Dosing Pump Market Summary

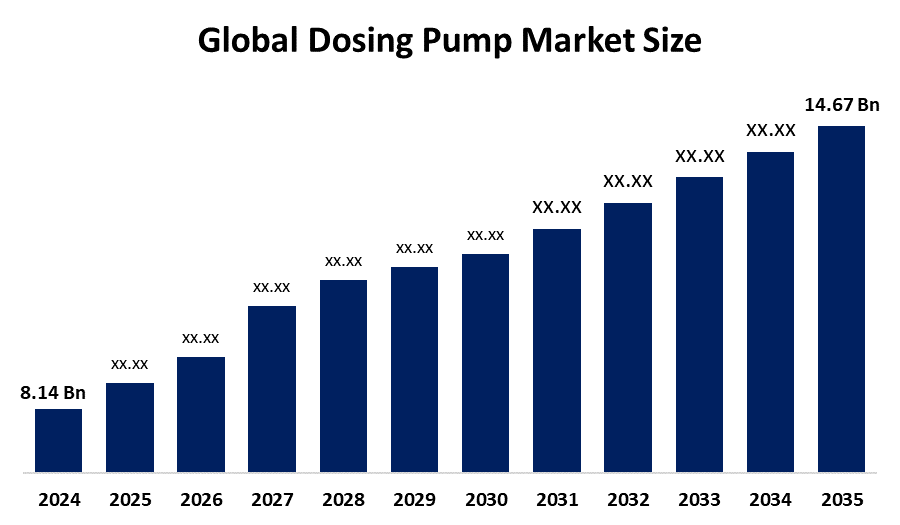

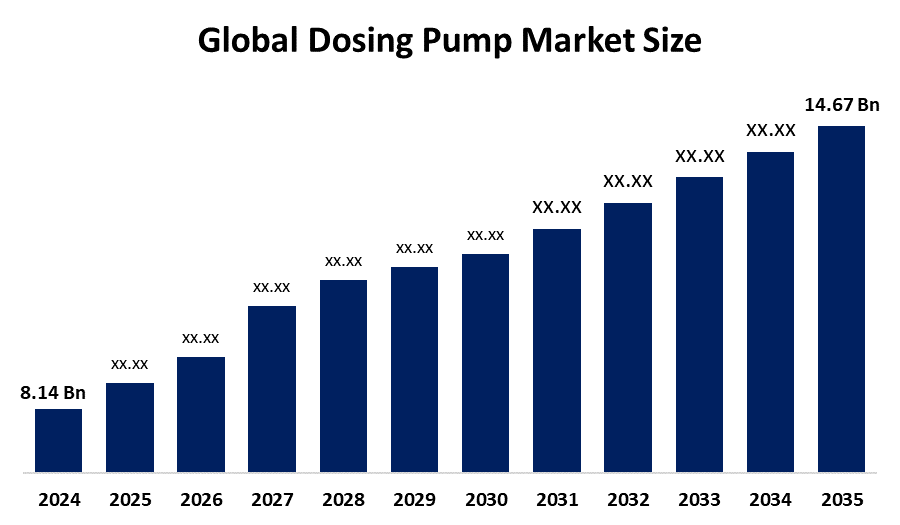

The Global Dosing Pump Market Size Was Estimated at USD 8.14 Billion in 2024 and is Projected to Reach USD 14.67 Billion by 2035, Growing at a CAGR of 5.5% from 2025 to 2035. The need for accurate chemical dosing, increased industrial automation, stricter environmental regulations, the need for water treatment, chemical processing, and pharmaceuticals, as well as improvements in pump technologies that increase efficiency and dependability, are all driving growth in the dosing pump market.

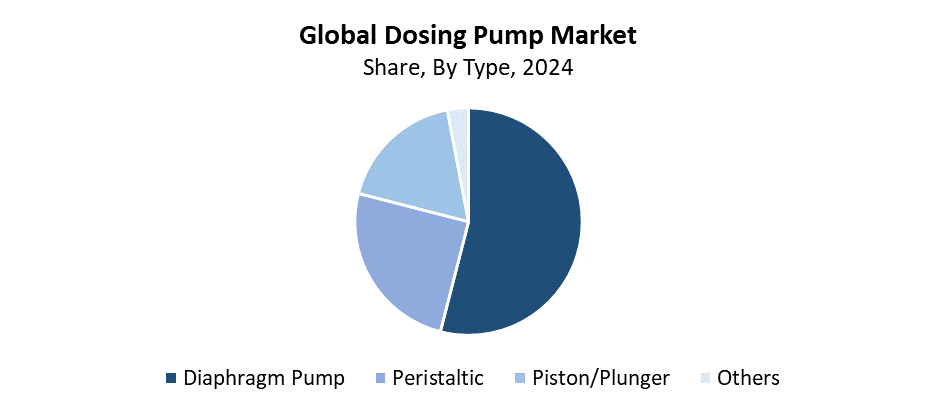

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific dosing pump market held the largest revenue share of 40.7% and dominated the global market.

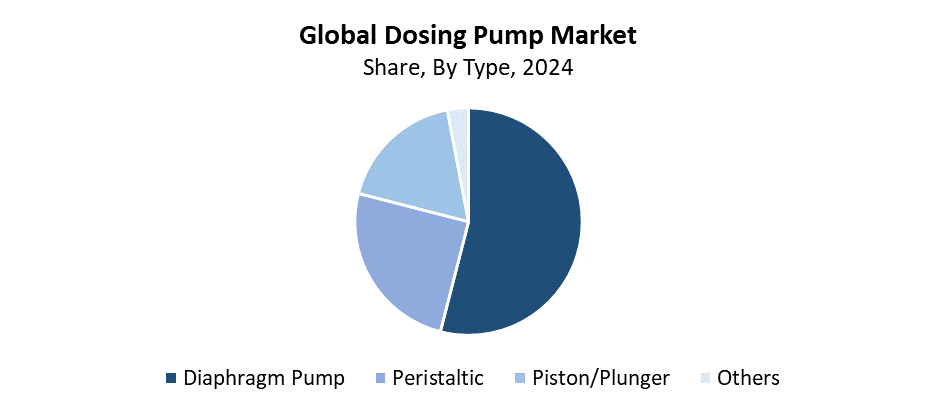

- In 2024, the diaphragm pump segment held the highest revenue share of 54.2% and dominated the global market by type.

- With the biggest revenue share of 22.8% in 2024, the water and wastewater segment led the worldwide dosing pump market by end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 8.14 Billion

- 2035 Projected Market Size: USD 14.67 Billion

- CAGR (2025-2035): 5.5%

- Asia Pacific: Largest Market in 2024

The market for dosing pumps operates through the development and operation of pumps which deliver exact chemical or liquid amounts into process streams at controlled flow rates. Water treatment, chemical processing, pharmaceuticals, food and beverage, and oil and gas industries all make extensive use of these pumps. The market growth depends on safe chemical dosing systems, which protect product quality and meet regulatory standards. These systems safeguard the environment. The pharmaceutical and food processing sectors require exact fluid management systems, rigorous environmental controls, and industrial automation, which drives their expansion. The market growth receives additional backing from organisations which want to decrease chemical waste while improving their operational efficiency.

Technological developments have brought about major changes to the dosing pump market. Modern pumps operate with smart sensors, digital control systems, IoT connectivity, and automated monitoring, which delivers precise dosage control, real-time feedback and maintenance forecasting. Advanced dosing solutions have become essential because governments worldwide enforce strict regulations on industrial emissions, wastewater treatment, and water quality standards. The use of advanced dosing pumps becomes necessary for sustainable chemical management programs and energy efficiency initiatives. This drives innovation and market expansion.

Type Insights

The diaphragm pump segment leads the global dosing pump market with the largest revenue share of 54.2% in 2024. Diaphragm pumps operate with high precision and reliability to handle viscous and corrosive fluids, which makes them the best choice for chemical dosing, water treatment, and pharmaceutical applications. The equipment operates without leaks because of its durable construction. This helps reduce maintenance costs and operational downtime. Diaphragm pumps maintain their position as top sellers because industrial automation continues to grow, and water treatment and process industries need exact chemical dosing. The dosing pump industry gains market dominance through its ability to operate in multiple sectors, which digital control systems and material advancements continue to strengthen for long-term market expansion.

The peristaltic pumps segment is anticipated to experience substantial growth throughout the forecast period. The expansion takes place because the pump can transfer sterile fluids and shear-sensitive and sensitive fluids without contamination. This makes it perfect for biotechnology and pharmaceutical, food, and beverage applications. Peristaltic pumps have become essential for businesses that need both high precision and strict cleanliness because they offer exact flow management, simple upkeep, and leak-free operation. The requirement for peristaltic pumps continues to grow because automated dosing systems with digital controls have become more prevalent. The worldwide market growth will speed up because biotechnology and healthcare, and water treatment infrastructure investments are increasing, while safety and process reliability regulations become stricter.

End Use Insights

The water and wastewater segment led the global dosing pump market by holding the largest revenue share of 22.8% in 2024. The need for precise chemical dosing in water treatment facilities drives this market because it ensures safe drinking water, proper wastewater treatment and environmental rule compliance. The increasing need for exact chemical dosing in water treatment facilities drives this market because it ensures safe drinking water, proper wastewater treatment, and environmental rule compliance. The growing urbanisation, together with industrial expansion and water contamination concerns, has made advanced dosing solutions essential for modern times. The precise application of coagulants, disinfectants, and pH adjusters through dosing pumps leads to decreased chemical waste production and lower operational costs. The extensive use of dosing pumps in this sector continues to grow because government programs and environmentally friendly water infrastructure investments maintain their position as a market leader.

The chemical segment of the dosing pump market is expected to grow at the fastest CAGR during the forecast period. The increasing requirement for exact chemical dosing in petrochemicals, speciality chemicals, and industrial manufacturing drives this growth because these industries need precise fluid management to achieve operational efficiency and safety standards. Chemical producers can achieve better operational precision, waste reduction, and regulatory compliance through automated dosing systems that operate under digital control for safety and environmental standards. The market experiences growth through two main factors, which include chemical plant establishment in developing nations. Expanding markets for specialised high-value chemical products. The segment continues to expand because new materials and control systems, and pump designs become available for chemical applications across the globe.

Regional Insights

The Asia Pacific region leads the global dosing pump market with the largest revenue share of 40.7% in 2024. The main drivers of this market dominance are rapid urbanisation and industrialisation, together with expanding water and wastewater treatment infrastructure in China, India, and Japan. The region demands exact and reliable dosing solutions because its food and beverage, pharmaceutical, and chemical industries continue to grow. The government promotes advanced dosing pump technology because it wants to control water quality. It also wants to create sustainable industrial operations and follow environmental regulations. The Asia Pacific region leads the global dosing pump market because of increasing investments in smart chemical dosing systems and advancements in pump durability and operational efficiency.

North America Dosing Pump Market Trends

The North American dosing pump market is expected to grow at a steady rate throughout the forecast period because of increasing environmental regulations, expanding industrial automation, and growing water treatment infrastructure investments. The US and Canada stand as the leading nations in this field because they need precise chemical dosing to meet environmental and safety standards. The market grows because the food and beverage, pharmaceutical, and chemical industries need exact and trustworthy fluid handling solutions. Digital controls, IoT integration, and smart monitoring systems represent technological advancements which enhance process reliability. They also enhance operational efficiency. The region receives support for dosing pump usage from government programs that promote industrial safety and sustainable water management.

Europe Dosing Pump Market Trends

The European dosing pump market experiences significant growth because the chemical and pharmaceutical industries, together with water and wastewater treatment facilities, need more equipment. The development of industrial safety programs, water quality initiatives, sustainable chemical management and environmental regulations creates key growth opportunities. The countries of France, Germany, and the United Kingdom are rapidly adopting advanced dosing technologies to boost operational efficiency and meet regulatory requirements. The region experiences growing automation and digital transformation through smart sensors, IoT-enabled pumps and automated control systems. These reduce operating costs and enhance dosage precision. The European market continues its expansion because businesses choose reliable, high-precision dosing pump solutions after learning about sustainable environmental practices and energy-saving benefits.

Key Dosing Pump Companies:

The following are the leading companies in the dosing pump market. These companies collectively hold the largest market share and dictate industry trends.

- KNAUER Wissenschaftliche Geräte GmbH

- IDEX Corporation

- SPX Flow

- Verder Liquid B.V.

- Netzsch Pumps

- Diener Precision Pumps

- Nikkiso Co. Ltd.

- SEKO S.P.A.

- Blue White Pumps

- ProMinent Group

- Emec S.r.l.

- Others

Recent Developments

- In October 2024, the PERIPRO tube pump was introduced by NETZSCH and is intended for continuous operation in demanding applications such as wastewater treatment. To avoid contamination, the pump features an integrated leak detection system and a hermetically sealed construction. There is less maintenance and downtime because the tube is the only wear component. It works well for dosing chemicals in a variety of sectors, including food-grade additives and lime milk.

- In February 2024, Watson-Marlow introduced the Qdos H-FLO, a high-flow chemical dosing pump that can handle pressures of up to 7 bar and flow rates of up to 600 L/h. For chemicals like acids, disinfectants, and flocculants, it provides ±0.5% repeatability and ±1% accuracy. RFID pumphead recognition, leak detection, and network integration with PROFINET, PROFIBUS, and EtherNet/IP are all features of the pump. For increased process safety, a pressure sensor is an optional feature that offers real-time monitoring.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the dosing pump market based on the below-mentioned segments:

Global Dosing Pump Market, By Type

- Diaphragm Pump

- Peristaltic

- Piston/Plunger

- Others

Global Dosing Pump Market, By End Use

- Water & Wastewater

- Chemical

- Oil & Gas

- Food & Beverage

- Pharmaceutical

- Others

Global Dosing Pump Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa