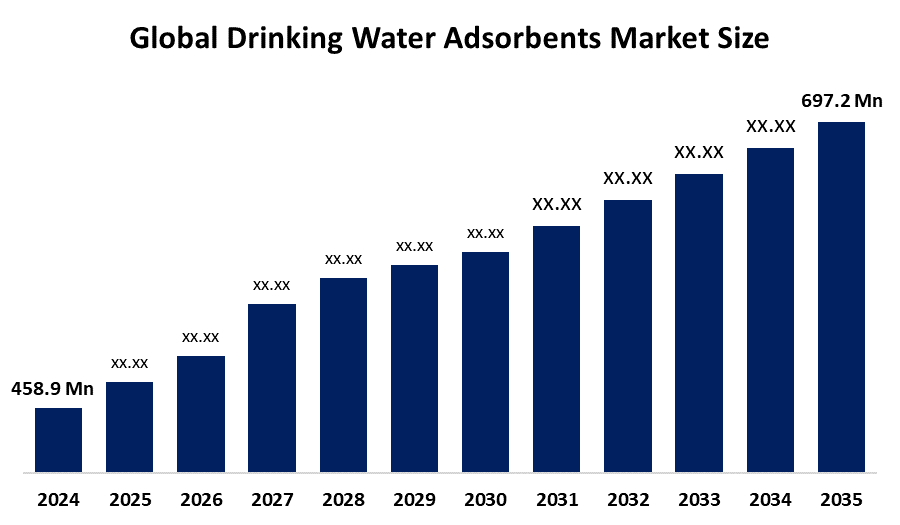

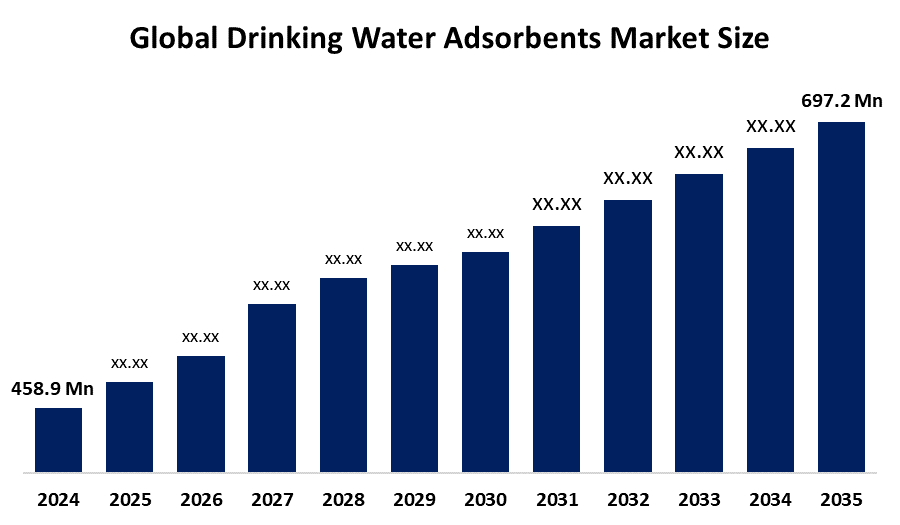

Global Drinking Water Adsorbents Market Insights Forecasts to 2035

- The Global Drinking Water Adsorbents Market Size Was Estimated at USD 458.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.88% from 2025 to 2035

- The Worldwide Drinking Water Adsorbents Market Size is Expected to Reach USD 697.2 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Drinking Water Adsorbents Market

The global drinking water adsorbents market is driven by increasing concerns over water contamination and the rising demand for safe, potable water. Adsorbents such as activated carbon, silica gel, and zeolites are widely used to remove impurities like heavy metals, organic compounds, and pathogens from drinking water. Market growth is fueled by rapid urbanization, industrialization, and growing public awareness of health risks linked to unsafe water. Governments worldwide are implementing strict regulations and initiatives to ensure water quality, such as the U.S. EPA’s Safe Drinking Water Act and India’s Jal Jeevan Mission, which emphasize water purification infrastructure and technology adoption. Technological advancements and increased investment in sustainable water treatment solutions further boost the market. Asia-Pacific, especially China and India, is emerging as a key market due to population growth and infrastructure development. Overall, the market reflects a shift toward eco-friendly, efficient, and cost-effective water purification technologies.

Attractive Opportunities in the Drinking Water Adsorbents Market

- Advancements in nanomaterials and the development of sustainable, bio-based adsorbents offer higher purification efficiency while minimizing environmental impact. This innovation opens new avenues for more effective and green water treatment solutions.

- Rapid urbanization and increasing populations in regions like Asia-Pacific and Africa drive demand for compact, decentralized water purification systems. These solutions offer convenient, on-site access to clean drinking water, especially in rural and underserved areas.

- Large-scale government programs such as India’s Jal Jeevan Mission and global goals like the UN’s SDG 6 promote investments in water purification infrastructure. Collaborations between public and private sectors enhance technology adoption and expand clean water access worldwide.

Global Drinking Water Adsorbents Market Dynamics

DRIVER: Government regulations and initiatives promoting safe water access further drive market demand

Key growth factors for the drinking water adsorbents market include increasing global water pollution, rising awareness of waterborne diseases, and growing demand for clean drinking water. Rapid urbanization and industrial discharge have heightened the need for effective water purification methods. Government regulations and initiatives promoting safe water access further drive market demand. Technological advancements in adsorbent materials, such as nanomaterials and bio-based adsorbents, enhance purification efficiency and sustainability. Additionally, expanding infrastructure in emerging economies and the rise in point-of-use water filtration systems contribute significantly to market expansion, especially in Asia-Pacific, Africa, and Latin America.

RESTRAINT: Disposal and regeneration of used adsorbents pose environmental and operational challenges

Despite strong growth, the drinking water adsorbents market faces several restraining factors. High initial costs of advanced adsorbent materials and water treatment systems can limit adoption, particularly in developing regions. Limited awareness and lack of technical expertise in rural areas further hinder market penetration. Additionally, the disposal and regeneration of used adsorbents pose environmental and operational challenges. Inconsistent raw material quality and supply chain disruptions may also impact production. Furthermore, the presence of alternative water purification technologies, such as membrane filtration and UV treatment, creates competition, potentially slowing the adoption of adsorbent-based solutions in certain markets.

OPPORTUNITY: Innovations in nanotechnology and the development of eco-friendly

Innovations in nanotechnology and the development of eco-friendly, bio-based adsorbents offer enhanced efficiency and reduced environmental impact. Expanding urban populations, particularly in the Asia-Pacific and Africa, create strong demand for decentralized and point-of-use filtration systems. Government-led initiatives such as India’s Jal Jeevan Mission and the UN’s Sustainable Development Goals (SDG 6 – Clean Water and Sanitation) support large-scale infrastructure development. Additionally, growing interest in smart water purification systems and digital monitoring tools opens new avenues for integrated solutions. Partnerships between public and private sectors also provide a platform for advancing access to clean drinking water globally.

CHALLENGES: Limited awareness in underdeveloped regions hampers widespread adoption

The drinking water adsorbents market faces several challenges, including high operational and maintenance costs, especially for advanced materials. Limited awareness in underdeveloped regions hampers widespread adoption. Managing the safe disposal and regeneration of spent adsorbents remains an environmental concern. Variability in water quality across regions requires customized solutions, increasing complexity. Additionally, competition from alternative purification technologies and fluctuating raw material availability can impact market stability and growth, particularly in cost-sensitive markets. Regulatory compliance also adds to operational burdens.

Global Drinking Water Adsorbents Market Ecosystem Analysis

The global drinking water adsorbents market ecosystem includes raw material suppliers, adsorbent manufacturers (e.g., activated carbon, zeolites), system integrators, and end-users such as households, municipalities, and industries. Regulatory bodies like the EPA enforce quality standards, driving adoption. Research institutions and technology firms contribute innovations like bio-based or nanomaterial adsorbents. Logistics and waste management services handle distribution and disposal of spent materials. Together, these players ensure efficient water purification, driven by rising demand for clean water, sustainability goals, and government initiatives.

Based on the product, the zeolite segment dominated the global drinking water adsorbents market in 2024

The zeolite segment indeed dominated the global drinking water adsorbents market in 2024. This growth is primarily attributed to zeolites' high adsorption efficiency, selective ion-exchange capabilities, and eco-friendly nature. They are especially effective in removing heavy metals, ammonia, and radioactive ions from drinking water. Additionally, their cost-effectiveness, thermal stability, and regeneration potential make them a preferred choice for both municipal and household water treatment systems. Increasing regulatory focus on removing contaminants like lead, arsenic, and PFAS has further boosted demand for zeolite-based solutions across key regions, especially in Asia-Pacific and North America.

North America is anticipated to hold the largest market share of the drinking water adsorbents market during the forecast period

North America is anticipated to hold the largest market share of the drinking water adsorbents market during the forecast period, driven by stringent environmental regulations, advanced water treatment infrastructure, and rising concerns over contaminants like PFAS, lead, and microplastics. The U.S. Environmental Protection Agency (EPA) has implemented strict standards for drinking water quality, prompting municipalities and industries to adopt efficient adsorbents such as activated carbon and zeolites. Additionally, increased investment in sustainable water purification technologies, coupled with high consumer awareness and widespread use of point-of-use systems, further supports market dominance in the region. Canada’s focus on clean water initiatives also contributes to this trend.

Asia Pacific is expected to grow at the fastest CAGR in the drinking water adsorbents market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the drinking water adsorbents market during the forecast period, driven by rapid urbanization, industrialization, and a rising population. Increasing awareness about waterborne diseases and the urgent need for clean drinking water are accelerating the adoption of advanced adsorbents in countries like China, India, and Southeast Asian nations. Government initiatives such as India’s Jal Jeevan Mission and China's investments in rural water safety projects are boosting demand. Additionally, expanding infrastructure, growing environmental concerns, and increasing foreign investments in water treatment technologies contribute to the region’s dynamic market growth.

Key Market Players

KEY PLAYERS IN THE DRINKING WATER ADSORBENTS MARKET INCLUDE

- Calgon Carbon Corporation

- BASF SE

- Ecolab Inc. (Purolite)

- Xylem Inc.

- Kurita Water Industries Ltd.

- Cabot Corporation

- Clariant AG

- Arkema Group

- Lanxess AG

- Mitsubishi Chemical Corporation

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the drinking water adsorbents market based on the below-mentioned segments:

Global Drinking Water Adsorbents Market, By Product

- Zeolite

- Clay

- Alumina

- Activated Carbon

- Manganese Oxide

- Cellulose

Global Drinking Water Adsorbents Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa