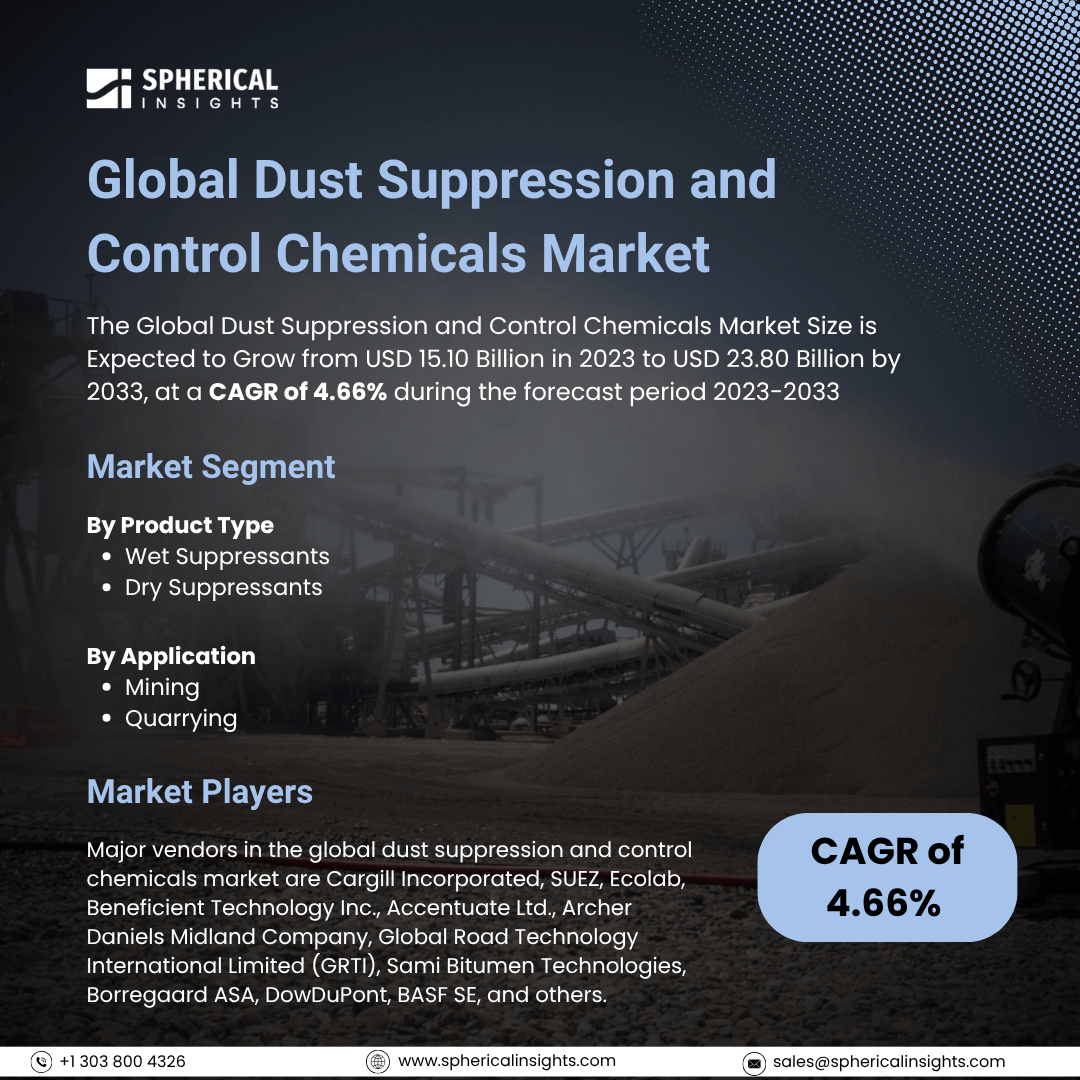

Global Dust Suppression and Control Chemicals Market Size To Exceed USD 23.80 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Dust Suppression and Control Chemicals Market Size is Expected to Grow from USD 15.10 Billion in 2023 to USD 23.80 Billion by 2033, at a CAGR of 4.66% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Dust Suppression and Control Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Wet Suppressants and Dry Suppressants), By Application (Mining and Quarrying), By End-User Industry (Mining & Metal Processing, Construction & Demolition, Manufacturing & Processing Plants, Agriculture & Agribusiness, and Oil & Gas), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The global dust suppression and control chemicals market refers to the worldwide industry involved in the production, distribution, and application of chemical formulations designed to reduce or eliminate airborne dust particles in various environments. These chemicals are primarily used in mining, construction, cement production, and transportation sectors to enhance air quality, improve worker safety, comply with environmental regulations, and protect equipment. The market encompasses products such as lignin sulfonates, calcium chloride, magnesium chloride, polymers, and surfactants and is driven by increasing industrial activities, stricter environmental standards, and growing awareness of occupational health hazards. Furthermore, the global dust suppression and control chemicals market is driven by rising health and safety regulations, increasing mining and construction activities, and growing awareness of air quality issues. Demand is also driven by the need to reduce environmental impact, control particulate emissions, and enhance operational efficiency in industries such as cement, power generation, and transportation infrastructure. However, high product costs, limited awareness in developing regions, regulatory hurdles, environmental concerns over certain chemical agents, and the availability of alternative dust control methods hinder the widespread adoption of dust suppression chemicals.

The dry suppressants segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of the product type, the global dust suppression and control chemicals market is divided into wet suppressants and dry suppressants. Among these, the dry suppressants segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to their ease of application, long-lasting effectiveness, and suitability for arid environments and mining operations. Increasing demand from the construction, mining, and transportation sectors, along with growing environmental concerns over airborne particulates, is expected to drive strong growth of this segment during the forecast period.

The quarrying segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

On the basis of the application, the global dust suppression and control chemicals market is divided into mining and quarrying. Among these, the quarrying segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is attributed to high dust generation during extraction and processing activities. Stringent regulations on worker safety and air quality, along with growing demand for effective dust control solutions in mining and construction materials production, are expected to drive robust growth of this segment during the forecast period.

The mining & metal processing segment accounted for the greatest share in 2023 and is anticipated to grow at a substantial CAGR over the forecast period.

On the basis of the end-user industry, the global dust suppression and control chemicals market is divided into mining & metal processing, construction & demolition, manufacturing & processing plants, agriculture & agribusiness, and oil & gas. Among these, the mining & metal processing segment accounted for the greatest share in 2023 and is anticipated to grow at a substantial CAGR over the forecast period. The segmental growth is attributed to intense dust generation during excavation, crushing, and smelting activities. Rising global demand for metals, stricter environmental and occupational safety regulations, and the need for efficient air quality management are expected to fuel strong growth throughout the forecast period.

North America is projected to hold the largest share of the global dust suppression and control chemicals market over the forecast period.

North America is projected to hold the largest share of the global dust suppression and control chemicals market over the forecast period. The regional growth is attributed to stringent environmental regulations, advanced mining and construction industries, and strong focus on worker safety. High awareness, technological advancements, and increased investment in infrastructure and resource extraction activities further support the region’s dominant market position during the forecast period.

Asia Pacific is expected to grow at the fastest CAGR growth of the global dust suppression and control chemicals market during the forecast period. The regional growth is attributed to rapid industrialization, urbanization, and infrastructure development. Expanding mining, construction, and manufacturing sectors in countries like China, India, and Australia, along with increasing environmental and occupational safety regulations, are driving significant demand for effective dust control solutions in the region.

Company Profiling

Major vendors in the global dust suppression and control chemicals market are Cargill Incorporated, SUEZ, Ecolab, Beneficient Technology Inc., Accentuate Ltd., Archer Daniels Midland Company, Global Road Technology International Limited (GRTI), Sami Bitumen Technologies, Borregaard ASA, DowDuPont, BASF SE, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In Mrach 2024, Camfil Air Pollution Control (APC) has launched its latest innovation - the Gold Series Timer (GST) - an innovative-edge dust collection controller. The GST is a simple but effective device for controlling pulse-jet cleaning in industrial dust collection systems, like baghouses. With its cutting-edge design, the GST offers an intuitive and easy-to-implement solution for pulse-jet cleaning for industrial dust collection systems.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global dust suppression and control chemicals market based on the below-mentioned segments:

Global Dust Suppression and Control Chemicals Market, By Product Type

- Wet Suppressants

- Dry Suppressants

Global Dust Suppression and Control Chemicals Market, By Application

Global Dust Suppression and Control Chemicals Market, By End-Use Industry

- Mining & Metal Processing

- Construction & Demolition

- Manufacturing & Processing Plants

- Agriculture & Agribusiness

- Oil & Gas

Global Dust Suppression and Control Chemicals Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa