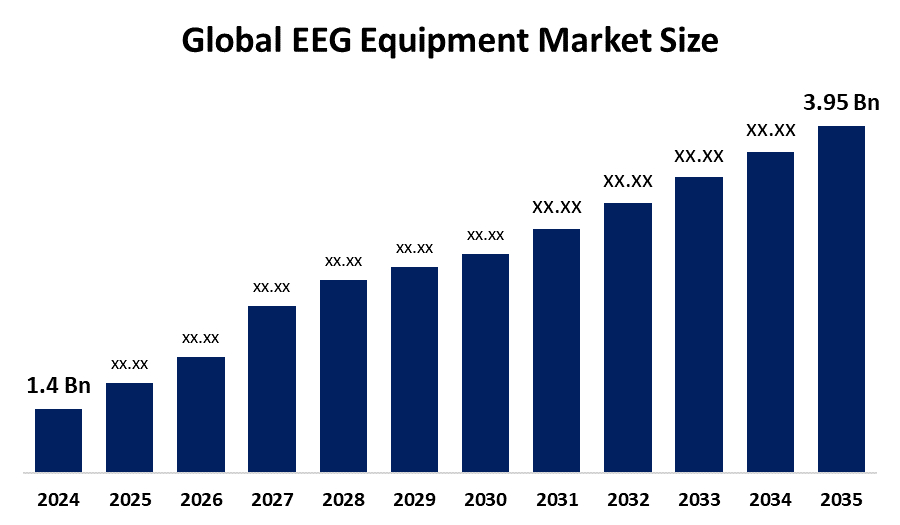

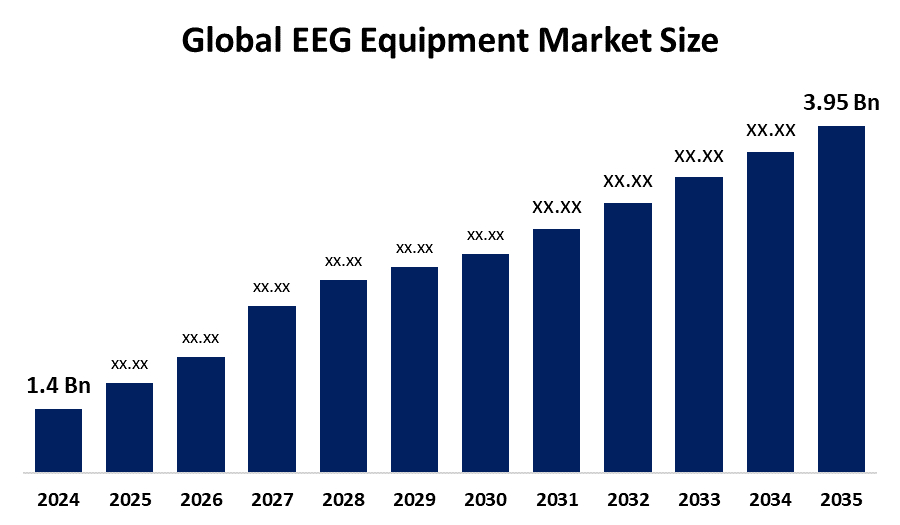

Global EEG Equipment Market Insights Forecasts to 2035

- The Global EEG Equipment Market Size Was Estimated at USD 1.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.89% from 2025 to 2035

- The Worldwide EEG Equipment Market Size is Expected to Reach USD 3.95 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

EEG Equipment Market

Electroencephalography (EEG) equipment uses scalp or intracranial electrodes to capture the electrical activity of the brain and then transforms it into waveforms for research and clinical analysis. Routine clinical EEG carts, long-term video-EEG (VEEG) monitoring suites, and wearable/ambulatory devices for home usage are just a few examples of the systems available, which are frequently combined with AI-assisted analysis. Increased use in peri-operative monitoring and neuroscience research, together with the high and growing burden of epilepsy, sleep disorders, and neurological problems in critical care, is driving demand. To speed up reporting and lessen workload, vendors are integrating cloud connectivity, decision-support algorithms, and seamless connections to EMRs.

Attractive Opportunities in the EEG Equipment Market

- Automated seizure/spike identification, trend analysis, and report automation are examples of AI-enabled clinical decision assistance integrated into EEG software that reduces review time and aids in addressing the scarcity of neurologist specialists.

- Switch to ambulatory and home-based EEG, such as wearable or patch devices with remote viewing, which increases accessibility, facilitates long-term monitoring, and lowers inpatient expenses.

- Comprehensive centres and the extension of epilepsy programmes combine long-term VEEG with surgical assessment (SEEG, grids/strips), which leads to improvements in high-channel systems, synchronised video, and centralised data platforms, generating multi-system refresh cycles across networks.

Global EEG Equipment Market Dynamics

DRIVER: Rising Neurodiagnostic Volumes and Clinical Expansion

Hospitals and outpatient facilities are being compelled to boost EEG output due to the rising incidence of epilepsy, acute encephalopathy, post-stroke seizures, and sleep problems. Peri-operative monitoring programmes extend the use of continuous electroencephalography (cEEG) beyond neurology, while clinical guidelines and quality initiatives are expanding its use in intensive care units (ICUs) for the detection of non-convulsive seizures and status epilepticus. Adoption is further maintained by reimbursement support for remote professional interpretation and long-term monitoring. In order to reduce scale hurdles, vendors are increasingly bundling cloud review portals, synchronised HD video, and high-channel amplifiers.

RESTRAINT: Capital Budgets, Workflow Burden, and Training Gaps

The substantial capital and IT integration required for advanced VEEG suites and ICU cEEG solutions slow down procurement in environments with limited funds. Large data quantities from lengthy recordings lead to staffing bottlenecks for technicians and neurophysiologists, as well as longer review times. Facilities may have trouble managing artefacts, telemetry hygiene, and regular procedures, which could affect the quality of the data. Requirements for interoperability and cybersecurity may cause deployment schedule extensions. Together, these elements lengthen replacement cycles and restrict penetration in smaller centres.

OPPORTUNITY: AI, Cloud, and Home Monitoring at Scale

Regulatory-approved AI systems for point-of-care seizure/status-epilepticus detection and decision assistance shorten review periods and allow for early intervention. Cloud solutions facilitate after-hours coverage and regional command centres by enabling centralised reading across dispersed stations. Remote dashboards and ambulatory/wearable EEG enable post-discharge follow-up and home-based long-term monitoring for patients who have not received a diagnosis.

CHALLENGES: Competitive Modalities and Legal/IP Headwinds

EEG providers must demonstrate additive value for certain indications where MRI, CT, or advanced functional imaging may be given priority. Tight integration with ICU platforms is necessary since continuous EEG competes with other monitors for manpower and space in critical care. In the meantime, customers and partners may experience additional uncertainty due to patent conflicts and IP enforcement in quick EEG and AI analytics. Cost and complexity are increased when trying to meet regulatory requirements for post-market surveillance and AI transparency. A more controversial IP environment around EEG devices is shown by recent ITC and court filings.

Global EEG Equipment Market Ecosystem Analysis

The ecosystem includes cloud archiving, video and networking, analytical software/AI, EEG gear (amplifiers, headboxes, scalp and intracranial electrodes), and service/education (installation, training, remote reading). While hospitals/IDNs, diagnostic labs, ambulatory EEG providers, and comprehensive epilepsy centres are located downstream, electrode and cap suppliers, especially intracranial electrode specialists who assist epilepsy surgery programmes, are located upstream.

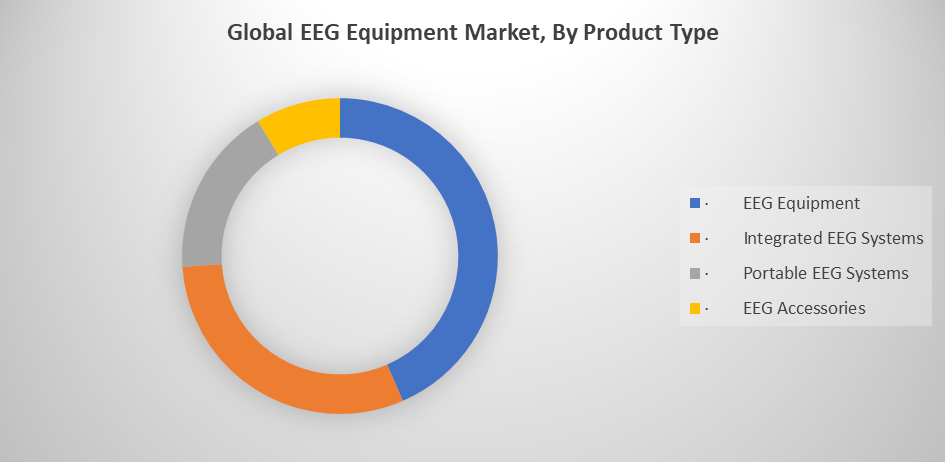

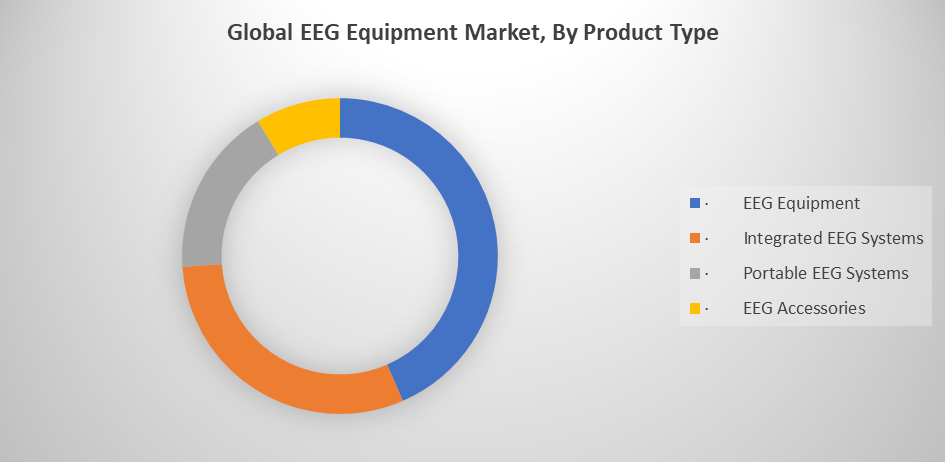

Based on the product type, the EEG equipment segment led the market with the leading revenue share over the forecast period

The segment dominance is driven by which refers to conventional hospital and clinic-based systems with specialised amplifiers and electrodes. Pre-operative neurological evaluation, encephalopathy assessment, and epilepsy diagnosis all make extensive use of these systems. Because of their precision, scalability, and compatibility with long-term monitoring systems, hospitals favour them.

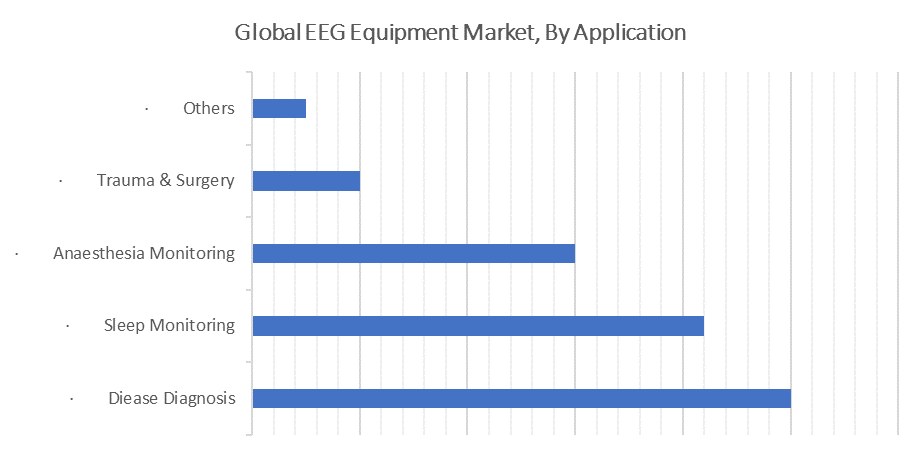

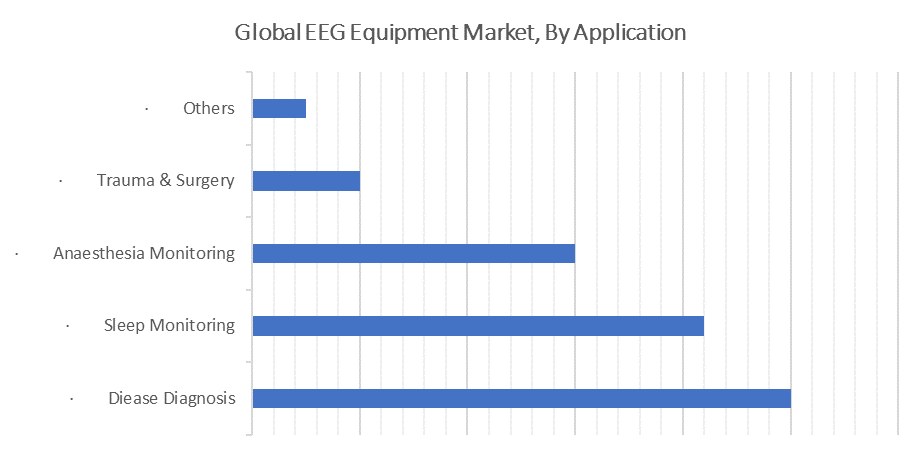

Based on the application, the disease diagnosis segment led the market with the major revenue share during the forecast period

The disease diagnosis segment led the market, holding the largest revenue share during the forecast period. The disease diagnostics, specifically for neurodegenerative illnesses, stroke consequences, and epilepsy. EEG is still the major method used to identify aberrant brain activity, particularly seizure patterns, and to inform therapy choices. There is a consistent need for both traditional and cutting-edge EEG systems because hospitals, neurology clinics, and research institutes maintain high testing volumes for both initial diagnosis and follow-up.

North America is anticipated to hold the largest market share of the EEG equipment market during the forecast period

North America is anticipated to hold the largest market share in the EEG equipment market during the forecast period. The high frequency of neurological conditions, a well-established healthcare system, and early adoption of cutting-edge diagnostic tools. Strong reimbursement structures for continuous EEG in critical care and long-term EEG monitoring are advantageous to the area. Equipment updates are further accelerated by the presence of top manufacturers, research facilities, and comprehensive epilepsy centres. Furthermore, the region's dominance is reinforced by the quick adoption of cloud-based data sharing and AI-assisted EEG analysis.

Asia Pacific is expected to grow at the fastest CAGR in the EEG equipment market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the EEG equipment market during the forecast period. The growing awareness of epilepsy and sleep disorders, growing neurology departments, and increasing healthcare investments. Government programmes in nations like China, India, and Japan are expanding access to cutting-edge neurodiagnostic technology. Demand is being increased by the expansion of specialised hospitals and diagnostic facilities, as well as a new trend towards portable and home-based EEG equipment. The incidence of neurological disorders is rising due to rapid urbanisation and an ageing population, which is propelling market expansion.

Recent Development

- In October 2024, Natus Medical pursued FDA approval for its innovative EEG device. It uses NeuroWorks software and AI-powered seizure detection algorithms to detect non-convulsive and status epilepticus in acute care settings.

- In August 2024, Natus Medical Incorporated introduced autoSCORE, an AI model for automatic clinical EEG interpretation. It aims to improve clinical outcomes and care value for millions with epilepsy.

Key Market Players

KEY PLAYERS IN THE EEG EQUIPMENT MARKET INCLUDE

- Advanced Brain Monitoring

- Cadwell Industries

- CEPHALON

- Compumedics

- Fresenius

- General Electric (GE Healthcare)

- Koninklijke Philips (Philips Healthcare)

- Medtronic

- Natus Medical

- Nihon Kohden

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the EEG equipment market based on the below-mentioned segments:

Global EEG Equipment Market, By Product Type

- EEG Equipment

- Integrated EEG Systems

- Portable EEG Systems

- EEG Accessories

EEG Equipment Market, By Application

- Diagnosis

- Sleep Monitoring

- Anaesthesia Monitoring

- Trauma & Surgery

- Others

Global EEG Equipment Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa