population and rising focus on energy efficiency and reliability create significant opportunities for automation system deployment.

Key Market Players

KEY PLAYERS IN THE ELECTRIC POWER DISTRIBUTION AUTOMATION SYSTEMS MARKET INCLUDE

- Schneider Electric SE

- ABB Ltd.

- Siemens AG

- General Electric (GE) Vernova

- Eaton Corporation

- Hitachi Energy

- Honeywell International Inc.

- S C Electric Company

- Cisco Systems, Inc.

- Landis Gyr

- others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the electric power distribution automation systems market based on the below-mentioned segments:

Global Electric Power Distribution Automation Systems Market, By Implementation

- Substation Automation

- Feeder Automation

- Consumer Side Automation

Global Electric Power Distribution Automation Systems Market, By Application

- Industrial

- Commercial

- Residential

Global Electric Power Distribution Automation Systems Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa